- Home

- »

- Consumer F&B

- »

-

Ginger Beer Market Size, Share And Trends Report, 2030GVR Report cover

![Ginger Beer Market Size, Share & Trends Report]()

Ginger Beer Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Alcoholic, Non-alcoholic), By Flavor (Original, Flavored), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-945-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ginger Beer Market Summary

The global ginger beer market size was estimated at USD 5,476.7 million in 2024 and is projected to reach USD 8,133.1 million by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The market growth can be attributed to growing health-conscious consumer behaviors, a preference for craft beverages, and a rise in the popularity of non-alcoholic drinks.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, non-alcoholic accounted for a revenue of USD 4,384.5 million in 2024.

- Alcoholic is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5,476.7 Million

- 2030 Projected Market Size: USD 8,133.1 Million

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

As consumers become more aware of the health benefits associated with ginger, including its anti-inflammatory and digestive properties, the demand for ginger-based products, particularly ginger beer, has surged. Marketers are leveraging these health benefits in their messaging, thereby attracting consumers who are seeking natural and functional beverages. This trend aligns with a broader shift towards wellness, prompting both established brands and new entrants to innovate their product offerings to include ginger beer variants that cater to dietary preferences, such as low-sugar or organic options.

Consumers are increasingly drawn to artisanal and locally produced drinks, seeking unique flavors and authentic experiences that commercial products often lack. Craft breweries and small-scale producers are capitalizing on this trend by experimenting with creative formulations that incorporate a variety of ingredients, such as different spices and fruits. This artisanal approach not only enhances flavor profiles but also creates a narrative around the product, appealing to an audience that values craftsmanship and quality. Many brands are promoting their products as being made with natural ingredients, emphasizing the absence of artificial preservatives or sweeteners. This trend towards transparency and health-oriented choices has allowed alcoholic ginger beer to position itself as a "better-for-you" alcoholic option.

The rise of the mocktail culture has propelled the demand for ginger beer as a mixer in non-alcoholic beverages. With more consumers opting for alcohol-free experiences, ginger beer has found its place in the cocktail repertoire, serving as a flavorful alternative to traditional mixers like tonic water or soda. Bars and restaurants are increasingly incorporating ginger beer into their drink menus, showcasing it in innovative cocktails that highlight its spiciness and versatility. This trend not only broadens the consumer base for ginger beer but also positions it as a staple in the growing market for non-alcoholic beverages, further driving demand.

The growth of e-commerce and digital platforms has transformed how consumers discover and purchase ginger beer. With the convenience of online shopping, consumers can easily find and purchase a diverse range of ginger beer brands and flavors from the comfort of their homes. Many companies are now investing in direct-to-consumer models, utilizing social media and digital marketing to create brand awareness and foster customer loyalty. In addition, the growth of subscription services offering curated selections of craft beverages is further propelling the market, allowing consumers to discover new and exciting ginger beer products regularly.

Manufacturers are exploring innovative brewing techniques that enhance the flavor profile and texture of ginger beer, leading to more refined products. Modern fermentation technology allows for better control over the fermentation process, enabling producers to achieve a consistent taste and quality. Moreover, automation in production lines has streamlined processes, reducing costs and increasing efficiency. The use of sustainable practices and natural ingredients, bolstered by advanced extraction methods, has also catered to the rising consumer demand for healthier beverage options. As a result, traditional brewing methods are being reimagined, allowing new players to enter the market with unique offerings that appeal to both health-conscious consumers and those seeking authentic, craft-inspired experiences.

Type Insights

The non-alcoholic segment accounted for a share of 75.6% of the global revenue in 2024, spurred by an increase in health-conscious lifestyles and the growing popularity of non-alcoholic alternatives. As consumers become more aware of the health impacts of alcohol, many are opting for non-alcoholic beverages that provide similar taste experiences without the effects of intoxication. Non-alcoholic ginger beer, often crafted with real ginger and natural flavors, offers a refreshing option that caters to this demand, making it an attractive choice for gatherings and social events where alcoholic consumption is not desired. Furthermore, the versatility of non-alcoholic ginger beer as a mixer in various cocktails and mocktails has also bolstered its appeal to consumers looking to enjoy sophisticated drinks without alcohol.

The alcoholic segment is expected to grow at a CAGR of 8.2% from 2025 to 2030, driven by a growing consumer inclination towards craft beverages and unique flavor profiles. With the rise of the craft beer movement, many breweries are experimenting with ginger beer as a flavorful alternative to traditional beers and ciders. Alcoholic ginger beer is often favored for its refreshing taste, lower alcohol content compared to standard beers, and versatility in cocktails. As consumers increasingly seek bold and artisanal experiences, the introduction of premium and small-batch varieties has become a significant trend, appealing to younger demographics who prioritize quality and authenticity in their beverage choices.

Flavor Insights

Flavored ginger beer accounted for a share of 61.6% of the global revenue in 2024, driven by a surge in demand for flavored variants, as consumers increasingly seek innovative and diverse taste experiences. Flavored ginger beers, which include infusions of botanical ingredients, fruits, and spices, align with the growing trend of experimentation in beverages. Ingredients such as hibiscus, lime, mango, and even chili are being infused to create exciting flavor combinations that appeal to adventurous consumers. This trend is particularly pronounced among younger demographics, who view flavored beverages as a more engaging alternative to traditional soft drinks.

Original ginger beer is expected to grow at a CAGR of 6.0% from 2025 to 2030. The original ginger beer segment maintains a strong and loyal following due to its traditional roots and unparalleled ginger flavor profile. This segment is particularly appealing to consumers who appreciate classic beverages and are drawn to products with authenticity and heritage. Original flavored beers are often made using time-honored brewing methods, which resonate with consumers who value craftsmanship and quality. As the global market moves towards premiumization, the classic version of beer is being marketed as a specialty product that offers a unique tasting experience reminiscent of historical recipes and artisanal production methods.

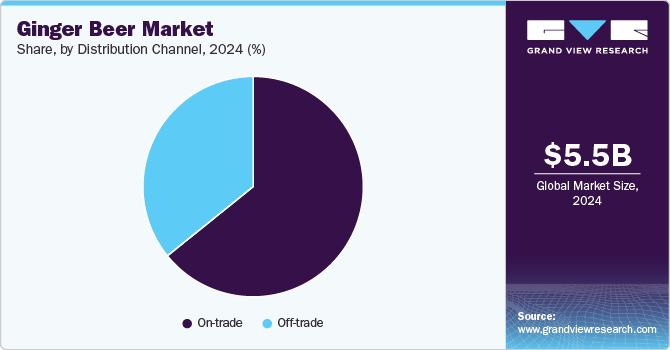

Distribution Channel Insights

The sales of ginger beer through on-trade channels accounted for a share of 64.2% of the global revenue in 2024, driven primarily by the increasing popularity of craft beverages in bars, restaurants, and clubs. Consumers are increasingly seeking unique and flavorful experiences, and ginger beer fits perfectly into this trend. Mixologists are creatively incorporating ginger beer into cocktails, enhancing its appeal among a diverse clientele. Premium and artisanal brands have found a lucrative space in on-trade establishments, as they elevate the dining experience by offering signature drinks that highlight the complex flavors of ginger beer. As such, establishments that focus on local sourcing and craft production are likely to see stronger sales, catering to a growing segment of young consumers who value authenticity and quality in their beverage choices.

The sales of ginger beer through off-trade channels are expected to grow at a CAGR of 7.8% from 2025 to 2030, driven by the burgeoning demand for ginger beer through retail outlets, including supermarkets, convenience stores, and online platforms. With busy lifestyles becoming the norm, consumers are increasingly purchasing ginger beer for home consumption, spurred by promotional discounts and attractive packaging in retail environments. The rise of e-commerce has also played a significant role, enabling consumers to conveniently order a wider variety of ginger beer brands and flavors from the comfort of their homes. This online accessibility has expanded the consumer base, reaching individuals who may not have previously been exposed to the product.

Regional Insights

The ginger beer market in North America captured a revenue share of over 37.1% of the market, driven by a rising consumer preference for craft beverages and natural, health-oriented options. The health benefits associated with ginger, including its anti-inflammatory and digestive properties, have increased its appeal among health-conscious consumers. Moreover, the trend towards non-alcoholic beverages is gaining momentum, with ginger beer often positioned as a flavorful alternative to traditional alcoholic drinks. Besides, the emergence of numerous artisanal brands has sparked innovation in flavors and formulations, appealing particularly to younger demographics that favor unique and exotic taste experiences.

U.S. Ginger Beer Market Trends

The ginger beer market in the U.S. is expected to grow at a CAGR of 6.9% from 2025 to 2030, driven by rising consumer interest in craft beverages and health-conscious choices. As more Americans turn to non-alcoholic options, ginger beer has become a favored mixer in cocktails and a standalone drink, often perceived as a natural remedy for various ailments due to its ginger content. The trend of artisanal and locally produced beverages has also gained traction, with many consumers preferring smaller brands that offer unique flavors and high-quality ingredients. This growing preference for premium beverages has driven an increase in both the diversity and the availability of ginger beer products across retail platforms.

Europe Ginger Beer Market Trends

The ginger beer market in Europe is expected to grow at a CAGR of 6.5% from 2025 to 2030. Theregion is characterized by a rich heritage of traditional beverages and an evolving trend towards innovative flavors. The demand for ginger beer in this region is largely influenced by the growing popularity of natural and organic products, as consumers become more aware of health and wellness. Moreover, countries including Germany, the UK, and Spain have a long-standing association with ginger ale and beer, leading to a faster adoption of ginger beer as a versatile mixer and standalone beverage. European consumers are increasingly seeking out beverages that not only tantalize their taste buds but also align with their health-conscious lifestyles. This trend has led to an expansion of ginger beer variants that incorporate natural ingredients, appealing to a niche market that values authenticity and quality.

The ginger beer market in Germany is poised for substantial growth, fueled by a rising inclination toward innovative soft drinks and a burgeoning craft beverage culture. Consumers in Germany have developed a taste for unique flavors beyond traditional sodas, leading to an uptick in the popularity of ginger beer. Many young and health-conscious Germans are drawn to naturally flavored beverages, and ginger beer’s blend of spiciness and sweetness makes it a compelling alternative. Besides, several breweries and beverage producers have begun to introduce craft ginger beer options, emphasizing quality ingredients and authentic brewing methods, which resonate with the German palette for quality. Additionally, Germany’s strong market for non-alcoholic beverages plays a significant role in the demand for ginger beer.

The UK holds a prominent position in the global ginger beer market, owing to its rich history in brewing and the ever-growing interest in both traditional and innovative beverage choices. The increasing popularity of craft beverages has significantly influenced the ginger beer market, with many consumers choosing artisanal brands that offer a variety of unique flavors and brewing styles. Moreover, the traditional association of ginger beer with cocktails, such as the Moscow Mule, further bolsters its demand, especially as cocktail culture continues to prosper in urban areas. Besides, the UK's health-focused consumer base is driving the ginger beer market as people shift toward healthier alternatives to sugary soft drinks.

Asia Pacific Ginger Beer Market Trends

The ginger beer market in the Asia Pacific is expected to witness a CAGR of 8.3% from 2025 to 2030. The increasing health consciousness among consumers, particularly in countries like India, Indonesia, and China, has propelled ginger-based products into the spotlight, as ginger is widely respected for its medicinal properties and culinary versatility. In addition, the influence of Western trends, such as craft beverages and premium mixers, has catalyzed a shift in consumer preferences towards more diverse and exotic drink options. This has led to a vibrant market characterized by a growing range of ginger beer products that cater to local tastes while also introducing innovative flavor combinations.

The ginger beer market in China is expected to witness a CAGR of 8.0% from 2025 to 2030, propelled by changing consumer preferences and rising health awareness. The traditional use of ginger in Chinese culture, along with its perceived health benefits, provides a strong foundation for the growth of ginger beer. As younger consumers increasingly seek out unique and flavored beverages, ginger beer has gained traction, with several domestic brands entering the market to cater to these evolving tastes. These local producers often blend traditional ginger flavors with other local ingredients, creating distinctive products that appeal to the adventurous Chinese palate and the growing trend of culinary exploration.

The ginger beer market in Japan is poised for substantial growth, driven by a trend of craft beverages, coupled with a preference for premium quality, which has led to increased offerings of ginger beer in both domestic and import markets. Japanese consumers, known for their discerning taste, are increasingly drawn to artisanal products that highlight natural flavors and ingredients. As a result, local breweries and beverage companies have begun crafting ginger beers that infuse regional flavors, appealing to both the domestic audience and international visitors. In addition, the rising popularity of casual drinking and social occasions in Japan has contributed to an uptick in ginger beer consumption. As bars and restaurants experiment with cocktail mixes that incorporate ginger beer, its use as a mixer for non-alcoholic options, such as shandies or mocktails, is becoming more common.

Latin America Ginger Beer Market Trends

The ginger beer market in Latin America is expected to witness a CAGR of 6.4% from 2025 to 2030. Traditionally, ginger has been used in various local concoctions; however, the commercialization and marketing of ginger beer have introduced this effervescent drink to a broader audience. Countries such as Brazil and Argentina are seeing a surge in interest in both domestic and imported ginger beer brands that incorporate local flavors and ingredients. As urbanization continues and consumer sophistication grows, the market is likely to expand beyond traditional grocery channels, penetrating bars, restaurants, and specialty beverage outlets that cater to a demand for high-quality and exotic drink options.

Middle East & Africa Ginger Beer Market Trends

The Middle East and Africa are emerging markets for ginger beer, showcasing an interesting blend of traditional herbal beverages and modern interest in crafted drinks. Many consumers in this region associate ginger with medicinal properties; hence, ginger-based beverages are well-received as functional health drinks. Moreover, the trend towards adopting natural and organic products is prevalent, with ginger beer positioned as not only a refreshment but also a health-conscious option, catering to a demographic increasingly concerned about their wellbeing. Besides, the growing interest in local ingredients has spurred developments in the craft beverage sector, where ginger beer is being produced with regional flavors that resonate well with local consumers.

Key Ginger Beer Company Insights

The global ginger beer market is characterized by the presence of several key players who are driving innovation and expanding their footprints through a mix of strategies such as product launches, partnerships, and acquisitions. Key companies operating in the market include Fever-Tree, Crabbie’s Alcoholic Ginger Beer, Bundaberg Brewed Drinks, Q MIXERS, and Goslings Rum. The significant R&D investments have allowed these companies to explore functional ingredients that appeal to health-oriented consumers, positioning their brands advantageously in a competitive market landscape.

Partnerships between ginger beer manufacturers and food service establishments are also on the rise, effectively increasing market penetration while introducing consumers to new ways of enjoying ginger beer, such as cocktails and culinary applications. This collaborative approach not only expands brand reach but also fosters consumer loyalty through unique experiences. For instance, some firms, such as Goslings Rum, have sought partnerships with craft cocktail bars and restaurants, tapping into the growing trend of mixology and premium mixers, which has effectively boosted brand visibility and sales. Besides, the ongoing expansion of these key industry players into emerging markets in Asia and Africa also reflects a broader strategy to capitalize on rising consumer interest in craft beverages globally.

Key Ginger Beer Companies:

The following are the leading companies in the ginger beer market. These companies collectively hold the largest market share and dictate industry trends.

- Crabbie’s Alcoholic Ginger Beer

- Bundaberg Brewed Drinks

- Fever-Tree

- Fentimans

- Rachel’s Ginger Beer

- Gunsberg

- Natrona Bottling Company

- Goslings Rum

- Old Jamaica Ginger Beer

- Q MIXERS

Recent Developments

-

In September 2024, Canada Dry introduced a new ginger beer, emphasizing the perfect balance of spice. This strategic product launch taps into growing consumer demand for bold, flavorful beverages, enhancing brand differentiation while expanding Canada Dry's presence in the premium soft drink market.

-

In January 2023, Ginger's Revenge expanded its distribution network through a strategic partnership with Bear Island Distributors. This move is set to enhance the brand's market reach and visibility, providing access to new customer segments and strengthening its regional presence, driving further growth opportunities.

Ginger Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.82 billion

Revenue forecast in 2030

USD 8.13 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million,and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Poland; Germany; Netherlands; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Crabbie’s Alcoholic Ginger Beer; Bundaberg Brewed Drinks; Fever-Tree; Fentimans; Rachel’s Ginger Beer; Gunsberg; Natrona Bottling Company; Goslings Rum; Old Jamaica Ginger Beer; Q MIXERS

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Ginger Beer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ginger beer market report based on type, flavor, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcoholic

-

Non-alcoholic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Poland

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ginger beer market size was estimated at USD 5.48 billion in 2024 and is expected to reach USD 5.8 billion in 2025.

b. The global ginger beer market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 8.13 billion by 2030.

b. North America dominated the ginger beer market, with a share of 37.1% in 2024. This is attributable to the region's increasing awareness of health and wellness among consumers.

b. Some key players operating in the ginger beer market include Crabbie’s Alcoholic Ginger Beer; BUNDABERG BREWED DRINKS; Fever-Tree; Fentimans; Rachel’s Ginger Beer; Gunsberg; Natrona Bottling Company; Goslings Rum; Old Jamaica Ginger Beer; Q MIXERS

b. Key factors driving market growth include growing demand for low-alcoholic flavored drinks, increasing availability of a wide range of flavored beer, and personalized product offerings worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.