- Home

- »

- Next Generation Technologies

- »

-

Legal Services Market Size, Share & Growth Report, 2030GVR Report cover

![Legal Services Market Size, Share & Trends Report]()

Legal Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Taxation, Real Estate), By Firm Size (Large, Medium, Small), By Provider, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-818-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Legal Services Market Summary

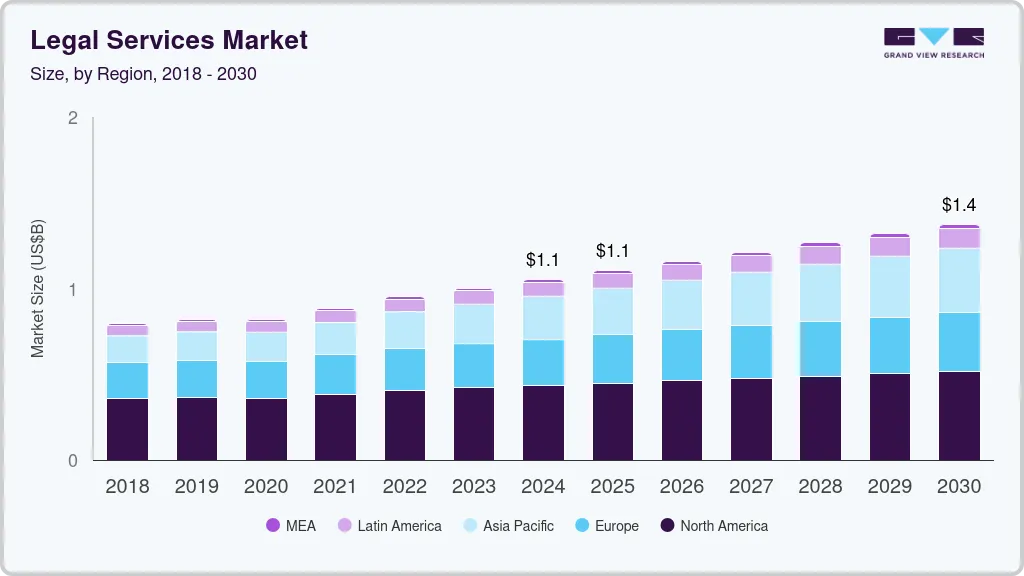

The global legal services market size was estimated at USD 1,052.90 billion in 2024 and is projected to reach USD 1,375.64 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The rising demand for data privacy and cybersecurity expertise is shaping the market as companies face increasing regulatory scrutiny and cyber threats.

Key Market Trends & Insights

- North America legal services market dominated globally with a revenue share of over 41% in 2024.

- The legal services market in the U.S. is expected to grow at a CAGR of 2.5% from 2025 to 2030.

- By service, the corporate segment led the market in 2024, accounting for over 31% of the global revenue.

- By provider, the legal business firms segment accounted for the largest market revenue share in 2024.

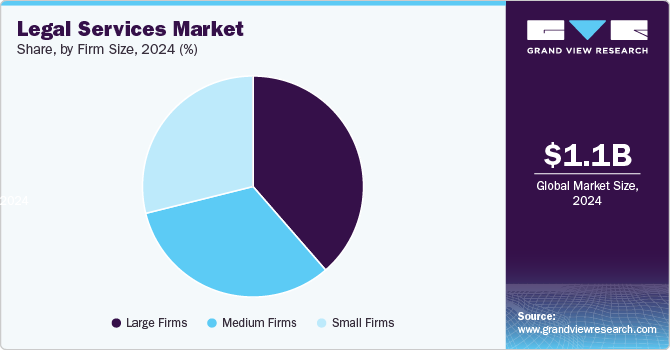

- By firm size, the large firms segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,052.90 Billion

- 2030 Projected Market Size: USD 1,375.64 Billion

- CAGR (2025-2030): 4.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Law firms are expanding their offerings in data protection, compliance, and risk management, with some establishing dedicated cybersecurity practice groups to help clients navigate these evolving challenges. This shift reflects the critical role of legal advisors in supporting businesses with robust data governance strategies, especially in sectors handling sensitive information, such as healthcare, finance, and technology.

The growing demand for Environmental, Social, and Governance (ESG) compliance services is also a notable trend, as companies worldwide prioritize sustainable practices to meet regulatory standards and investor expectations. Law firms are developing specialized ESG services to help clients navigate complex regulations related to climate change, human rights, and corporate governance. This trend is particularly strong in Europe but is increasingly gaining traction in the U.S. and Asia-Pacific as global firms seek to align with responsible business practices.

The market's growth has not only impacted law firms but has also significantly transformed corporate legal departments. Litigation management is another area where AI has been instrumental in transforming corporate legal departments. Government departments require legal services for a wide range of matters, including regulatory compliance, legislative drafting, and litigation. In addition, the increasing use of technology in the delivery of legal services has led to the adoption of AI-powered tools in government departments, contributing to the growth of the legal service market in this segment. Government departments are also increasingly outsourcing legal services to specialized law firms to gain access to the necessary expertise and resources. This has led to increased demand for legal services from government departments, particularly in areas such as environmental law, healthcare law, and intellectual property law. Overall, the provider segment of the market is expected to continue growing, with government departments playing an important role in driving demand for specialized legal services.

As businesses face increasing legal challenges, there is a growing demand for litigation services to help resolve disputes and protect their interests. This trend is driven by a variety of factors, including the complexity of modern legal disputes, the need for specialized expertise in various areas of law, and the rising costs of litigation. As a result, litigation is becoming an increasingly important area of practice for legal professionals, with many firms investing in this area to meet the growing demand. This growth is expected to continue in the coming years as businesses and individuals seek out legal services to help them navigate the complex and ever-changing legal landscape. In July 2023, Womble Bond Dickinson announced a partnership with a boutique litigation firm, Simmonds & Narita L.P. This partnership aimed to enhance the dispute resolution and litigation practice rate of Womble Bond Dickinson.

These firms are expanding services and increasing their headcount to compete with larger firms while still offering personalized attention to their clients. This trend can be attributed to several factors, including the need for specialized expertise, the increasing complexity of legal matters, and the demand for cost-effective legal services. Medium-sized firms can offer a more focused range of services and can build close relationships with their clients, providing them with tailored legal advice and solutions. In addition, medium-sized firms are more flexible in their operations, allowing them to adapt quickly to changes in the legal market. This has resulted in a growing number of clients choosing to work with medium-sized firms rather than larger ones. Overall, the growth of medium-sized law firms is expected to continue as they carve out their space in the market.

Service Insights

The corporate segment led the market in 2024, accounting for over 31% of the global revenue. This can be attributed to the increasing complexity of business regulations and the need for companies to navigate them effectively. As a result, law firms are expanding their services to cater to the needs of corporate clients, including contract drafting and negotiating, mergers and acquisitions, intellectual property protection, and employment law matters. In addition, technology is playing an increasingly important role in the delivery of legal services, with the adoption of AI-powered tools to streamline workflows and improve efficiency. All in all, the corporate legal services sector is poised for continued growth in the coming years. In October 2023, Wolters Kluwer Legal & Regulatory launched a new Legal Services Portal for Legisway Enterprise and Legisway Essential for their corporate legal department. The new portal helps businesses to streamline their legal intake process by capturing requests and then triaging and delegating those tasks to relevant members of the legal department.

The taxation segment is predicted to foresee significant growth in the coming years. This growth can be attributed to various factors, such as the complexity of tax laws and regulations, the need for specialized knowledge in tax planning, and the increasing number of businesses and individuals seeking assistance with tax-related matters. As a result, many law firms have expanded their services to include taxation, providing clients with a comprehensive approach to their legal and financial needs. This trend is expected to continue as the importance of tax planning and compliance continues to rise in today's ever-changing economic landscape. In October 2023, PwC partnered with artificial intelligence platforms OpenAI and Harvey. This partnership aims to train and deploy foundation models of tax, legal, and human resources services.

Provider Insights

The legal business firms segment accounted for the largest market revenue share in 2024.These firms are formed by a few lawyers to get involved in the law practice, and they are primarily involved in advising clients about their legal responsibilities & rights and representing the clients in criminal or civil cases, business transactions, and other matters requiring legal advice. The increasing investments by these firms in client education, pipeline management, local community activities, and public relations are expected to drive segmental growth over the forecast period. The strategic investments made by legal service firms are attributed to this high share. Legal business firms invest in business development tactics, such as client education, pipeline management, local community activities, and public relations. This segment is also projected to show significant growth during the estimated period. Due to the stagnant growth of the market over the years, some firms have started to either lower their expenses or raise their rates since they find it challenging to maintain profitability.

The private practicing attorneys segment is anticipated to exhibit the fastest CAGR over the forecast period. This can be credited to increasing preference for private attorneys as they give undivided attention to a particular client’s case. Moreover, they have access to resources such as mental health assessments, DNA and other testing, expert witnesses, forensics specialists, private investigators, etc., required to mount a viable defense. This can be attributed to the increasing demand for specialized legal services from individuals and small businesses. Private practicing attorneys offer a wide range of legal services, including family law, real estate law, personal injury law, and criminal defense. They provide legal advice and representation to clients who may not have the resources to establish their in-house legal departments.

In addition, private practicing attorneys are increasingly leveraging technology solutions such as AI-powered tools to improve the efficiency and accuracy of their services. This has led to increased demand for their services, particularly from individuals who may not have traditionally sought out legal services. Overall, the provider segment of the market is expected to continue growing, with private practicing attorneys playing an important role in meeting the legal needs of individuals and small businesses.

Firm Size Insights

The large firms segment held the largest market revenue share in 2024. Large firms’ diversified range of services is attributed to this large share. For instance, large firms deliver most judicial work, such as large-scale litigations, significant business transactions, and criminal defense matters for businesses across various industries. The increased demand from large organizations for corporate and judicial services is expected to drive the growth of the large firm segment during the estimated period. Large firms are expanding their services and hiring more lawyers to cater to the needs of their clients. This trend can be attributed to several factors, including the complexity of legal matters, the globalization of business, and the need for specialized expertise. In addition, larger firms can offer a broader range of services, including litigation, corporate law, intellectual property, and regulatory compliance. This has resulted in a consolidation of the legal market, with larger firms acquiring smaller ones to increase their market share. However, this trend has also led to concerns about the cost of legal services, as larger firms often charge higher fees. Overall, the growth in the size of law firms is expected to continue as the demand for specialized legal services continues to increase.

The small firms segment is predicted to foresee the fastest growth in the coming years. These law firms provide personalized services and a one-on-one working relationship as they handle a limited number of cases. Moreover, they are more affordable as they charge less due to their lesser cost of operations compared to large firms. These legal service firms are growing geographically while expanding their global customer base by providing high-end specialized services that involve complex transactions, which is expected to drive segmental growth over the coming years.

Regional Insights

North America legal services market dominated globally with a revenue share of over 41% in 2024. In North America, the market is expanding due to the increasing need for comprehensive compliance, cross-border advisory, and risk management services. Companies are navigating complex legal frameworks across Canada, Mexico, and other jurisdictions, fueling demand for regional expertise in areas like trade law and environmental regulations. North American firms are also prioritizing innovation, adopting new technology solutions to deliver more efficient, tailored legal services across various industries.

U.S. Legal Services Market Trends

The legal services market in the U.S. is expected to grow at a CAGR of 2.5% from 2025 to 2030. In the U.S., the legal services landscape is shaped by a rising demand for specialized expertise in compliance, data privacy, and mergers and acquisitions (M&A). American law firms are leading the shift toward digital transformation, integrating AI, data analytics, and legal tech solutions to improve operational efficiency and client service. This tech-driven approach allows U.S. firms to respond to increasingly complex client needs, maintaining a competitive edge in a highly dynamic legal environment.

Europe Legal Services Market Trends

The legal services market in Europe is expected to witness significant growth over the forecast period. In Europe, legal services are heavily influenced by rising cross-border transactions, regulatory changes, and a focus on Environmental, Social, and Governance (ESG) compliance. Law firms are expanding their offerings in these areas, helping clients navigate new standards and legal frameworks across jurisdictions. With a growing emphasis on ESG, European firms are uniquely positioned to support clients in adapting to these regulatory demands while fostering sustainable practices.

Asia Pacific Legal Services Market Trends

The Asia Pacific legal services market is anticipated to register the fastest CAGR over the forecast period. The Asia-Pacific region is experiencing heightened demand in areas such as corporate law, intellectual property (IP), and dispute resolution, driven by rapid economic growth and complex trade regulations. Legal service providers are scaling up their capabilities to support both domestic and international clients facing these evolving challenges. In response, many firms are pursuing cross-border collaborations and investing in specialized talent to better serve diverse regional markets.

Key Legal Services Company Insights

Leading firms in the legal services industry, including Baker McKenzie LLP, Clifford Chance, Deloitte, DLA Piper LLP, and Ernst & Young Global Limited, are advancing their competitive positioning and expanding their client reach. To achieve these goals, they are actively engaged in strategic activities such as partnerships, mergers and acquisitions, collaborations, and the launch of new services and technologies. This forward-thinking approach strengthens their market presence and enables them to innovate in response to shifting security demands, ensuring they stay at the forefront of the industry.

-

Baker McKenzie LLP specializes in delivering comprehensive global legal solutions, with a strong focus on cross-border transactions, intellectual property, and compliance matters. Known for its extensive network, Baker McKenzie collaborates closely with clients to navigate complex international regulations and to support large-scale mergers, acquisitions, and litigation cases. Clifford Chance, on the other hand, is recognized for its expertise in banking and finance, corporate law, and dispute resolution, particularly in the European and Asian markets. By leveraging its high-profile legal insights and innovative practices, Clifford Chance serves leading financial institutions, facilitating regulatory compliance and risk management in dynamic, regulated industries.

-

Deloitte, through its Deloitte Legal division, provides end-to-end legal advisory services tailored to corporate restructuring, tax, and labor law, helping businesses manage legal risk in a digitally transforming world. Emphasizing technology-enabled solutions, Deloitte also delivers integrated legal management that combines traditional advisory services with automation to streamline compliance. DLA Piper LLP is well-regarded for its capabilities in real estate law, intellectual property, and international arbitration, serving clients across numerous sectors with a presence in over 40 countries. Known for its strategic collaborations, DLA Piper assists companies in managing cross-jurisdictional transactions and regulatory challenges, positioning itself as a leader in global legal services.

Key Legal Services Companies:

The following are the leading companies in the legal services market. These companies collectively hold the largest market share and dictate industry trends.

- Baker McKenzie LLP

- Clifford Chance

- Deloitte

- DLA Piper LLP

- Ernst & Young Global Limited (EY)

- Kirkland & Ellis LLP

- KPMG

- Latham & Watkins LLP

- PwC

- Skadden, Arps, Slate, Meagher & Flom LLP

Recent Developments

-

In July 2024, Baker McKenzie LLP announced the acquisition of a majority stake in its long-time associated firm, Legal Advisors, Abdulaziz Alajlan & Partners, to be rebranded as Baker McKenzie Law Firm.

-

In September 2024, Deloitte unveiled AI Factory-as-a-Service, a comprehensive, scalable suite of Generative AI (GenAI) capabilities. The new offering, built on the NVIDIA AI platform, featured NVIDIA AI Enterprise software, NVIDIA NIM Agent Blueprints, and accelerated computing and integrated Oracle’s enterprise AI technology.

-

In October 2023, Deloitte launched DARTbot, a cutting-edge Gen AI-powered internal chatbot, to generate intelligent responses and provide significant insights to approximately 18,000 Deloitte Audit & Assurance professionals in the U.S. in their everyday tasks and decision-making processes.

Legal Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,105.04 billion

Revenue forecast in 2030

USD 1,375.64 billion

Growth Rate

CAGR of 4.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

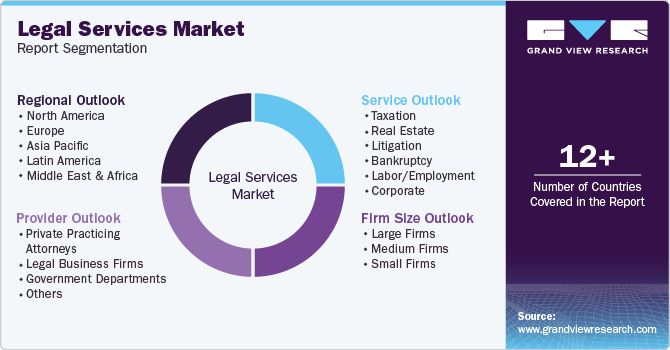

Segments covered

Service, firm size, provider, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Baker McKenzie LLP; Clifford Chance; Deloitte; DLA Piper LLP; Ernst & Young Global Limited; Kirkland & Ellis LLP; KPMG; Latham & Watkins; PwC; Skadden; Arps; Slate; Meagher & Flom LLP.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Legal Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal services market report based on service, firm size, provider, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Taxation

-

Real Estate

-

Litigation

-

Bankruptcy

-

Labor/Employment

-

Corporate

-

-

Firm Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Firms

-

Medium Firms

-

Small Firms

-

-

Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Practicing Attorneys

-

Legal Business Firms

-

Government Departments

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global legal services market size was estimated at USD 1,052.90 billion in 2024 and is expected to reach USD 1,105.04 billion in 2024.

b. The global legal services market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 1,375.64 billion by 2030.

b. The legal business firms segment dominated the global legal services market with a share of 46.9% in 2024. This is attributed to the increasing investments by legal business firms in client education, pipeline management, local community activities, and public relations.

b. Some of the key players in the global legal services market include Baker & McKenzie; Clifford Chance LLP; E&Y; Deloitte; Kirkland & Ellis LLP; LATHAM & WATKINS LLP; PwC; and KPMG.

b. Key factors that are driving the legal services market growth include technological disruptions in the legal industry and a rise in the number of alternative legal service providers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.