Germany Flavors Market Summary

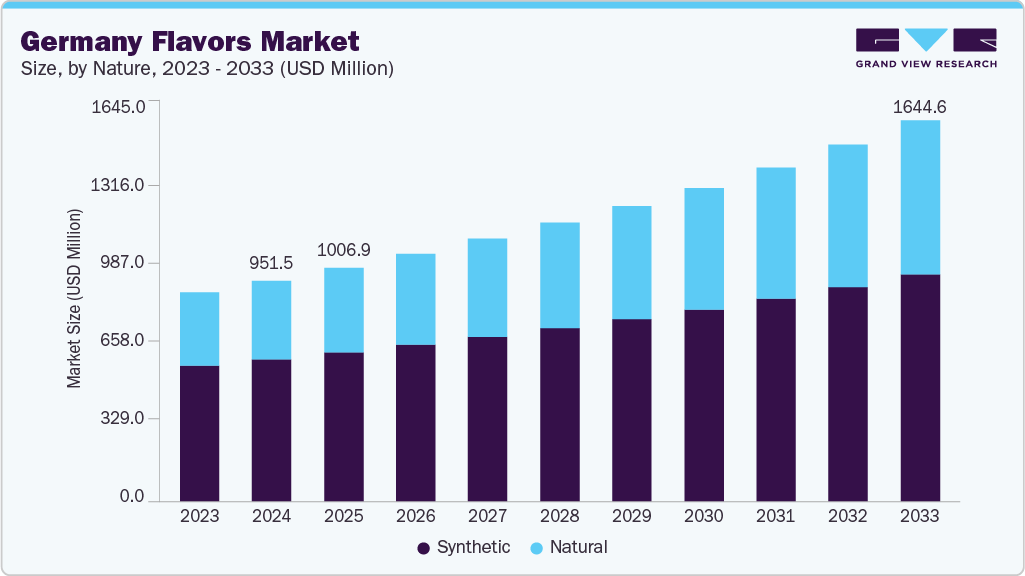

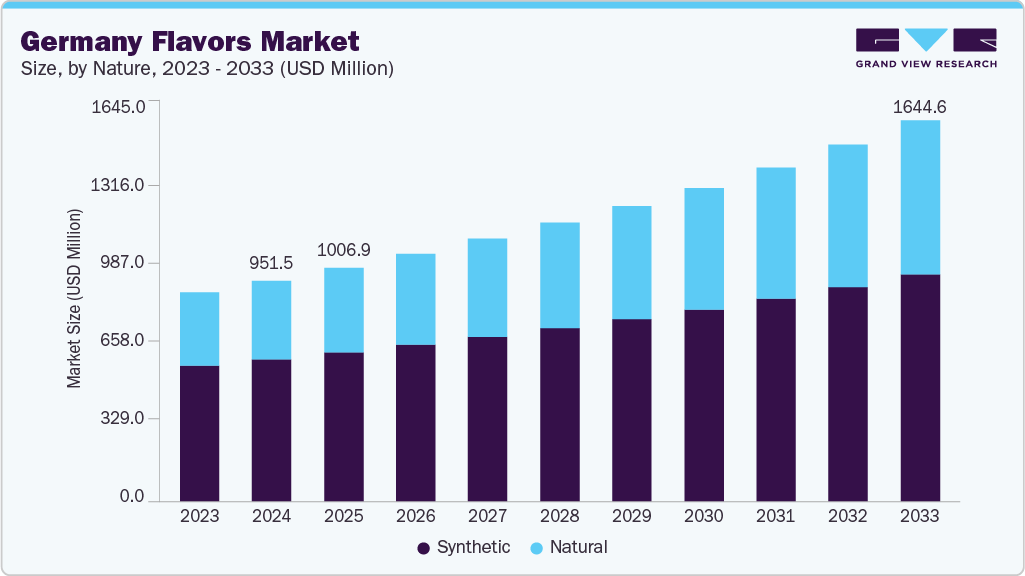

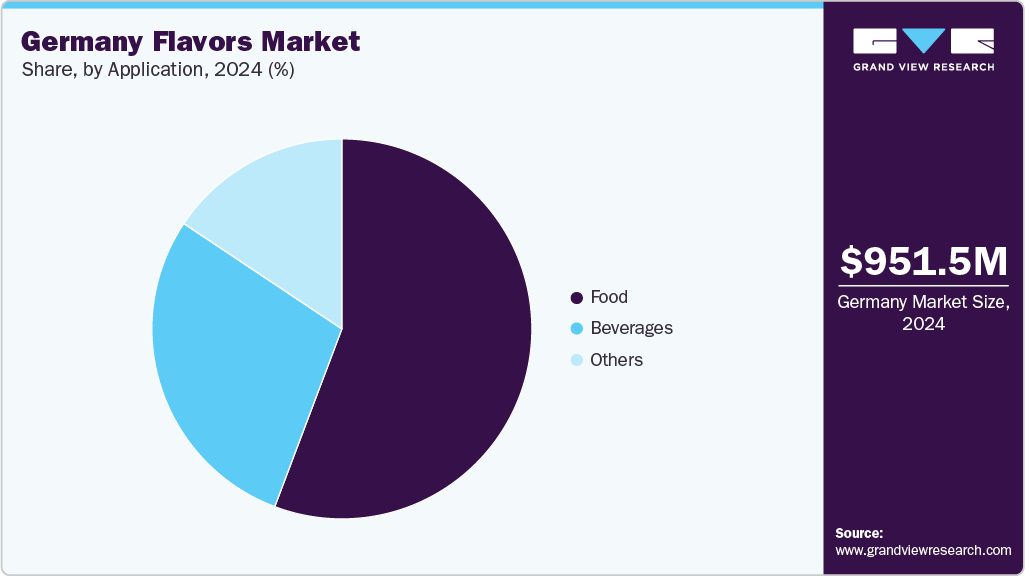

The Germany flavors market size was estimated at USD 951.5 million in 2024 and is projected to reach USD 1,644.6 million by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market growth is attributed to shifting consumer preferences, increasingly driven by a desire for diverse and authentic culinary experiences.

Key Market Trends & Insights

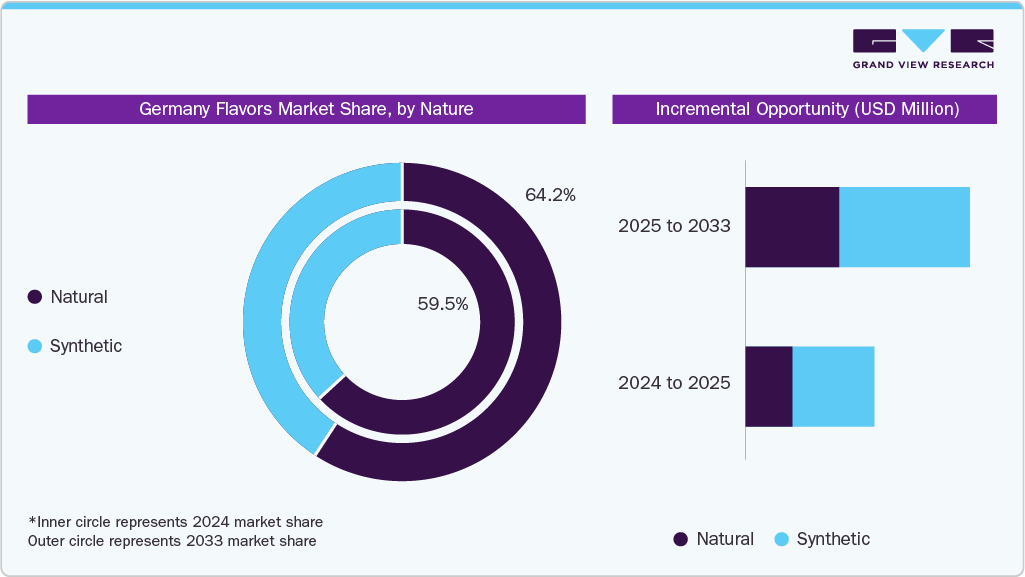

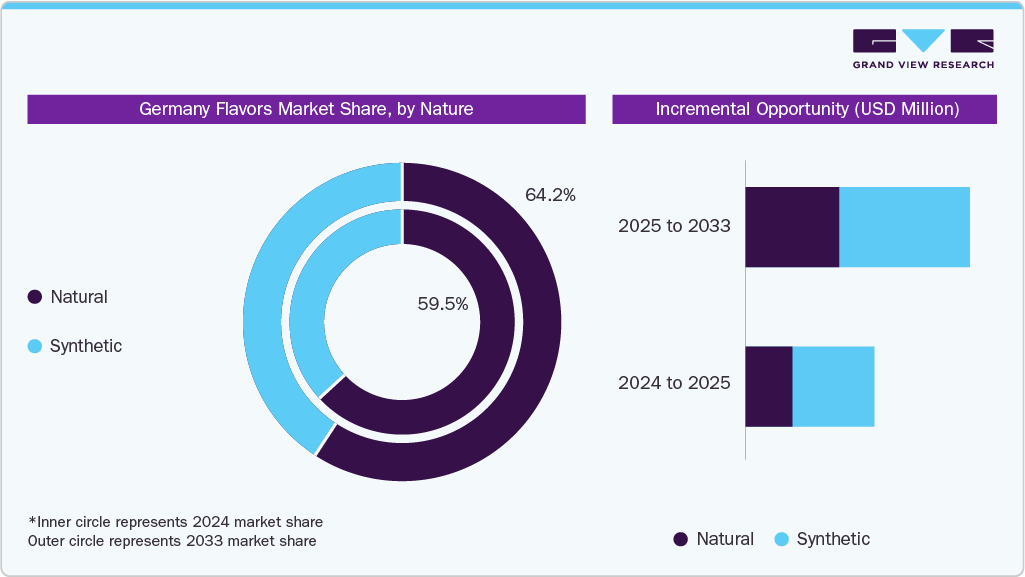

- By nature, the synthetic segment held the highest market share of 64.2% in 2024.

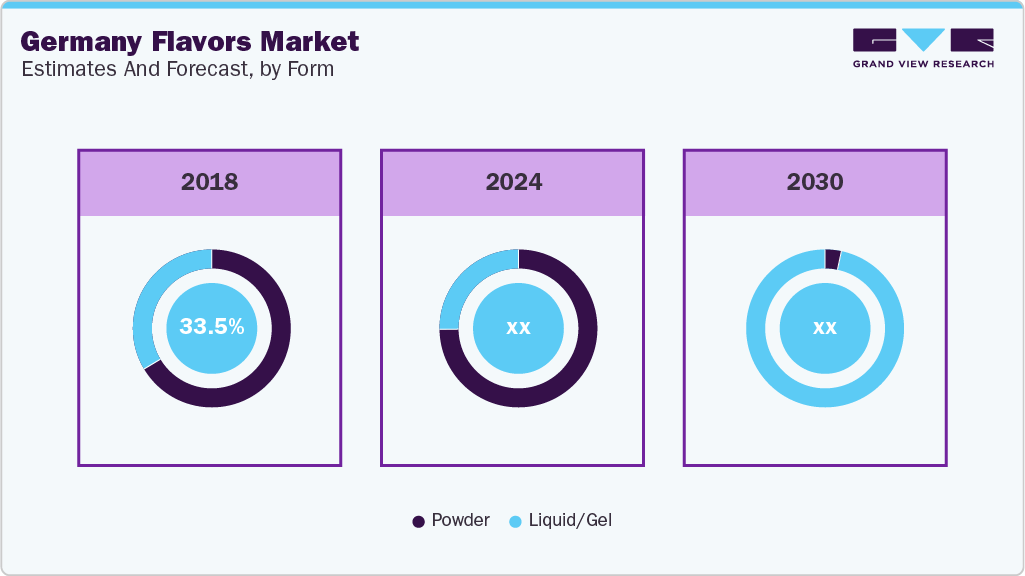

- Based on form, the powder segment held the highest market share in 2024.

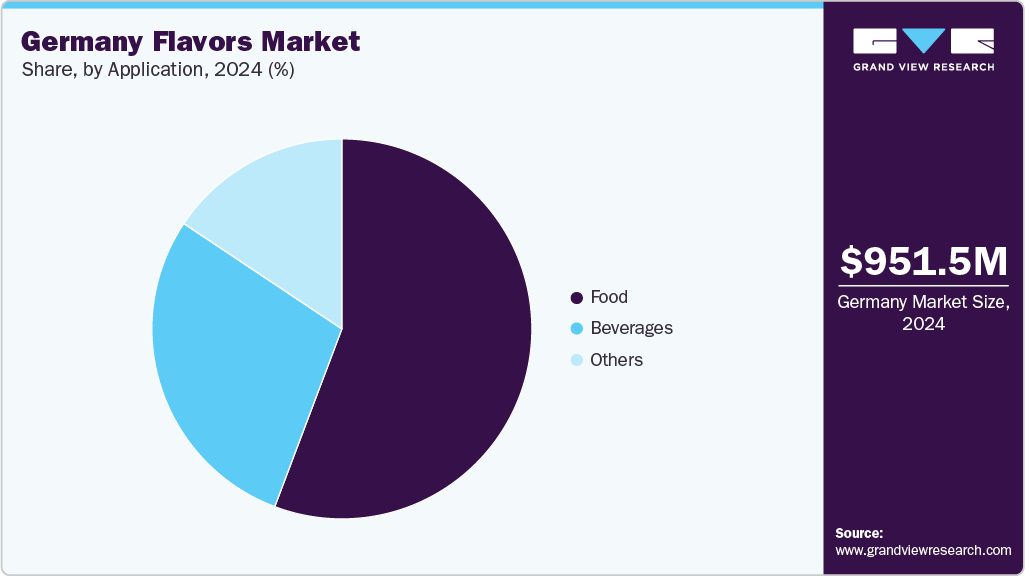

- Based on application, the food segment held the highest market share of 64.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 951.5 Million

- 2033 Projected Market Size: USD 1,644.6 Million

- CAGR (2025-2033): 6.3%

Another key growth driver in Germany’s flavor market is the increasing consumer demand for natural and clean-label ingredients. German consumers emphasize transparency more, favoring food and beverage products with recognizable, minimally processed components. This shift drives strong interest in natural flavorings derived from fruits, vegetables, herbs, and spices, while artificial flavors face growing scrutiny. As a result, manufacturers are reformulating products to align with clean-label expectations, often emphasizing sustainability and ethically sourced ingredients.

In addition, the growing adoption of plant-based diets amplifies the need for innovative flavor solutions that enhance the sensory appeal of vegetarian and vegan offerings. In the German market, traditional and regionally inspired flavors remain highly influential. Popular choices include herbal notes from dill, parsley, chives, marjoram, and spices such as caraway, juniper berries, and paprika. Sweet-and-sour flavor profiles, often created with vinegar, fruit, and sugar, are commonly used in sauces and dressings. Flavors inspired by tea (black and fruit), beer, and herbal liqueurs are widely appreciated in beverages.

Nature Insights

The synthetic segment accounted for the largest revenue share of 64.2% in 2024. Synthetic flavors remain strong, primarily due to their cost-efficiency and product consistency. These flavors are significantly less expensive than natural alternatives, appealing to manufacturers aiming to control production costs, especially within price-sensitive segments. In addition, synthetic flavors offer scalability and uniform quality, unaffected by seasonal fluctuations or raw material availability issues commonly affecting natural ingredients. As a result, synthetic flavors are widely used across various processed food and beverage categories, particularly in mass-market products where affordability and reliability are critical.

affecting natural ingredients. As a result, synthetic flavors are widely used across various processed food and beverage categories, particularly in mass-market products where affordability and reliability are critical.

The natural flavors market is projected to grow at a CAGR of 7.8% from 2025 to 2033. Increasing consumer demand for natural and clean-label ingredients drives innovation across the industry. This shift is largely attributed to heightened awareness regarding the potential health concerns linked to artificial additives and a growing inclination toward transparency, authenticity, and sustainability in food and beverage consumption. As consumers actively seek products with recognizable and minimally processed ingredient profiles, manufacturers invest in advanced R&D capabilities to develop natural flavoring solutions from botanical extracts, fruits, vegetables, herbs, and spices.

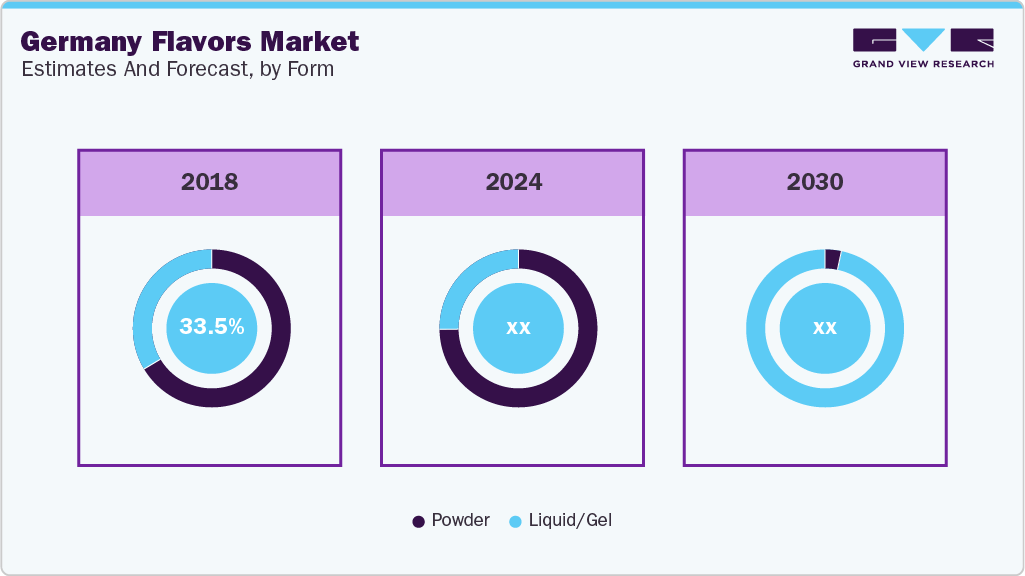

Form Insights

The powder flavors market accounted for a revenue share of over 68.0% in 2024. Powdered flavors are gaining traction in the food and beverage industry due to their convenience and long shelf life, making them especially suitable for processed foods, snacks, and ready-to-mix drinks. Their ease of storage, handling, and precise dosing enables manufacturers to maintain consistent flavor quality in large-scale production. Their adaptability across various applications, including dry seasonings, rubs, and encapsulated systems, enhances their appeal. The rising consumer demand for clean-label products further drives interest in natural and organic powdered flavors derived from fruits, vegetables, and spices, as the market shifts toward healthier, more transparent ingredient profiles.

The liquid/gel flavors market is estimated to grow at a CAGR of 5.5% from 2025 to 2033. Liquid and gel flavors continue to gain momentum in the food and beverage industry, largely due to their ability to deliver concentrated, authentic taste profiles. It is particularly critical in high-impact categories such as beverages, confectionery, dairy, and gourmet applications, where immediate and robust flavor release is essential. Their excellent solubility and compatibility with other liquid ingredients ensure even distribution and a consistent sensory experience across batches. Liquid and gel formats also offer operational advantages; they integrate easily into existing production lines with minimal equipment adjustment, making them ideal for artisanal and industrial-scale manufacturers. In addition, the rising popularity of premium ready-to-drink (RTD) beverages, craft cocktails, syrups, and specialty sauces has fueled demand for these versatile formats. Liquid and gel flavors also allow greater flexibility in flavor layering, enabling brands to experiment with exotic blends, customized taste experiences, and clean-label formulations.

Application Insights

The food segment accounted for a share of 64.5% revenue in 2024. A prominent trend shaping the flavor industry is the growing consumer interest in ethnic and regional cuisines, which drives demand for authentic spice blends, sauces, and flavor profiles that reflect German culinary traditions. In parallel, there is an increasing emphasis on quality and transparency, with consumers favoring flavor ingredients sourced from real fruits, vegetables, herbs, and spices. This shift is compelling food manufacturers to adopt more natural, clean-label flavor solutions. In addition, the expanding market for convenience foods and ready-to-eat meals presents a critical opportunity for flavor innovation. These products require robust flavor systems capable of withstanding industrial processing and maintaining sensory appeal throughout their shelf life. As a result, formulators are increasingly seeking advanced flavor technologies that enhance taste and effectively mask undesirable notes from preservatives or protein fortifiers, ensuring optimal product palatability and consumer satisfaction.

The beverage segment is projected to grow at a CAGR of 6.8% from 2025 to 2033, driven by evolving consumer preferences and health-conscious trends. A prominent development is the growing popularity of functional beverages enriched with vitamins, minerals, and botanical extracts. This shift requires flavor solutions that deliver appealing taste and effectively balance or mask off-notes from active ingredients. In addition, the increasing demand for no-sugar drinks has accelerated the need for natural flavor enhancers and sweetness modulators to preserve sensory appeal without high sugar content. In alcoholic and non-alcoholic categories, consumer interest in experimentation and novelty is fueling the rise of craft beverages, premium cocktails, and unique formulations featuring exotic fruits, spices, and herbs. As a result, flavor innovation remains central to product differentiation and market growth in Germany’s dynamic beverage industry.

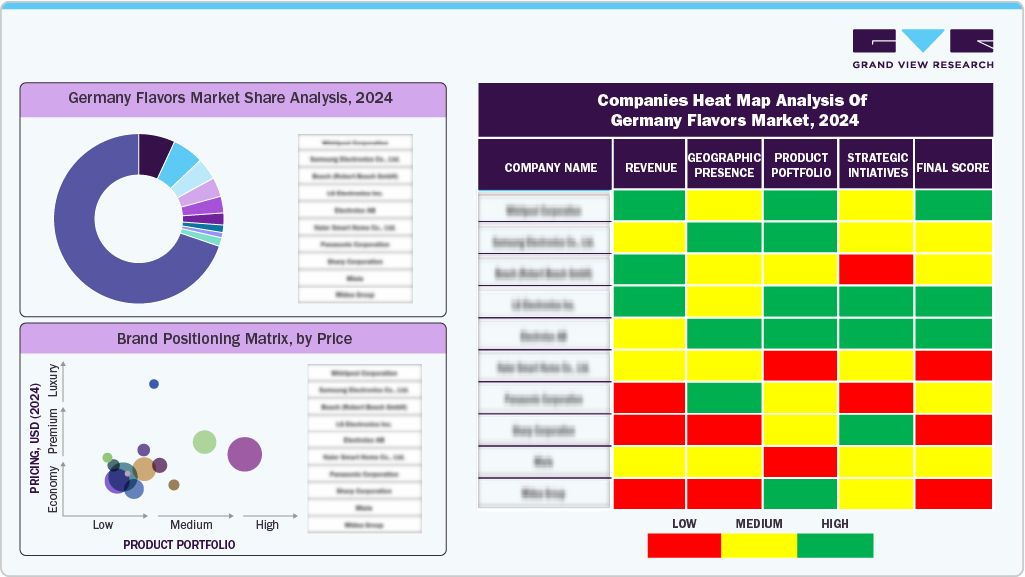

Key Germany Flavors Company Insights

Some of the key players in the German flavors market include Givaudan, Döhler GmbH, Silesia, Givaudan, and others.

- Givaudan, a global leader in the flavor and fragrance industry, is headquartered in Vernier, Switzerland, and has a strong presence in the German market. With a legacy dating back to 1895, the company offers a broad portfolio of flavor solutions for food and beverage, including natural, clean-label, and health-enhancing ingredients. Givaudan focuses on innovation through advanced sensory science, sustainable sourcing, and consumer-driven research.

Key Germany Flavors Companies:

- Döhler GmbH

- Silesia

- Givaudan (Givaudan Deutschland GmbH)

- Bell Flavors & Fragrances GmbH

- Pure Flavour GmbH

- Hertz flavors

- Frey + Lau GmbH

Germany Flavors Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 1,006.9 million

|

|

Revenue forecast in 2033

|

USD 1,644.6 million

|

|

Growth rate

|

CAGR of 6.3% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Nature, form, application

|

|

Key companies profiled

|

MITOS ADöhler GmbH, Silesia, Givaudan (Givaudan Deutschland GmbH), Bell Flavors & Fragrances GmbH, Pure Flavour GmbH, Hertz flavors, Frey + Lau GmbH

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Germany Flavors Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany flavors market report based on nature, form, and application:

-

Nature Outlook (Revenue, USD Million, 2021 - 2033)

-

Form Outlook (Revenue, USD Million, 2021 - 2033)

-

Application Outlook (Revenue, USD Million, 2021 - 2033)