- Home

- »

- Next Generation Technologies

- »

-

Geofencing Market Size And Share, Industry Report, 2030GVR Report cover

![Geofencing Market Size, Share & Trends Report]()

Geofencing Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Technology, By Type (Fixed Geofencing, Mobile Geofencing), By Organization Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-112-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

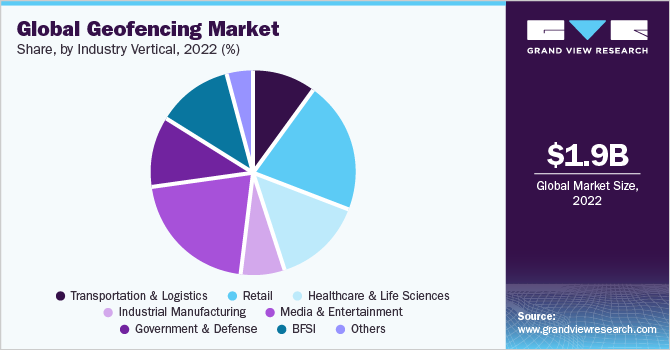

The global geofencing market size was estimated at USD 1.95 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 21.7% from 2023 to 2030. The increase in location-based service (LBS) demand and the prevalence of mobile devices are some of the primary growth drivers. Applications, including telematics, human resources, and kid location services, also expand the market. The market would expand rapidly if privacy and data security concerns related to geofencing services were improved over the period. Due to their advantages, the market is also predicted to benefit from the rising adoption of the Internet of Things (IoT) and geofencing solutions across various industry verticals.

During the forecast period, it is anticipated that there will be a wide variety of geofencing, which many suppliers offer to service application areas for a specific local territory, such as a street, a city, or a suburb of a city. Some service providers in these multi-vendor setups might geofence their services to a certain local area. Others, however, engage in local, national, or international interactions, necessitating the effective placement of geofences. Moreover, security and surveillance also play a crucial role in geofencing as security systems are connected with geofencing to track unauthorized access to restricted regions. Security staff can be quickly informed if someone enters a prohibited area.

With the prominent growth of mobile promotion due to the growing overstimulation from mass media and mass advertising, companies are trying to stand out from rivals through creative and original marketing concepts at the point of sale. This factor is anticipated to augment the growth of the market over the forecast period. Offline components and modern mobile elements are blended to maximize the experience at the POS. Innovative mobile parts pique consumers' interest and provide extra value, promoting sales through mobile advertising.

Component Insights

The solution segment led the market in 2022, accounting for over 59.5% share of the global revenue. Solutions describe the programs or systems that let companies and organizations set up, control, and use geofences for various goals. This software solution frequently integrates location-based technology with intuitive user interfaces to make the implementation of geofencing methods easier. Using the software-enabled app, developers generate dynamic push notifications with photos, videos, and integrated action buttons. This type increases the response rate by allowing users to act immediately from the idle screen. Depending on the content, direct actions include ordering, buying, replying, or engaging in an activity like answering a questionnaire.

The Service segment is estimated to grow significantly registering the highest CAGR over the forecast period. Services use geofencing technology and location-based solutions offered by businesses or platforms. These services primarily consist of the equipment, facilities, and knowledge needed to execute, oversee, and improve geofencing plans for companies and organizations. The support and maintenance services are anticipated to further fuel the geofencing market. The continuing help and maintenance given by service providers to guarantee the efficient operation and best performance of geofencing solutions. These services are crucial for companies using geofencing technology to maintain their dependability, security, and utility over time.

Technology Insights

The active geofencing segment led the market in 2022, accounting for over 57.3% share of the global revenue. Prominent growth of active geofencing among retailers is fueling the market growth. Retailers deliver targeted messages and offers to customers within a predetermined radius of a particular area using active geofencing to entice them to enter the store and make a purchase. Additionally, automation technologies that use different geofencing methods have become popular due to the widespread acceptance of digital technology and the growing demand for business intelligence tools across numerous industries. Thanks to active geofencing services and real-time location systems, manufacturers can access solutions like real-time process and employee tracking.

The passive geofencing segment is estimated to grow significantly over the forecast periodPassive geofencing can contribute to business growth in various ways by enhancing customer engagement, improving marketing effectiveness, and providing valuable data insights. and overall well-being. Businesses utilize passive geofencing to provide users with timely and appropriate real-time content based on their location. Businesses may boost client engagement and maintain their audience's interest by offering personalized and location-specific information. Thanks to passive geofencing, businesses can target consumers within geographic areas with marketing messages and adverts. With better marketing ROI, this targeted precision increases the possibility that prospective customers will become actual purchasers.

Type Insights

The fixed geofencing segment held the largest revenue share of over 57.8% in 2022. Significant innovations and services offered by major players are fueling the market growth. For instance, in September 2022, M3 revealed other substantial innovations to its commercial Labor Management software, M3 Labor, including geo-fencing and beacon technologies. With this new feature functionality, M3 Labor users can now define a fixed region radius where employees can clock in and out on-site. With the introduction of these new capabilities, it will be possible to prevent erroneous punching and ensure that hotel staff clocks in and out at the proper times and locations.

The mobile geofencing segment is predicted to foresee significant growth over the forecast period. A location-based technology entitled mobile geofencing, often called mobile location-based geofencing, leverages mobile devices' GPS, Wi-Fi, cellular data, or RFID to build virtual boundaries, or geofences, around particular geographic locations. Mobile device actions or alerts are triggered when a device enters or leaves these predefined geofenced zones.Setting up virtual boundaries on digital maps to highlight places or interesting areas is known as mobile geofencing. The size of these limits might range from a few meters to entire neighborhoods, cities, or regions. Moreover, Mobile geofencing is used by businesses for location-based marketing campaigns. Businesses can send clients personalized promos or discounts when they are close to a real store or other venue to entice them to stop by.

Organization Size Insights

The large enterprise segment held the largest revenue share of over 65.4% in 2022. When customers enter or move around shop locations, large retail chains, and businesses use geofencing to give them tailored promotions and personalized offers. Hyper-local marketing strategies made possible by geofencing encourage people to visit actual stores and increase sales. Moreover, for large enterprises with sizable vehicle fleets, geofencing is crucial. It enables real-time vehicle tracking, optimizes routes, keeps tabs on vehicle movements, and delivers insightful data for raising fleet productivity and cutting expenses.

The SMEs segment is predicted to foresee significant growth in the forecast period. The growth is attributed to SMEs running hyper-local marketing campaigns due to geofencing. They send tailored promotions and adverts to potential customers within certain geofenced zones, such as those surrounding their physical store or rivals. This enhances the likelihood that leads will be converted into consumers and helps their marketing efforts become more effective. moreover, SMEs gain a competitive edge in their regional marketplaces due to geofencing. They differentiate themselves from other brands and establish a distinctive brand identity by offering clients personalized and location-specific experiences.

Industry Vertical Insights

The retail segment held the largest revenue share of over 20% in 2022. Market suppliers are launching cutting-edge solutions to offer retailers more exact, pertinent, and personalized information at the appropriate time and location. For instance, Alpine IQ, the top data provider and marketing solutions for cannabis retailers and brands, added geofence messaging to its array of omnichannel messaging options in August 2022. By leveraging the customer's latitude and longitude coordinates to pinpoint their location when using the retailer's or brand's specially developed Alpine IQ native app, this technology makes geofencing possible.

The transportation & logistics segment is predicted to foresee significant growth in the forecast period. Companies managing shipments using geofencing technology have an advantage over their rivals because they handle shipments more accurately and transparently, with real-time updates. Customer satisfaction and overall delivery (operational) efficiency increase. Moreover, yard management & monitoring are techniques that leverage geofencing technology fueling the market growth. An automated system that plans dock loading and unloading assignments inside the yard receives the tracking information. This helps the truck driver find the proper loading/unloading dock at the appointed time. This ensures that drivers stay aware of the expansive yard's perimeter and save time due to chaotic truck movements and traffic inside the warehouse.

Regional Insights

North America dominated the market in 2022, accounting for over 33.5% share of the global revenue. Significant investments and improvements are being made in geofencing in North America across various end users, including healthcare, transportation, logistics, BFSI, defense, and many more. The market is pushing for the region's real-time location technology and spatial data integration. Additionally, most businesses in the BFSI, retail, transportation, and logistics sectors-all of which may employ geofencing are in this area. In addition, North America, specifically the United States and Canada, has one of the most advanced economies in the world. Due to the region's strong communication and internet infrastructure, it dominates the market.

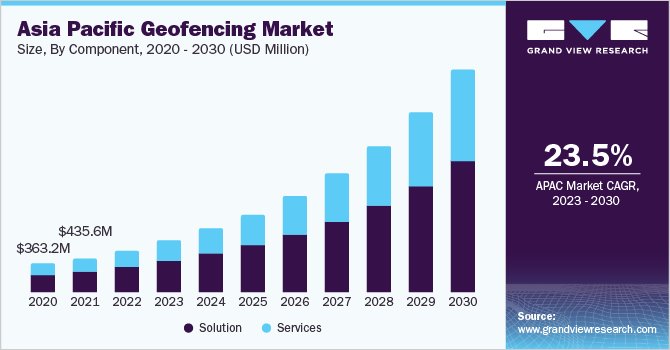

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. Innovations of products and new solution offerings by key market players fuel the market growth in this region. Geofencing has been used in the Asia Pacific region across many industries for a variety of purposes. Retailers and other firms commonly use geofencing to send tailored marketing and promotions to customers as they visit specified places or get close to their physical stores.

Key Companies & Market Share Insights

Prominent companies have adopted product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategies to boost their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, In February 2023, MapmyIndia, a tech firm in India, building GIS AI technologies, telematics solutions, digitized map data, and location-based SaaS, introduced smart helmet kits, GPS trackers, and dash cam. The new products include smart helmet kits, dash cameras, in-dash navigation systems, and vehicle GPS trackers. Two-wheeler owners use the GPS tracker and smart helmet kits, but the dash camera and in-dash navigation system are intended for cars. Some prominent players in the global geofencing market include:

-

Simpli.fi

-

Thumbvista

-

GPSWOX

-

DreamOrbit

-

Esri

-

LocationSmart

-

Bluedot Innovation

-

Apple, Inc

-

Geomoby

-

Upland Localytics

-

Succorfish

-

Visioglobe

-

Raveon Technologies

-

Urban Airship

-

Mapcite

-

Mediavision.

Geofencing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.37 billion

Revenue forecast in 2030

USD 9.36 billion

Growth Rate

CAGR of 21.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, organization size, Industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Simpli.fi; Thumbvista; GPSWOX; DreamOrbit; LocationSmart; Bluedot Innovation; Apple, Inc.; Geomoby; Upland Localytics; Succorfish; Visioglobe; Raveon Technologies; Urban Airship; Mapcite; Mediavision

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geofencing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global geofencing market report based on component, technology, type, organization size, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

Deployment & Integration Services

-

Support & Maintenance Services

-

Consulting & Advisory Services

-

API Management & Testing Services

-

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Active Geofencing

-

Passive Geofencing

-

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed Geofencing

-

Mobile Geofencing

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small & Medium-Sized Enterprises

-

Large Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation and Logistics

-

Retail

-

Healthcare and Life Sciences

-

Industrial Manufacturing

-

Media and Entertainment

-

Government and Defense

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global geofencing market size was estimated at USD 1.95 billion in 2022 and is expected to reach USD 2.37 billion in 2023.

b. The global geofencing market is expected to grow at a compound annual growth rate of 21.7% from 2023 to 2030 to reach USD 9.36 billion by 2030.

b. North America accounted for the highest value share in 2022 owing to Al's & location base service (LBS) strong research and development capabilities in developed economies, research institutes, and several prominent LBS enterprises in this region.

b. Some key players operating in the geofencing market include Simpli.fi, Thumbvista, GPSWOX, DreamOrbit, LocationSmart, Bluedot Innovation, Apple, Inc, Geomoby, Upland Localytics, Succorfish, Visioglobe, amounf others.

b. Key factors that are driving the geofencing market growth include the increasing demand for Location Based Services (LBS) and increasing prevalence of mobile devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.