- Home

- »

- Agrochemicals & Fertilizers

- »

-

Gibberellins Market Size And Share, Industry Report, 2033GVR Report cover

![Gibberellins Market Size, Share & Trends Report]()

Gibberellins Market (2026 - 2033) Size, Share & Trends Analysis Report by By Application (Malting of Barley, Increasing Sugarcane Yield, Fruit Production, Seed Production), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-004-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 – 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Gibberellins Market Summary

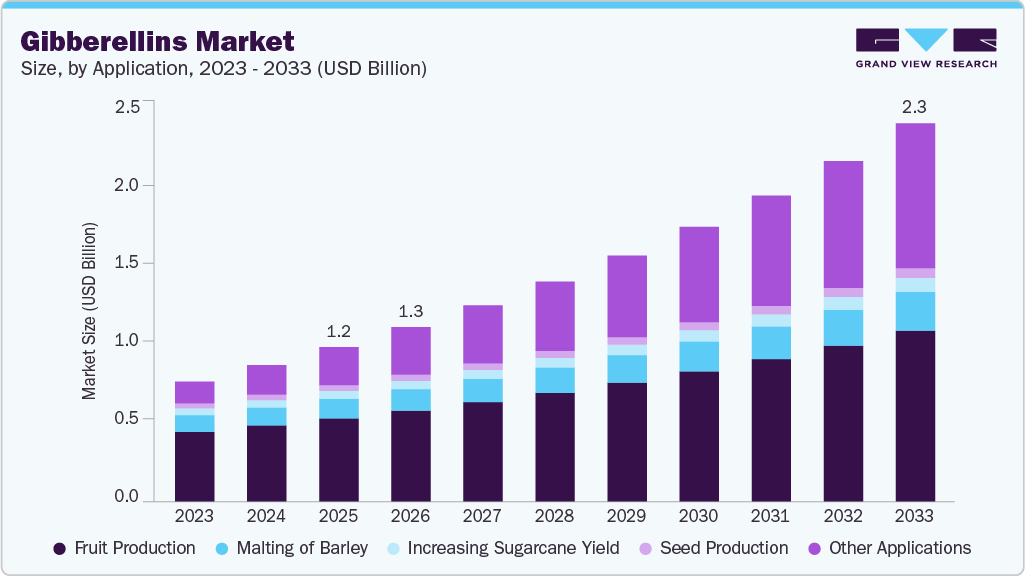

The global gibberellins market size was estimated at USD 1,167.8 million in 2025 and is projected to reach USD 2,342.2 million by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The growing global population and decreasing area for cultivation are anticipated to drive the product demand over the forecast period.

Key Market Trends & Insights

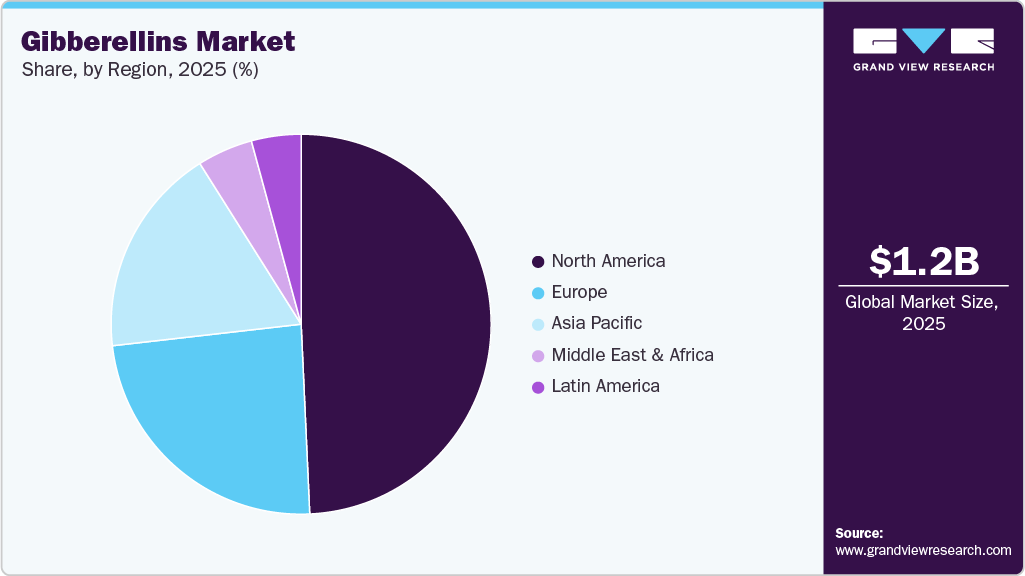

- North America dominated the global gibberellins market with the largest revenue share of 49.3% in 2025.

- The U.S. gibberellins industry is expected to grow at a substantial CAGR of 8.8% from 2026 to 2033.

- By application, the fruit production segment is expected to grow at a significant CAGR of 9.4% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 1,167.8 Million

- 2033 Projected Market Size: USD 2,342.2 Million

- CAGR (2026-2033): 9.1%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

Gibberellins control cell elongation, stimulate the extension growth, delay aging, and increase the rate of fruit production in plants. The growing demand for fine quality vegetables & fruits has increased the utilization of gibberellin in the agriculture industry. Farmers prefer this product as it fosters the growth of plants under uncontrollable and unpredictable environments. Gibberellins are majorly used for the production of apples and grapes.As global population growth places increasing pressure on food supply systems, farmers are adopting plant growth regulators such as gibberellins to enhance seed germination, stem elongation, flowering, and fruit development. Gibberellins are widely used in cereals, fruits, and horticultural crops to improve yield uniformity and quality, making them an important input in modern agriculture.

Another key driver is the rising adoption of precision and high-value agriculture, particularly in fruit and vegetable cultivation. Gibberellins are extensively applied in crops such as grapes, apples, citrus fruits, and rice to regulate plant growth stages, increase fruit size, and improve marketable yield. The expansion of protected cultivation, greenhouse farming, and export-oriented horticulture has further increased demand for consistent and predictable crop performance, supporting the use of gibberellin-based products.

Additionally, the shift toward sustainable and biologically derived agrochemicals is contributing to market growth. Gibberellins, being naturally occurring plant hormones, are increasingly viewed as environmentally compatible alternatives to certain synthetic growth stimulants. Regulatory restrictions on conventional agrochemicals and growing awareness of residue management are encouraging the adoption of plant growth regulators with favorable environmental profiles, positioning gibberellins as a key growth driver in the agricultural inputs market

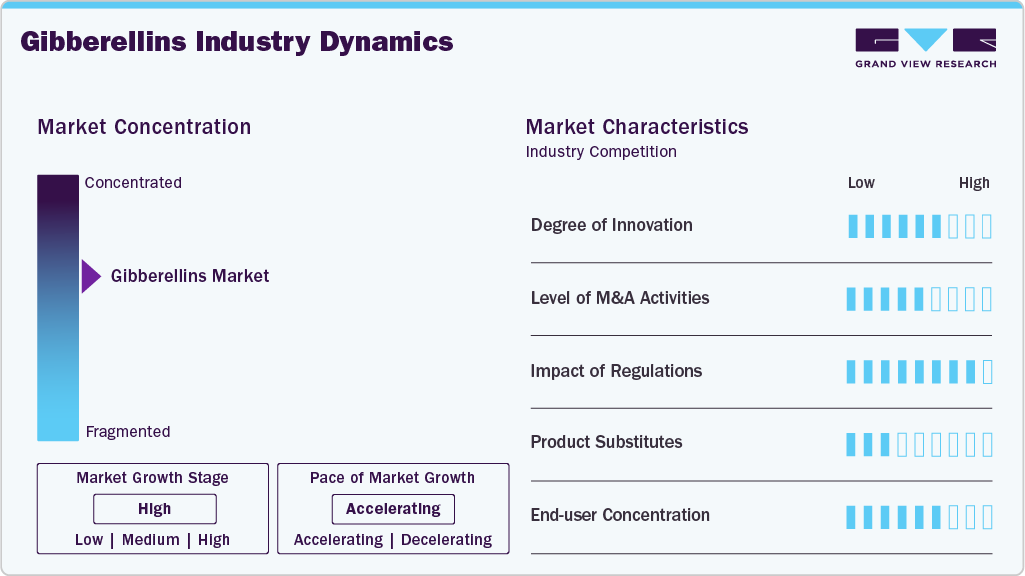

Market Concentration & Characteristics

The gibberellins market is characterized by its specialty-driven nature and strong linkage to crop-specific applications. Demand is highly influenced by the cultivation of high-value crops such as fruits, vegetables, and cereals, where precise control over plant growth stages is critical. The market exhibits seasonal demand patterns, aligned with planting and crop growth cycles, and is dominated by formulated products tailored to specific crops and climatic conditions. Product performance, application timing, and dosage precision are key factors influencing purchasing decisions.

Another defining characteristic of the market is its regulatory and technical intensity. Gibberellin products are subject to agricultural input regulations related to safety, efficacy, and residue limits, which vary across regions. As a result, market participation requires strong R&D capabilities, regulatory compliance, and agronomic support, creating moderate entry barriers. The market also shows a gradual shift toward bio-based and fermentation-derived production, reflecting broader trends in sustainable agriculture and increasing preference for environmentally compatible plant growth regulators.

Application Insights

The fruit production segment led the gibberellins industry, accounting for the largest revenue share of 71.4% in 2025. This is driven by extensive use of gibberellins in high-value horticultural crops such as grapes, apples, citrus, and cherries. Gibberellins are widely applied to increase fruit size, improve uniformity, enhance coloration, and delay senescence, directly improving marketable yield. Export-oriented fruit farming and premium quality requirements further support high adoption. The strong return on investment for growers makes fruit production the dominant application segment.

The malting of barley segment is expected to grow with a CAGR of 8.9% during the forecast period. The growth is driven by rising global demand for beer, craft beverages, and malt-based food products. Gibberellins are used to stimulate uniform germination and enzyme activation during the malting process, improving malt quality and processing efficiency. Growth in the brewing industry, particularly premium and craft beer production, is accelerating adoption. Increasing focus on process consistency and yield optimization further supports segment expansion.

Regional Insights

The North America gibberellins market accounted for the largest revenue share of 49.3% in 2025. North America represents a mature and technology-driven gibberellins market, supported by advanced agricultural practices and high adoption of plant growth regulators in fruit and cereal crops. Demand is concentrated in horticulture, vineyards, and malting barley, where yield uniformity and quality enhancement are critical. Strong agronomic awareness and precision farming practices support consistent usage.

The U.S. gibberellins market is driven by extensive use in fruit production, vineyards, and malting barley. Advanced farming practices and strong integration with agronomic advisory services support consistent demand. Regulatory oversight ensures controlled usage, favoring high-quality formulations. Stable agricultural output underpins steady market growth.

Asia Pacific Gibberellins Market Trends

The Asia Pacific is expected to grow the fastest with a CAGR of 10.3% during the forecast period. The region’s growth is driven by expanding agricultural output, rising food demand, and increasing adoption of modern crop management techniques. Strong demand from fruit production, rice cultivation, and horticulture underpins growth across China, India, and Southeast Asia. Government initiatives supporting yield enhancement and crop quality improvement further accelerate adoption. The region benefits from a large farming base transitioning toward regulated plant growth regulator usage

The China gibberellins market represents one of the largest and fastest-growing national markets, supported by large-scale fruit and rice cultivation. Government focus on improving agricultural productivity and quality drives adoption of plant growth regulators. Increasing farmer awareness and modernization of agricultural inputs further support market expansion. Domestic production also enhances product availability.

Europe Gibberellins Market Trends

Europe’s gibberellins market is shaped by stringent agricultural regulations and sustainability-focused farming practices. Demand is strong in fruit cultivation and malting barley, particularly in Western and Central Europe. The market favors high-efficacy, low-residue formulations, aligning with strict environmental and food safety standards. Growth is steady but controlled, with innovation focused on application efficiency rather than volume expansion.

The Germany gibberellins market is specialty-oriented, with demand concentrated in malting barley and high-value horticulture. Strong presence of the brewing industry supports consistent usage in barley malting. Strict regulatory standards influence product selection and application practices. Germany also plays a role in R&D and formulation development within Europe.

Latin America Gibberellins Market Trends

Latin America’s gibberellins market is driven by export-oriented agriculture, particularly in fruits such as grapes, citrus, and berries. Countries in the region increasingly adopt gibberellins to improve fruit size, quality, and consistency for international markets. Favorable climatic conditions and expanding commercial farming support demand growth. However, adoption remains uneven due to varying regulatory frameworks and levels of agronomic awareness.

Middle East and Africa Gibberellins Market Trends

The Middle East & Africa market is emerging, supported by growing investments in horticulture and controlled-environment agriculture. Gibberellins are increasingly used to enhance crop performance under arid and semi-arid conditions, particularly in fruit and vegetable cultivation. Adoption is driven by food security initiatives and yield optimization efforts. Despite strong long-term potential, market growth is constrained by limited awareness and infrastructure in parts of the region.

Key Gibberellins Company Insights

Some of the key players operating in the market include BASF SE, Afton Chemical Corporation, Evonik Industries AG, and The Lubrizol Corporation.

-

Valent U.S.A. Corporation, The company is manufacturer, producer, and seller of pest management and crop protection products in agriculture market of the U.S. and Canada. The products are used to protect & enhance crop yield and improve quality of the crop. The company operates in various business segments including golf course, turf, nursery, landscape operations, industrial vegetation management, and greenhouse. It has its own research laboratory in Dublin, California. The company is based in Walnut Creek, California and has additional offices in Longwood, Florida; Fresno, California; Mahomet, Illinois; and Collierville, Tennessee.

Key Gibberellins Companies:

The following are the leading companies in the gibberellins market. These companies collectively hold the largest market share and dictate industry trends.

- Valent U.S.A. Corporation

- Jiangsu Fengyuan Bioengineering Co., Ltd.

- Nufarm Ltd.

- Sichuan Guoguang Agrochemical Co. Ltd.

- Xinyi (H.K.) Industrial Co., Ltd.

- Fine Americas, Inc.

- SePRO Corporation

- Zhejiang Qiangiang Biochemical Co., Ltd.

- Shanghai Fuang Agrochemical Co. Ltd.

- Biosynth AG

- Zodiac Brand Space Pvt. Ltd.

Recent Developments

-

In November 2023, Researchers from the Singapore-MIT Alliance for Research and Technology (SMART) and the Temasek Life Sciences Laboratory, in collaboration with PepsiCo, have developed groundbreaking nanosensors that can detect and differentiate gibberellins (GAs), which are essential plant growth hormones. Unlike traditional methods, these non-destructive sensors have been successfully tested, offering a revolutionary approach for monitoring live plants and early-stage plant stress. The potential applications in crop management and precision agriculture, these nanosensors could provide farmers with valuable tools to optimize yields and enhance plant biotechnology.

Gibberellins Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1,272.3 million

Revenue forecast in 2033

USD 2,342.2 million

Growth rate

CAGR of 9.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific: Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Valent U.S.A. Corporation; Jiangsu Fengyuan Bioengineering Co., Ltd.; Nufarm Ltd.; Sichuan Guoguang Agrochemical Co. Ltd.; Xinyi (H.K.) Industrial Co., Ltd.; Fine Americas, Inc.; SePRO Corporation; Zhejiang Qiangiang Biochemical Co., Ltd.; Shanghai Fuang Agrochemical Co. Ltd.; Biosynth AG; Zodiac Brand Space Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gibberellins Market Report Segmentation

This report forecasts volume & revenue growth at the global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global gibberellins market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

Malting Of Barley

-

Increasing Sugarcane Yield

-

Fruit Production

-

Seed Production

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the gibberellins market include Valent U.S.A. Corporation; Nufarm Ltd.; Sichuan Guoguang Agrochemical Co. Ltd.; and Fine Americas, Inc.

b. Key factors that are driving the market growth include growing global population, decreasing area for cultivation and ability of the gibberellins to control cell elongation, stimulate the extension growth, delay aging, and increase the rate of fruit production in plants.

b. The global gibberellins market size was estimated at USD 1,167.8 million in 2025 and is expected to reach USD 1,272.3 million in 2026.

b. The global gibberellins market is expected to grow at a compound annual growth rate of 9.1% from 2026 to 2033 to reach USD 2,342.2 million by 2033.

b. The North America gibberellins market accounted for the largest revenue share of 49.3% in 2025. North America represents a mature and technology-driven gibberellins market, supported by advanced agricultural practices and high adoption of plant growth regulators in fruit and cereal crops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.