- Home

- »

- Homecare & Decor

- »

-

Glass Cleaner Market Size & Share, Industry Report, 2033GVR Report cover

![Glass Cleaner Market Size, Share & Trends Report]()

Glass Cleaner Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Liquid Glass Cleaner, Spray Glass Clean, Foam Glass Cleaner), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-689-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glass Cleaner Market Summary

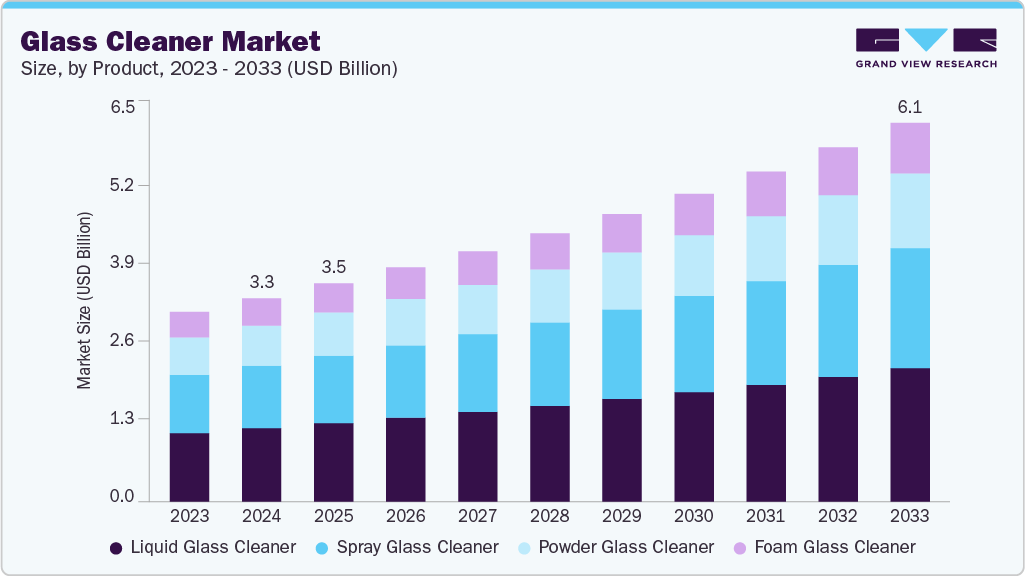

The global glass cleaner market size was estimated at USD 3.29 billion in 2024 and is projected to reach USD 6.14 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. One of the most significant contributors to this expansion is the rapid global urbanization.

Key Market Trends & Insights

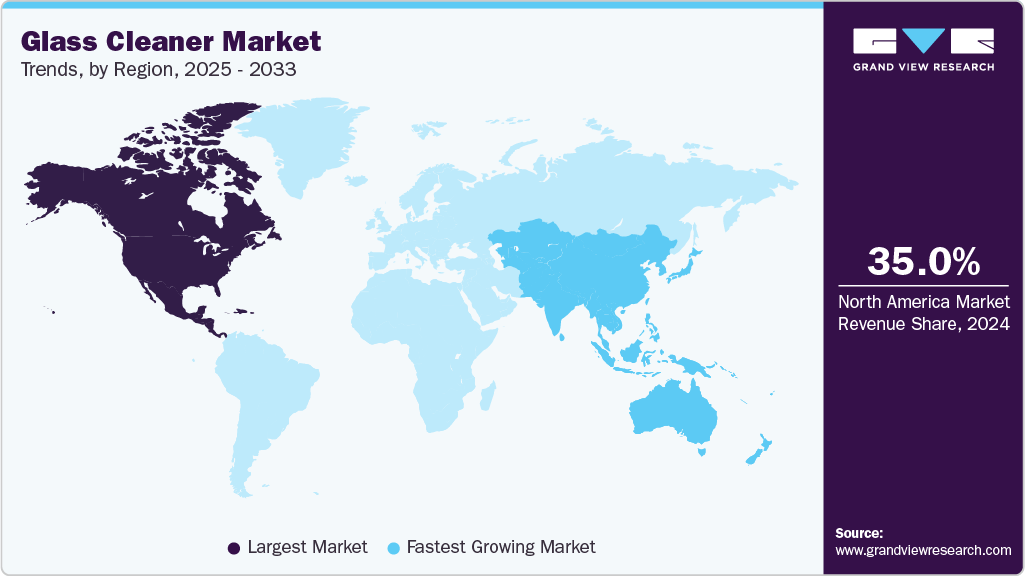

- North America was the largest market for glass cleaner, accounting for over 35% of the global market in 2024.

- India is expected to be fastest growing market for glass cleaner globally

- By product type, the liquid glass cleaner had the highest market share of 30% in 2024.

- By distribution channel, Offline sales segment were the most commonly used distribution channels for glass cleaners, generating over USD 2.27 billion in 2024.

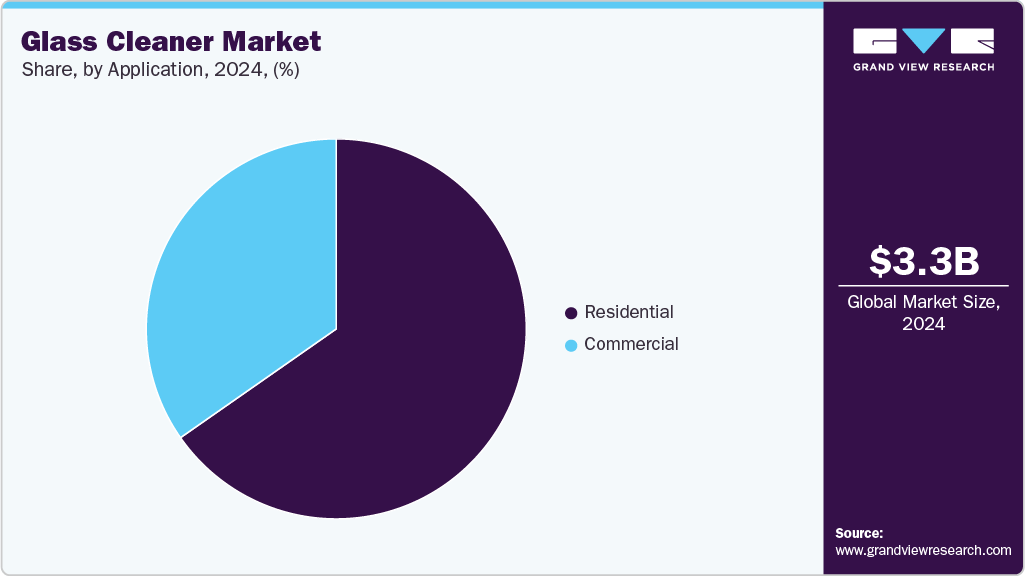

- By application, the residential segment is the largest end user in the global glass cleaner market, accounting for over 60% of the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.29 Billion

- 2033 Projected Market Size: USD 6.14 Billion

- CAGR (2025-2033): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As more people move to urban areas, the demand for both residential and commercial buildings continues to grow, many of which feature large glass surfaces like windows, facades, and partitions. The popularity of modern architectural designs that include extensive glass elements requires regular cleaning and maintenance, significantly increasing the need for efficient glass cleaning products.Another key factor driving market growth is the rising public awareness of the importance of cleanliness and hygiene. Following the COVID-19 pandemic, both consumers and businesses have focused more on maintaining sanitary environments in homes and workplaces. Glass surfaces, which are highly visible and easily show fingerprints and smudges, need frequent cleaning to maintain hygiene standards and visual appeal. This trend has greatly boosted the demand for specialized glass cleaning products known for their effectiveness and ease of use.

Technological innovation and ongoing product development also significantly influence the market's growth path. Manufacturers are investing in research to develop advanced formulas, such as ammonia-free and eco-friendly glass cleaners, that appeal to environmentally conscious consumers. Furthermore, the creation of products with anti-fogging, streak-free, and quick-drying features has increased consumer interest. As smart homes and commercial spaces become more popular, innovative, high-tech glass cleaning solutions have gradually entered the market.

The expansion of both physical retail and e-commerce platforms has further sped up market growth by making glass cleaning products more accessible than ever. Online shopping, in particular, has allowed brands to enter new markets, connect directly with consumers, and provide a larger variety of products. Greater product visibility and aggressive marketing strategies have helped position glass cleaners as essential household and professional cleaning supplies, driving growth across different regions.

Consumer preferences are also shifting toward environmentally friendly products, in line with increasing concern over the use of harsh chemicals and non-recyclable packaging. Especially in developed regions, stricter regulations and greater environmental awareness are driving the adoption of sustainable cleaning solutions. As manufacturers reformulate products with natural ingredients and eco-friendly packaging, the market for green or natural glass cleaners continues to grow rapidly.

The rising disposable income levels and changing lifestyles, especially in emerging economies, have enabled consumers to seek higher-quality household products, including premium glass cleaners. The willingness to invest in branded, convenient, and reliable cleaning solutions is becoming stronger, gradually replacing traditional homemade cleaning agents. The growth efforts of leading global brands in these rapidly growing markets further boost demand, supporting the continuous expansion of the market.

One of the primary hurdles is the intense competition from alternative cleaning solutions, including multipurpose cleaners, homemade mixtures, and numerous low-cost substitutes, which often erode the market share of dedicated glass cleaning products. Additionally, the market is increasingly affected by rising environmental concerns and regulatory constraints on chemical ingredients, compelling manufacturers to invest in the development of eco-friendly and safer formulations. This shift can result in higher production costs and lengthier innovation cycles, potentially impacting product affordability and time-to-market. Market saturation in developed regions further intensifies competition, driving price wars and making it difficult for brands to maintain healthy profit margins, especially as consumers tend to favor lower-priced options. The proliferation of counterfeit and low-quality products also poses a risk, as it can undermine consumer trust and damage the reputation of established brands.

Product Insights

Liquid glass cleaner held the largest share of the market, valued at USD 1.20 billion in 2024. Liquid glass cleaners represent the largest segment in the market, accounting for approximately half of the total share. This dominance is primarily attributed to their remarkable versatility and effective cleaning performance on a broad range of glass surfaces, from household windows and mirrors to commercial facades. Consumers’ long-standing familiarity with liquid formulations, combined with their proven ability to deliver streak-free results through ammonia or alcohol-based solutions, reinforces brand trust and widespread usage across residential and commercial settings.

Spray glass cleaners have emerged as the fastest-growing product segment within the market, growing at a CAGR of 7.5% from 2025 to 2033. Their rapid adoption is fuelled by increasing demand for convenience, efficiency, and targeted cleaning. Trigger and aerosol sprays enable quick and even application, reducing effort and product waste while delivering a professional, streak-free finish. This convenience is particularly attractive to busy households and commercial environments that prioritize time-saving and hygienic practices. Furthermore, spray formats are portable and well-suited for a variety of glass surfaces, including vehicle interiors and modern architectural glass, which contributes to their accelerated growth. Ongoing innovations, such as anti-fog features and eco-friendly formulations, are also expanding the appeal of spray cleaners to environmentally conscious consumers.

Foam glass cleaners, while holding a smaller market share, are valued for their unique ability to adhere to vertical and sloped surfaces, preventing drips and allowing the cleaning agent to stay in contact with grime longer. This makes them especially effective against tough stains and a preferred choice in professional or commercial cleaning tasks, such as maintaining shower doors, high-rise windows, and other challenging surfaces. The growing popularity of specialized cleaning solutions and consumers' willingness to try new formats are contributing to modest but steady growth in this category.

Powder and concentrate glass cleaners mainly serve industrial and commercial customers who need cost-effective solutions in large quantities. These formats also help reduce packaging waste and enhance sustainability, which appeals to businesses looking to lessen their environmental impact. The ability to create custom-strength cleaning solutions supports the shift toward personalized and eco-friendly routines, although adoption in the residential market remains limited compared to other types.

Application Insights

The residential segment is the largest end user in the global glass cleaner market, accounting for over 60% of the market in 2024. This is driven by consumers' daily need to maintain hygiene, clarity, and aesthetics on glass surfaces such as windows, mirrors, shower enclosures, and glass furniture. This dominance is supported by growing urban populations, rising disposable incomes, increased awareness of health and sanitation, and the proliferation of appliances and home décor items that feature glass. After the COVID-19 pandemic, awareness of household hygiene and the importance of regular cleaning routines increased, making glass cleaners an essential part of home maintenance. The wide variety of available products-including traditional liquids, convenient sprays, and eco-friendly options-meets diverse consumer preferences and budgets, sustaining high demand.

Product innovation has also played a key role in shaping the residential market segment. Manufacturers continually introduce new features such as ammonia-free formulas, natural ingredients, pleasant scents, and multi-surface compatibility, directly responding to consumer demands for safer and more convenient solutions. The growth of e-commerce has further boosted the residential glass cleaner market by increasing accessibility and offering a wide range of choices. As emerging economies in Asia-Pacific and Latin America experience rapid urbanization and construction, the demand for glass cleaners in residential settings is expected to grow accordingly, reinforcing the segment’s leadership in overall market share.

The commercial segment, although smaller than the residential segment in current market share, is the fastest-growing part of the glass cleaner market. Growth in this area is driven by the construction boom of modern office complexes, retail centers, malls, hospitals, hospitality venues, and public buildings that feature extensive glass installations. In these busy environments, keeping glass surfaces spotless and hygienic is not just about looks but also an operational requirement linked to customer perception, health standards, and compliance with regulations. As a result, commercial users prefer advanced, high-performance glass cleaning products-often industrial-strength liquids, concentrated powders, or specialized foams-that clean effectively with speed and efficiency.

The adoption of smart and automated cleaning technologies continues to reshape the commercial landscape. The use of IoT-enabled devices, robotic cleaners, and advanced formulas with anti-fog or antimicrobial features has become increasingly popular, especially in high-value sectors like hospitality and healthcare. The global trend toward urbanization and dense infrastructure development further drives this sector’s growth. As commercial spaces grow and prioritize cleanliness, the need for innovative, sustainable large-scale glass cleaning solutions is expected to increase rapidly, making the commercial sector a key driver of future market expansion.

Distribution Channel Insights

Offline sales were the most commonly used distribution channels for glass cleaners, generating over USD 2.27 billion in 2024. The offline channel, which includes supermarkets, hypermarkets, convenience stores, and specialty retail outlets, remains the dominant market share. This leadership is driven by several factors, including the immediate availability of products, the ability for customers to physically inspect items before buying, and long-standing habits that build trust in traditional retail settings. In many regions, especially in emerging markets, consumers rely heavily on offline stores for household essentials due to their extensive geographical presence. Additionally, commercial buyers frequently purchase cleaning supplies in bulk through offline channels to satisfy urgent operational needs, further emphasizing the importance of this distribution method.

Meanwhile, the online distribution channel is the fastest-growing segment in the glass cleaner market, experiencing rapid expansion in recent years. This surge is primarily driven by the increasing adoption of e-commerce platforms, which offer unmatched convenience, a wide variety of products, and competitive prices. The online channel particularly appeals to younger, tech-savvy, urban consumers who value hassle-free shopping, door-to-door delivery, and the ability to compare products through reviews and ratings. The COVID-19 pandemic also sped up the shift toward digital shopping, as consumers aimed to reduce in-person interactions and embraced contactless retail options. Additionally, brands leverage digital marketing, targeted promotions, and influencer campaigns to attract and keep online shoppers. As digital infrastructure and consumer familiarity with e-commerce continue to improve worldwide, the online segment is expected to sustain its strong growth, even as offline retail remains the primary sales channel.

Regional Insights

North America was the largest market for glass cleaners and accounted for a market revenue of over USD 1.08 billion in 2024. The region, especially the U.S., has a high disposable income, which supports the demand for quality and specialized cleaning products. Urbanization and the proliferation of glass-based architectural projects, such as high-rise buildings and commercial complexes, have expanded the requirement for glass maintenance and cleaning services. Moreover, there is a rising trend towards eco-friendly cleaning solutions, driven by consumer preferences and environmental regulations. Innovations in cleaning technology, including robotic and AI-powered glass cleaning systems, also contribute to market growth by improving cleaning efficiency and safety. The persistent demand from sectors such as residential, commercial, automotive, and specialized industries further consolidates North America's leading position in this market.

U.S. Glass Cleaner Market Trends

The U.S. dominates the market, making up a large part of the region’s glass cleaner sales and generating about USD 1 billion in revenue in 2024. Key drivers of growth include a stronger focus on cleanliness after COVID-19, higher disposable income, and widespread infrastructure suitable for glass cleaning products. The residential sector in the U.S. accounts for a large share of this demand, with consumers seeking streak-free results and advanced product formulas. Additionally, technological progress has led to the development of glass cleaners with improved features like quick-drying, anti-fog, and streak-free formulations, increasing user satisfaction. The reliance of the commercial real estate industry on glass facades also boosts market demand. Regulatory pushes for greener products have encouraged innovation in eco-friendly glass cleaners, contributing to the market's growth.

Asia Pacific Glass Cleaner Market Trends

The Asia Pacific region is expected to grow fastest at a CAGR of 8% from 2025 to 2033. The Asia Pacific region is experiencing robust growth in the glass cleaner market, with powerful performances from China, India, and Japan. This growth is fueled by rapid urbanization, increasing construction activities, and the expansion of commercial buildings, including malls, offices, hotels, and retail outlets. The increasing population and rising disposable income in countries like India have led to greater household consumption of glass cleaning products. Furthermore, the proliferation of skyscrapers and glass-based architecture in China requires specialized cleaning solutions that can maintain glass surfaces at great heights. The hospitality and healthcare sectors in the region also contribute significantly to growth due to their strict cleanliness standards. Technological adoption, rising consumer awareness of hygiene, and the expansion of e-commerce platforms for easy product availability further accelerate market growth. Sustainability trends are also being adopted, with a growing demand for environmentally conscious and non-toxic products.

Key Glass Cleaner Company Insights

The global glass cleaner market's competitive landscape is moderately consolidated, featuring a mix of established multinational corporations and several regional players actively competing. Leading companies such as Reckitt Benckiser Group PLC, The Clorox Company, S. C. Johnson & Son Inc., Chemical Guys Company, CRC Industries, Zep Inc., Rutland Fire Clay Company, PPG Industries Inc., and Diversey Inc. dominate a significant share of the market.

Key Glass Cleaner Companies:

The following are the leading companies in the glass cleaner market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- PPG Industries, Inc.

- The Clorox Company

- Reckitt Benckiser

- Stoner Inc.

- Zep Inc.

- Rutland Fire Clay Company

- ITW Global Brands Inc.

- S. C. Johnson & Son Inc.

- Diversey Inc.

- Weiman Products LLC

- Seventh Generation Inc.

- Sprayway Inc.

- Unilever

- Henkel AG & Co. KGaA

Glass Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.53 billion

Revenue forecast in 2033

USD 6.14 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

3M Company; PPG Industries, Inc.; The Clorox Company; Reckitt Benckiser; Stoner Inc.; Zep Inc.; Rutland Fire Clay Company; ITW Global Brands Inc.; S. C. Johnson & Son Inc.; Diversey Inc.; Weiman Products LLC; Seventh Generation Inc.; Sprayway Inc.; Unilever; Henkel AG & Co. KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

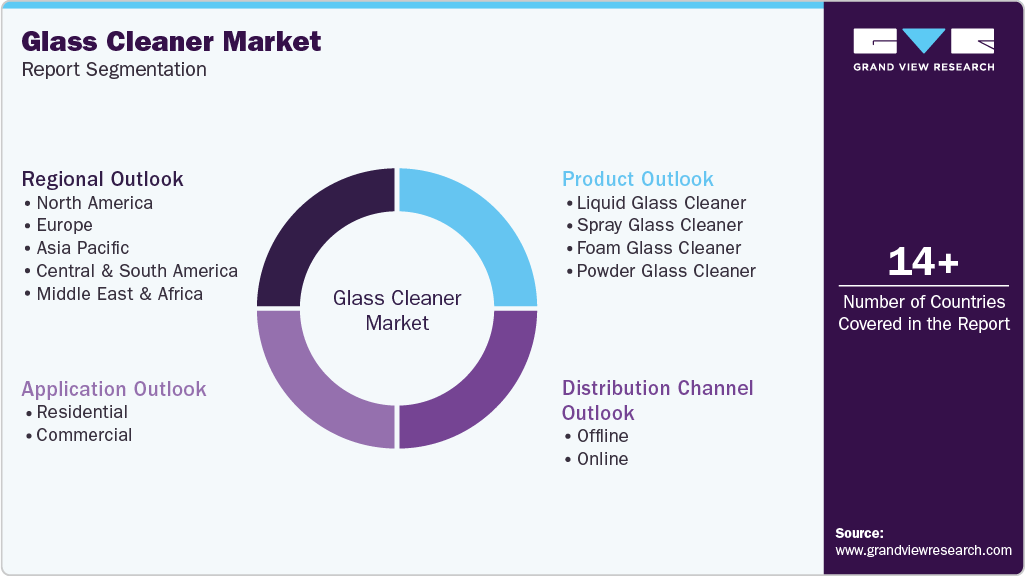

Global Glass Cleaner Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. Grand View Research has segmented the global glass cleaner market report by product, application, distribution channel and region.

-

Product Outlook (Revenue, USD Billion, 2021 - 2033)

-

Liquid Glass Cleaner

-

Spray Glass Cleaner

-

Foam Glass Cleaner

-

Powder Glass Cleaner

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.