- Home

- »

- Semiconductors

- »

-

Smart Lighting Market Size, Share & Trends Report, 2030GVR Report cover

![Smart Lighting Market Size, Share & Trends Report]()

Smart Lighting Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Connectivity (Wired, Wireless), By Application (Indoor, Outdoor), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-490-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Lighting Market Summary

The global smart lighting market size was valued at USD 15.05 billion in 2022 and is projected to reach USD 72.35 billion by 2030, growing at a compound annual growth rate (CAGR) of 22.1% from 2023 to 2030. The ability of lights to connect with IoT devices and create a variety of ambient lighting using just smartphones or tablets has increased its popularity and demand across commercial and residential spaces.

Key Market Trends & Insights

- Europe dominated the market and accounted for the largest revenue share of 37.0% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 24.0% during the forecast period.

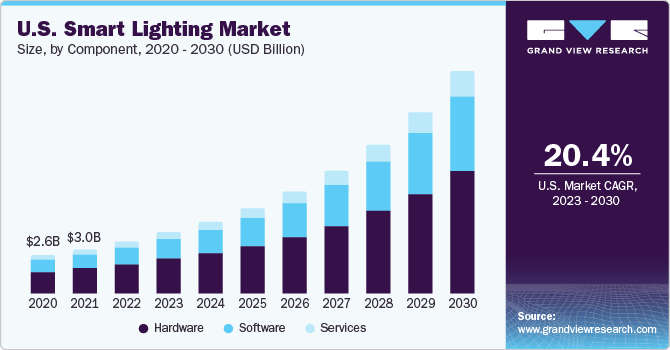

- Based on component, the hardware segment led the market with a revenue share of 56.9% in 2020.

- Based on connectivity, the wired segment accounted for the largest revenue share of 64.2% in 2022 and is expected to grow at the fastest CAGR of 21.8% during the forecast period.

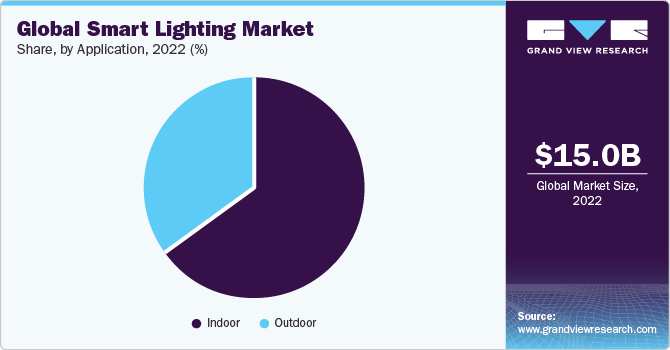

- Based on application, the indoor segment accounted for the largest revenue share of 65.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 15.05 Billion

- 2030 Projected Market Size: USD 72.35 Billion

- CAGR (2023-2030): 22.1%

- Europe: Largest market in 2022

- Asia Pacific: Fastest growing market

Smart lights are dimmable with various color tones as per requirement, can be scheduled to turn on/off, monitor lighting’s energy usage, and be connected via Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee. Additionally, smart lights can be voice-controlled by integration with the platform, such as Google Assistant, Amazon’s Alexa, Apple’s Siri, or Microsoft’s Cortana. These wide ranges of features apart from illumination coupled with the growing adoption of IoT devices and smart assistant platforms have created market growth avenues for smart lighting.

Smart lighting is also termed connected lighting as it can be seamlessly integrated into the IT network in a building or city infrastructure to share information regarding the status of the operation. For instance, smart street lights in city parking or roads ensure safety by offering wide coverage, environmental monitoring, parking and traffic management information, and city surveillance by connecting with IoT devices. Smart lights are often integrated with sensors, which turn them into a point of intelligence device to gather information on activity patterns, daylight levels, occupancy, changes in temperature, or humidity. This information proves to be vital for government departments to take appropriate actions and monitor the city for unwarranted activity.

Government policies encouraging energy conservation and environment protection coupled with stringent regulations discourage the usage of incandescent lamps, which is anticipated to bolster the demand for LED smart lighting. The global lighting industry consumes approximately 19% of the total electricity and is responsible for around 6% of the total greenhouse gas emissions. On the contrary, LED smart lights are highly efficient. They consume almost 70% less energy and connect devices to collect information for future processes. They have significantly longer life spans and are free from any mercury content. Similarly, there are no harmful greenhouse gas emissions associated with LED lights. Thus, LED technology has potentially revolutionized the entire lighting industry and infiltrated the smart lighting segment wherein LED is a preferable choice among vendors and consumers.

The penetration of smart lights is expected to increase owing to benefits such as controlled power usage, longer life, multiple light settings in a single lamp/luminaire, and availability of a wide range of modern decorative lighting products. The adoption of smart lighting in the residential, commercial, and industrial sectors is yet to reach its full potential. Hence, various government initiatives to promote the use of LED-based smart lights are expected to boost their demand over the forecast period.. Moreover, countries such as China, Brazil, Colombia, Mexico, France, Spain, and Germany have imposed a complete ban on the sale of incandescent lamps to encourage the adoption of LED lights; wherein high-income groups are leaning towards LED-based smart lights. Furthermore, many smart lighting companies had reported a negative impact of the COVID-19 pandemic due to the lockdown, disrupting construction activity, and raw material supply. The decline in consumer purchasing capacity, and delay in completing construction projects due to the COVID-19 pandemic pushed the smart lights purchase order quantity, timeline, and payment.

Smart lights consist of several networked components, including lighting fixtures that collect information about the physical environment and allow users to control or adjust devices based on their requirements. The advent of the Internet of Things (IoT) and its rising set of applications in lighting systems has contributed to the growth of the market. Moreover, advancements in technologies that allow the easy integration of functions such as ambient sensing and voice control in lighting systems have widened and diversified the scope of smart lighting applications.

Smart lighting systems use wired and wireless communication protocols such as Bluetooth, Wi-Fi, ZigBee, DALI, EnOcean, and Sigfox for the networking of necessary components. Lighting control modules receive real-time information such as the lighting environment and transmit signals to the lighting system or luminaires to undertake actions such as switching on or switching off lights and adjusting brightness. For instance, Hue Lighting by Philips is a smart home lighting system, which provides an entire range of lights that can be controlled using the Hue app on smartphones. The emergence of such integrated lighting systems has boosted the demand for smart lamps and smart fixtures.

LED prices have been plummeting over the past years owing to various factors, including overproduction of LED chips and packages and a comparatively slower rise in the demand for LED lamps from the backlight segment. The trend has led to the introduction of low-priced LED chips and packages in the general household lamp segment. Several governments have been promoting the use of LED lights owing to benefits such as energy efficiency, cost-effectiveness, and a longer lifespan when compared to other lighting.

Moreover, concerns regarding the rising consumption of non-renewable power, which is a major contributor to greenhouse emissions and environmental deterioration, are rising among consumers and enterprises. Lighting is an indispensable requirement in daily activities and accounts for around 15% of global electricity consumption and around 5% of global greenhouse gas emissions. Conserving the energy utilized in lighting can significantly limit carbon emissions and improve environmental health. Increasing pressure to make changes on this front has encouraged several policymakers and governments to implement sustainable policies to promote energy-saving lighting products. Additionally, several governments are promoting and providing education on sustainable energy-saving practices to end consumers. Increased awareness related to the quality of health and energy conservation practices could drive the demand for energy-saving products in the near future.

However, the total cost of ownership of smart lighting includes the direct and indirect expenses incurred during the complete life cycle of owning or using a smart lighting product. It includes the cost of equipment, cost of installation, deployment, operation, upgrading, production, and maintenance. Moreover, smart lights consist of various components such as sensors, control systems, dimmers, switches, and software. As a result, the initial costs of smart lights are higher than conventional lights, which may compel several residential owners and low-budget end-users to select alternate or conventional energy-saving lighting. This could limit the adoption of smart lights to a certain extent. Also, smart lights are sometimes incompatible with conventional infrastructures and fittings due to the difference in their form factor and circuitry, which means the switches may have to be replaced at times. Similarly, all the smart lighting fixtures associated with conventional or existing fittings cannot be used with all lighting sources as an enclosed fixture does not allow the heat to dissipate from the bulb. LED bulbs dissipate less heat as compared to incandescent bulbs because of the heat sink installed at the base of the LED bulb. However, if the LED bulb is enclosed in a closed housing, it would not be able to dissipate the generated heat effectively and the overall lifespan of an LED lamp may be reduced. Such compatibility concerns could restrain the growth of the market.

Component Insights

The smart lighting market is segmented into three components, namely hardware, software, and services. The hardware segment led the market with a revenue share of 56.9% in 2020. Smart lighting hardware has been further categorized into lamps and luminaires, wherein the lamp segment is exhibiting high growth potential during the period 2023 to 2030. The hardware segment demand is attributed to the popularity of connected lighting bulbs and fixtures that can change hues, dim lights, and switch on/off using a controlling device such as a smartphone or tablet.

The software segment is expected to grow at the fastest CAGR of 22.9% during the forecast period. The demand for Smart Lighting is driven by the increasing adoption of smart lighting for data-driven causes in critical areas. Also, the software application is required by each brand to facilitate the controlling of lights using smartphones or tablets. The apps also help in connecting smart lights with smart platforms such as Alexa, Crotona, and Siri to control using voice commands. The immense popularity of creating an ambient atmosphere and aiding in data collection in smart cities is expected to boost the segment growth over the forecast period.

Connectivity Insights

The wired segment accounted for the largest revenue share of 64.2% in 2022 and is expected to grow at the fastest CAGR of 21.8% during the forecast period. The wired connections are required for the range above 30 feet. Ethernet as an exception can facilitate wired connection within 100 meters, while DALI, DSI, and DLVP provide connectivity above the range of 1000 feet. The increasing adoption of smart lighting in commercial and industrial spaces is driving the demand for wired connectivity in the smart lighting space.

The wireless segment is expected to grow at a significant CAGR during the forecast period. Wireless connectivity in a smart lighting environment is highly preferred among consumers who need connections within a small range. Wireless technology such as Wi-Fi, Bluetooth, SmartThings, Z-Wave, or ZigBee connects lighting fixtures with smartphone apps to control the light bulb's functions. The residential sector has majorly adopted wireless technology to control the luminaire hues and color for aesthetic purposes within a confined space.

Application Insights

The indoor segment accounted for the largest revenue share of 65.5% in 2022. The indoor application is further sub-segmented into residential, commercial, and industrial. The residential segment is expected to attain a high growth rate over the forecast period due to the rising popularity of smart lighting bulbs and fixtures that can be controlled by the user for setting different lighting moods. Additionally, demand within commercial and industrial space is propelled by the need to control lighting consumption as the office spaces or warehouses are functional 24x7 and need regular power supply throughout the day and night. Installing smart lighting with inbuilt sensors ensures lights are used only in the required area based on the movement of people, which is captured by the sensors. Also, the light setting can automatically dim based on outside lighting inside the premises.

The outdoor segment is expected to grow at the fastest CAGR of 22.8% during the forecast period. The outdoor segment is further sub-segmented into highways & roadways, architecture, and others. The outdoor architectural application comprises lighting for patios, gardens, exterior walls, and outdoor premises of the residential or commercial space. The burgeoning demand for smart lighting in outdoor applications is fueled by the need to provide energy-efficient lights and monitor outdoor activity. This phenomenon is specifically adapted for smart street lighting. The government has invested in installing LED-based smart lighting connected with the camera and sensors to capture and share data on outdoor activity.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 37.0% in 2022. Europe is leading the way in drafting safety and uniform performance standards for certain indoor commercial smart lighting for garages, roadways, and parking. Dedicated LED luminaires and LED replacement smart lamps are emerging as the key growth areas in the lighting industry in line with the continued advancements in LED designs and technology. While incumbent smart lighting manufacturers continuously update their product offerings, existing manufacturers are expanding their product portfolio to foray into the market. A looming surplus of dedicated smart luminaires vendors can be particularly noted for applications, such as downlighting, task lighting, landscape lighting, general ambient illumination, and outdoor general area lighting.

Asia Pacific is expected to grow at the fastest CAGR of 24.0% during the forecast period owing to the surging demand from the commercial and residential application segments. China is projected to emerge as the largest revenue contributor controlling the highest global market share. Countries, including Japan, India, and South Korea, are anticipated to be at the forefront of smart lighting adoption due to their rising economies and increasing investments in smart city projects. The smart lighting demand in the Asia Pacific is largely influenced by the changing scenario of lighting across commercial sectors. The increasing commercial building construction for office, retail, and entertainment is creating an opportunity for fresh demand for smart lighting. However, the onset of the COVID-19 pandemic affecting construction activities during the initial days, is expected to inhibit the expected growth in demand for smart lighting.

North America is estimated to grow at a significant CAGR due to consumers' growing acceptance of smart lighting and the energy-efficient solution to the lighting problem in the region. Also, several leading companies, such as Honeywell International Inc., have introduced smart lighting solutions with the latest technologies, encouraging the adoption of smart lighting solutions in the region.

Key Companies & Market Share Insights

The leading players in the market are undertaking strategies such as product developments, mergers and acquisitions, strategic partnerships, and business expansions to maintain their stronghold on the market. For instance, in May 2023, Cyclone Lighting, a manufacturer of outdoor lighting fixtures released a new luminaire called Elencia. Elencia features high-performance optics and a modern lantern design, making it a stylish and functional choice for outdoor lighting. Cyclone Lighting is a brand of Acuity Brands Lighting, Inc.

Key Smart Lighting Companies:

- Acuity Brands Lighting, Inc.

- Signify Holding

- Honeywell International Inc.

- Itron Inc.

- IDEAL INDUSTRIES, INC.

- Häfele America Co.

- Wipro Lighting

- YEELIGHT.

- Sengled Optoelectronics Co., Ltd.

- Verizon

- Schneider Electric

Recent Developments

-

In March 2023, Itron, Inc. signed a contract with Duquesne Light Company (DLC) to improve operational efficiency, update infrastructure, and enable smart city applications. Itron plans to supply DLC with its smart street lighting solution, which includes LED lights, sensors, and software for dimming, collecting data, and controlling traffic. The solution is expected to assist DLC in conserving energy, improving safety, and better understanding how its consumers use its services.

-

In January 2023, YEELIGHT, a smart lighting manufacturer unveiled a new range of products including the Cube Smart Lamp, an Automatic Curtain Opener, and a Smart Scene Panel. These products work with the new smart home standard, Matter, which is expected to be released later this year.

-

In October 2022,IDEAL INDUSTRIES, INC. announced the sale of Casella, its occupational and environmental monitoring equipment business, to TSI Instruments Ltd., a subsidiary of TSI Incorporated. This strategic divestiture allows IDEAL to focus on its core business and growth ambitions in the professional electrician products, high power density connections, and superior charging solutions markets.

-

In September 2022, Alcorcón, a city in Spain, launched a smart city pilot project with Itron's intelligent street lighting solution. The project includes upgrading existing streetlights to LEDs and adding Networked Lighting Controllers (NLCs) from Itron. The NLCs provide the ability to dim and control lights, as well as collect health status data and provide advanced configuration options.

-

In August 2022, Häfele America Co. launched the Loox Illuminated Wireless Adjustable Shelf System, a new LED lighting innovation. This system is meant for frameless cabinets such as closets, entertainment centers, kitchens, and pantries. It comes with wireless controllers, adjustable shelves, and a variety of lighting options to suit the user’s needs.

-

In July 2022, Signify Holdings. introduced a new line of smart WiZ lighting solutions designed to improve daily comfort and convenience. The new collection adds to the existing line-up with table and floor lamps, a portable light switch, and new ceiling lights and lamps.

Smart Lighting Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 17.86 billion

Revenue forecast in 2030

USD 72.35 billion

Growth Rate

CAGR of 22.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Acuity Brands Lighting, Inc.; Signify Holding.; Honeywell International Inc.; Itron Inc.; IDEAL INDUSTRIES, INC.; Häfele America Co.; Wipro Lighting.; YEELIGHT.; Sengled Optoelectronics Co., Ltd.; Verizon; Schneider Electric

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

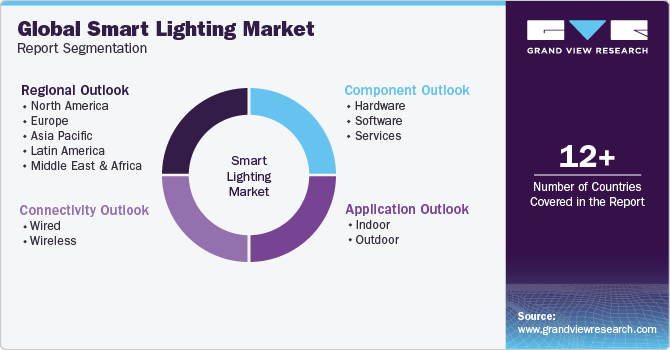

Global Smart Lighting Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart lighting market based on component, connectivity, application, region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Lamp

-

Luminaire

-

-

Software

-

Services

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor

-

Residential

-

Commercial

-

Outdoor

-

Highways and Roadways

-

Architectural

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart lighting market size was valued at USD 15.05 billion in 2022 and is expected to reach USD 17.86 billion in 2023.

b. The global smart lighting market is expected to witness a compound annual growth rate of 22.1% from 2023 to 2030 to reach USD 72.35 billion by 2030.

b. Europe dominated the market and accounted for the largest revenue share of 37.0% in 2022. Europe is leading the way in drafting safety and uniform performance standards for certain indoor commercial smart lighting for garages, roadways, and parking.

b. Some key players operating in the smart lighting market include Acuity Brands Lighting, Inc.; Signify Holding.; Honeywell International Inc.; Itron Inc.; IDEAL INDUSTRIES, INC.; Häfele America Co.; Wipro Lighting.; YEELIGHT.; Sengled Optoelectronics Co., Ltd.; Verizon; and Schneider Electric; among others

b. Key factors driving the smart lighting market growth include the ability of lights to connect with IoT devices and create a variety of ambient lighting using just smartphones or tablets, which has increased its popularity and demand across commercial and residential spaces.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.