- Home

- »

- Advanced Interior Materials

- »

-

Geocomposites Market Size & Share, Industry Report, 2030GVR Report cover

![Geocomposites Market Size, Share & Trends Report]()

Geocomposites Market (2025 - 2030) Size, Share & Trends Analysis Report By Function (Separation, Reinforcement), By Application (Water & Wastewater Management, Road & Highway), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-537-8

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Geocomposites Market Size & Trends

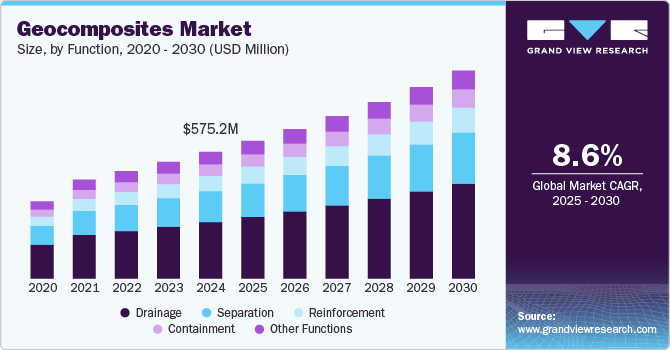

The global geocomposites market size was USD 575.2 million in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030, driven by increasing infrastructure development and the rising need for cost-effective and high-performance construction materials. Geocomposites, which combine multiple geosynthetic materials to enhance functionality, are widely used in civil engineering applications such as road construction, drainage systems, landfills, and environmental protection projects.

The expansion of the construction sector, particularly in emerging economies, has fueled demand for advanced geosynthetic solutions that provide superior mechanical, hydraulic, and filtration properties. In addition, governments worldwide are investing heavily in infrastructure modernization, including highways, bridges, railways, and tunnels, driving the adoption of geocomposites for soil stabilization, erosion control, and reinforcement applications.

The rising demand for improved road and railway infrastructure is another major factor driving market growth. As global landfill & mining networks expand, there is a growing need for geocomposite materials that enhance road longevity, prevent soil erosion, and improve overall structural stability. Geocomposites are widely used in railway track reinforcement, where they help distribute loads efficiently, reduce maintenance costs, and prevent track deformation. With increasing investments in smart cities and landfill & mining infrastructure projects worldwide, the demand for geocomposites is expected to continue rising, particularly in regions with challenging soil conditions.

The increasing use of geocomposites in the mining and energy sectors is also contributing to market growth. In mining operations, geocomposites are used for slope reinforcement, waste containment, and drainage applications. They help prevent soil erosion and ensure the safe disposal of mining waste, enhancing operational efficiency and environmental compliance. In addition, in the energy sector, geocomposites play a crucial role in renewable energy projects such as solar farms and wind energy installations, where they provide foundation stabilization and erosion control. The expansion of the mining and renewable energy industries is expected to drive further demand for geocomposites in the coming years.

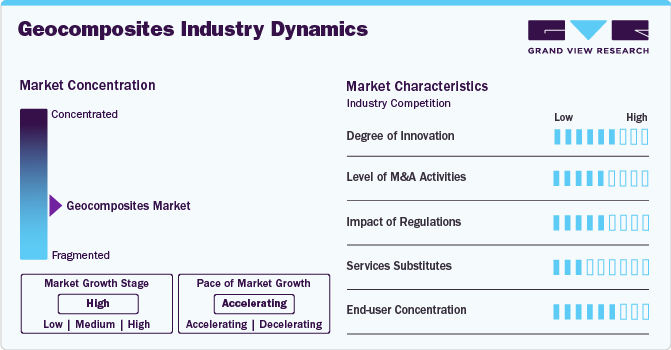

Market Concentration & Characteristics

The global geocomposites industry is characterized by a moderate-to-high degree of market concentration, with key players continuously engaging in technological innovations and strategic collaborations to enhance product performance and expand their market presence. The degree of innovation within the market is significant, driven by advancements in material science, sustainability concerns, and the increasing demand for geosynthetic solutions in infrastructure development. Companies are investing in the development of eco-friendly and high-performance geocomposites that offer enhanced durability, filtration, and reinforcement capabilities. In addition, ongoing merger and acquisition activities are shaping the competitive landscape, with major players acquiring smaller firms to strengthen their product portfolios and expand their geographical reach. These strategic moves help market leaders capitalize on growing infrastructure projects, particularly in emerging economies, where demand for geocomposites in road construction, drainage systems, and landfill engineering is rising.

The impact of regulations on the geocomposites industry is significant, as stringent environmental and construction industry standards drive the adoption of sustainable and high-quality materials. Regulatory bodies across regions are emphasizing the use of geocomposites in erosion control, waste management, and water conservation projects to minimize environmental degradation. The availability of service substitutes remains limited, as geocomposites offer superior performance compared to traditional soil stabilization and drainage methods. However, competition from alternative geosynthetic products, such as geotextiles and geomembranes, poses a challenge to market growth. The market also exhibits a high end-use concentration, with key demand segments including landfill & mining infrastructure, waste management, water conservation, and mining applications. As global urbanization and road & highwayization continue to accelerate, the demand for geocomposites in these end-use sectors is expected to remain strong, reinforcing the market's growth trajectory.

Function Insights

The drainage segment led the market with the largest revenue share of 44.55% in 2024, driven by increasing infrastructure development and the need for efficient water management solutions. As urbanization and road & highwayization continue to accelerate worldwide, the demand for advanced drainage systems in civil engineering applications has risen substantially. Geocomposite drainage solutions are widely used in roadways, railways, landfills, and retaining structures to ensure proper water flow and prevent structural failures caused by water accumulation.

The separation segment is expected to grow significantly at a CAGR of 8.7% over the forecast period, driven by increasing infrastructure development and the rising need for durable and cost-effective soil stabilization solutions. Governments and private sector entities worldwide are investing heavily in road construction, railway projects, and land reclamation, necessitating the use of geocomposites for the efficient separation of different soil layers. These materials help enhance the longevity and performance of infrastructure by preventing the intermixing of soil and aggregates, reducing maintenance costs, and improving load-bearing capacity.

Application Insights

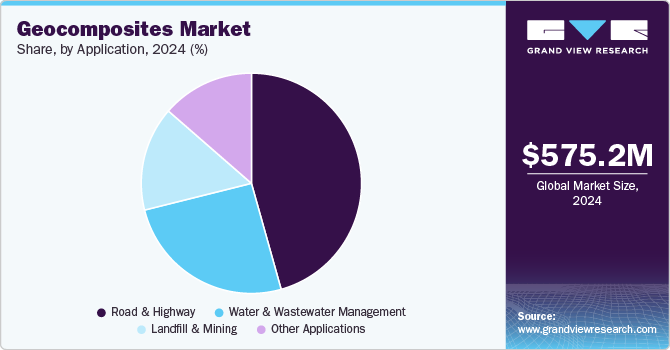

The road & highway segment dominated the market and held the largest revenue share of 45.64% in 2024, driven by increasing infrastructure development projects worldwide. Governments and private sector entities are investing heavily in road expansion and maintenance programs to enhance landfill & mining networks. Geocomposites play a crucial role in improving road durability, reducing maintenance costs, and enhancing load-bearing capacity, making them a preferred choice in modern road construction.

The water & wastewater management segment is expected to grow at the fastest CAGR of 9.1% over the forecast period, driven by increasing environmental concerns and stringent regulations regarding water resource management. Governments and regulatory bodies worldwide are implementing strict wastewater treatment guidelines, compelling industries and municipalities to adopt advanced solutions such as geocomposites. These materials offer superior filtration, drainage, and reinforcement properties, making them essential in the construction of reservoirs, canals, and landfill liners.

Regional Insights

The North America geocomposites industry growth is due to the expansion of the mining industry in North America. Mining operations require efficient containment and drainage systems to manage waste materials and prevent environmental damage. Geocomposites, including geotextile-geonet and geotextile-geomembrane composites, are widely used in tailings storage facilities and heap leach pads, enhancing the safety and efficiency of mining activities while ensuring environmental protection.

U.S. Geocomposites Market Trends

The waste management industry is driving demand for geocomposites, particularly in landfill applications. As the country faces increasing waste disposal challenges, geocomposites are widely used for landfill liners, leachate drainage, and gas collection systems. These materials help contain hazardous waste and prevent groundwater contamination, aligning with stringent environmental regulations set by the U.S. Environmental Protection Agency (EPA). The rising adoption of geocomposites in railway infrastructure is another key market driver. As the U.S. rail network undergoes modernization, geocomposites are increasingly used for track stabilization, subgrade reinforcement, and drainage control. These materials enhance the durability of railway tracks, reducing maintenance costs and improving operational efficiency.

Asia Pacific Geocomposites Market Trends

Asia Pacific geocomposites industry dominated globally, with the largest revenue share of 31.57% in 2024. The growing urbanization and road & highwayization in the region are major factors driving market growth. With rising population density in metropolitan areas, governments and private developers are constructing residential and commercial buildings at an unprecedented pace. The use of geocomposites in foundations, retaining walls, and drainage systems helps improve structural integrity and prevent soil erosion. In addition, rapid road & highway growth has increased the need for geocomposites in factory floors, parking lots, and storage facilities, where soil reinforcement is crucial for stability and durability.

The China geocomposites industry is driven by the expansion of China's landfill & mining infrastructure, particularly in railway and highway projects, which has significantly boosted the adoption of geocomposites. With China leading the world in high-speed rail construction, geocomposites are extensively used for track bed stabilization, vibration control, and moisture management. The government's Belt and Road Initiative (BRI) has also contributed to the increasing deployment of geocomposite materials in large-scale international infrastructure projects, strengthening the market's growth trajectory.

Europe Geocomposites Market Trends

The Europe geocomposites industry growth is attributed to the rapid expansion of the waste management and landfill sector in the region. European countries are focusing on improved waste disposal solutions to comply with EU directives on landfill management. Geocomposites, particularly in the form of geosynthetic clay liners and drainage composites, are widely used in landfill capping and leachate collection systems to prevent groundwater contamination and ensure environmental protection. The rising focus on water conservation and flood management is also driving the demand for geocomposites in Europe. Climate change has led to unpredictable weather patterns, increasing the risk of flooding and soil erosion. Geocomposites are extensively used in stormwater management systems, canal linings, and riverbank reinforcement projects to mitigate the impact of excessive rainfall and improve water retention in agricultural areas.

The Germany geocomposites industry growth is driven by the expansion of the renewable energy sector, which is a significant driver propelling the demand for geocomposites in Germany. As the country transitions towards a greener economy, large-scale wind farms and solar power plants require stable and durable foundations. Geocomposites are increasingly being used in these renewable energy projects for soil stabilization, drainage, and erosion protection. With Germany’s commitment to achieving carbon neutrality by 2045, the geocomposites market is expected to benefit from increased investments in sustainable energy infrastructure.

Latin America Geocomposites Market Trends

The Latin American geocomposites industry growth is attributed to the increasing adoption of geocomposites in the agricultural sector to improve soil stability and optimize irrigation systems. Agriculture remains a key economic driver in the region, and geocomposites play a crucial role in preventing soil erosion, controlling water runoff, and enhancing drainage in farmlands. With the expansion of precision agriculture and sustainable farming practices, the demand for geocomposites in agricultural applications is expected to grow.

Middle East & Africa Geocomposites Market Trends

The Middle East & Africa geocomposites industry growth is driven by the significant role played by the water conservation and management sector in the MEA region. With many areas in the Middle East and Africa experiencing water scarcity, efficient water management solutions are critical. Geocomposites are used in water reservoirs, canals, and dams to improve water retention and minimize seepage, thus contributing to better water management and conservation. The need for these materials is increasing in urban and rural areas as governments look to ensure sustainable water use in response to the growing demand for water resources.

Key Geocomposites Company Insights

Some of the key players operating in the market include CLIMAX SYNTHETICS PVT. LTD., TenCate Geosynthetics Americas

-

CLIMAX SYNTHETICS PVT. LTD. is a leading manufacturer of geosynthetics and geocomposite materials based in India. The company specializes in providing high-quality products for a wide range of civil engineering applications, including roads, railways, landfills, drainage systems, and more. CLIMAX SYNTHETICS offers a diverse portfolio of geocomposites, such as geotextiles, geogrids, geomembranes, and drainage products.

-

TenCate Geosynthetics Americas is a part of the global TenCate Group, a prominent player in the geosynthetics industry. The company provides a wide array of high-performance geocomposite materials for infrastructure, environmental, and agricultural applications. Their product offerings include geotextiles, geogrids, geocells, geomembranes, and erosion control materials, all of which are designed to improve the performance, durability, and sustainability of engineering projects.

Leggett & Platt, Incorporated, and GSE Environmental are some of the emerging market participants in the geocomposites industry.

-

Leggett & Platt, Incorporated, a global diversified manufacturer, offers geocomposite solutions that focus on infrastructure, erosion control, drainage, and land reclamation. Leggett & Platt’s product portfolio includes a variety of geotextiles, geogrids, and composite drainage products that are engineered to provide long-term performance, reduce environmental impact, and improve construction efficiency.

-

GSE Environmental is a leading provider of geosynthetic solutions, focusing on innovative geocomposites and related products for the civil engineering and environmental sectors. Based in the United States, the company’s product range includes geomembranes, geotextiles, geogrids, geocomposites for landfill containment, and drainage systems. GSE Environmental is known for its high-quality, durable, and environmentally responsible products that offer superior performance in challenging conditions.

Key Geocomposites Companies:

The following are the leading companies in the geocomposites market. These companies collectively hold the largest market share and dictate industry trends.

- CLIMAX SYNTHETICS PVT. LTD.

- TenCate Geosynthetics Americas

- Leggett & Platt, Incorporated

- GSE Environmental

- Thrace Group

- ABG Ltd.

- HUESKER

- Officine Maccaferri Spa

- Terram

- Ocean Global

Recent Developments

- In August 2024, Genap entered into an exclusive partnership with Watershed Geo, a prominent geosynthetics manufacturer, to distribute and install ClosureTurf, an innovative synthetic closure system designed for landfills.

Geocomposites Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 624.7 million

Revenue forecast in 2030

USD 943.7 million

Growth Rate

CAGR of 8.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

CLIMAX SYNTHETICS PVT. LTD.; TenCate Geosynthetics Americas; Leggett & Platt; Incorporated; GSE Environmental; Thrace Group; ABG Ltd.; HUESKER; Officine Maccaferri Spa; Terram; Ocean Global

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geocomposites Market Report Segmentation

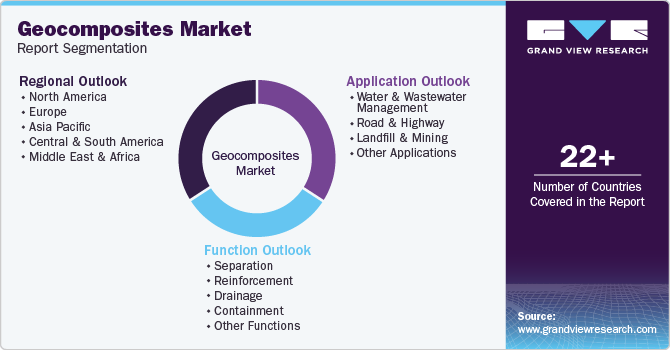

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geocomposites market report based on function, application, and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Separation

-

Reinforcement

-

Drainage

-

Containment

-

Other Functions

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water & Wastewater Management

-

Road & Highway

-

Landfill & Mining

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canda

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global geocomposites market size was estimated at USD 575.2 million in 2024 and is expected to reach USD 624.7 million in 2025.

b. The geocomposites market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2030 to reach USD 943.7 million by 2030.

b. The drainage segment led the market and accounted for the largest revenue share of 44.55% in 2024, driven by increasing infrastructure development and the need for efficient water management solutions.

b. Some of the key players operating in the geocomposites market include CLIMAX SYNTHETICS PVT. LTD., TenCate Geosynthetics Americas, Leggett & Platt, Incorporated, GSE Environmental, Thrace Group, ABG Ltd., HUESKER, Officine Maccaferri Spa, Terram, and Ocean Global

b. The key factors that are driving the geocomposites market include increasing infrastructure development, stringent environmental regulations, rising demand for efficient water management solutions, advancements in geosynthetic technologies, and growing concerns over soil erosion and groundwater contamination.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.