- Home

- »

- Electronic & Electrical

- »

-

Germany Office Supplies Market Size, Industry Report, 2033GVR Report cover

![Germany Office Supplies Market Size, Share & Trends Report]()

Germany Office Supplies Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Paper Supplies, Writing Supplies, Filing Supplies, Desk Supplies, Binding Supplies), By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-647-7

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Office Supplies Market Summary

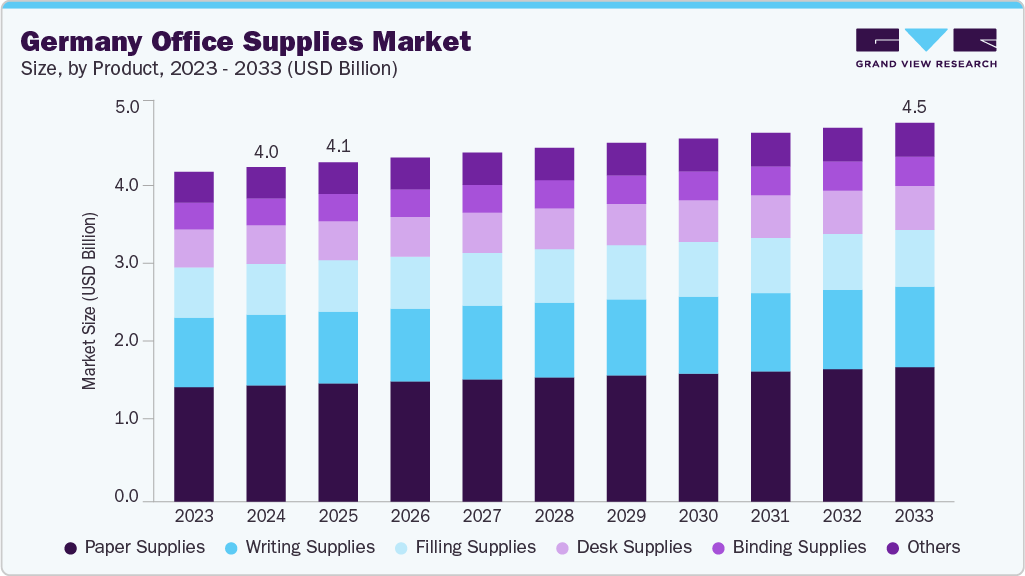

The Germany office supplies market size was estimated at USD 4.00 billion in 2024 and is projected to reach USD 4.53 billion by 2033, growing at a CAGR of 1.4% from 2025 to 2033. The demand for office supplies in Germany is driven by the steady growth of the service sector, a strong base of SMEs, and consistent procurement from government offices and educational institutions.

Key Market Trends & Insights

- By product, paper supplies accounted for a market share of 34.08% in 2024.

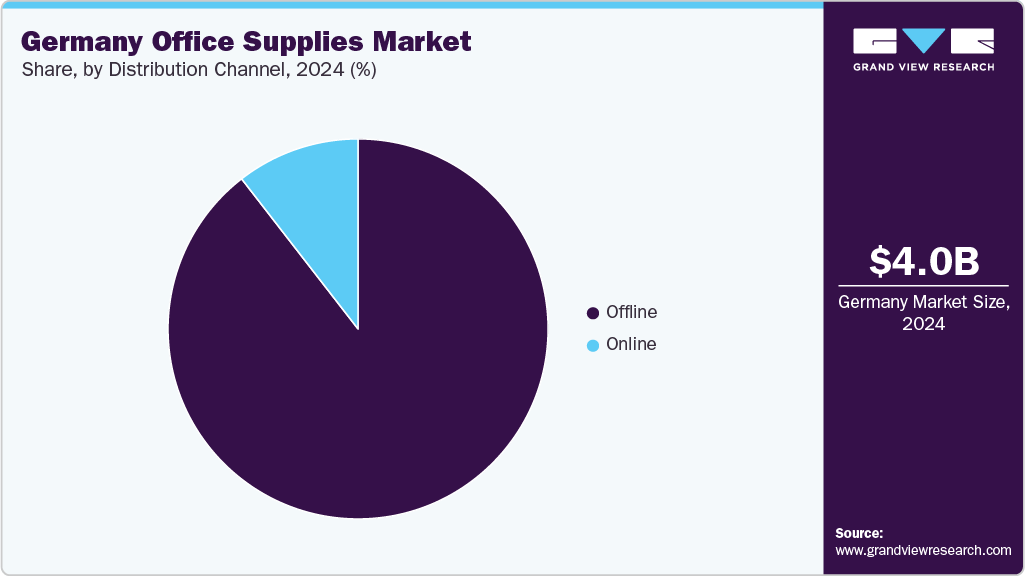

- By distribution channel, the offline channel accounted for a market share of 89.81% in 2024.

- By end use, the educational institutes held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.00 Billion

- 2033 Projected Market Size: USD 4.53 Billion

- CAGR (2025-2033): 1.4%

Germany's office supplies market maintains stable growth due to the country’s structured work culture, high levels of administrative and operational organization, and the continued relevance of physical documentation and stationery in corporate and institutional workflows. Despite digitalization, many German workplaces retain hybrid systems that require traditional supplies, particularly in compliance-heavy sectors. In addition, the rise in home offices and hybrid work setups has sustained individual-level purchases, reinforcing baseline demand even as office footprints evolve.

According to the Federal Ministry of Education and Research, nearly 3.4 million companies in Germany are classified as small and medium-sized enterprises (SMEs) based on the European Commission's definition, accounting for over 99% of all businesses in the country’s business sector. These SMEs, particularly in manufacturing hubs such as Bavaria and North Rhine-Westphalia, heavily rely on traditional office supplies such as paper, pens, and filing systems for daily administrative tasks, contracts, and record keeping. Many still prioritize physical documentation due to strict regulatory and compliance standards in industries like automotive and engineering.

The public sector also plays a significant role in driving demand. Federal and local government offices and Germany’s extensive education system-from primary schools (Grundschule) to universities in cities such as Berlin and Munich-consistently procure traditional supplies such as notebooks, folders, and writing tools. These purchases are often secured through long-term contracts, ensuring stable stock levels across departments and reflecting the country’s strong focus on efficient public administration.

Culturally, German workplaces emphasize order, precision, and thorough planning, which sustains steady demand for organizing tools such as binders, filing cabinets, and planners. This is particularly evident in business centers such as Frankfurt and Hamburg, where offices continue to depend on physical materials for meetings, project tracking, and compliance documentation. Despite the rise of hybrid work, many employees maintain well-equipped home offices stocked with traditional supplies, upholding the high organizational standards typical of German work culture.

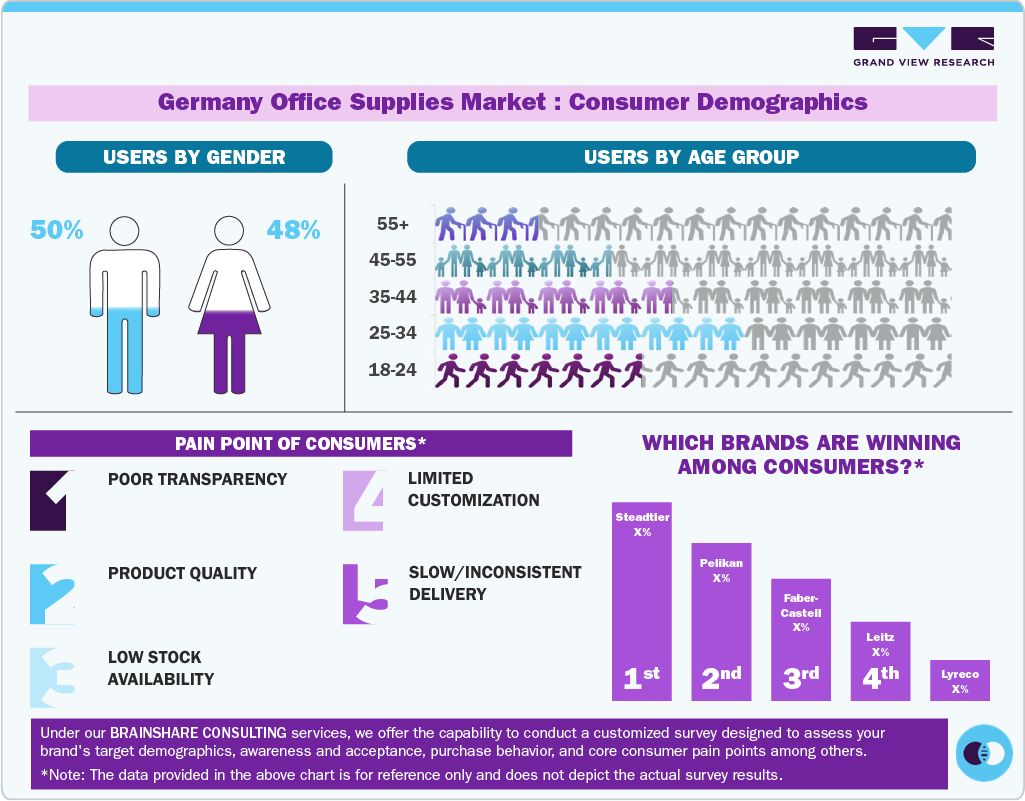

Consumer Demographic Insights

The demographic breakdown of traditional office supply users in Germany shows a nearly equal distribution between genders, with men accounting for 50% and women making up 48% of users. This balance reflects the equal participation of both genders in office-based professions, education, and administrative roles where traditional supplies such as pens, paper, and folders are still regularly used.

In terms of age, the largest user groups fall within the 25-34 and 35-44 age brackets, which include early to mid-career professionals who rely heavily on office supplies in daily work. The 18-24 group also has notable usage, likely driven by university students and young professionals. Usage gradually declines in the 45-55 and 55+ age groups, though these segments still contribute meaningfully, particularly in roles involving documentation, compliance, and education. Overall, demand is strong across all working-age populations.

Consumers in the Germany office supplies market face several pain points that affect their purchasing experience and satisfaction. Common issues include poor transparency in pricing and product sourcing, which makes it difficult for buyers to make informed decisions. Many also report inconsistent product quality, particularly with bulk or low-cost items. Stock availability can be unreliable, causing disruptions for businesses and schools that depend on a steady supply.

In addition, limited options for product customization pose challenges for organizations seeking branded or tailored solutions. Moreover, slow or inconsistent delivery timelines further frustrate consumers who require timely restocking of essential supplies.

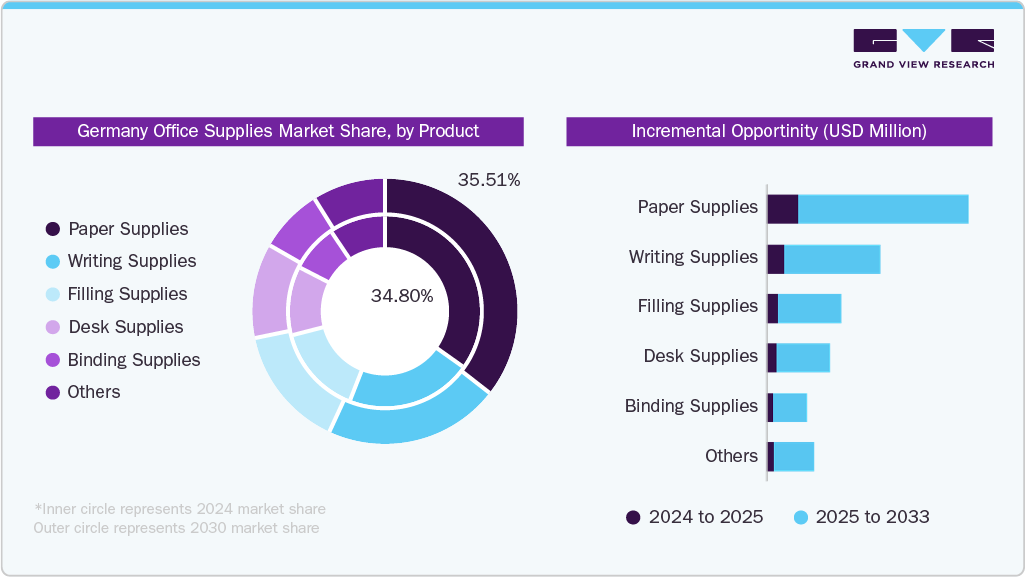

Product Insights

Paper supplies accounted for a largest share of 34.80% of the revenue in 2024, primarily due to the continued reliance on printed documentation across businesses, government offices, and educational institutions. Despite digitalization, sectors such as legal, education, public administration, and manufacturing still require physical records for compliance, reporting, and archiving. For example, SMEs and public offices in regions such as Bavaria and North Rhine-Westphalia regularly use printing paper, notepads, and forms for administrative tasks.

In addition, Germany’s strong academic infrastructure-from primary schools to universities-drives steady demand for notebooks, exam sheets, and worksheets, further supporting the high revenue share of paper products.

The writing supplies market is projected to grow at a fastest CAGR of 1.5% from 2025 to 2033, due to the continued use of pens, pencils, markers, and correction tools across offices, schools, and administrative settings. Despite increasing digital adoption, handwritten documentation remains a daily part of work routines in many SMEs, law offices, and public sector departments. In addition, educational institutions-from Grundschule to universities-sustain steady demand for writing tools among students and teachers. Brands such as Staedtler, Faber-Castell, and Pelikan continue to see consistent demand for traditional writing instruments, especially in regions with strong education infrastructure such as Baden-Württemberg and Saxony.

End-use Insights

The educational institutes segment accounted for a largest share of 31.77% of the revenue in Germany’s office supplies market in 2024 due to the country’s vast and structured education system, which includes over 30,000 schools and numerous universities. From primary schools (Grundschulen) to renowned institutions such as Ludwig Maximilian University in Munich and Humboldt University in Berlin, traditional supplies such as notebooks, pens, folders, drawing materials, and exam papers remain essential for daily academic activities. Despite growing digital integration, many schools and universities continue to emphasize handwritten learning and physical documentation, especially in subjects such as mathematics, languages, and art. In addition, government-supported procurement for public schools further contributes to stable, large-scale demand for traditional office and school supplies.

The office supplies market for corporations is projected to grow at a fastest CAGR of 1.4% from 2025 to 2033, driven by the sustained administrative needs of the country’s strong base of small and medium-sized enterprises (SMEs) and large corporations. Despite increasing digitalization, businesses continue to rely on traditional supplies such as paper, pens, folders, and planners for meetings, documentation, and compliance purposes. Industries such as finance, legal services, and manufacturing, particularly in economic hubs such as Frankfurt, Munich, and Stuttgart, maintain steady usage of these materials to support day-to-day operations and regulatory requirements. Furthermore, hybrid work models have prompted many professionals to equip home offices with basic supplies, further supporting consistent demand.

Distribution Channel Insights

The sales of office supplies through offline channels accounted for a largest share of around 89.81% of the revenue in 2024, owing to the country’s strong preference for traditional retail and B2B procurement methods, especially among schools, government offices, and SMEs. Many institutions and public sector departments purchase supplies in bulk through long-standing contracts with local distributors or physical wholesalers to ensure product quality, delivery reliability, and compliance with procurement guidelines.

In addition, brick-and-mortar stores like Staples, Office Depot, and regional stationery chains remain popular among consumers who prefer to inspect products such as paper, pens, and folders in person before buying. This preference for physical purchasing is robust in smaller cities and rural regions, where online adoption is comparatively slower.

Office supplies sales through online channels are projected to grow at a fastest CAGR of 1.1% from 2025 to 2033. This can be attributed to steady digital adoption and persistent preferences for traditional purchasing methods. Factors driving this growth include increasing comfort with e-commerce among small and medium enterprises, the convenience of online ordering, and access to a broader product range with competitive pricing. For instance, platforms such as Amazon Business and specialized office supply websites offer easy reordering and subscription services, appealing to busy professionals. In addition, advancements in logistics and faster delivery times are making online purchases more attractive. However, the growth remains limited as many companies still rely on established relationships with local suppliers for bulk orders and immediate needs, reflecting a cautious shift rather than a rapid transformation.

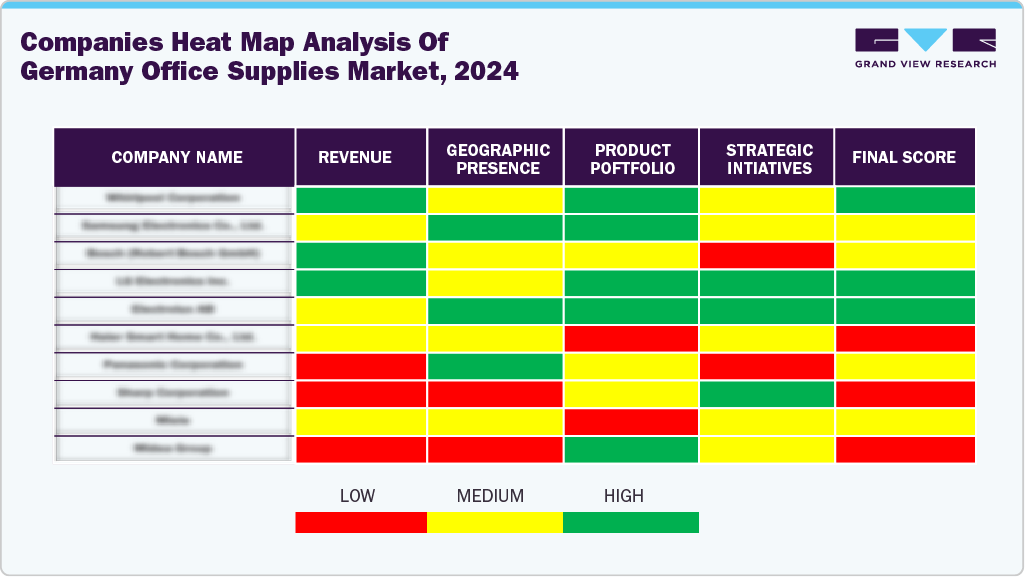

Key Germany Office Supplies Company Insights

Established and emerging players in the Germany office supplies market operate in a highly competitive environment, driven by a focus on product diversification, digital integration, and pricing flexibility. Companies are increasingly investing in e-commerce platforms and automation to meet rising demand for convenient, fast delivery across business and educational sectors. The shift toward hybrid and remote work models has altered purchasing patterns, with increased demand for ergonomic furniture, digital tools, and home-office essentials. Established brands dominate through expansive retail networks and private label offerings, while newer entrants leverage online-only models and sustainability-focused product lines.

Key Germany Office Supplies Companies:

- Staples Solutions

- Lyreco Deutschland

- Office Depot Germany

- Viking

- Antalis

- Würth Group

- Manutan

- RAJA

- Papyrus Deutschland

- Bürobedarf Müller

Recent Developments

-

Stationery Pal, a retailer specializing in stationery products, launched the Lamy Safari Meets Jetstream limited edition pen. The launch event was highlighted on their blog, showcasing the collaboration between Lamy, a renowned pen manufacturer, and Jetstream, known for its smooth-writing ink. The launch introduced a unique pen that combines the popular Lamy Safari design with the Jetstream ink technology, offering a distinctive writing experience.

Germany Office Supplies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.06 billion

Revenue forecast in 2033

USD 4.53 billion

Growth rate

CAGR of 1.4% from 2025 to 2033

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel

Country scope

Germany

Key companies profiled

Staples Solutions; Lyreco Deutschland; Office Depot Germany; Viking; Antalis; Würth Group; Manutan; RAJA; Papyrus Deutschland; Bürobedarf Müller

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Germany Office Supplies Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2018 to 2033. For the purpose of this study, Grand View Research has segmented the Germany office supplies market report on the basis of product, end-use, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Paper Supplies

-

Writing Supplies

-

Filing Supplies

-

Desk Supplies

-

Binding Supplies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2033)

-

Corporate

-

Educational Institutes

-

Hospitals

-

Hotels

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The Germany office supplies market size was estimated at USD 4.00 billion in 2024 and is expected to reach USD 4.06 billion in 2025.

b. The Germany office supplies market is expected to grow at a compound annual growth rate (CAGR) of 1.4 % from 2025 to 2033 to reach USD 4.53 billion by 2033.

b. Paper supplies accounted for a revenue share of 34.80% in 2024, primarily due to the continued reliance on printed documentation across businesses, government offices, and educational institutions.

b. Some key players operating in the Germany office supplies market include Staples Solutions, Lyreco Deutschland, Office Depot Germany, Viking, Antalis, Würth Group, Manutan, RAJA, Papyrus Deutschland, Bürobedarf Müller

b. Key factors driving market growth include the steady growth of the service sector, a strong base of SMEs, and consistent procurement from government offices and educational institutions. flavors, low-sugar options, and broader retail availability boost appeal across mainstream and niche segments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.