- Home

- »

- Medical Devices

- »

-

Geriatric Care Services Market Size And Share Report, 2030GVR Report cover

![Geriatric Care Services Market Size, Share & Trends Report]()

Geriatric Care Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service (Home Care Services, Adult Care Services, Institutional Care Services), By Region, And Segment Forecasts

- Report ID: 978-1-68038-398-0

- Number of Report Pages: 76

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Geriatric Care Services Market Summary

The global geriatric care services market size was estimated at USD 1,012.0 billion in 2022 and is projected to reach USD 1,648.6 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. A significant rise in the aging population has fueled the demand for geriatric care services. Rising government support, the prevalence of chronic infectious diseases, focus on preventive health care for the old age population, and advantageous long-term reimbursement policies for senior housing are some factors likely to drive the market growth.

Key Market Trends & Insights

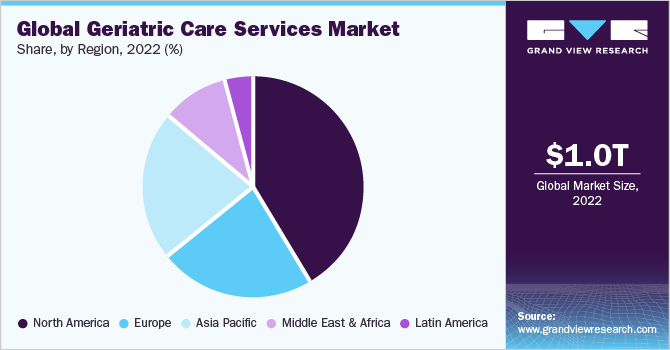

- North America dominated the market and accounted for the largest revenue share of 41.8% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 8.3% during the forecast period.

- Based on services, the home care segment dominated the market with the largest revenue share of 42.3% in 2022.

- In terms of services, the home care segment is expected to growing at the fastest CAGR of 6.8% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 1,012.0 billion

- 2030 Projected Market Size: USD 1,648.6 billion

- CAGR (2023-2030): 6.3%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

According to the Congressional Budget Office, the legislative branch of the U.S. government has estimated that the percentage of people aged 65 or older relative to the number of people aged 25 to 64 is projected to rise from 34% in 2023 to 46% in 2053. The COVID-19 pandemic had a significant impact on the global market. The elderly population was more prone to get affected by the virus, therefore older adults and their families sought assistance with healthcare management, home care, and nursing services. Due to the risks associated with communal living spaces, such as nursing homes and assisted living facilities, many families opted for home care services for their elderly family members.

This shift created opportunities for home care agencies and caregivers to provide personalized assistance in a safer environment. According to a survey by the Centers for Disease Control and Prevention (CDC), 4127 adult daycare service centers in the U.S. were active in 2020 during the pandemic.

The pandemic also fostered innovation in the geriatric care industry by providing technological solutions, such as remote monitoring devices, gadgets for emergency assistance, wearable health trackers, and communication platforms, which were increasingly utilized to ensure the well-being and safety of older adults and patients with minimal effort. For instance, the CarePredict Tempo Series 3 monitors daily activities via sensors and alerts family members if something changes in a senior's routine, helping to identify health risks such as accidents, heart attacks, or any major hazards.

The development of specialty robots that can assist the elderly in performing daily tasks and an aging population that is more susceptible to neurological conditions, cancer, orthopedic conditions, atherosclerosis, cardiovascular diseases, respiratory disorders, arthritis, and Alzheimer’s disease are some factors that are anticipated to fuel the growth of the geriatric care services market. According to the Alzheimer's Association in Chicago, it is estimated that 6.7 billion of the U.S. population aged 65 and older are suffering from Alzheimer's disease in 2023 and the proportion is projected to grow up to 12 billion by 2050.

Geriatric care services help in providing legal and financial aid to the geriatric population catering to their psychological as well as social needs which comprises services such as nutritional, healthcare, emotional & psychological support, and accommodation for elderly people. According to the World Health Organization (WHO), it is estimated that by 2050, the global population of adults aged 60 years and above is expected to double from 12% to 22% respectively.

Services Insights

The service segment is categorized into home care, adult day care, and institutional care services. The home care segment dominated the market with the largest revenue share of 42.3% in 2022 and is also expected to grow at the fastest CAGR of 6.8% over the forecast period, owing to the benefits associated with home care segments such as the comfort, independent caretaking, and less expenditure. Home care services offer valuable assistance to families in creating care plans for their elderly members, covering a wide range of medical treatments, nursing services, and personalized care.

These services are delivered by licensed professionals who possess expertise in this field. One notable advantage of home care services is their cost-effective structure, which allows for efficient allocation of resources. Caregivers employed by home care service providers visit the patients multiple times per week, ensuring that their specific needs are met and identifying any unattended care requirements within the geriatric population.

The adult daycare services segment is further bifurcated into healthcare and non-medical healthcare services. One of the emerging trends in the geriatric service market is Intergenerational Day Centers (IDCs). These are facilities that provide care and activities for both older adults and children under one roof. IDCs offer benefits for both generations, such as improved cognitive function, emotional well-being, and mutual learning. IDCs also promote social cohesion and cultural diversity by fostering positive interactions between different age groups and backgrounds.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.8% in 2022. Key factors attributing to its large share include the constant development of reimbursement policies coupled with the presence of a wide variety of long-term care centers throughout the U.S. According to the National Library of Medicines, around 237,400 individuals in the U.S. were enrolled in adult day services centers (ADSCs) in 2020.

Asia Pacific is expected to grow at the fastest CAGR of 8.3% during the forecast period. Changing family structure in countries such as China is expected to heighten the need for an outside care provider. Due to China's 1980-2015 one-child policy, fewer families are expected to sustain an aging population, and an increasing number of elderly people are living alone. The growing geriatric population with long-term medical conditions, growing disposable income, and rising awareness regarding these healthcare facilities are some of the factors attributing to the rapid growth in countries such as Japan, China, and India.

Key Companies & Market Share Insights

The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. Factors such as investment in research & development, compliance with regulatory policies, and technological advancements are constantly driving the introduction of novel techniques. For instance, in January 2023, Baracoda, a provider of innovative IoT services, announced the launch of BHeart, an innovative health tracker with an unlimited battery.

BHeart is a discreetly integrated technology that can be seamlessly embedded within bracelets and watch bands, ensuring compatibility with any traditional timepiece. It leverages its innovative BMotion energy harvesting technology, which is currently patent pending. This cutting-edge feature enables BHeart to recharge itself completely by harnessing the power of motion, body heat, and environmental light. By gathering ample energy from these sources, BHeart powers a diverse array of sensors that collect and transmit valuable health data to a smartphone application compatible with both iOS and Android devices. BHeart utilizes this captured energy to motivate and inspire its users towards leading a more active lifestyle.

Similarly, various healthcare organizations are undertaking initiatives to spread awareness and minimize hospital admissions, readmissions, and the risks associated with it, among the elderly population. For instance, in March 2023, Encompass Health Corporation announced the launch of its Care Transitions Program which is designed to effectively complement the discharge plans of patients, with a particular focus on reducing hospital readmissions among older adults. This program is specifically tailored to address the unique needs of this demographic and aims to ensure a smooth transition from hospital to home, thereby enhancing patient outcomes and minimizing the likelihood of returning to the hospital for further care. Some prominent players in the global geriatric care services market include:

-

Brookdale Senior Living Inc.

-

EXTENDICARE

-

Gentiva

-

Knight Health Holdings, LLC (Kindred Hospitals)

-

Sunrise Senior Living

-

Genesis HealthCare

-

Home Instead, Inc.

-

GGNSC Holdings LLC

Geriatric Care Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,074.9 billion

Revenue forecast 2030

USD 1,648.6 billion

Growth rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Brookdale Senior Living Inc.; EXTENDICARE; Gentiva; Knight Health Holdings, LLC (Kindred Hospitals); Sunrise Senior Living; Genesis HealthCare; Home Instead, Inc.; GGNSC Holdings LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Geriatric Care Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global geriatric care services market report based on service and region:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home Care Services

-

Health Care

-

Medical Care

-

Physiotherapy Services

-

Telehealth

-

Palliative Care

-

Hospice Care

-

-

Non-Medical Home Care

-

Personal Care

-

Homemaking

-

Meals and Grocery

-

Rehabilitation

-

Others

-

-

-

Adult Care Services

-

Health Care

-

Non-Medical Care

-

-

Institutional Care Services

-

Nursing Homes

-

Palliative Care

-

Hospice Care

-

-

Hospital-based

-

Assisted Living

-

Independent Senior Living

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global geriatric care services market size was estimated at USD 1,012.0 billion in 2022 and is expected to reach USD 1,074.9 billion in 2023.

b. The global geriatric care services market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 1.6 billion by 2030.

b. North America dominated the geriatric care services market with a share of 41.8% in 2022. Key factors attributing to its large share include the constant development of reimbursement policies coupled with the presence of a wide variety of long-term care centers.

b. Key players operating in the global geriatric care services market include Brookdale Senior Living, Kindred Healthcare Inc., Extendicare, Inc., Senior Care Centers of America, and Genesis Healthcare Corp.

b. The presence of various long-term care service providers coupled with favorable reimbursement policies are a few factors expected to boost the growth of the geriatric care services market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.