- Home

- »

- Alcohol & Tobacco

- »

-

Germany Draught Beer Market Size, Industry Report, 2033GVR Report cover

![Germany Draught Beer Market Size, Share & Trends Report]()

Germany Draught Beer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Keg Beer, Cask Beer), By Category (Premium, Regular), By Production Type (Macro Breweries, Microbreweries), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-695-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Draught Beer Market Summary

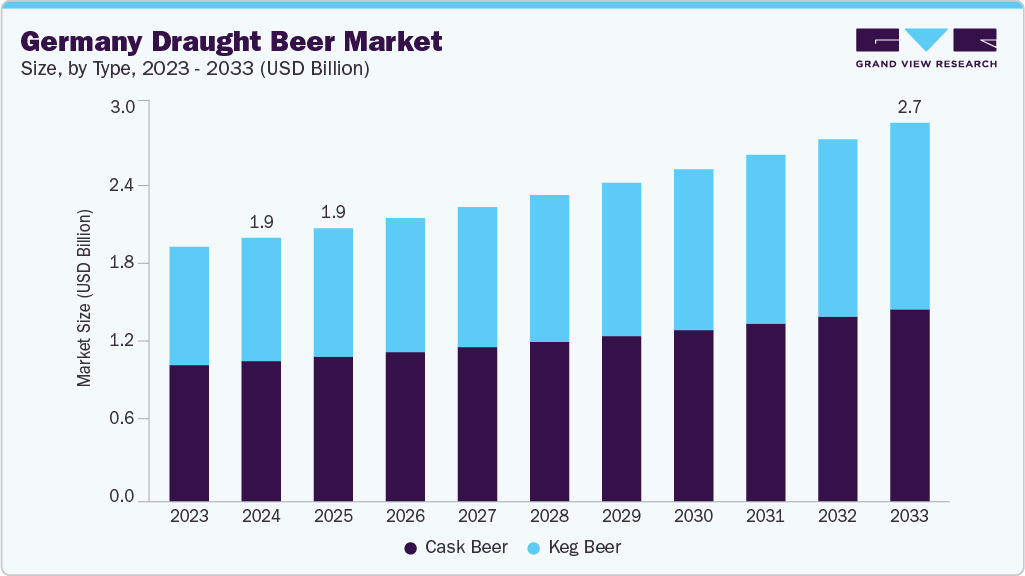

The Germany draught beer market size was estimated at USD 1.90 billion in 2024 and is projected to reach USD 2.73 billion by 2033, growing at a CAGR of 4.2% from 2025 to 2033. This growth is driven by a strong cultural affinity for freshly tapped beer, increasing consumer preference for locally brewed and craft options, and rising demand for premium, experiential beverages in social settings.

Key Market Trends & Insights

- By type, the cask beer segment held the largest market share of 53.3% in 2024.

- By category, the regular segment held the largest market share of 49.7% in 2024.

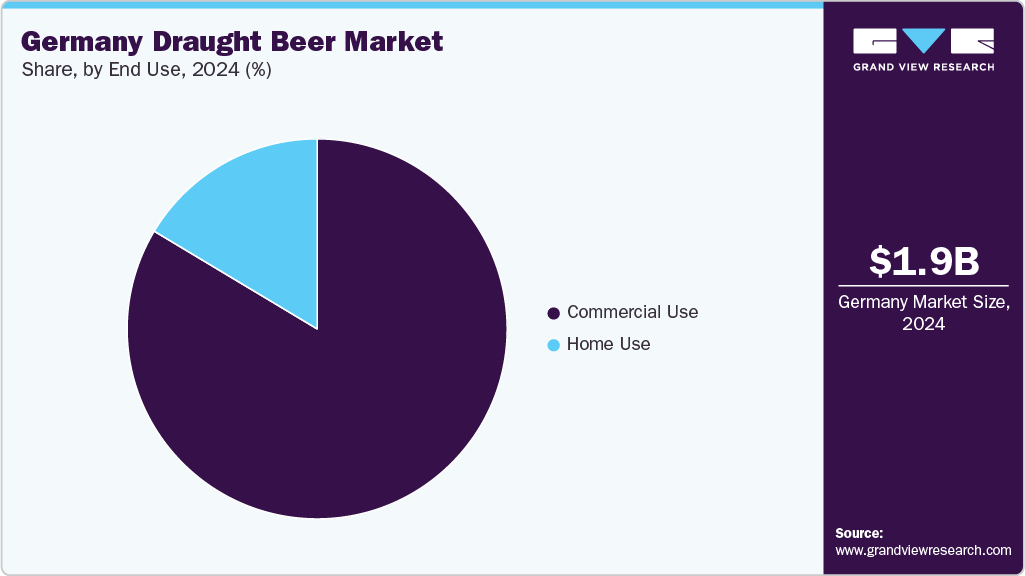

- By end use, the commercial use segment held the largest market share of 83.6% in 2024.

- By production type, the microbreweries segment is expected to grow at the fastest CAGR of 5.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Billion

- 2033 Projected Market Size: USD 2.73 Billion

- CAGR (2025-2033): 4.2%

According to the German Brewers Association, over 1,500 breweries were active in Germany as of 2023. This brewing landscape continues to drive innovation in draught beer offerings, especially in the craft and regional segments. The increasing popularity of local taprooms and microbreweries has created strong demand for freshly served beer with a distinct character. Consumer interest in supporting regional producers and reducing packaging waste has fueled on-premise consumption. These factors are expected to contribute to the sustained growth of the draught beer market in Germany.

The Germany draught beer industry is also benefiting from innovations in brewing techniques and growing consumer interest in premium experiences. Breweries increasingly focus on enhancing flavor profiles, freshness, and quality, which are best delivered through the draught format. The shift toward more sustainable and localized consumption is encouraging the use of refillable kegs and reducing packaging waste. At the same time, hospitality venues are investing in improved tap systems to maintain consistency and ensure customer satisfaction. These developments are expected to strengthen further the appeal of draught beer among traditional and modern consumers.

Consumer Insights

Despite inflationary pressures, eating and drinking out is socially significant for German consumers. Many people associate social gatherings with beer, especially when served fresh in bars, restaurants, and beer gardens. This strong emotional connection has helped draught beer maintain popularity even as household budgets tighten.

The younger population in Germany, particularly those aged 25 to 34, is more inclined to explore craft and alcohol-free draught beer options that reflect modern values and lifestyles. These consumers are influenced by social media, sustainability trends, and interest in local, small-batch production. In contrast, older adults tend to favor traditional beer styles with consistent flavor and heritage, placing value on authenticity and familiarity. Environmental awareness, moderation in alcohol intake, and growing interest in premium experiences are shaping purchase decisions. As a result, consumer expectations are evolving toward greater transparency, quality, and social responsibility in draught beer offerings.

Type Insights

The cask beer segment led the German draught beer market with the largest revenue share of 53.3% in 2024. This dominance reflects Germany’s longstanding tradition of hand‑pulled ales, especially in historic pubs and craft taprooms nationwide. The culture of cask-served beer enhances its premium positioning, and the format is deeply integrated into regional and communal brewing heritage. A strong network of smaller breweries and local pubs ensures consistent quality and supply, supporting competitive pricing and consumer loyalty. Growing concerns over packaging waste and carbon footprints have favored cask formats due to their minimal processing and reduced environmental impact, reinforcing consumer preference for authentic, sustainable beer experiences in Germany.

The keg beer segment is expected to witness the fastest CAGR of 4.8% over the forecast period. The growth of this segment is driven by the increasing preference for convenience, consistent quality, and extended shelf life offered by keg systems. Many hospitality venues favor keg beer for its ease of storage, reduced waste, and faster service capabilities. Brewers are also focusing on modern keg packaging to improve efficiency and freshness. As consumer demand shifts toward varied options in beer, including alcohol-free and specialty options, keg beer is expected to continue to gain popularity across traditional and modern outlets.

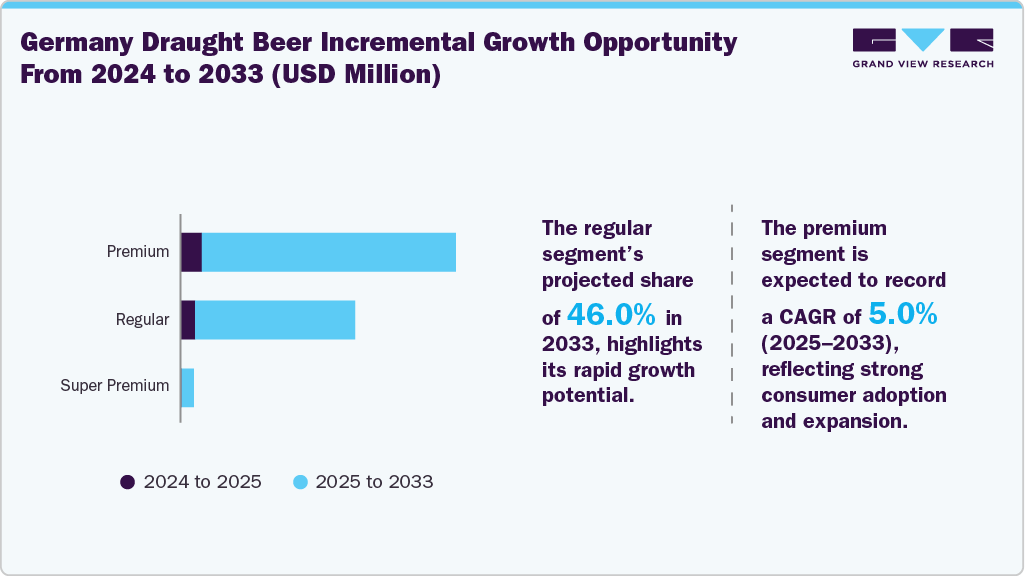

Category Insights

The regular segment held the largest revenue share in the German draught beer market in 2024. The continued popularity of classic beer styles such as Pils and Helles supports the growth of this segment. Pils and Helles are widely available on tap in bars, restaurants, and beer gardens, making them the default choice in most on-premise settings.

The premium segment is expected to witness the fastest CAGR over the forecast period. The growth is driven by increasing consumer interest in craft-style, limited-edition, and high-quality draught beers that offer unique taste. Many beer drinkers are ready to pay more for freshness, specialty ingredients, and artisanal brewing methods. Breweries focus on innovation in flavor, presentation, and branding to appeal to a more discerning audience. These trends are expected to contribute to the demand for premium options that align with sustainability values and regional authenticity over the coming years. This trend is especially visible in urban centers, where lifestyle, social experiences, and brand storytelling heavily influence purchasing decisions.

Production Type Insights

The macro breweries segment held the largest revenue share in 2024, supported by their wide distribution networks and consistent product availability across Germany. Established brewers such as Krombacher, Bitburger, and Warsteiner continue to dominate the draught market through strong branding, national presence, and long-standing partnerships with restaurants, pubs, and event venues. These large-scale producers ensure a stable supply, competitive pricing, and standardized quality, which appeals to mainstream consumers. Their ability to invest in large-volume keg systems and logistics further strengthens their position in the draught segment.

The microbreweries segment is expected to witness the fastest CAGR over the forecast period, driven by rising consumer interest in craft, locally produced, and specialty draught beers. Independent brewers are gaining traction by offering small-batch varieties with unique flavor profiles, seasonal ingredients, and regional branding. These breweries often cater to niche audiences through taprooms, community events, and direct relationships with bars and restaurants. Their agility allows for continuous experimentation and faster response to emerging trends.

End Use Insights

The commercial use segment held the largest revenue share in the German draught beer market in 2024, supported by the country’s robust pub, restaurant, and festival culture. One of the strongest indicators of commercial demand for draught beer is Oktoberfest, where 6.7 million visitors attended the 2024 festival, consuming 7 million liters of beer in just 16 days. Beer tents and beer gardens at such festivals remain central to Germany’s drinking culture, drawing domestic and international crowds.

The home use segment is expected to record the fastest CAGR over the forecast period, driven by changing consumption habits and the growing availability of compact draught systems for domestic use. Consumers are increasingly seeking the convenience of enjoying freshly tapped beer at home, especially during gatherings, sports events, and weekends. The rising popularity of countertop draught machines and mini-kegs is making premium beer experiences more accessible beyond bars and restaurants. Shifts in lifestyle, work-from-home trend, and interest in curated, craft selections are also contributing to this growth.

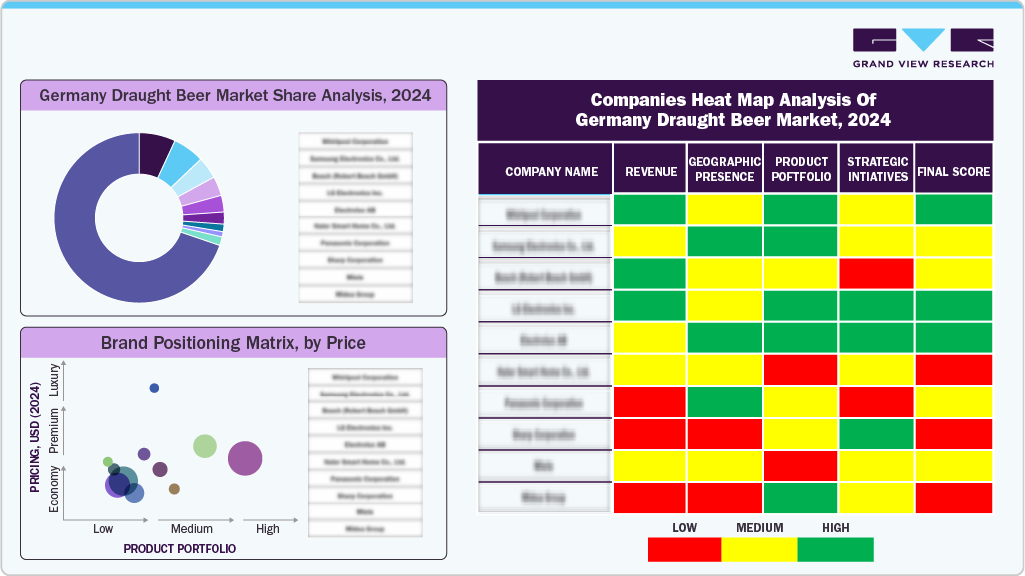

Key Germany Draught Beer Company Insights

Some key companies operating in the market include Krombacher, Bitburger-Braugruppe.de, Warsteiner, and Paulaner Brauerei Gruppe GmbH & Co. KGaA.

- Krombacher maintains a dominant position in Germany’s draught beer market through its flagship Pils, which are widely served in pubs, restaurants, and events. The company benefits from an extensive distribution network, strong brand recognition, and long-standing ties with hospitality partners nationwide.

Key Germany Draught Beer Companies:

- Krombacher

- Bitburger-Braugruppe.de

- Warsteiner

- Paulaner Brauerei Gruppe GmbH & Co. KGaA

Recent Developments

-

In November 2024, Krombacher unveiled its largest investment in over 200 years, committing over USD 104.1 million to overhaul its Littfetal site, Germany.

Germany Draught Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2033

USD 2.73 billion

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, category, production type, end use

Country scope

Germany

Key companies profiled

Krombacher, Bitburger-Braugruppe.de, Warsteiner, Paulaner Brauerei Gruppe GmbH & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany draught beer market report based on type, category, production type, and end use:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Keg Beer

-

Cask Beer

-

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

-

Production Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial Use

-

Home Use

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.