- Home

- »

- Advanced Interior Materials

- »

-

Geothermal Heat Pump Market Size & Share Report, 2030GVR Report cover

![Geothermal Heat Pump Market Size, Share & Trends Report]()

Geothermal Heat Pump Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Open Loop, Closed Loop), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-963-0

- Number of Report Pages: 126

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geothermal Heat Pump Market Summary

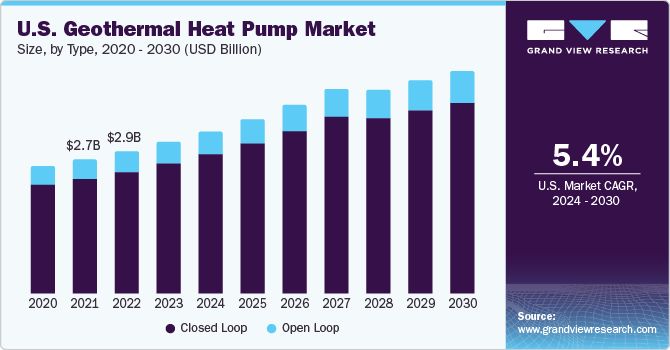

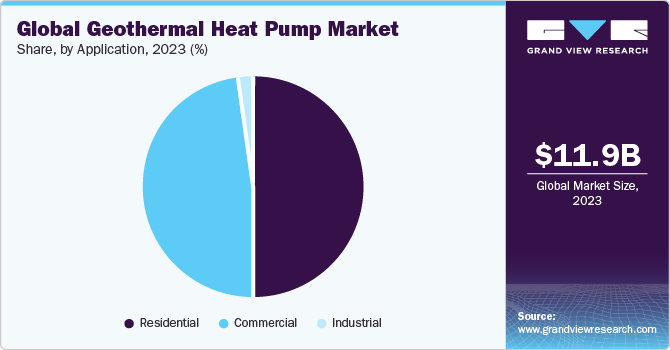

The global geothermal heat pump market size was estimated at USD 11.97 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The growing demand for reliable, cost-effective, and energy-efficient solutions is projected to drive market growth over the forecast period.

Key Market Trends & Insights

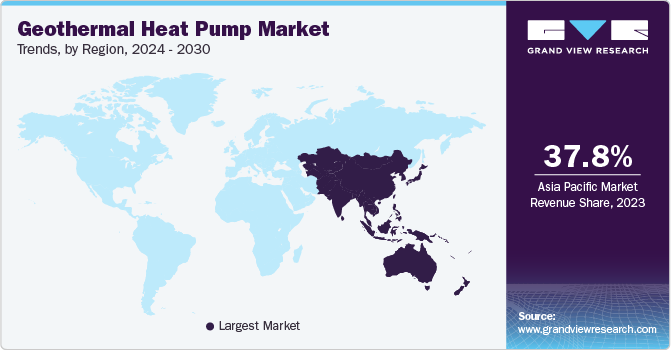

- Asia Pacific held the largest revenue share of 37.83% in 2023.

- By type, the closed-loop type segment held the largest market share of 85.46% in 2023.

- By application, the residential application segment led the market in 2023 with a revenue share of 49.4%.

Market Size & Forecast

- 2023 Market Size: USD 11.97 Billion

- 2030 Projected Market Size: USD 17.87 Billion

- CAGR (2024-2030): 5.6%

- Asia Pacific: Largest market in 2023

Such a pump extracts heat from the horizontal or vertical collector. Extracted heat is commonly distributed through a hydronic distribution system. A GHP offers higher efficiency than an air source owing to advantage of the stable temperature of its geothermal subsoil heat source.

The U.S. is one of the major markets for the GHP. Increasing carbon emissions and fluctuating energy prices led consumers to use renewable heat sources, which is expected to drive product demand in country. The U.S. government has favorable policies encouraging installation of heat pumps, such as personal tax credits and direct incentives for product installation.

Improving energy efficiency across industries is one of the major objectives of governments across world. The rising need for renewable energy sources along with extensive government support in the form of subsidies, incentives, and other monetary benefits is projected to drive market growth over the forecast period. The growing population coupled with rapid industrialization has resulted in massive energy consumption globally.

Growing consumption of fossil fuels, such as coal, oil, and natural gas, to meet heating requirements has a severely harmful impact on environment. Rising awareness about climate change and greenhouse gas emissions is expected to boost demand for energy-efficient products and technologies. Moreover, government regulations and emission standards are projected to increase demand for energy-saving products, such as GHP, in industrial and residential sectors, thereby supporting market growth.

U.S. government has favorable policies in place, such as personal tax credits and direct incentives on product installation, which encourage installation of heat pumps. Improving energy efficiency across industries is one of the prime objectives of governments across world. The rising need for renewable energy sources, along with extensive government support in the form of subsidies, incentives, and other monetary benefits, is projected to drive market growth over the forecast period. Personal tax credits are offered on installation of heat pumps only if they meet or exceed EnergyStar program requirements under energy policy act (EPAct). Federal tax credit initially allowed homeowners to claim 30% of the cost of installing a GHP system.

Soil temperatures in most areas of U.S. are usually warmer than air during winters and cooler in summers. GHPs use ground's constant temperature to cool and heat buildings. According to the Environmental Protection Agency (EPA), GHPs are the most cost-effective, environmentally clean, and energy-efficient systems for cooling and heating buildings including homes, office buildings, schools, and hospitals.

Market Dynamics

As a large number of existing residential properties in developing economies age, new constructions are inadequate to meet the increasing demand. As a result, business for improvement, maintenance, and upkeep of existing properties in the housing market flourishes. In addition, the rising need for more infrastructure and property developments in the Asia Pacific region is expected to surge demand for GHP over the coming years.

Indonesian construction industry is expected to expand at a fast pace, driven by government investments in transport infrastructure. Malaysia is expected to face challenges owing to the new government’s policy to reduce the country’s debt by cutting investments in construction projects. However, rising demand for affordable housing homes is expected to strengthen demand for GHP over the forecast period.

The cost of installation is accompanied by high labor costs and the cost of drilling & excavation. A heating system requires fine-tuning and custom fabrication of parts during installation to ensure that it works reliably, otherwise, the system is likely to fail prematurely. The cost of replacing an old heat pump includes costs associated with disposal and removal of wirings, ducts, and lines needed for new system to run properly. Capital funding required to install a new heating system in industrial sector is higher as compared to that in residential segment, as aspects such as design, ductwork, remote accessibility, and energy-efficiency are to be taken into consideration.

A geothermal system also requires electricity to function, which means high-utility bills and a high carbon footprint. However, geothermal systems can be powered by wind or solar energy, making them even more cost-effective and sustainable. Other forms of renewables used in residential/commercial sector can easily be adapted from site-to-site with minor modifications. However, GHPs need to be uniquely sized, designed, and installed for each residential or commercial location, thereby increasing the initial costs.

Type Insights

The closed-loop type segment held the largest market share of 85.46% in 2023 considering high demand for these products due to their efficiency, low maintenance cost, and high durability. The closed-loop GHP uses multiple loops of interconnected pipes buried in ground. A water or antifreeze solution flows continuously through the pipe. Geothermal heat is absorbed into the solution flowing in a closed loop.

Depending upon the type of land and space availability, closed-loop GHP can be installed in a horizontal or vertical configuration. Horizontal configuration requires a substantial amount of ground area. Horizontal loop pipes are buried in trenches 6 to 10 feet deep and 100 to 400 feet long. Piping of horizontal loop is usually coiled and stacked to provide a larger area for heat transfer.

Vertical closed loop is the most common configuration due to higher efficiency and low space requirement. Vertical loop configuration is installed in holes drilled deep into the ground. U-shaped loops of pipe are inserted in holes, which are usually placed about 20 feet apart. Vertical configuration takes advantage of renewable energy from ground, in a “free” way and reduces heating costs.

The open-loop GHP segment is projected to witness a significant CAGR over the forecast period. The open-loop GHP uses groundwater from wells, lakes, rivers, or ponds as a heat source. Open loop is the simplest and cheapest type of GHP. However, open-loop installation is not feasible in many situations owing to limited availability of groundwater source, or low-quality groundwater, or local restrictions on open-loop systems.

Application Insights

The residential application segment led the market in 2023 with a revenue share of 49.4% on account of growing demand for energy-efficient products that are designed for space heating, cooling, and hot water generation applications in homes and apartments. Horizontal closed-loop GHPs are widely used in residential application segment.

Residential sector is one of the most lucrative sectors, which is expected to propel demand for GHP. Favorable government initiatives and tax rebates offered on installation of energy-saving products are projected to augment demand for GHP in residential sector. Northern countries, in particular, use GHP for heating purposes due to cold temperatures.

The commercial application segment is anticipated to witness a significant CAGR over the forecast period. Increasing use of large GHPs in commercial buildings for space heating or cooling is expected to be one of the major factors influencing market growth. Vertically closed-loop systems are typically most appropriate for large commercial buildings.

Increasing demand for cost-effective renewable heating & cooling technology solutions in industrial sector is projected to drive product demand over coming years. GHP is used in numerous industrial processes including evaporation processes, dehumidification, and water heating or cooling applications. Chemical, petroleum, and food & beverage are major end-use industries, which are expected to drive GHP market over the forecast period.

Regional Insights

Asia Pacific held the largest revenue share of 37.83% in 2023. Improving economic conditions and rapid industrialization and commercialization are anticipated to augment market growth over the coming years. A strong regional consumer base has led to a surge in demand for GHP. Moreover, it is one of biggest manufacturing sectors with a dense population, which is projected to positively impact market growth.

Europe is projected to be second-largest regional market over the forecast period. Favorable government initiatives associated with reducing energy consumption are anticipated to boost product demand. The recovering construction sector is also projected to contribute to market growth in near future.

The rising requirement for space heating and water heating in North America is projected to propel market growth in this region. The growing commercial sector is also expected to boost demand for advanced heating and cooling solutions. Moreover, government initiatives and rebates provided on incorporating eco-friendly and energy-saving technologies are projected to augment demand for upgraded GHPs in the region.

Recovering market conditions in Central & South America is expected to boost industrial production, which is expected to drive regional GHP market. Growing energy consumption in countries, such as Brazil and Argentina, is expected to boost demand for energy-efficient heating solutions, thereby augmenting market growth. Evolving residential and commercial construction sectors are also projected to fuel product demand in region.

Key Companies & Market Share Insights

Companies in the market have undertaken strategies, such as technology innovations, research & development, partnerships, and mergers & acquisitions, to expand their product portfolio as well as to manufacture cost-effective, highly efficient, and superior products. Regional companies form strategic partnerships with major international players to promote development of products with international standards. Major manufacturers of heat pumps are also concentrating on improving and expanding their after-sales and service network through M&A. For instance, in November 2022, Dandelion Energy raised USD 70 million to grow its operations in the U.S. and players behind financing were NGP's energy transition investing division and Lennar, a major national homebuilder. Dandelion powers heat pumps in a home's backyard using condensed geothermal drilling.

Key Geothermal Heat Pump Companies:

- Stiebel Eltron

- Ingersoll Rand (Trane)

- Vaillant Group

- Viessmann

- Glen Dimplex

- Daikin

- NIBE

- Carrier

- ClimateMaster, Inc.

- Bard HVAC

- OCHSNER

- Maritime Geothermal

- Robert Bosch LLC

- Dandelion

- Spectrum Manufacturing

Geothermal Heat Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.87 billion

Revenue forecast in 2030

USD 17.87 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 - 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Sweden; Finland; Switzerland; Netherlands; China; Japan; South Korea; Australia; Brazil; Chile; UAE; Saudi Arabia

Key companies profiled

Stiebel Eltron; Ingersoll Rand (Trane); Vaillant Group; Viessmann; Glen Dimplex; Daikin; NIBE; Carrier; ClimateMaster, Inc.; Bard HVAC; Spectrum Manufacturing; Dandelion; Robert Bosch LLC; Maritime Geothermal; OCHSNER

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geothermal Heat Pump Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geothermal heat pump market report based on type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Closed Loop

-

Horizontal

-

Vertical

-

-

Open Loop

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Sweden

-

Finland

-

Switzerland

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global geothermal heat pump market size was estimated at USD 11.97 billion in 2023 and is expected to reach USD 12.87 billion in 2024.

b. The geothermal heat pump market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 17.87 billion by 2030.

b. Asia Pacific is the largest geothermal heat pumps market and accounted for 37.83% of the total demand in 2023 owing to the growing residential and commercial constructions in developing countries of Asia Pacific.

b. The key factors that are driving the geothermal heat pump market are the growing demand for energy-efficient products and favorable government policies.

b. Some of the key players operating in the geothermal heat pump market include Stiebel Eltron, Ingersoll Rand (Trane), Vaillant Group, Viessmann, Glen Dimplex, Daikin, NIBE, Carrier, ClimateMaster, Inc, Bard HVAC, Spectrum Manufacturing, Dandelion, Robert Bosch LLC, Maritime Geothermal, and OCHSNER.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.