- Home

- »

- Next Generation Technologies

- »

-

Generative AI Market Size, Share And Growth Report, 2030GVR Report cover

![Generative AI Market Size, Share & Trends Report]()

Generative AI Market Size, Share & Trends Analysis Report By Component (Software, Services), By Technology, By End-use, By Application, By Model, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-011-4

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Generative AI Market Size & Trends

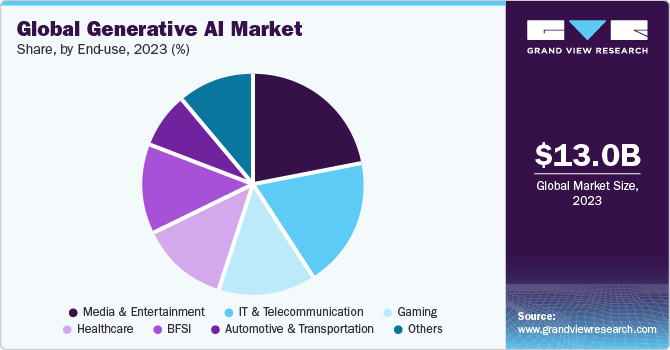

The global generative AI market size was estimated at USD 13.0 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 36.5% from 2024 to 2030. Factors such as the rising application scope of technologies including super-resolution, text-to-image conversion, & text-to-video conversion, and modernization of workflow across industries are driving the demand for generative AI applications among industries, such as media & entertainment, retail, manufacturing, IT, and telecom. For instance, in March 2023, Microsoft Corporation launched a model, Visual ChatGPT, which comprises multiple visual foundation models and enables users to interact with ChatGPT through graphical user interfaces.With this model, ChatGPT can handle user requests for image generation and editing.

Furthermore, growing need for building virtual worlds in the metaverse,deployment of large language models (LLM), and conversational GenAI ability are further fueling the market demand. Generative AI in the gaming market is used for transforming the gaming industry in various ways, enhancing game development, player experiences, and content creation. The COVID-19 pandemic had a positive impact on the market as businesses shifted to the online work model, speeding up digitalization across industries. As per IBM’s Global AI Adoption Index 2022 report, over 53% of IT professionals commented that they have accelerated the roll-out of AI in the last 24 months as a part of their response to the pandemic. Moreover, during the pandemic, advanced diagnosing tools were developed using AIto analyze clinical, epidemiological, genomic data related to COVID-19, and various other imaging systems.

Generative AI makes use of unsupervised learning algorithms for spam detection, image compression, and preprocessing data stages, such as removing noise from visual data, to improve picture quality. Moreover, supervised learning algorithms are used for medical imaging and image classification. Furthermore, it has applications in various industries, such as BFSI, healthcare, automotive & transportation, IT & telecommunications, media & entertainment, and others. Generative AI is a powerful tool that can be used to create new ideas, solve problems, and create new products. Moreover, it can help organizations save money and time, increase efficiency, and enhance the quality of content generated.

Popular generative AI tools include ChatGPT, GPT-3.5, DALL-E, MidJourney, and Stable Diffusion. Generative AI is at a developing stage, which will require a skilled workforce and high investment in implementation for development. According to IBM’s global AI adoption index 2022 report, 34% of respondents believed that a lack of AI skills, expertise, or knowledge was restricting its adoption for industries. Hence, the unavailability of a skilled workforce and the high implementation costs are expected to slow down the pace of market development.

The revolution in cloud storage solutions has boosted the market expansion by offering a strong ground for technology development and deployment. Cloud storage provides scalable computing power, enabling access to resource-intensive generative AI model training for businesses without heavy capital spending. Furthermore, it guarantees high efficiency in data accessibility and collaboration, enabling the storage and sharing of various datasets across global teams. The cost-effective pay-as-you-go model of cloud storage reduces economic restraints and accelerates secure management of sensitive Generative AI projects. Offerings of pre-trained models and APIs by cloud providers simplify development procedures, whilst cloud-based infrastructure augments resource optimization and business agility. Subsequently, cloud storage solutions foster generative AI innovation, enabling companies to explore creative avenues and fuel market growth.

Generative AI is poised to create a new wave of software revenue. The technology is being used to create specialized assistants, new infrastructure products, and copilots that accelerate coding. According to a recent survey, the increasing demand for generative AI products is expected to create an upsurge of around USD 300 billion in new software revenue. The biggest beneficiaries of this trend are likely to be cloud computing companies. As enterprises shift more workloads to the public cloud, they will be looking for generative AI solutions to help them automate tasks and improve efficiency. Cloud computing companies like Amazon Web Services, Microsoft, Google, and Nvidia are already well-positioned to capitalize on this demand.

Generative AI allows models to become multimodal, which means they can process multiple modalities simultaneously, such as images and text, broadening their application areas and increasing their versatility. Generative AI enhances the connection to the world where humans communicate with computers using natural language rather than programming languages. Generative AI has the potential to transform businesses by opening new opportunities for automation, innovation, and personalization, all while lowering costs and improving customer experience. For instance, in March 2023, Grammarly, Inc., a U.S.-based AI-based writing assistant, announced the launch of GrammarlyGo, a feature of generative AI enabling users to compose writing, edit, and personalize text.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by Natural Language Processing (NLP), machine learning (ML), computer vision, and speech processing. In addition, the increasing application scope of novel technologies with the help of multimodal AI models that allow the mixing of audio, video, and images for creating new content supports market growth. In December 2023, Google released Gemini, a generative AI multimodal system that can understand and converse intelligently about input, including pictures, text, speech, music, computer code, and more.

The market is fragmented, featuring several global and regional players. The market players are investing in research & development (R&D) to develop advanced solutions and gain a competitive edge in the market. Moreover, they are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change.

In November 2021, IBM announced the acquisition of SXiQ, an Australian digital transformation services company specializing in cloud applications, cloud platforms, and cloud cybersecurity. The acquisition aimed at helping IBM’s AI strategy and hybrid cloud by empowering enterprises to modernize and improve sophisticated mission-critical applications on multiple platforms and clouds.

Component Insights

The software component segment led the market with the largest revenue share of 64.5% in 2023 and is expected to continue to dominate the industry over the forecast period. This growth can be attributed to factors, such as growing fraudulent activities, overestimation of capabilities, unexpected outcomes, and rising concerns over data privacy. Generative AI software is expected to play a significant role in various industries and sectors, including fashion, entertainment, and transportation, as it is becoming more powerful through robust ML models. For instance, brands like H&M and Adidas have used generative AI to create clothing designs and custom sneakers. Moreover, this technology has also been used to generate unique patterns for fabrics and prints, saving designers time and effort.

The service segment is anticipated to witness the fastest CAGR during the forecast period. The segment growth can be attributed to the increasing concerns over the protection of data, fraud detection, trading prediction, and risk factor modeling. Cloud-based generative AI services are expected to gain popularity as they provide flexibility, scalability, and cost-effectiveness, propelling the service segment's growth. For instance, in April 2023, Amazon Web Service (AWS), a U.S.-based IT service management company, announced Amazon Bedrock and multiple generative AI services. This service aims to provide AWS customers with a suite of generative AI tools for building chatbots, generating & summarizing text, and classifying images based on a prompt.

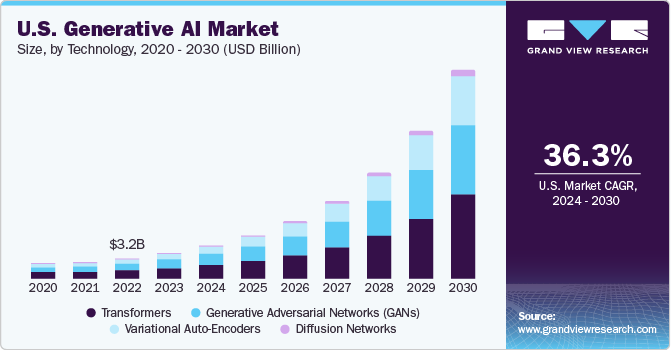

Technology Insights

The transformers segment held the largest revenue share in 2023. This can be attributed to the increasing adoption of transformers applications such as text-to-image AI, which envisages converting text to an image. For instance, generative AI tools such as DALL-E is a transformer that understands the text data and converts the data accordingly. GPT-3 is an example of a transformer built by the OpenAI team, a San Francisco-based AI research laboratory. This model can generate text that appears to have been written by a human and compose poetry and emails.

The diffusion networks segment is expected to witness the fastest CAGR during the forecast period. To meet the increasing demands of image synthesis, image generation has become essential for various industries, such as BFSI, healthcare, medical & entertainment, automotive & transportation, defense, and many others, as they are equipped to provide high-value to businesses, government, and public. Moreover, diffusion networks address the drawbacks of Generative Adversarial Networks (GANs) by better handling noise and generating a significantly higher diversity of images with similar or higher quality while requiring little effort in training. Using diffusion networks for generative AI can help leverage various unique capabilities, including creating diverse images, rendering text in various artistic styles, and animation.

Application Insights

The natural language processing segment dominated the market in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. NLP is a powerful generative AI tool with numerous text and speech generation applications. Deep learning advances have resulted in the development of neural NLP models, such as Recurrent Neural Networks (RNNs), and transformer models, such as BERT, developed by researchers at Google AI Language and GPT-3, developed by OpenAI, a U.S.-based AI company. These models significantly enhanced the accuracy and efficiency of NLP-based generative AI applications, propelling segment growth.

The computer vision segment is anticipated to grow at the fastest CAGR during the forecast period. The rapid adoption of computer vision systems in the transportation and automotive sectors drives segment growth. One of the major factors driving the computer vision market includes quicker processing and higher accuracy, combined with the economic benefits of computer vision systems. Moreover, the growing use of computer vision in non-industrial applications, such as surveillance, healthcare, and monitoring, creates a lucrative opportunity for the computer vision market trends.

Model Insights

The large language segment dominated the market in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. The segment growth can be attributed to various applications, ranging from chatbots capable of holding conversations with users to content-generation tools that can write product descriptions or articles. Large language models may help in the reduction of time and cost associated with the development of NLP applications. Large language models, such as ChatGPT, have become popular in NLP. These models can comprehend and generate human-like language, making them useful in various applications.

The multi-modal generative model is expected to witness the fastest CAGR from 2024 to 2030. The multi-modal generative model can achieve greater accuracy and robustness by combining data from multiple modalities, propelling the segment’s growth. The image & video model segment will grow at a significant rate as it can assist in rapidly creating high-quality, realistic images & videos, which are difficult or impossible to achieve using traditional methods. Moreover, image synthesis is also being used to develop more realistic and immersive virtual worlds for entertainment and gaming purposes.

End-use Insights

The media & entertainment segment led the market with the largest revenue share of 22.6% in 2023 and is projected to grow at a significant CAGR from 2024 to 2030. The increasing adoption of generative AI for creating better advertisement campaigns is likely to drive the demand for this technology in the media & entertainment industry. For instance, in January 2023, BuzzFeed, Inc., an internet media, news, and entertainment company in the U.S., announced a plan to use AI tools provided by Open AI, a U.S.-based AI company, to enhance and personalize specific content offerings. Generative AI in the logistics market is used for route optimization, risk management, communication, and collaboration to enhance overall efficiency, reduce costs, and improve the adaptability of supply chain processes.

The BFSI segment is expected to witness the fastest CAGR from 2024 to 2030. The segment growth is attributed to the increasing implementation of AI & ML in the sector to prevent fraudulent activities, secure data, and meet the dynamic needs of various stakeholders in financial services. Generative AI benefited the banking industry by creating marketing images & text and generating data to make ML applications more efficient and accurate. Moreover, generative AI in commercial banking can accelerate back-office tasks such as answering real-time questions about a customer’s financial performance in complex scenarios.

Regional Insights

North America dominated the market with a revenue share of 40.2% in 2023 and is projected to grow at a CAGR of 36.6% over the forecast period, due to factors, such as rising pseudo-imagination & medical care and increasing banking frauds. Also, the presence of prominent market players, such as U.S.-based Meta, Microsoft, and Google LLC, technology organizations, and the presence of experts are likely to drive regional market growth. The regional market is also driven by factors, including increasing demand for AI-generated content in the media & entertainment, healthcare, and other industries and availability of large amounts of data for training generative models.

U.S. Generative AI Market Trends

The U.S. market is expected to grow at the fastest CAGR over the forecast period due to the growing adoption of deep learning and machine learning across various industries including small and medium enterprises (SMEs).

The Europe market was identified as a lucrative region in this industry due to the increasing adoption of AI. For instance, in January 2019, the European Commission’s Artificial Intelligence for European Union (AI4EU) project was launched. The project had a budget of USD 21.0 million and aimed to boost Europe's technology capabilities and accelerate AI adoption across various sectors of the economy.

UK Generative AI Market Trends

The UK market is expected to grow at the fastest CAGR over the forecast period, due tothe growing emphasis on automation and efficiency in various industries. Businesses are leveraging generative AI to automate tasks that traditionally require significant human involvement, leading to time and cost savings. The efficiency gains achieved through generative AI in design prototyping, content creation, and creative processes drive its widespread adoption across diverse sectors.

Germany Generative AI Market Trends

The Germany market is expected to grow at the fastest CAGR from 2024 to 2030, due to robust digital infrastructure in the country. The country's advanced telecommunications networks and widespread access to high-speed internet create an environment conducive to implementing AI solutions. This digital infrastructure facilitates seamless data exchange and connectivity, essential components for the effective functioning of generative AI systems.

Asia Pacific is anticipated to grow at the fastest CAGR of 37.5% from 2024 to 2030. An increasing number of government initiatives in AI in Asia Pacific and the growing adoption of AI applications are driving the growth of the market in Asia Pacific. The regional market growth is also attributed to the rapidly digitizing businesses, which strain cloud networks and data centers. Moreover, AI adoption assists the organizations in enabling civil society members to be responsible and informed users of AI devices.

China Generative AI Market Trends

The China market is expected to grow at the fastest CAGR from 2024 to 2030 due to the increasing integration of generative AI in China's education sector. Educational institutions leverage AI technologies to enhance teaching methodologies, provide personalized learning experiences, and develop innovative educational content. Generative AI creates interactive and adaptive learning materials that align with the evolving needs of the education sector. Pursuing academic advancement fuels the adoption of generative AI solutions in classrooms and educational platforms throughout China.

Japan Generative AI Market Trends

The Japan market is expected to grow at the fastest CAGR from 2024 to 2030 due to rising geriatric population and demand for healthcare. Generative AI applications, such as medical imaging analysis and personalized treatment recommendations, are crucial in addressing the healthcare challenges associated with an aging demographic. The pursuit of advanced healthcare technologies aligns with Japan's commitment to providing high-quality medical services, contributing to market growth.

Saudi Arabia Artificial Intelligence (AI) Market Trends

The Saudi Arabia market is expected to grow at the fastest CAGR from 2024 to 2030 due to the country’s strategic focus on smart city development and digital transformation provides opportunities for deploying generative AI in urban planning and management. Generative AI contributes to optimizing city services, traffic management, and public safety, aligning with the objectives of creating modern and efficient urban environments. The government's initiatives to build smart cities and leverage technology for sustainable urban development drive the adoption of generative AI in various smart city applications.

Key Generative AI Company Insights

Some of the key players operating in the market include Amazon Web Services, Inc.; Google LLC (Alphabet Inc.), IBM; and Microsoft.

-

Amazon Web Services (AWS) offers a variety of solutions and services for generative AI. These offerings are tailored to assist organizations in innovating and scaling generative AI applications with enterprise-grade security, privacy, and access to industry-leading foundation models. AWS provides tools, such as Amazon Bedrock, Amazon SageMaker, NVIDIA GPU-powered Amazon EC2 instances, AWS Trainium, and AWS Inferentia, to facilitate the development and scaling of generative AI applications

-

Google LLC, a subsidiary of Alphabet, is a multinational technology company focusing on search engines, online advertising, computer software, cloud computing, and AI. Google LLC offers generative AI solutions and services through its Google Cloud platform. The platform provides tools such as Gemini, Google DeepMind’s multimodal model from Google DeepMind, which can understand various inputs, combine different types of information, and generate a wide range of outputs. In addition, Google Cloud's Generative AI Studio enables developers to interact with, tune, and deploy large AI models, thus accelerating generative AI to production

MOSTLY AI Inc. and Synthesia are some of the other market participants in the artificial intelligence market.

-

MOSTLY AI Inc. is a technology company providing AI-based software, IT, and IT consulting services. The company’s Synthetic Data Platform leverages deep neural networks to simulate representative and realistic data at scale and retains valuable information from it while making it impossible to re-identify any individual, due to the built-in privacy mechanism

-

Synthesia is a technology company that uses AI algorithms to create videos, translate them into different languages, change existing footage, and generate video content based on input, such as images and text, empowering content creators to scale their video creation with localized and personalized videos

Key Generative AI Companies:

The following are the leading companies in the generative AI market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these generative AI companies are analyzed to map the supply network.

- Synthesia

- MOSTLY AI Inc.

- Genie AI Ltd.

- Amazon Web Services, Inc.

- IBM

- Google LLC

- Microsoft

- Adobe

- Rephrase.ai

- D-ID

Recent Developments

-

In April 2023, Microsoft Corp. collaborated with Epic Systems, an American healthcare software company, to incorporate large language model tools and AI into Epic’s electronic health record software. This partnership aims to use generative AI to help healthcare providers increase productivity while reducing administrative burden

-

In March 2021, MOSTLY AI Inc. announced its partnership with Erste Group, an Australian bank to provide its AI-based synthetic data solution. Using synthetic data, Erste Group aims to boost its digital banking innovation and enable data-based development

Generative AI Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.88 billion

Revenue forecast in 2030

USD 109.37 billion

Growth rate

CAGR of 36.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

February 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, end-use, application, model, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; Australia; Brazil; Mexico; Chile; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Synthesia; MOSTLY AI Inc.; Genie AI Ltd.; Amazon Web Services, Inc.; IBM; Google LLC; Microsoft; Adobe; Rephrase.ai; and D-ID

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Generative AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global generative AI market research report based on component, technology, end-use, application, model, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Service

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational Auto-encoders

-

Diffusion Networks

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Gaming

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Computer Vision

-

NLP

-

Robotics And Automation

-

Content Generation

-

Chatbots & Intelligent Virtual Assistants

-

Predictive Analytics

-

Others

-

-

Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Language Models

-

Image & Video Generative Models

-

Multi-modal Generative Models

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global generative AI market size was estimated at USD 13.00 billion in 2023 and is expected to reach USD 16.88 billion in 2024.

b. The global generative AI market is expected to grow at a compound annual growth rate of 36.5% from 2024 to 2030 to reach USD 109.37 billion by 2030.

b. North America dominated the generative AI market with a share of 40.2% in 2023. This is attributable to the existence of leading companies researching & developing generative AI applications.

b. Some key players operating in the generative AI market include Synthesia, MOSTLY AI Inc., Genie AI Ltd., Amazon Web Services, Inc., IBM, Google LLC, Microsoft, Adobe, Rephrase.ai, and D-ID.

b. Key factors driving the generative AI market growth include rising applications of novel technologies and growing demand to modernize workflow across industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."