- Home

- »

- Advanced Interior Materials

- »

-

Atmospheric Water Generator Market Size Report, 2030GVR Report cover

![Atmospheric Water Generator Market Size, Share & Trends Report]()

Atmospheric Water Generator Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cooling Condensation, Wet Desiccation), By Application (Industrial, Commercial, Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-480-2

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Atmospheric Water Generator Market Summary

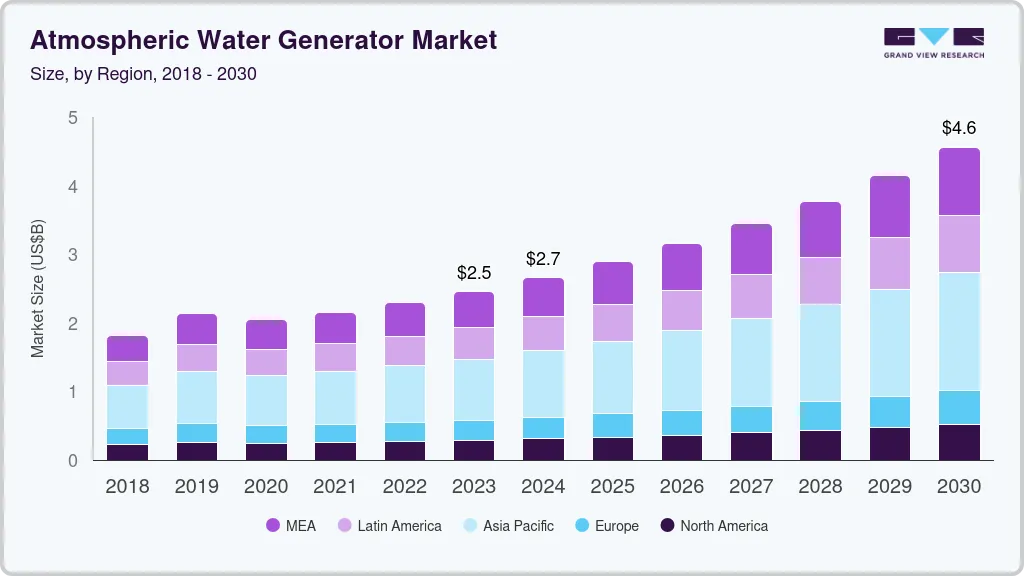

The global atmospheric water generator market size was estimated at USD 2.45 billion in 2023 and is projected to reach USD 4.55 billion by 2030, growing at a CAGR of 9.4% from 2024 to 2030. The industry growth is expected to be driven by freshwater scarcity and increasing technological investments followed by favorable government regulations.

Key Market Trends & Insights

- The atmospheric water generator market in North America is expected to register a CAGR of around 8.0% from 2024 to 2030.

- The U.S. accounted for approximately 8.4% CAGR from 2024 to 2030.

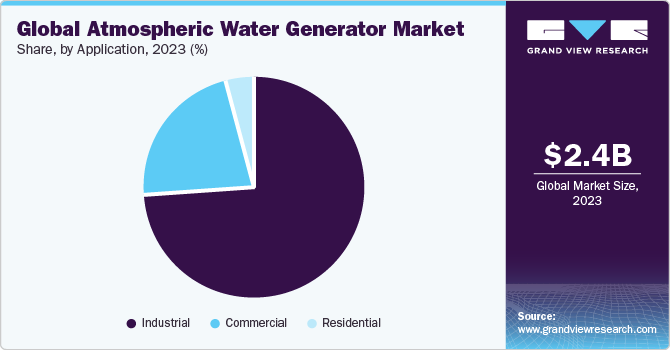

- By application, the industrial segment held the largest share and accounted for 73.9% in 2023.

- By product, the cooling condensation product segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.45 Billion

- 2030 Projected Market Size: USD 4.55 Billion

- CAGR (2024-2030): 9.4%

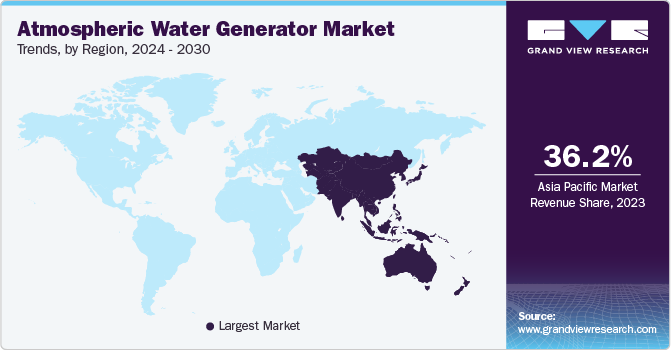

- Asia Pacific: Largest market in 2023

In addition, advances in atmospheric water generator technology have improved efficiency, scalability, and affordability, making them more accessible to various end-users. Innovations in materials, condensation methods, and energy utilization have enhanced the performance and reliability of AWG systems, thereby driving market growth.

The demand for atmospheric water generators in the U.S. is expected to grow on account of increased water requirements attributed to the rising awareness related to hygiene and the constant washing of hands. Moreover, growing investments of around USD 35 billion to strengthen its water infrastructure through its Drinking Water and Wastewater Infrastructure Act, passed in April 2021, is also expected to drive the market.

Rising water scarcity, depleting groundwater levels, global supply chain disruptions, and various government initiatives are some of the factors that are likely to boost the demand for atmospheric water generators. Moreover, policies conducive to establishing water infrastructure are anticipated to augment the demand for atmospheric water generators over the forecast period.

Stringent government policies and regulations, including the Drinking Water Directive in the EU nations, Safe Drinking Water Act in the U.S., and Drinking Water Quality Standards in Japan, are intended to ensure the availability of safe potable water. The aforementioned policies are expected to boost growth over the forecast period.

High capital and maintenance required for atmospheric water generators are the key concerns, especially for residential consumers. The market growth in residential applications is hindered by the low purchasing power of consumers, primarily across Asia Pacific and the Middle East & Africa. As a result, researchers are continuously seeking new technologies that can reduce the manufacturing cost of the equipment.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulatory standards and compliance requirements govern the design, manufacturing, and distribution of atmospheric water generator systems to ensure their safety, efficiency, and environmental sustainability. Adherence to these regulations is crucial for market entry and consumer trust, driving manufacturers to invest in research, development, and quality assurance processes. In addition, environmental regulations play a pivotal role in governing the extraction and consumption of water resources. Atmospheric water generator systems offer a sustainable alternative to traditional water sources by extracting moisture from the air, but regulatory frameworks can influence their deployment and usage. Regulations related to water rights, environmental impact assessments, and water quality standards can impact the adoption and deployment of AWG systems in various regions.

The market demonstrates a notable degree of innovation spurred by technological advancements and increasing awareness of water scarcity and environmental sustainability. Manufacturers continually strive to enhance the efficiency, reliability, and sustainability of atmospheric water generator systems through advancements in condensation techniques, air filtration, energy efficiency, and water purification technologies. Integration of smart technologies such as IoT and AI enables remote monitoring and optimization, while modular and portable designs cater to diverse applications. Moreover, innovations in water quality enhancement ensure compliance with regulatory standards, while market expansion strategies drive adoption across various sectors and regions.

The end-user concentration in the atmospheric water generator industry varies, with applications spanning residential, commercial, industrial, and humanitarian sectors. While residential consumers seek atmospheric water generator systems for self-sufficiency and water security, commercial and industrial entities utilize them for sustainable water supply solutions and disaster resilience. Additionally, humanitarian organizations deploy atmospheric water generator systems in remote or disaster-affected areas lacking access to clean water. This diverse end-user landscape underscores the versatility and adaptability of atmospheric water generator technologies to meet a wide range of water needs across different sectors and regions.

In the atmospheric water generator industry, potential substitutes include traditional water sources such as municipal water supply, well water, bottled water, and desalination systems. While atmospheric water generator systems offer sustainable and decentralized water generation solutions, these substitutes may be preferred in certain contexts due to factors such as existing infrastructure, cost considerations, and water quality requirements.

Application Insights

The industrial application segment held the largest share and accounted for 73.9% in 2023. The demand for industrial-grade atmospheric water generators is expected to increase from bottling facilities for beverages, government or military facilities for water security, food growing, and processing facilities where water demand is more than 15,000 liters a day. The demand for atmospheric water generators that need less maintenance and have a low environmental effect is increasing. Manufacturers such as SkyH2O are working on integrating technology for new water infrastructure projects to offer fresh potable water to water districts and major commercial and industrial water users, which is expected to complement industrial growth.

The commercial application segment is projected to grow at a significant CAGR over the forecast period. Commercial atmospheric water generators are used in commercial buildings, such as hotels and theatres, to ease water shortages. These units include an onboard power source, resulting in long-term power generation and lower energy costs. Furthermore, the growing number of smart city initiatives, particularly in developed countries, is likely to drive market expansion over the forecast period. Communities throughout the world have begun to concentrate on modernizing water infrastructure to provide clean and safe drinking water for everybody. Funding by global organizations such as WHO and UNICEF is likely to accelerate market growth.

Product Insights

The cooling condensation product segment held the largest revenue share in 2023. Water scarcity issues resulting in drought conditions in various countries across the globe, coupled with rising demand from industries and the commercial sector, are expected to augment the segment growth over the forecast period. Cooling condensation primarily utilizes electronic and electrical components for water generation. Growing industrial activities in countries such as Germany, the U.S., and China, coupled with the high water output offered by cooling condensation atmospheric water generators, are expected to have a positive impact on product demand over the forecast period.

The demand for wet desiccation is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. Wet desiccation technology is comparatively new and is primarily used in army base camps and large-scale industries. The dehumidifier is absent in the wet desiccation technique, due to which energy expenditure is comparatively less as compared to cooling condensation. Wet desiccation atmospheric water generators use brine solution containing salts that may result in corrosion. As governments have outlawed the use of these toxic inhibitors, the demand for wet desiccation-based atmospheric water generators is likely to grow at a slower rate. To reduce this, several inhibitors are required, which have high toxicity levels.

Regional Insights

The atmospheric water generator market in North America is expected to register a CAGR of around 8.0% from 2024 to 2030. Ideal climatic conditions concerning high relative humidity, along with the rapid reduction of freshwater reserves in North America, are expected to propel the market growth. Technological advancements related to the superior performance of AWG units in terms of high-quality water generation are anticipated to bolster market growth over the forecast period.

U.S. Atmospheric Water Generator Market Trends

The U.S. accounted for approximately 8.4% CAGR from 2024 to 2030. This can be attributed to the robust demand for AWG units from the industrial sector on account of the product's capability to generate over 75,000 liters of water per day. The country is witnessing climate change, resulting in droughts in some parts of the U.S.

Asia Pacific Atmospheric Water Generator Market Trends

Asia Pacific dominated the global market with a revenue share of 36.2% in 2023. The water scarcity and depleting freshwater resources in the region can be attributed to the growing number of atmospheric water generator installations. Rising industrialization coupled with growing infrastructure activities is anticipated to augment the regional product demand over the forecast period.

The India atmospheric water generator market is estimated to grow at a significant CAGR from 2024 to 2030. The rapid growth of the industrial sector has resulted in water scarcity across various parts of the country. Growing construction and manufacturing activities in the economy are expected to boost the demand for atmospheric water generators.

The atmospheric water generator market in China held over 41% share in the Asia Pacific market. The demand for AWG in China is primarily driven by industrial activities such as construction, farming, chemicals, textiles, and sanitation. The increasing demand for pure water for drinking, industrial processes, and commercial applications in the country is expected to positively impact the AWG market.

Europe Atmospheric Water Generator Market Trends

The atmospheric water generator market in Europe is anticipated to witness significant growth from 2024 to 2030. The rising awareness pertaining to the benefits, such as optimum water quality and cost efficiency offered by the AWG units for a diversified array of end-use applications, is expected to propel the market growth in the European region over the forecast period.

The Germany atmospheric water generator market is expected to grow significantly at a CAGR of around 7.0%. The country is engaged in investing in conducting quality research & development of the qualified workforce owing to the augmenting industrial sector. Growing industrial activities in the country, coupled with high water output offered by the cooling condensation AWGs, are expected to have a positive impact on product demand.

The atmospheric water generator market in UK held over 12.0% share in the European market. The growth of the atmospheric water generator market in the UK is picking up, with several companies such as Hogen Systems, Plants Water, Requench, and WatAir offering commercial atmospheric water generators in the country.

Central & South America Atmospheric Water Generator Market Trends

The atmospheric water generator market in Central & South America is estimated to grow rapidly in the coming years, owing to the region's depletion of freshwater resources coupled with consecutive years of drought in the Central & South America is expected to propel the demand for atmospheric water generators over the forecast period.

The Brazil atmospheric water generator market held around 25% share of the Central & South American market. The presence of industrial effluents such as heavy metals in water bodies on account of the discharge of industrial wastewater into waterways without proper disposal is expected to make the water from these sources unhealthy to drink. For instance, in Recife and Sao Paulo, the areas surrounding the rivers are considered unsafe sources of potable water. This is expected to drive the market growth over the forecast period.

Middle East & Africa Atmospheric Water Generator Market Trends

The atmospheric water generator market in the Middle East & Africa is growing as gulf countries have dry and hot air, which is unsuitable for AWGs. However, the region has high humidity levels during the evening and night, which can be used to produce a significant amount of water from AWGs. These attributes, coupled with the rising demand for industrial-grade AWGs in the army base camps, are expected to stimulate market growth over the forecast period.

The Saudi Arabia's atmospheric water generator market held around 30% share in the Middle East & African market. Saudi Arabia is compelled to launch programs like Qatrah program to curb excessive water consumption in the country. This is likely to open avenues for atmosphere water generator manufacturers over the forecast period.

Key Atmospheric Water Generator Company Insights

The market is fragmented, with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants' strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base. In addition, evolving consumer preferences, along with quality requirements as well as energy efficiency, are projected to offer new opportunities for key participants.

In May 2023, in collaboration with UAE-based atmospheric water generator manufacturer Eshara Water, Azelio AB, and Masdar City, Khalifa University of Science and Technology unveiled the world's inaugural atmospheric water generation system (AWG). This innovative system is uniquely powered by a combination of solar energy and electrical thermal energy storage, marking a significant advancement in sustainable water technology.

Key Atmospheric Water Generator Companies:

The following are the leading companies in the atmospheric water generator market. These companies collectively hold the largest market share and dictate industry trends.

- Akvo Atmospheric Water Systems Pvt. Ltd.

- Dew Point Manufacturing

- Ray Agua

- WaterMaker India Pvt. Ltd.

- PlanetsWater

- Water Technologies International, Inc.

- SkyWater Air Water Machines

- Drinkable Air

- Hendrx Water

- Energy and Water Development Corp. (EAWC)

- Atlantis Solar

- GENAQ Technologies S.L.

- Air 2 Water Solutions

- EcoloBlue, Inc.

- Watergen

Recent Developments

-

In August 2023, Spout introduced a new atmospheric water generator, engineered by Bould, capable of generating two and a half gallons of potable water daily. Moreover, the device has the capacity to consistently produce up to 2.5 gallons of water each day. Remarkably, approximately 80% of households worldwide reside in climates with sufficient humidity for the device to operate effectively.

-

In January 2023, Airiver unveiled its atmospheric water generators for the consumer market. The U.S.-based company's latest offering introduces a sustainable water supply solution for communities in search of convenient access to eco-friendly and purified water. Leveraging minimal power consumption and featuring a multi-stage filtration system capable of removing impurities that conventional filters may miss, Airiver's cutting-edge technology guarantees the production of up to 30 liters of pure, alkaline water daily.

-

In May 2022, Watergen, in collaboration with SMV Jaipuria Group, an Indian conglomerate, has inked an agreement to introduce its atmospheric water generator technology to India. This Israeli company has introduced its 'GENius' atmospheric water generator technology to address the pressing issue of inadequate access to clean water in India, particularly affecting three-quarters of rural families. Under the terms of the joint venture, SMV Jaipuria Group will oversee the manufacturing of the GENius machines designed to extract potable water from the atmosphere.

Atmospheric Water Generator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.65 billion

Revenue forecast in 2030

USD 4.55 billion

Growth rate

CAGR of 9.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Finland; UK; Turkey;China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia

Key companies profiled

Akvo Atmospheric Water Systems Pvt. Ltd.; Dew Point Manufacturing; Ray Agua; PlanetsWater; Water Technologies International, Inc.; SkyWater Air Water Machines; Hendrx Water; Atlantis Solar; EcoloBlue, Inc.; Air 2 Water Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

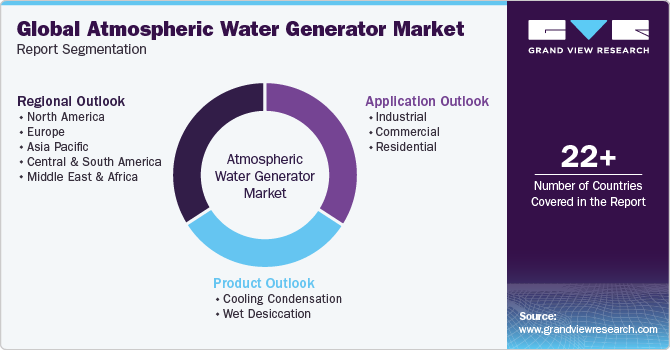

Global Atmospheric Water Generator Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the atmospheric water generator market report based on product, application, and region:

-

Product Outlook Outlook (Revenue, USD Million, 2018 - 2030)

-

Cooling Condensation

-

Wet Desiccation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Finland

-

UK

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global atmospheric water generator market size was estimated at USD 2.45 billion in 2023 and is expected to reach USD 2.65 billion in 2024.

b. The global atmospheric water generator market, in terms of revenue, is expected to grow at a compound annual growth rate of 9.4% from 2024 to 2030 to reach USD 4.55 billion by 2030.

b. Asia Pacific dominated the global atmospheric water generator market and accounted for a 36.2% share, in terms of revenue, in 2023. The growing number of atmospheric water generator installations in the region can be attributed to water scarcity and depleting freshwater resources. Furthermore, rising industrialization coupled with growing infrastructure activities in the region is anticipated to augment the product demand over the forecast period.

b. The key factors that are driving the atmospheric water generator market include diminishing freshwater levels, depleted water sources, as well as increased infrastructure development.

b. Some of the key players operating in the atmospheric water generator market include Akvo Atmospheric Water Systems Pvt. Ltd., Dew Point Manufacturing, Ray Agua, PlanetsWater, Water Technologies International, Inc., SkyWater Air Water Machines, Hendrx Water, Atlantis Solar, EcoloBlue, Inc., Air 2 Water Solutions among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.