- Home

- »

- Homecare & Decor

- »

-

Germany Serviced Apartment Market, Industry Report, 2033GVR Report cover

![Germany Serviced Apartment Market Size, Share & Trends Report]()

Germany Serviced Apartment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Long-term, Short-term), By End-use (Corporate/ Business Traveler, Leisure Traveler), By Booking Mode (Direct Booking, Corporate Contracts), And Segment Forecasts

- Report ID: GVR-4-68040-707-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Germany Serviced Apartment Market Trends

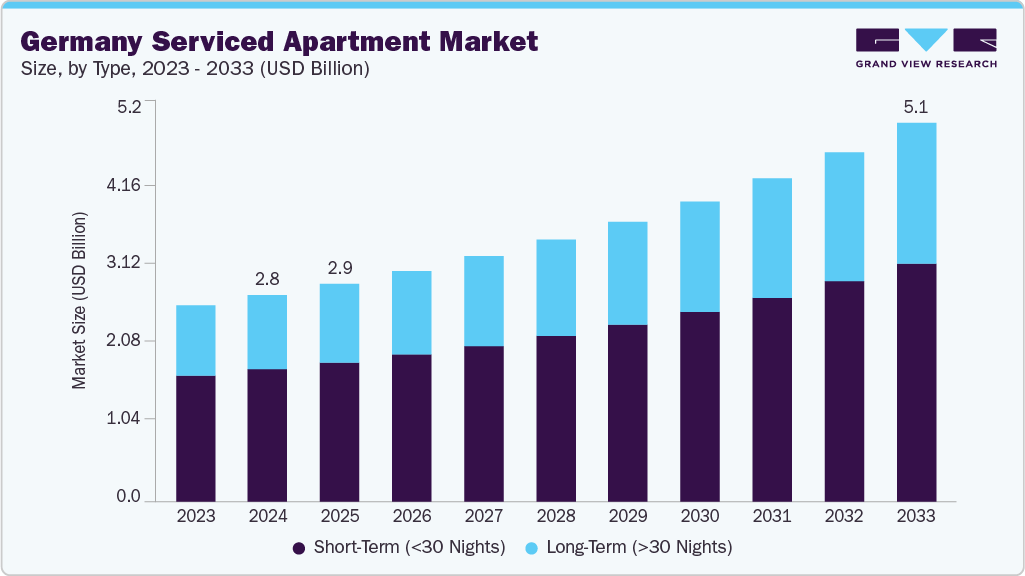

The Germany serviced apartment market size was estimated at USD 2.80 billion in 2024 and is projected to reach USD 5.14 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. As global mobility resumes and hybrid work reshapes business travel, serviced apartments are gaining traction in major German cities such as Berlin, Frankfurt, Munich, and Hamburg, as well as rising secondary hubs like Leipzig, Düsseldorf, and Stuttgart. This shift is bolstered by Germany’s strong infrastructure, cross-border connectivity, and investment in digital nomad-friendly policies.

A major growth lever in the German market is the sustained inflow of corporate travelers and project-based professionals, especially in sectors such as automotive, pharmaceuticals, IT, and consulting. Companies with regional and global operations frequently place employees in long-term assignments or rotational roles, creating consistent demand for serviced accommodation. Operators such as Adina Apartment Hotels and Brera Serviced Apartments are expanding their footprint in Frankfurt and Munich to cater to this clientele. Adina’s Berlin Mitte property, for example, blends hotel services with apartment-style living, including kitchens, laundry facilities, and wellness amenities designed for extended work-related stays.

Germany is also witnessing a rise in flexible living among remote professionals, freelancers, and international workers. Cities with robust tech scenes, like Berlin and Cologne, have become hotspots for digital nomads seeking both community and autonomy. Providers such as LimeHome and SMARTments business have adapted to this trend by offering seamless check-ins, high-speed connectivity, workstations, and design-forward interiors. Their fully digital operating model and focus on mid- to long-term rentals appeal to remote-first professionals who value convenience without compromising lifestyle.

Leisure tourism and city breaks are further driving demand, especially from domestic travelers and intra-European visitors. The cultural depth and architectural heritage of cities like Dresden, Nuremberg, and Heidelberg are drawing tourists looking for immersive, multi-day stays. Serviced apartments are proving ideal for families and small groups seeking kitchen access, extra space, and affordability. Brands like Staycity and Numa are capturing this demand by offering well-located properties with flexible booking options, smart room technology, and curated local experiences.

Post-pandemic travel preferences are reshaping guest expectations, with an emphasis on cleanliness, autonomy, and hybrid hospitality. This has led to an uptick in properties offering contactless services, mobile key access, and integrated digital concierge platforms. Eco-consciousness is also becoming a priority: providers such as THE FLAG and ipartment have incorporated green building standards, waste-reduction initiatives, and energy-efficient appliances into their design and operations, aligning with the values of sustainability-minded guests.

With changing workforce mobility patterns, strong domestic tourism, and evolving traveler preferences, Germany’s serviced apartment segment is primed for continued expansion. Operators are increasingly focused on experience design, operational flexibility, and scalability to serve a broadening customer base, from relocating professionals and business commuters to tech workers, weekend explorers, and lifestyle-conscious travelers. As investment continues to flow into this resilient hospitality sub-sector, Germany remains a key growth market for both regional and international serviced apartment brands.

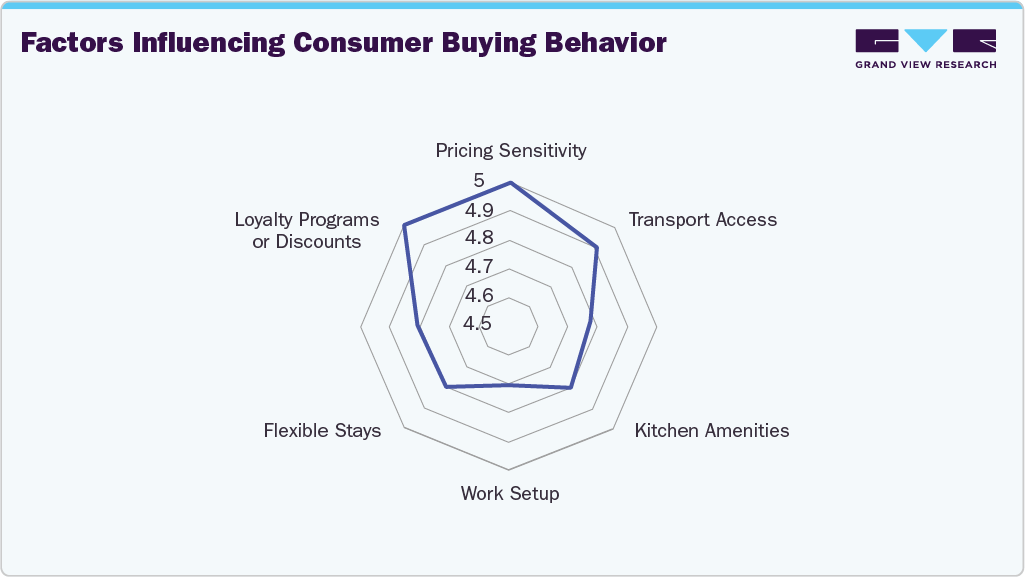

Consumer Insights

Cities like Berlin and Hamburg are witnessing growing demand from professionals working remotely within Germany who relocate temporarily for lifestyle reasons, drawn by vibrant neighbourhoods, culture, and connectivity. These users prioritise design-led interiors, reliable internet, and quiet workspaces over traditional hotel services. Providers such as SMARTments, ipartment, and Brera have responded by offering hybrid formats that blend compact studio living with co-working spaces, on-demand services, and app-enabled concierge features. Some are also integrating partnerships with fitness brands or delivery platforms to attract younger renters who view accommodation as part of a broader living ecosystem.

Leisure travelers within Germany’s domestic tourism landscape are also increasingly choosing serviced apartments over hotels, particularly in cultural cities such as Leipzig, Freiburg, and Heidelberg. Weekend travelers and families prefer the additional space, kitchen access, and self-service features, especially during seasonal events or public holidays. A significant portion of this traffic is being captured by digital-first operators such as numa and limehome, whose tech-driven models appeal to travelers seeking consistent quality, minimal interaction, and local design aesthetics. These patterns indicate that across business, leisure, and blended use cases, German consumers are embracing serviced apartments for their balance of autonomy, practicality, and urban convenience.

Consumers increasingly expect operators to demonstrate environmental responsibility through energy-efficient buildings, renewable energy sourcing, and recycling infrastructure. In response, operators like Numa and Brera Serviced Apartments are integrating low-carbon building materials, digital check-in to reduce paper use, and optional cleaning schedules to minimize water consumption. These measures not only appeal to eco-conscious guests but also align with ESG reporting demands from corporate clients. Properties that transparently communicate their green credentials, whether through LEED certification or sustainability badges, are gaining a competitive edge, particularly in Tier-1 cities.

Rather than viewing accommodation as a functional necessity, many consumers, especially in the hybrid work lifestyle, treat serviced apartments as integrated living spaces. This has driven demand for design-conscious interiors, communal lounges, fitness zones, and access to neighbourhood amenities such as cafés, public parks, and cultural venues. In cities like Leipzig and Düsseldorf, serviced apartments with access to creative districts or riverside promenades are outperforming sterile, business-only blocks. Features such as soundproofed work areas, standing desks, and ergonomic lighting have become a baseline expectation for long-stay digital professionals. German users are drawn to environments that support productivity without sacrificing comfort or lifestyle.

Type Insights

Short-term (<30 nights) stays accounted for a market revenue share of 63.86% in 2024, driven by strong demand in business-focused cities such as Frankfurt, Berlin, and Düsseldorf. These cities host year-round trade fairs, corporate meetings, and regulatory briefings that require brief, high-value stays. Serviced apartments meet these needs with flexible terms, in-room workspaces, and hotel-like services. Operators benefit from higher average daily rates (ADRs) compared to long-term bookings, improving per-unit revenue. The rise in domestic city breaks and cross-border weekend travel, often booked last-minute via platforms like Booking.com or HRS, further amplified short-stay volumes.

Long-term (>30 nights) stays are projected to grow at a CAGR of 7.5% over the forecast period, driven by corporate relocation, academic mobility, and prolonged training assignments. Key cities such as Berlin, Frankfurt, and Munich are seeing increased demand from firms seeking flexible, cost-stable housing for international staff without the constraints of standard leases. At the same time, professionals in tech, research, and consulting are choosing extended stays in furnished units that allow them to work, live, and travel seamlessly. Operators are adapting by offering tiered monthly packages, self-contained amenities, and simplified check-in terms to suit this evolving segment.

End-use Insights

Corporate/business travelers accounted for a market revenue share of 52.30% in 2024. For many professionals, serviced apartments provide a more comfortable, flexible alternative to hotels during work trips, client visits, and project assignments. The ability to cook meals, work from a quiet space, and unwind without the rigidity of hotel routines made a noticeable difference. Business stays often blend into leisure time, especially when trips stretch over weekends or include multiple meetings across regions. Compared to hotels, these units offered better privacy, more room to settle in, and often at a lower per-night cost.

Expats and relocators are projected to grow at a CAGR of 8.5% over the forecast period. Serviced apartments have become the preferred choice due to their move-in-ready setup, furnished interiors, and short-term flexibility. These units eliminate the delays and paperwork often tied to conventional rental agreements, especially in competitive housing markets. Tighter rental regulations and limited long-term housing availability have further pushed newcomers to opt for serviced accommodation during their settling-in phase, supporting sustained growth in this segment.

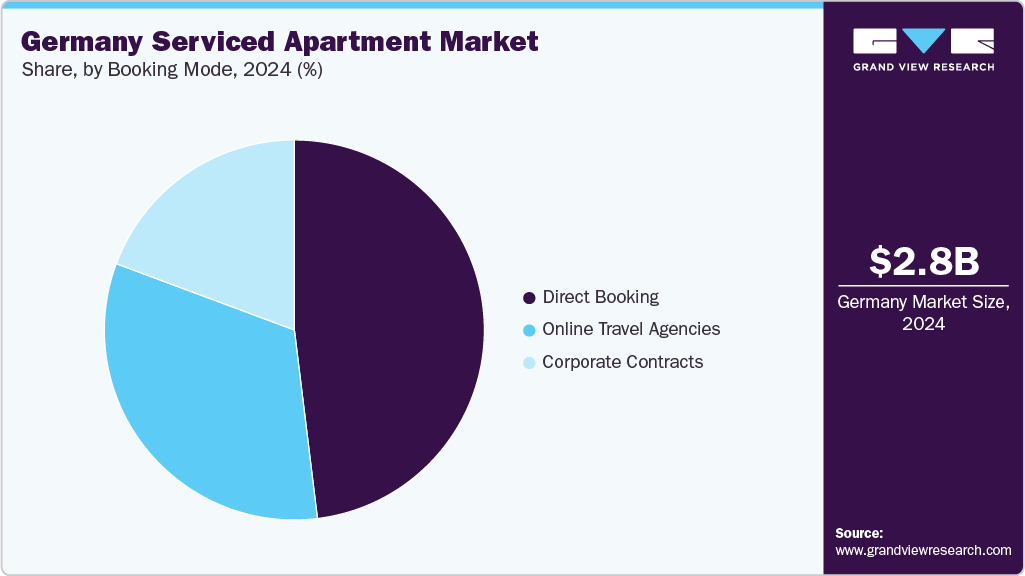

Booking Mode Insights

Direct bookings accounted for a market revenue share of 48.06% in the year 2024. Many providers revamped their digital platforms, optimizing websites, apps, and loyalty ecosystems, to attract both corporate and individual guests. Features such as dynamic pricing, early check-in options, and exclusive discounts incentivized direct reservations. In cities such as Berlin, Hamburg, and Düsseldorf, corporate travel managers increasingly pursued direct contracts to simplify billing, maintain service consistency, and ensure availability during peak periods.

Corporate contracts are projected to grow at a CAGR of 8.0% over the forecast period, driven by rising demand for flexible, cost-effective housing solutions for mobile workforces. As firms expand project-based collaborations and nearshore operations, the need for scalable and standardized housing solutions has become critical. Serviced apartment providers are responding by offering volume-based pricing, invoicing integration, and compliance-ready lease documentation, making procurement smoother for corporate teams. The increasing preference for bundled service packages, covering broadband, maintenance, and concierge support, eliminates operational overheads for employers while enhancing employee satisfaction.

Key Germany Serviced Apartment Company Insights

The serviced apartment industry in Germany has matured into a structured ecosystem, integrating international operators, relocation housing providers, and regional hospitality brands to address evolving mobility and accommodation needs. The industry caters to a diverse user base, corporate transferees, digital nomads, trainees, and long-term visitors, through flexible lease terms and professionally managed, furnished units. Operators offer bundled services such as regular cleaning, high-speed internet, in-unit kitchens, and multilingual guest support, which enhance convenience while remaining cost-competitive compared to hotels and traditional leases. Market momentum is reinforced by strategic alliances with HR outsourcing firms, relocation consultancies, and business travel platforms, enabling bulk bookings and long-term arrangements. The segment is also benefiting from increased adoption of modular design concepts, allowing properties to efficiently serve both short- and long-term guests. Tech integration has become central to the customer journey, with many providers upgrading to self-service check-in, mobile access, and loyalty-linked booking engines. Younger business travelers and mobile professionals are drawn to branded, design-led apartments that combine work, living, and wellness features in one space. At the same time, long-stay demand from expatriates and trainees fuels the need for quiet, well-located units with workspace and extended service options. Supported by Germany’s stable employment market, inward corporate investment, and urban housing supply gaps, the serviced apartment segment is expected to maintain steady, yield-focused growth over the next decade.

Key Germany Serviced Apartment Companies:

- Adina Apartment Hotels

- Brera Serviced Apartments

- Limehome GmbH

- ipartment GmbH

- The Ascott Limited

- Marriott International

- Fraser Suites

- Staycity Group

- Staybridge Suites

- SilverDoor Apartments

Recent Developments

-

In April 2025, NUMA Group significantly expanded its operations, doubling its scale within just 12 months. The Berlin-based hospitality tech company now manages over 6,500 units across Europe, marking a sharp rise from 3,000 the previous year. This growth is driven by its asset-light model and use of proprietary technology that streamlines operations and enhances guest experiences. With a presence in more than 30 European cities, NUMA continues to partner with real estate owners and investors to convert traditional hospitality properties into digitally operated boutique apartments, catering to modern travelers seeking seamless, contactless stays.

-

In February 2025, Hospitality tech company Bob W announced the launch of a new property in Frankfurt, marking its fifth location in Germany. The Frankfurt opening is part of the company’s rapid European expansion strategy, which combines hotel-quality service with apartment-style living through its fully digital operations. Known for blending local design with smart technology, Bob W aims to meet the growing demand for flexible, short- and long-term stays among modern travelers. The company continues to grow its presence across major European cities by partnering with property owners to transform traditional buildings into tech-enabled boutique accommodations.

Germany Serviced Apartment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.96 billion

Revenue forecast in 2033

USD 5.14 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, booking mode

Country scope

Germany

Key companies profiled

Adina Apartment Hotels; Brera Serviced Apartments; Limehome GmbH; ipartment GmbH; The Ascott Limited; Marriott International; Fraser Suites; Staycity Group; Staybridge Suites; SilverDoor Apartments

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Serviced Apartment Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany serviced apartment market report based on type, end-use, and booking mode.

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Long-term (>30 Nights)

-

Short-term (<30 Nights)

-

-

End-use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Corporate/Business Traveler

-

Leisure Travelers

-

Expats and Relocators

-

-

Booking Mode Outlook (Revenue, USD Billion, 2021 - 2033)

-

Direct Booking

-

Online Travel Agencies

-

Corporate Contracts

-

Frequently Asked Questions About This Report

b. The Germany serviced apartment market was estimated at USD 2.80 billion in 2024 and is expected to reach USD 2.96 billion in 2025.

b. The Germany serviced apartment market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 5.14 billion by 2033.

b. Short-term (<30 nights) stays accounted for a revenue share of 63.86% in the Germany serviced apartments industry in 2024, due to high demand from business travellers, trade fair visitors, and tourists seeking flexible, fully equipped accommodation for brief stays.

b. Some of the key players in the Germany serviced apartment market are Adina Apartment Hotels; Brera Serviced Apartments; Limehome GmbH; ipartment GmbH; The Ascott Limited; Marriott International; Fraser Suites; Staycity Group; Staybridge Suites; SilverDoor Apartments

b. The Germany serviced apartment market is driven by strong corporate travel demand, growth in remote and hybrid work, rising expat relocations, a steady influx of leisure tourists, increasing emphasis on sustainability, adoption of smart living technologies, event and trade fair-related stays, and the appeal of flexible, fully furnished, home-like accommodations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.