- Home

- »

- Consumer F&B

- »

-

Gelato Market Size, Share And Trends, Industry Report, 2033GVR Report cover

![Gelato Market Size, Share & Trends Report]()

Gelato Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Dairy, Plant), By Flavor (Vanilla, Chocolate, Fruits & Berries), By Production Method, By Packaging, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-825-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gelato Market Summary

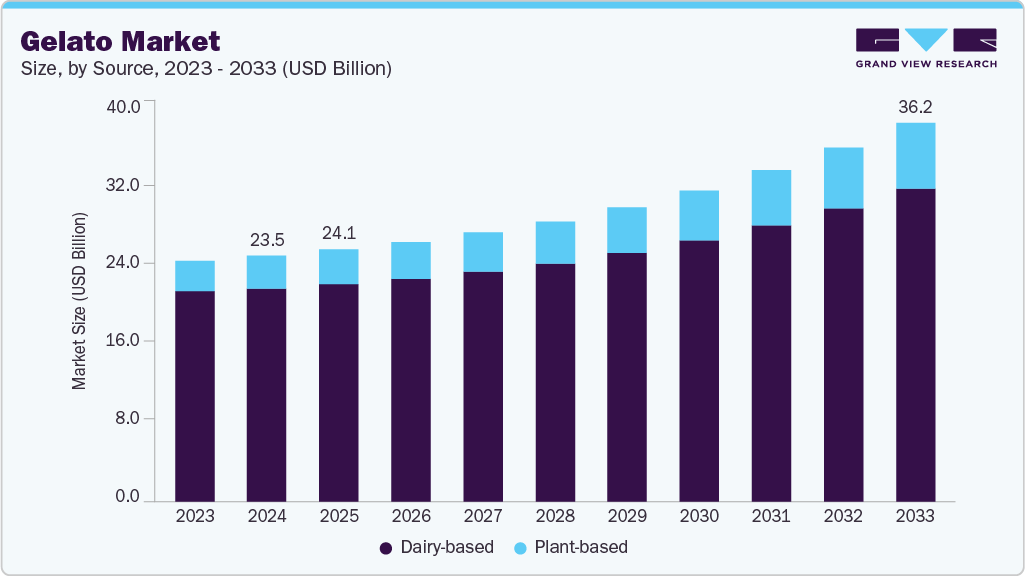

The global gelato market size was estimated at USD 23.48 billion in 2024 and is expected to reach USD 36.22 billion by 2033, expanding at a CAGR of 5.2% from 2025 to 2033. The market growth is driven by a stronger consumer preference for artisanal and premium desserts emphasizing authentic Italian recipes, natural ingredients, and rich textures. As consumers seek indulgent and high-quality dessert experiences, gelato is a preferred choice across developed and emerging regions.

Key Market Trends & Insights

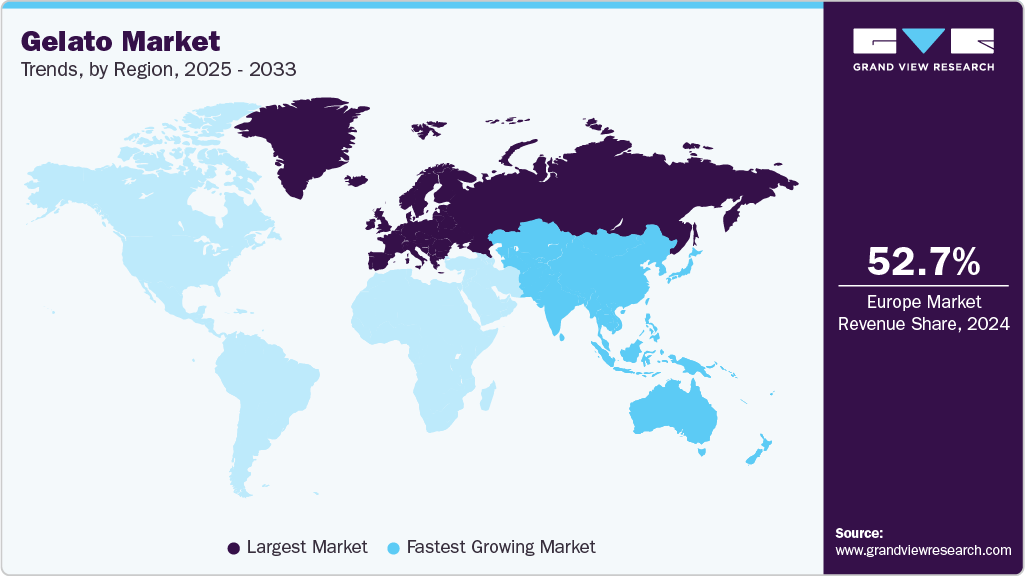

- Europe held the largest share of the global gelato market in 2024, accounting for around 50%.

- By source, the dairy-based segment dominated the market with over 85% share in 2024.

- By flavor, the vanilla segment dominated the market with around 25% share in 2024.

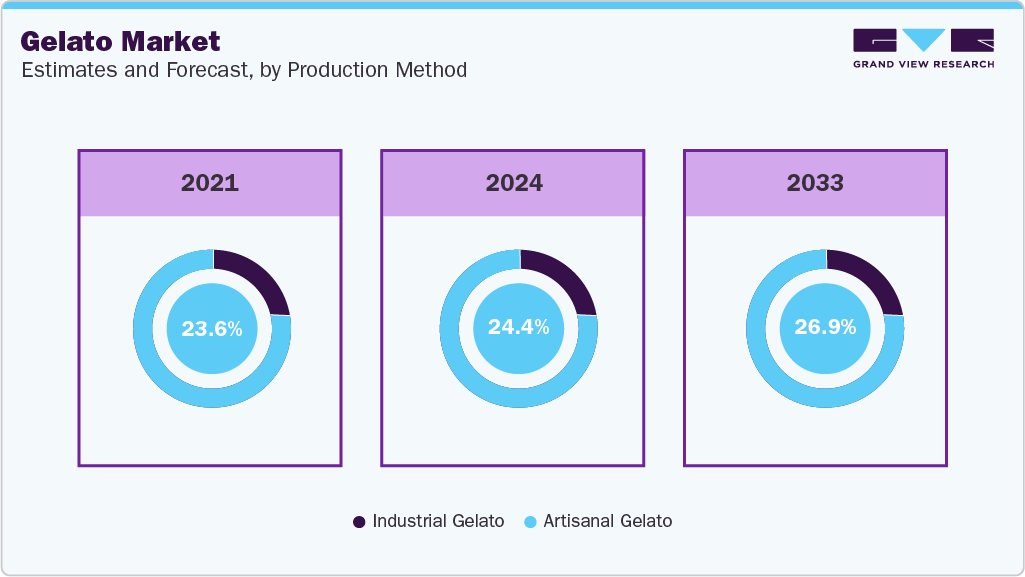

- By production method, the artisanal gelato segment dominated the market with 75% share in 2024.

- By packaging, the impulse packaging segment dominated the market and accounted for over 52% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.48 Billion

- 2033 Projected Market Size: USD 36.22 Billion

- CAGR (2025-2033): 5.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

The rising focus on health and wellness has further reshaped market dynamics and prompted a gradual shift in consumer preferences toward more nutritious indulgences. Many consumers opt for low-sugar, dairy-free, and vegan gelato alternatives that align with balanced and sustainable lifestyles. This trend is particularly evident among younger and urban populations, who actively seek desserts that combine taste with health benefits. In response, brands reformulate their products with natural sweeteners, plant-based ingredients, and fewer additives to meet evolving expectations. For instance, in February 2023, Valsoia introduced a new line of plant-based gelato flavors in Italy and expanded its dairy-free portfolio to meet rising consumer demand for premium vegan desserts. Such product innovations reflect the broader industry movement toward functional and clean-label formulations and reinforce the stronger appeal of healthier and ethically produced gelato worldwide.

In addition, expanding gelato cafes, boutique parlors, and retail chains across global markets has enhanced accessibility and visibility. Leading producers now adopt franchise models, region-specific flavor innovation, and eco-friendly packaging to strengthen brand positioning. The growing cultural influence of Italian cuisine and the strong appeal of experiential dessert consumption continue to accelerate the growth of the gelato industry.

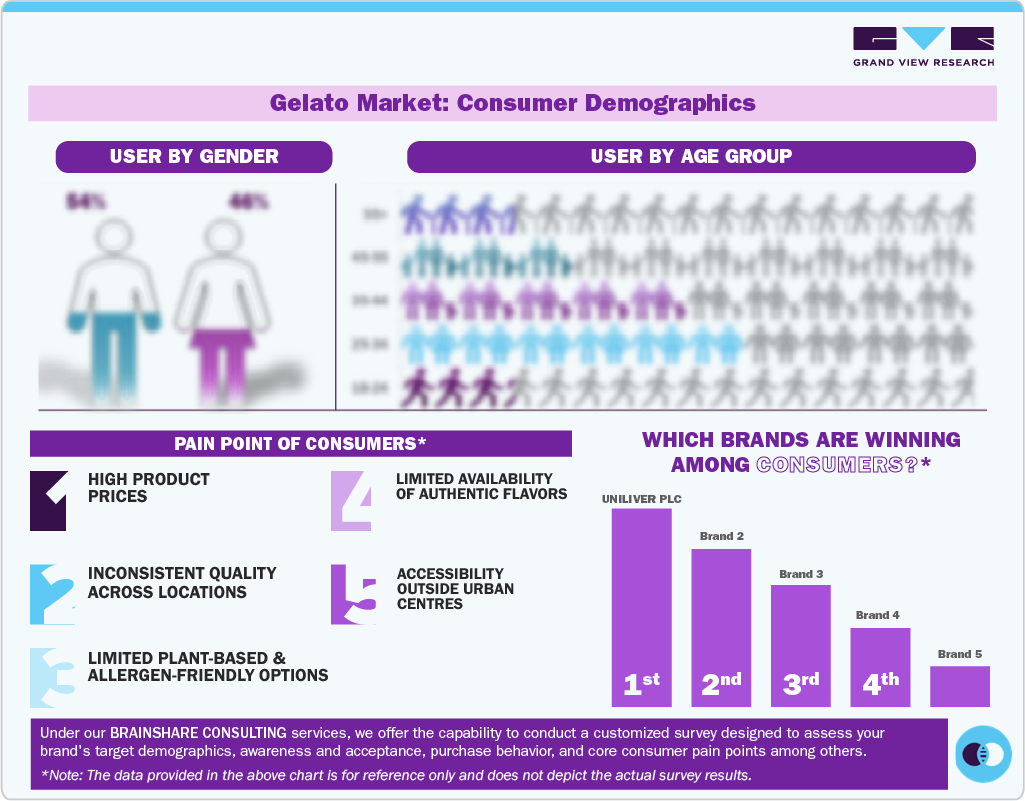

Consumer Insights

The global gelato market reflects a consumer base that values premium flavor, real ingredients, and an authentic dessert experience. Younger urban consumers remain at the center of this shift, as they show clear interest in products that offer richness, freshness, and an Italian-style appeal. Millennials and Gen Z view gelato as a refined choice compared to traditional ice cream, which strengthens demand across both mature and emerging markets. Rising disposable incomes and broader exposure to global food culture further support the appeal of artisanal gelato worldwide.

Consumer Demographics

Health-focused choices shape consumer behavior. A growing share of buyers prefers dairy-free, vegan, low-sugar, and clean-label gelato made from natural bases such as oat, almond, or coconut milk. Major brands respond by expanding product lines, offering new flavor concepts, and improving clarity around ingredient sources.

This shift toward authenticity, wellness, and responsible production defines modern expectations and sets the direction for future growth in the global gelato market.

Source Insights

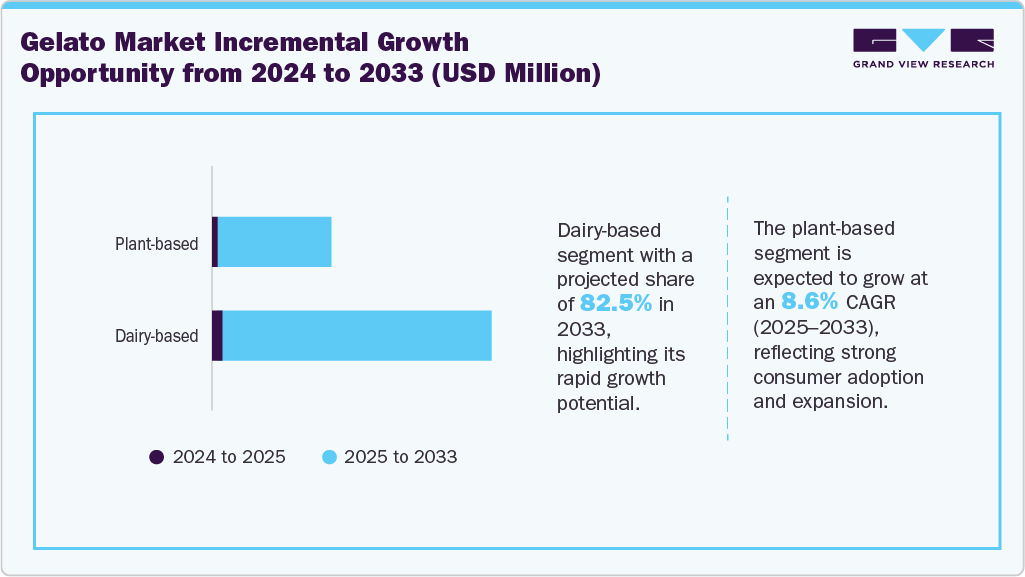

The dairy-based segment accounted for the largest share of 86.9% of the global revenue in 2024. Growth is driven by the high demand for dairy-based gelato, supported by its rich texture, authentic taste, and strong consumer preference for traditional recipes. Dairy ingredients such as milk and cream provide a smooth and dense consistency that enhances flavor and mouthfeel, making gelato more indulgent compared to other frozen desserts. Consumers associate dairy-based gelato with authenticity and premium quality, which sustains steady demand across regions. In addition, dairy bases offer greater flavor versatility and stability, allowing manufacturers to develop diverse product ranges without compromising consistency, reinforcing the segment’s dominance in artisanal and commercial gelato production.

The plant-based segment is expected to grow at the fastest CAGR of 8.6% in the gelato market due to rising demand for vegan, lactose-free, and environmentally sustainable products. Consumers are adopting plant-based diets driven by health consciousness and ethical concerns. Manufacturers are expanding their non-dairy offerings using almond, oat, coconut, and soy bases to cater to these evolving preferences. For instance, in April 2024, Plantaway launched its plant-based gelato line in India. Made with 100% plant-based ingredients, the range includes flavors like Strawberry Shortcake, Salted Caramel Crunch, and Sicilian Pistachio. The launch reflects the strong market shift toward innovative and sustainable alternatives.

Flavor Insights

The vanilla segment dominated the market in 2024 with a market share driven by vanilla's universal appeal and versatility, making it a preferred flavor among global consumers. Its smooth and creamy taste blends well with various toppings, mix-ins, and dessert combinations, appealing to traditional and modern palates. Vanilla is a reliable base for artisanal and premium gelato formulations, allowing manufacturers to experiment with flavor pairings while retaining a familiar taste. In addition, its association with quality and authenticity reinforces consumer trust, ensuring steady demand and establishing vanilla as the dominant flavor in the gelato industry.

The fruits and berries segment is projected to register the fastest CAGR during the forecast period, driven by rising consumer preference for refreshing, naturally flavored desserts made with real ingredients. Producers in the gelato industry focus on using real fruit purees, organic components, and natural sweeteners to align with the demand for clean-label and health-oriented indulgences. For instance, in June 2022, Noosa Yogurt launched its Frozen Yogurt Gelato line, offering flavors such as Strawberries & Cream, Chocolate Fudge, Sea Salt Caramel, and Honey Vanilla Bean, crafted with whole milk yogurt, real fruit, and probiotics. This launch reflected the industry’s shift toward fruit-based desserts that combine indulgence with nutritional value. The nutritional richness of berries, high in antioxidants and vitamins, further supports this segment’s rapid expansion, reinforcing its appeal among health-conscious consumers seeking authentic, natural, and flavorful gelato varieties.

Production Method Insights

The artisanal gelato segment accounted for the largest revenue share in 2024. The growth is driven by increasing consumer interest in authentic Italian flavors and premium dessert experiences, emphasizing craftsmanship and quality. Artisanal producers focus on traditional recipes, natural ingredients, and small-batch production to deliver superior freshness and texture. This method appeals to consumers seeking indulgence paired with authenticity. Many artisanal brands are introducing limited-edition or seasonal flavors to strengthen their market presence and highlight their creative expertise. For instance, in May 2022, Amorino launched spring gelato flavors, including Mascarpone Fig and Malaga, reflecting the strong market preference for artisanal, innovative, and high-quality desserts. Such launches underscore how artisanal brands enhance market diversity while maintaining product integrity. The rising demand for handcrafted desserts continues, positioning the artisanal segment as a major growth driver within the global gelato industry.

The industrial gelato segment is projected to grow at the fastest CAGR during the forecast period. The growth is driven by large-scale production efficiency, consistent quality, and extensive retail distribution networks that make industrial gelato widely accessible to consumers worldwide. Industrial producers benefit from economies of scale, maintaining competitive pricing while ensuring consistent flavor, texture, and quality standards. Leading brands continue to expand their manufacturing capabilities and invest in automation to improve output and distribution efficiency. For instance, in June 2025, Sammontana Italia introduced its gelato products to the U.S. market, debuting at Eataly locations in New York City with flavors such as Salted Caramel and Pistachio. This expansion reflects the increasing global demand for high-quality, mass-produced Italian gelato, reinforcing the dominance of industrial producers in meeting large-scale consumer needs and sustaining their leadership in the global gelato industry.

Packaging Insights

The take-home packaging accounted for the largest revenue share in 2024. The growth is driven by increasing consumer preference for convenient dessert options that can be enjoyed at home without compromising quality or freshness. Take-home packaging allows consumers to store gelato for longer periods while maintaining its texture and flavor, supporting flexible consumption occasions. The growing popularity of family-sized tubs and multipack formats further strengthens this trend, particularly among households seeking value and variety. Leading manufacturers are prioritizing eco-friendly and recyclable materials to align with global sustainability goals. For instance, in March 2022, Unilever replaced plastic packaging with recyclable paper tubs and lids for its Carte D’Or range, demonstrating the shift toward sustainable and premium take-home solutions. These factors collectively position the take-home segment as the dominant packaging format in the global gelato market.

The impulse packaging segment is projected to grow at the fastest CAGR from 2025 to 2033, driven by the increasing demand for on-the-go and single-serve dessert options that offer convenience and instant indulgence. Impulse packaging formats such as cups, cones, and sticks attract consumers seeking quick treats and during travel or leisure activities. The rise of modern retail outlets, quick-service restaurants, and convenience stores further boosts accessibility, encouraging spontaneous purchases. Younger consumers, in particular, favor impulse-packaged gelato for its portability and variety of flavors. Moreover, attractive packaging designs and limited-edition launches continue to enhance product visibility and drive repeat purchases, positioning the impulse packaging segment for rapid growth in the market.

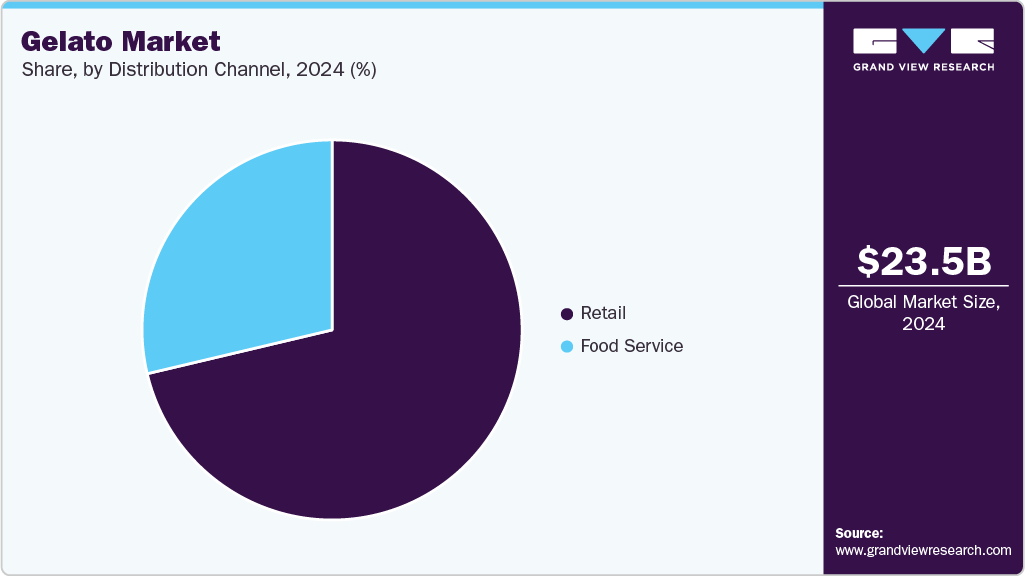

Distribution Channel Insights

The retail segment accounted for the largest revenue share in 2024. The growth is driven by strong consumer preference for in-store gelato experiences emphasizing freshness, customization, and authenticity. Retail outlets, including gelaterias, cafes, and specialty dessert parlors, allow customers to enjoy a wide variety of freshly prepared flavors and premium textures, which enhances perceived product quality. Leading gelato brands are expanding their presence to strengthen customer engagement and improve brand visibility. For instance, in September 2024, Baskin-Robbins achieved a significant milestone by inaugurating its 1,000th store in India and the SAARC region. The new outlet, located in Andheri, Mumbai, spans over 750 square feet, making it the largest Baskin-Robbins store in the city. This expansion underscores the brand's robust growth trajectory and strategic focus on enhancing accessibility to its diverse gelato offerings. Such developments highlight the continued dominance of the offline segment in the global gelato industry, supported by experiential dining trends and the consumer desire for immediate, high-quality indulgence.

The food service segment is expected to witness significant growth from 2025 to 2033. The rise of cafes, dessert shops, bakeries, and fine dining spots is increasing gelato consumption in food service. Gelato's artisanal and premium image fits well with modern menus. Major countries with a heavy tourist influx boost the need for genuine dessert experiences. Seasonal flavors from chefs and different serving options such as plated desserts, gelato sandwiches, and affogatos help differentiate menus and encourage repeat purchases. In addition, quick-service restaurants, fast-casual chains, and catering services are increasingly incorporating gelato to enhance their dessert selections. Gelato provides a premium yet affordable option, offers a higher perceived value, and supports better profits. Advances in freezer and countertop technology make serving easier. This helps gelato appear more often in busy food-service settings and supports strong volume growth.

Regional Insights

The gelato market in Europe held the largest revenue share of 52.7% in 2024, growth is driven by Europe’s strong heritage in gelato craftsmanship and the widespread consumer preference for authentic, premium-quality frozen desserts. Regional manufacturers continue to innovate with locally sourced ingredients and distinctive flavor profiles, strengthening the market’s appeal among consumers. The focus on authenticity and product innovation has encouraged leading brands to expand their premium offerings across European markets. For example, in May 2024, Crosta & Mollica expanded its UK retail offerings by introducing Mascarpone Stracciatella Gelato, crafted with fresh mascarpone and Italian whole milk, featuring dark chocolate flakes. This launch aligns with the growing demand for premium, artisanal frozen desserts in the European gelato market, reinforcing the region’s leadership in quality and craftsmanship.

UK Gelato Market Trends

The gelato market in the U.K. is projected to grow at the fastest CAGR of 6.4% from 2025 to 2033, growth is driven by the country’s strong retail infrastructure, increasing consumer preference for premium desserts, and the widespread presence of artisanal and international gelato brands. The U.K. has emerged as a key European hub for innovation in frozen desserts, with brands expanding their portfolios to meet demand for authentic Italian-style products. This innovation-driven environment continues to inspire creative product collaborations that capture consumer interest and elevate brand differentiation. In May 2025, KFC partnered with Hackney Gelato in the U.K. to release a unique Gravy Gelato, combining KFC’s signature gravy with smooth Italian-style gelato, appealing to consumers seeking innovative desserts. Such initiatives reinforce the U.K.’s position as a dynamic market leader within Europe, driving category expansion through novelty, quality, and craftsmanship.

North America Gelato Market Trends

The growth of the gelato market in North America is driven by rising consumer demand for premium, authentic, and healthier dessert options. Consumers increasingly prefer gelato over traditional ice cream due to its lower fat content, dense texture, and use of natural ingredients. The expansion of artisanal brands and the growing Italian culinary influence have further elevated gelato’s appeal across the U.S. and Canada. The region has also seen an increase in specialty gelato cafes and supermarket offerings that emphasize authenticity and flavor diversity. Continuous seasonal launches and innovative product lines further enhance brand visibility and consumer engagement. In March 2023, Righteous Gelato launched its Limited Edition Spring Collection in Canada, featuring Chocolate Easter Egg and Carrot Cake & Cream Cheese Gelato to strengthen its seasonal product portfolio. The ongoing product innovations, such as dairy-free and low-sugar formulations, are broadening the consumer base and fueling sustained market growth.

The U.S. led the North American gelato market in 2024. This growth is driven by the increasing consumer preference for premium and authentic frozen desserts that strike a balance between indulgence and quality. American consumers are increasingly drawn to Italian-style gelato for its rich texture, natural ingredients, and lower fat content compared to traditional ice cream. The expanding presence of artisanal brands, specialty gelaterias, and retail availability in supermarkets has further strengthened market accessibility. In addition, innovations such as vegan, low-sugar, and protein-enriched gelato variants are attracting health-conscious buyers. Growing collaborations between domestic and Italian brands continue to enhance product diversity, supporting the market’s strong upward trajectory.

Asia Pacific Gelato Market Trends

The gelato market in the Asia Pacific is projected to grow at the fastest CAGR of 8.2% from 2025 to 2033. Rising disposable incomes, rapid urbanization, and expanding cafe culture across key markets such as India, China, Japan, and Australia drive the growth. Consumers in the region are drawn to premium, artisanal desserts that offer authentic Italian flavors and natural ingredients. Brands are expanding their presence across Asia through product diversification and localized flavor development to capture evolving consumer preferences. For instance, in April 2025, Baskin-Robbins introduced an Italian Gelato range in India, featuring flavors like Chocolate & Roasted Hazelnut, Mango and Cream, and Blueberry Cheesecake. Such launches highlight the region’s increasing appetite for high-quality frozen desserts, positioning Asia Pacific as the fastest-growing market for gelato.

China’s growing middle class is driving demand for premium international desserts, making gelato a strong player in this market. As disposable incomes increase, urban millennials and Gen Z consumers are becoming more willing to try artisanal frozen desserts. They view these options as healthier and more indulgent than regular ice cream. Gelato’s key features, such as its dense texture, lower fat content, natural ingredients, and artisanal approach, appeal to quality-conscious consumers who appreciate authenticity and craftsmanship. The rise of Western-style cafes, boutique dessert shops, and food trends on social media is further driving interest in gelato. In major cities such as Shanghai, Beijing, Guangzhou, and Chengdu, premium dessert consumption has turned into a lifestyle choice, making gelato a popular and culturally relevant product in the Chinese market.

Key Gelato Market Company Insights

Several brands in the global gelato market have identified untapped opportunities within their product portfolios and aim to capture these through innovation and diversification. This includes the introduction of new flavor combinations, the expansion of plant-based and low-sugar options, and the development of region-specific products that cater to local tastes and dietary preferences. Companies enhance their retail presence and adopt experiential marketing strategies to engage consumers who seek authentic and premium dessert experiences. By targeting niche segments and adapting to evolving consumption trends, these brands aim to strengthen their market position and expand their global presence within the growing gelato industry.

-

Unilever PLC is a major global producer of frozen desserts, with a notable presence in the gelato market through brands such as Talenti. Its portfolio features premium gelato, innovative flavours, and dairy-free options, supported by a strong international manufacturing and distribution network.

-

Amorino is a premium artisanal gelato brand known for natural ingredients and traditional Italian recipes. Its offerings include gelato, sorbets, and macarons, distributed through an expanding network of boutiques across Europe, North America, and other global regions.

Key Gelato Companies:

The following are the leading companies in the gelato market. These companies collectively hold the largest market share and dictate industry trends.

- Unilever PLC

- Amorino

- Gelatissimo

- SAMMONTANA Italia S.p.A.

- Crosta Mollica

- Righteous Gelato Ltd.

- Hackney Gelato

- Baskin-Robbins, Inc.

- Uli's Gelato

- G.S. Gelato & Desserts, Inc.

Recent Developments

-

In November 2024, Gelatissimo launched the Roasted Black Sesame gelato, featuring crunchy roasted seeds and a nutty-sweet profile, expanding its Asian-inspired flavor offerings for consumers.

-

In January 2024, European private equity firm Perwyn invested strategically in UK-based Italian food brand Crosta & Mollica, supporting its expansion into international markets and bolstering its presence in the UK. The investment aligns with the growing demand for premium, authentic Italian gelato and other food products.

Gelato Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 23.47 billion

Revenue Forecast in 2033

USD 36.22 billion

Growth rate (Revenue)

CAGR of 5.2% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, flavor, production method, packaging, distribution channel, region

Regional Scope

North America, Europe, Asia-Pacific, Middle East & Africa, Central & South America

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, Japan, South Korea; Australia & New Zealand, Saudi Arabia, South Africa UAE, Brazil, Argentina

Key companies profiled

Unilever PLC; Amorino; Gelatissimo; SAMMONTANA Italia S.p.A.; Crosta Mollica; Righteous Gelato Ltd.; Hackney Gelato; Baskin-Robbins, Inc.; Uli's Gelato; G.S. Gelato & Desserts, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gelato Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global gelato market report on the basis of source, flavor, production method, packaging, distribution channel and region:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Dairy-based

-

Plant-based

-

-

Flavor Outlook (Revenue, USD Million, 2021 - 2033)

-

Vanilla

-

Chocolate

-

Fruits & Berries

-

Nuts

-

Others

-

-

Production Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial Gelato

-

Artisanal Gelato

-

-

Packaging Outlook (Revenue, USD Million, 2021 - 2033)

-

Impulse packaging

-

Take-home packaging

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Food Service

-

Retail

-

Offline

-

Online

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

Southeast Asia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.