- Home

- »

- Biotechnology

- »

-

Gene Synthesis Market Size & Growth Analysis Report, 2030GVR Report cover

![Gene Synthesis Market Size, Share & Trends Report]()

Gene Synthesis Market (2023 - 2030) Size, Share & Trends Analysis Report By Method (Solid-phase Synthesis, Chip-based Synthesis, PCR-based Enzyme Synthesis), By Service, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-597-3

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global gene synthesis market size was valued at USD 1.76 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 16.1% from 2023 to 2030. The growth of the market is attributed to factors such as favorable government policies relating to synthetic biology. Investors have been more focused on synthetic biology research during the past few years. Approximately USD 8.0 billion in governmental and commercial funding was allocated to the synthetic biology sector in 2020. The COVID-19 outbreak has benefited the gene synthesis market by creating significant growth opportunities. Researchers are exploring untapped possibilities in the gene synthesis field, which is helping to boost market growth in terms of revenue generation. For instance, researchers at the National Institute of Standards and Technology have developed synthetic SARS-CoV-2 gene fragments to assist researchers to develop accurate and reliable diagnostic tests for the disease.

Synthetic DNA technological advancements are getting significant traction as a viable method to address concerns associated with the increasing number of emerging viruses and the potential threats of the next global pandemic. The SARS-CoV-2 pandemic along with pandemics involving other novel diseases in the near future can be rapidly addressed with the help of this promising technique to quickly replicate and analyze genes of interest.

Targeted therapy has gained significant interest from the biotechnology and pharmaceutical industry and researchers. It has become an important technique of disease management. Targeted therapy in combination with immunotherapy and chemotherapy is anticipated to witness significant growth in the coming years. This would open up lucrative opportunities for both established and emerging players in the gene synthesis market.

The lack of skilled professionals in the field of gene synthesis and biotechnology is one of the main factors which could hinder the market growth, as the companies operating in this market would require trained and experienced staff at their facilities. Therefore, companies are entering into several strategic collaborations with universities to offer staff online workshops, on-site training, and sponsored projects to develop the right professionals. This would further help to drive the gene synthesis market growth.

Method Insights

Solid-phase synthesis dominated the gene synthesis market in 2022 owing to the increasing adoption rate during the past few years. The segment held around 35.87% of the revenue share in 2022. This is a prominent technology for applications in several fields and for various research purposes, since it may be used to create modified & canonical polymers of nucleic acids, specifically RNA or DNA.

Most companies currently offering commercial services for gene synthesis utilize a solid-phase synthesis process, using various synthesis platforms made available by companies such as Agilent technology, Blue Heron Biotech, and Sloning BioTechnology, among others.

The PCR-based enzyme segment is expected to register the fastest CAGR during the forecast period. Certain factors such as its precision, ease of use, and reasonably priced technology are the factors estimated to accelerate segment growth by 2030. It is an effective method to produce the A+T-rich malaria genome.

Moreover, PCR-based gene synthesis provides a simple solution to the issue of producing significant amounts of labeled protein for NMR spectroscopy, when the gene encoding the protein is difficult or unavailable to express effectively. Thus, the aforementioned applications of this technique are contributing to segment growth.

Service Insights

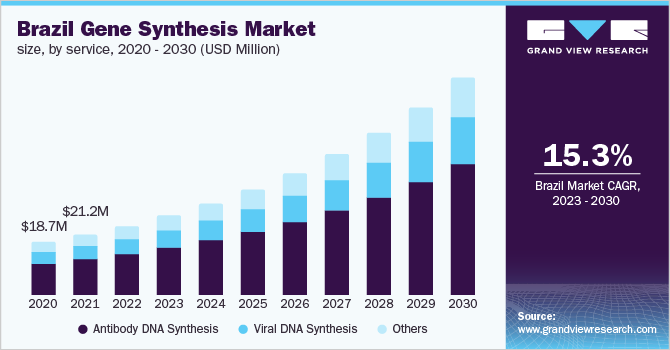

The antibody DNA synthesis segment held a 60.90% share of the market in 2022. The presence of several market players offering services for antibody DNA synthesis has contributed to the gene synthesis market dominance in 2022. Companies are providing services to research institutions and biotech/ pharma companies to allow cloning and synthesis of antibody chain sequences into any vector.

In April 2022, Twist Bioscience Corporation announced the launch of a high-throughput antibody production platform. Customers can convert digital DNA (dDNA) sequences into purified IgG antibodies using the antibody production workflow. In June 2022, Codex DNA, Inc. presented automated synthetic biology technologies to accelerate discovery workflows at the conference on antibody engineering and therapeutics in Europe.

Viral gene synthesis is projected to witness the fastest growth rate owing to the growing virus vector-related R&D activities. Furthermore, companies are involved in the synthesis of all structural and non-structural gene fragments or protein genes of the SARS-CoV-2. In February 2022, Eleven Therapeutics and Twist Bioscience Corporation developed a replicon tool, which can be used to examine viral genome replication and antiviral drug screening, along with therapeutic & vaccine development.

Application Insights

The gene & cell therapy development segment dominated the gene synthesis market by holding a 35.53% share of the revenue in 2022. This is anticipated to expand the advanced therapies pipeline for the treatment of chronic diseases. These therapies are gaining significant acceptance among therapy developers due to their efficiency in treating diseases that were not treatable using the traditional mode of treatment.

Several initiatives have been undertaken by biotechnology and pharmaceutical companies to promote cell and gene therapy treatments. In January 2022, Century Therapeutics entered into a collaboration with Bristol Myers Squibb Company to develop iPSC-derived allogeneic cell therapies.

Disease diagnosis is anticipated to witness the fastest growth rate in the coming years owing to the growing disease burden worldwide and a rising need for enhancement in medical diagnostics. Synthetic biology provides bio-molecular engineering strategies that can go beyond the limitations of traditional antibody-based diagnostics platforms, which are usually slow, expensive, and not appropriate for the testing of emerging pathogens or rare diseases.

Moreover, the increasing adoption of advanced techniques for driving scientific advancements, such as the production of designer cells that can employ synthetic gene circuits for surveying disease biomarkers and aiding in disease diagnosis, is also contributing to the segment’s growth.

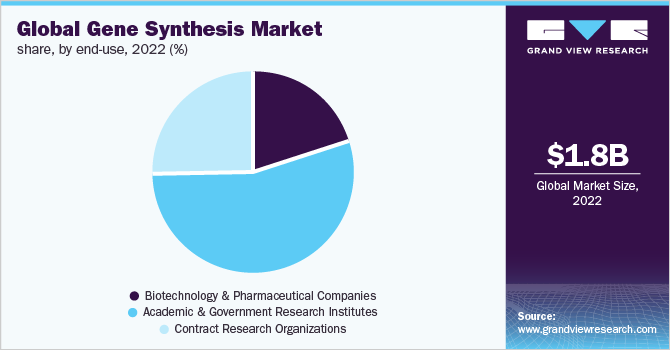

End-use Insights

Academic and government research institutes dominated the gene synthesis market in 2022 in terms of revenue share, owing to the increasing usage of gene synthesis services in research settings. In 2022, the segment held around 54.30% share of revenue globally. The research institutes are entering into collaborations with service providers to speed up their research programs that require the characterization and synthesis of gene fragments.

For instance, in February 2021, Medicines Manufacturing and Innovation Centre collaborated with Exactmer, Novartis, UK Research & Innovation, and AstraZeneca. This collaboration aims to develop a sustainable, scalable, and cost-effective manufacturing process for oligonucleotides.

Biotechnology and pharmaceutical companies are projected to witness significant growth in the coming years. Key players are also focusing on the development and launch of new platforms that can enhance the gene synthesis process. For instance, in August 2020, Codex DNA launched BioXp 3250 system for synthetic biology workflow. This platform aims to accelerate the development of new biologics and vaccines. It allows researchers to generate large DNA fragments of up to 7kb at high speed without compromising accuracy. These factors would further contribute to the segment’s growth.

Regional Insights

North America held the largest revenue share in 2022. This can be attributed to the presence of several key market players offering gene synthesis services, increasing interest of major biotechnology & pharmaceutical companies in gene & cell therapy development, the expanding field of synthetic biology in the region, and increasing interest in gene synthesis in the molecular biology arena.

Furthermore, the presence of a high number of contract research organizations (CROs) providing gene synthesis services is expected to increase revenue in the region. For instance, GenScript has established a significant presence across the North American region. It offers a broad range of services, including antibody drug development services and custom gene synthesis services

Asia Pacific is projected to witness the fastest growth rate during the forecast period due to increasing research activities for the development of effective therapeutics, coupled with increasing interest in synthetic biology research. In addition, there is a growing incidence of diseases due to lifestyle changes. Improving healthcare infrastructure, entry of large biotechnology organizations, and growing R&D activities are also expected to contribute to market growth.

Key Companies & Market Share Insights

Key players operating in the market are taking several strategic initiatives such as entering into collaborations, partnerships, and geographical expansions in favorable regions. Companies are introducing novel products to strengthen their product portfolio in the market. For instance, in March 2022, ProteoGenix launched XtenCHO Transient CHO Expression System.

This product simplifies recombinant protein production, further accelerating early-phase drug screening. Similarly, in February 2022, Integrated DNA Technologies, Inc. announced the introduction of Alt-R HDR Donor Blocks, which enables research professionals to edit the Homology-directed Repair (HDR) genome for developing treatments. Some of the prominent companies in the global gene synthesis market include:

-

GenScript

-

Brooks Automation, Inc. (GENEWIZ)

-

Boster Biological Technology

-

Twist Bioscience

-

ProteoGenix, Inc

-

Biomatik

-

ProMab Biotechnologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

Integrated DNA Technologies, Inc.

-

OriGene Technologies, Inc.

Gene Synthesis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.03 billion

Revenue forecast in 2030

USD 5.78 billion

Growth rate

CAGR of 16.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand; South Korea, Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GenScript; GENEWIZ; Boster Biological Technology; Twist Bioscience; ProteoGenix, Inc.; Biomatik; ProMab Biotechnologies, Inc.; Thermo Fisher Scientific, Inc.; Integrated DNA Technologies, Inc.; OriGene Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gene Synthesis Market Segmentation

This report forecasts revenue growth at global, regional, and country levels along with provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gene synthesis market report based on the method, service, application, end-use, and region:

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Solid-phase Synthesis

-

Chip-based Synthesis

-

PCR-based Enzyme Synthesis

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibody DNA Synthesis

-

Viral DNA Synthesis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene & Cell Therapy Development

-

Vaccine Development

-

Disease Diagnosis

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global gene synthesis market size was estimated at USD 1.76 billion in 2022 and is expected to reach USD 2.03 billion in 2023.

b. The global gene synthesis market is expected to grow at a compound annual growth rate of 16.1% from 2023 to 2030 to reach USD 5.78 billion by 2030.

b. The solid-phase synthesis method accounted for the largest revenue share in 2022 owing to its high accuracy and higher adoption rate over the past years. PCR and chip-based synthesis method is anticipated to witness the fastest growth owing to low cost, higher yield, and ability to synthesize large gene fragments.

b. Some of the prominent players in the gene synthesis market include GenScript, Brooks Automation, Inc. (GENEWIZ), Boster Biological Technology, Twist Bioscience, ProteoGenix, Biomatik, ProMab Biotechnologies, Inc., Thermo Fisher Scientific, Inc., Integrated DNA Technologies, Inc., and OriGene Technologies, Inc.

b. The declining price of DNA synthesis & sequencing, the advent of the enzymatic DNA synthesis process, and technological advancements in the DNA synthesis platforms are driving the gene synthesis market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.