- Home

- »

- Medical Devices

- »

-

Germany Health Insurance Market Size, Industry Report 2030GVR Report cover

![Germany Health Insurance Market Size (Gross Written Premium, New Business Premium), Share, And Trends Report]()

Germany Health Insurance Market (2025 - 2030) Size (Gross Written Premium, New Business Premium), Share, And Trends Analysis Report By Insurance Type (Public, Private), By Policy Type, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-550-8

- Number of Report Pages: 194

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Health Insurance Market Trends

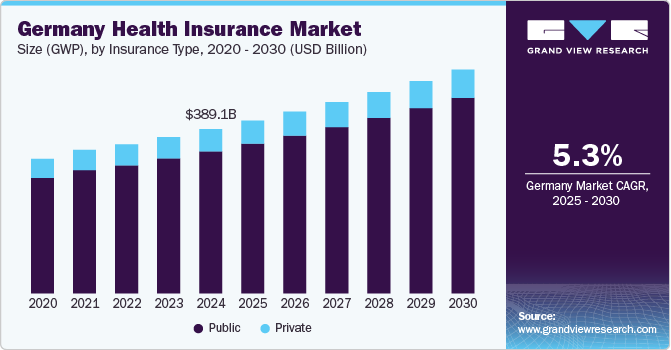

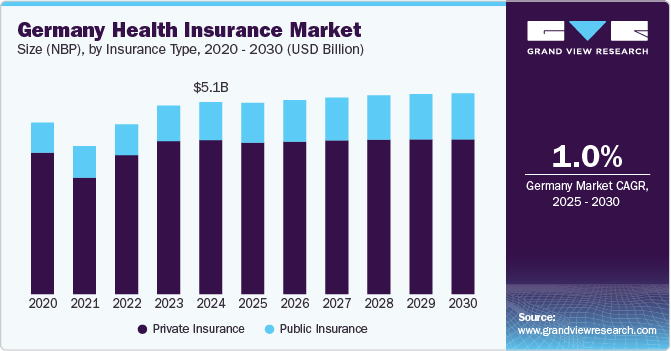

The Germany health insurance market size in terms of Gross Written Premium (GWP), was valued at USD 389.15 billion in 2024 and is expected to grow at a CAGR of 5.30% from 2025 to 2030. The Germany health insurance market size in terms of New Business Premium (NBP), was valued at USD 5.06 billion in 2024 and is expected to grow at a CAGR of 1.00% from 2025 to 2030.

The rising cost of healthcare in Germany is significantly boosting the demand for both public and private health insurance. Medical expenses in the country have been steadily increasing due to the growing prevalence of chronic diseases, driving the costs of advanced medical treatments, and ongoing expansions of healthcare infrastructure. For instance, the surgical treatment of heart disease in German clinics typically ranges from USD 15,000 to USD 45,000, depending on procedure complexity. These substantial medical costs highlights the necessity for comprehensive health coverage, prompting statutory (public) health insurance providers to enhance existing policies, ensuring widespread accessibility and affordability of care. Meanwhile, private health insurers are responding by developing innovative, tailored insurance plans designed to provide consumers with enhanced financial protection, broader healthcare options, and additional coverage flexibility. Consequently, rising healthcare expenditures continue to drive robust growth in both segments of Germany's health insurance market.

The Contribution Rates And Thresholds For Social Security In 2025 Are As Follows

Employer and Employee Social Security Contributions

2024 (USD)

2025 (USD)

Health insurance contribution ceiling

USD 73,362 per annum (USD 6,112 per month)

USD 76,309 per annum (USD 6,358 per month)

Pension insurance contribution ceiling

USD 97,171 (western states) per annum

USD 96,509 (eastern states) per annum

USD 99,089 per annum (USD 8,257 per month)

Unemployment insurance (UI)

2.4% split equally between employer and employee

2.4% split equally between employer and employee

Care insurance contribution

3.40%

4.0% with an additional 0.25% surcharge for employees without children

Source: Parakar Group

Furthermore, A Steady Growth In Healthcare Spending Is Indicating The Expansion Of The Health Insurance Market

2018

2019

2020

2021

2022

2023

Private healthcare expenditure (USD Million)

36.16

36.32

37.13

38.52

40.21

43.87

Out-of-pocket expenditure (USD Billion)

50.71

55.12

57.87

60.46

63.24

70.00

Source: WorldoMeter

The steady increase in private healthcare expenditure from USD 36.16 million in 2018 to USD 43.87 million in 2023, along with the significant rise in out-of-pocket spending from USD 50.71 billion to USD 70.00 billion over the same period, indicates strong growth in Germany’s health insurance market. This trend suggests a rising demand for private and supplementary health insurance plans, as individuals seek comprehensive coverage beyond statutory health insurance (SHI), thereby fostering Germany health insurance industry growth.

In addition, technological advancements are playing a crucial role in driving the health insurance landscape. Artificial intelligence (AI) is increasingly transforming Germany's health insurance sector, enhancing efficiency and accuracy in various operations. The adoption of AI enables health insurers to streamline claims processing, detect fraud more effectively, and personalize member engagement. For instance, AI-driven systems analyze vast datasets to identify patterns indicative of fraudulent claims, thereby reducing losses and improving operational efficiency. In addition, AI facilitates the development of tailored insurance plans by analyzing individual health data, enhancing customer satisfaction and retention.

A notable instance of technological advancements influencing the German health insurance market is the adoption of telemedicine services by leading health insurers. For instance, Techniker Krankenkasse (TK), one of Germany's largest public health insurance providers, introduced the TK-Doc app, which enables policyholders to consult with doctors via video calls. This service allows patients to receive medical advice, prescriptions, and referrals without requiring a physical visit to a healthcare facility, thereby improving accessibility and reducing healthcare costs.

Economic stability and high employment rates in Germany further contribute to the growth of the health insurance market. A strong labor market enables both employees and employers to invest in health insurance plans, thereby increasing market penetration. Employer-sponsored health insurance policies have gained popularity, with businesses offering comprehensive coverage as part of their employee benefits packages. For instance, Siemens AG, a major German employer, offers comprehensive private health insurance options to its employees as part of its benefits package, including the Siemens-Betriebskrankenkasse (SBK). This trend enhances workforce productivity and expands the customer base for health insurance providers.

The health expenditure in Germany has shown a consistent increase over the years, highlighting the growing financial commitment towards healthcare services. The table below presents the total healthcare expenditure by sources of funding from 2019 to 2023, demonstrating the significant role of statutory health insurance (SHI), private health insurance (PHI), government contributions, and private households in financing the healthcare system.

Health Expenditure by Sources of Funding (USD Million)

2019

2020

2021

2022

2023

Total Expenditure on Health

456,463.85

485,282.26

522,998.88

547,919.78

544,602.50

General Government Excluding Social Security Funds

20,188.85

35,041.21

46,039.00

53,205.34

25,736.74

Statutory Health Insurance

256,550.49

265,879.18

280,931.91

292,199.44

307,263.19

Social Long-Term Care Insurance

46,370.40

51,935.90

56,862.83

63,517.21

64,013.76

Statutory Pension Insurance

5,532.47

5,241.81

5,566.61

5,768.09

6,385.74

Statutory Accident Insurance

7,022.11

6,875.68

6,902.11

7,155.33

7,415.17

Private Health Insurance

38,129.49

38,981.65

40,436.06

42,215.26

46,055.51

Employers

19,190.26

19,692.31

20,284.64

21,299.75

22,409.55

Private Households/ Private Non-Profit Organisations

63,480.88

61,635.62

65,975.72

62,559.35

65,322.84

Source: Statistisches Bundesamt (Destatis)

Moreover, increasing launch of new products on the market to cater to the growing demand is supplementing Germany health insurance industry growth. For instance, in December 2024, O2 Germany, the telecom brand under Telefonica, teamed up with ERGO to introduce a pay-as-you-go travel insurance option. With “O2 Care | Travel,” O2 private customers can purchase international health insurance directly through their smartphones. The insurance coverage begins automatically whenever the mobile phone connects to a foreign network. It concludes as soon as customers reconnect to the German network. There are no fixed contract terms-O2 customers only pay for the time they are traveling.

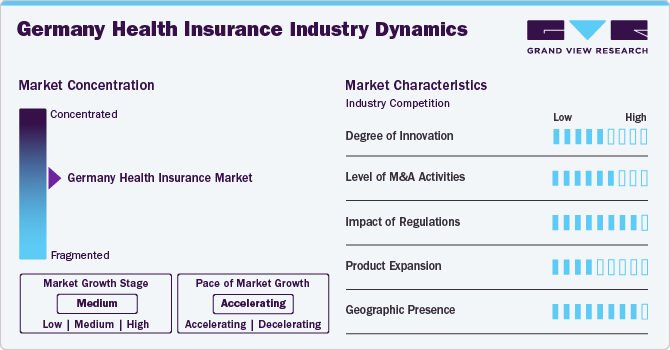

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, impact of regulations, level of partnership & collaboration activities, and geographic expansion. The German health insurance markets operate under a highly competitive and fragmented structure. The degree of innovation is moderate, and the impact of regulations on industry is high. The level of partnership & acquisition activities is moderate, and geographic expansion of the industry is high.

The degree of innovation in Germany’s health insurance market is significantly moderate, driven by digitalization, regulatory reforms, and personalized healthcare solutions. One of the most transformative advancements is the Electronic Patient File (ePA), introduced in 2021 and made universally accessible in 2025, allowing insured individuals to store and share medical records digitally. This innovation enhances efficiency in patient care and promotes data-driven decision-making.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. In March 2025, Munich Re announced its agreement to acquire Next Insurance in a deal that values the digital insurer based in the U.S. at USD 2.6 billion. Next Insurance, which is in Palo Alto, California, will be incorporated into Munich Re’s primary insurance division, Ergo, once the transaction is expected to close in the third quarter of 2025. This acquisition marks Ergo’s initial direct entry into the U.S. primary insurance market.

Regulations play a crucial role in shaping Germany’s health insurance market, ensuring universal healthcare coverage, cost efficiency, and service quality. The Digital Healthcare Act (DVG) has accelerated the adoption of telemedicine, digital health applications, and electronic patient records, compelling insurers to invest in IT infrastructure and data security to comply with GDPR regulations. Furthermore, employer-mandated health insurance contributions and reforms in long-term care insurance (Pflegeversicherung) continue to shape market dynamics by adjusting reimbursement models and funding mechanisms.

Insurance providers are increasingly diversifying their offerings to cater to different customer segments, including expatriates, freelancers, self-employed individuals, and corporate employees. Furthermore, increasing funding in health insurance firms enables greater investment in research, technology, and service innovation, leading to product expansion. For instance, as per the deutschland.de report released in 2024, the healthcare fund has available funds of USD 276.9 billion for health insurance companies.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. In November 2023, Allianz Partners introduced its latest offering, the EU Top-Up Plan, through its international health brand, Allianz Care. This initiative provided employers in Germany with a unique opportunity to enhance healthcare benefits for their employees across the European Union (EU). The plan enabled employers to offer supplementary coverage for various treatments, including dental care, optical services, and alternative therapies, which are typically not covered by national healthcare systems. By expanding healthcare options, Allianz aimed to strengthen employee well-being and support businesses in delivering comprehensive health benefits across multiple EU countries.

Insurance Type Insights

The insurance type segment comprises of public and private. Public insurance is further cross segmented into corporate policy and retail policy. The public segment dominated the market in 2024 and accounted for the largest revenue share of 86.5% and is also anticipated to register the fastest growth rate over the forecast period.

Statutory Health Insurance (SHI) in Germany, known as Gesetzliche Krankenversicherung (GKV), is a mandatory public health insurance system that covers approximately 90% of the population. It is based on the principle of solidarity, meaning contributions are income-dependent, and all insured individuals receive equal access to healthcare services, regardless of their earnings. Germany’s SHI system is managed by various non-profit health insurance funds (Krankenkassen), which fall into six major types:

-

AOK (Allgemeine Ortskrankenkassen - General Local Health Funds)

-

BKK (Betriebskrankenkassen - Company Health Insurance Funds)

-

IKK (Innungskrankenkassen - Guild Health Funds)

-

vdek (Ersatzkassen - Substitute Funds)

-

KBS (Knappschaft - Miners' Insurance Fund)

-

LKK (Landwirtschaftliche Krankenkassen - Agricultural Health Funds)

According to the Germany Visa report, approximately 74 million individuals in Germany were covered by statutory health insurance (GKV) in 2022, accounting for roughly 90% of the population, including both citizens and residents. A major growth driver for this segment is the mandatory enrollment policy, which requires employees earning below USD 74,969.4 per year (2024 threshold) to participate in SHI. This regulation ensures a stable influx of policyholders, sustaining market growth. In addition, government subsidies and employer-employee contribution-based funding support financial stability and accessibility.

Private segment in Germany health insurance industry is anticipated to register a significant growth over the forecast period. Private insurance is further cross segmented into corporate policy and retail policy. The private health insurance sector in Germany is growing steadily, with covering 10% of the population. A primary growth driver for private health insurance is its appeal to high-income individuals, self-employed professionals, and civil servants, who can opt for customized healthcare plans with premium services. Unlike SHI, which follows a standardized benefits model, private health insurance allows policyholders to select personalized coverage options, including dental, optical, and alternative medicine treatments. This flexibility makes private health insurance an attractive alternative for those seeking higher-quality care and faster medical appointments.

For Instance, Below Is The Product Offered by Debeka Krankenversicherungsvere A.G., A Private Insurer

Product/Service

Coverage Details

Average Premium (USD)

Target Client

Comprehensive Health Insurance

Full medical care (inpatient and outpatient), surgeries, dental, maternity, preventive care, rehabilitation, and alternative treatments. Worldwide emergency coverage.

- Private health insurance for civil servants: 874.02-961.42

- Private health insurance for civil service candidates : 861.16-947.28

- Private health insurance for self-employed and freelancers: 891.15-980.27

- Private health insurance for employees: 852.55-937.81

- Self-employed professionals, freelancers, and individuals over the income threshold for statutory insurance, as well as civil servants. It offers full private coverage.

- Civil servants and candidates working in government roles. Designed for employees in public sector roles who seek more comprehensive private coverage than what is available under SHI.

- Individuals pursuing a career in civil service who want to secure private health coverage ahead of their public service employment.

- Self-employed individuals and freelancers who are not eligible for SHI and need private coverage tailored to their needs.

- Employees in higher-income brackets or those with specific needs who prefer private health coverage over statutory insurance.

Moreover, rising demand for supplementary insurance plans among SHI members is driving segmental growth. Many Germans purchase additional private insurance policies to access better hospital accommodations, comprehensive dental treatments, and international coverage.

Policy Type Insights

The retail policy segment dominated the market in 2024 and accounted for the largest revenue share of 55.5%. The retail policy segment in Germany is driven by individuals, self-employed professionals, freelancers, and expatriates who require flexible and comprehensive healthcare coverage. Rising healthcare costs, an aging population, and increasing demand for customized insurance plans are fostering market growth. Furthermore, one of the key drivers of retail policy is the growth of self-employment and freelancing in Germany. As more professionals opt for independent work, they are required to purchase private health insurance (PHI) or supplementary SHI coverage. For instance, according to a report by Statistisches Bundesamt (Destatis), in 2023, 3.8% of all employed individuals aged 15 to 64 were self-employed. This growing self-employed workforce is directly fueling demand for retail health insurance policies, as individuals seek customized coverage options that align with their income structures and healthcare preferences.

Corporate policy segment in Germany health insurance market is anticipated to register a significant growth over the forecast period. Corporate health insurance policies in Germany are experiencing strong growth, as companies increasingly offer enhanced healthcare benefits to attract and retain employees In Germany, the statutory health insurance (SHI) system mandates that employers contribute equally to their employees' health insurance premiums. The standard contribution rate is 14.6% of an employee's gross salary, with the cost shared equally: 7.3% paid by the employer and 7.3% by the employee. In addition, the expansion of multinational corporations (MNCs) in Germany has fueled demand for cross-border corporate insurance plans.

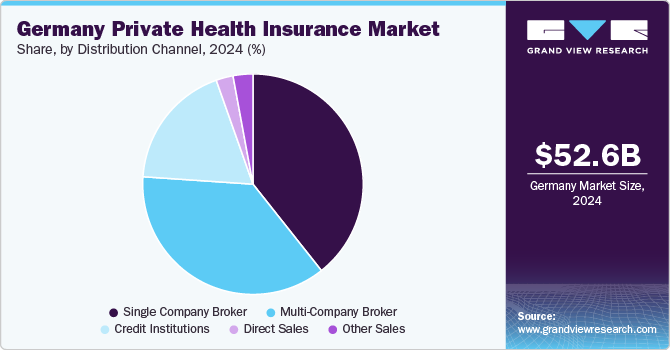

Private Health Insurance Market (GWP), by Distribution Channel Insights

The single company broker segment dominated the market in 2024 and accounted for the largest revenue share of 39.3%. Single company brokers serve as exclusive agents representing a single insurance provider, offering personalized insurance advisory services to individuals and businesses. This distribution channel is expanding due to the rising complexity of health insurance products and the need for tailored coverage solutions. Customers often prefer direct engagement with brokers to understand policy benefits, premium structures, and customized options, making personalized consultation a key driver for market growth. Moreover, increasing number of brokers in Germany is further supplementing market growth. For instance, in 2021, the German National Competent Authority (NCA) GDV has reported, utilizing information from the German Chambers of Industry and Commerce (DIHK), that there are a total of 46,700 registered insurance intermediaries working as brokers in Germany.

Credit institutions segment in Germany health insurance industry is anticipated to register a significant growth over the forecast period. Credit institutions, such as banks and financial service providers, have emerged as a significant distribution channel for health insurance in Germany. This channel is particularly growing due to the increased bundling of financial and insurance products, offering customers convenience and seamless financial planning. Banks often collaborate with insurance providers to offer complementary health coverage solutions, integrating insurance policies into broader financial service packages. The growing demand for integrated financial services, digital banking expansion, and bancassurance collaborations will continue to drive the growth of credit institutions as a distribution channel.

Key Germany Health Insurance Company Insights

In the public (statutory) segment, the market is consolidated among several large public insurers, with around 96 statutory health insurance funds operating as of 2023. The leading entities in this sector include Techniker Krankenkasse (TK), which is currently the largest statutory health insurer in Germany, with approximately 11.8 million members. Barmer is another significant competitor, serving around 8.68 million insured members, while Allgemeine Ortskrankenkasse (AOK) collectively covers around 27 million individuals across its regional branches.

The private health insurance sector is considerably fragmented, comprising 46 accredited insurance companies. Notable insurers in this segment include Allianz, one of the world's largest insurance groups, offering diverse and comprehensive health insurance products tailored to various customer segments. Debeka, another leading player, holds a substantial market share primarily among civil servants and high-income individuals. Other prominent private insurers include AXA, DKV (part of the ERGO Group), and Gothaer Group, all competing by offering flexible, personalized coverage and enhanced customer experiences.

Key Germany Health Insurance Companies:

- Allianz Se

- Debeka Krankenversicherungsvere A.g.

- Generali Deutschland

- Gothaer Kv Ag

- Axa Konzern Ag

- Union Krankenvers.

- Signal Iduna Kranken

- Barmenia Kv Ag

- Dkv Deutsche Krankenversicherung

- Bayerische Beamten K

- Continentale Kranken

- Huk-coburg Kranken

- Hansemerkur Kv Ag

- Hallesche Kranken

- Süddeutsche Kranken

Recent Developments

-

In February 2025, Lifeward Ltd., a global leader in groundbreaking medical technology aimed at improving the lives of individuals with physical challenges or disabilities, declared that it has completed its arrangement with BARMER, the second largest statutory health insurer in Germany, to establish the reimbursement procedure for supplying ReWalk Exoskeletons to eligible medical beneficiaries.

-

In October 2024, DKV Deutsche Krankenversicherung AG (DKV) introduced a new supplementary dental insurance product tailored for health-conscious clients. The new dental product line from DKV provides extensive coverage with generous, modern benefits for individuals with statutory health insurance.

-

In March 2024, ERGO, an insurer based in Germany, enhanced its operations in China by creating a new insurance brokerage joint venture with Beijing Foreign Enterprise Human Resources Service Co. This move broadened the company's reach in the Chinese market to take advantage of the significant growth prospects available.

-

In January 2022, DKV broadened its offerings by introducing PremiumMed, an all-encompassing health insurance plan. This move addressed the increasing need for extensive high-quality coverage.

Germany Health Insurance in Terms of GWP Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 409.10 billion

Revenue forecast in 2030

USD 529.70 billion

Growth rate

CAGR of 5.30% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type, policy type, distribution channel

Country scope

Germany

Key companies profiled

Allianz Se; Debeka Krankenversicherungsvere A.g.; Generali Deutschland; Gothaer Kv Ag; Axa Konzern Ag; Union Krankenvers.; Signal Iduna Kranken; Barmenia Kv Ag; Dkv Deutsche Krankenversicherung; Bayerische Beamten K; Continentale Kranken; Huk-coburg Kranken; Hansemerkur Kv Ag; Hallesche Kranken; Süddeutsche Kranken

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Health Insurance in Terms of NBP Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.03 billion

Revenue forecast in 2030

USD 5.29 billion

Growth rate

CAGR of 1.00% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance type

Country scope

Germany

Key companies profiled

Allianz Se; Debeka Krankenversicherungsvere A.g.; Generali Deutschland; Gothaer Kv Ag; Axa Konzern Ag; Union Krankenvers.; Signal Iduna Kranken; Barmenia Kv Ag; Dkv Deutsche Krankenversicherung; Bayerische Beamten K; Continentale Kranken; Huk-coburg Kranken; Hansemerkur Kv Ag; Hallesche Kranken; Süddeutsche Kranken

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Health Insurance Market Report Segmentation

This report forecasts revenue and volume growth at country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the Germany health insurance market report on the basis of insurance type, policy type, and distribution channel:

-

Insurance Type Outlook (Revenue USD Billion, 2018 - 2030)

-

Germany Health Insurance Market {Gross Written Premiums (GWP)}

-

Public

-

By Policy Type

-

Corporate Policy

-

Retail Policy

-

-

By Distribution Channel

-

Employer-Based Enrollment

-

Direct Enrollment via Public Health Insurance Funds

-

Online Platforms & Digital Enrollment

-

Other Channels (Family Insurance Enrollment, Special Membership Routes such as Künstlersozialkasse (KSK))

-

-

-

Private

-

By Policy Type

-

Corporate Policy

-

Retail Policy

-

-

By Distribution Channel

-

Single Company Broker

-

Multi-Company Broker

-

Credit Institutions

-

Direct Sales

-

Other Sales

-

-

-

-

Germany Health Insurance Market {New Business Premiums (NBP)}

-

Public

-

Private

-

-

-

(GWP) Policy Type Outlook (Revenue USD Billion, 2018 - 2030)

-

Corporate Policy

-

Retail Policy

-

Frequently Asked Questions About This Report

b. The Germany health insurance in terms of GWP market size was estimated at USD 389.15 billion in 2024 and is expected to reach USD 409.10 billion in 2025

b. The Germany health insurance in terms of GWP market is expected to grow at a compound annual growth rate of 5.30% from 2025 to 2030 to reach USD 529.70 billion by 2030.

b. Public segment dominated the Germany health insurance market with a share of 86.48% in 2024. A major growth driver for this segment is the mandatory enrollment policy, which requires employees earning below USD 74,969.4 per year (2024 threshold) to participate in SHI.

b. Some key players operating in the Germany health insurance market are Allianz SE, Debeka Krankenversicherungsvere A.G., Generali Deutschland, R+V Versicherung AG, AXA Konzern AG, ERGO, Techniker Krankenkasse (TK), BARMER, DKV Deutsche Krankenversicherung, Signal Iduna

b. Key factors that are driving the Germany health insurance market growth include rising healthcare costs, an aging population, and increasing demand for customized insurance plans

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.