- Home

- »

- Pharmaceuticals

- »

-

GLP-1 Receptor Agonist Market Size, Industry Report, 2033GVR Report cover

![GLP-1 Receptor Agonist Market Size, Share & Trends Report]()

GLP-1 Receptor Agonist Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Trulicity, Wegovy, Ozempic, Mounjaro), By Application (Diabetes, Obesity), By Route Of Administration, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-694-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

GLP-1 Receptor Agonist Market Summary

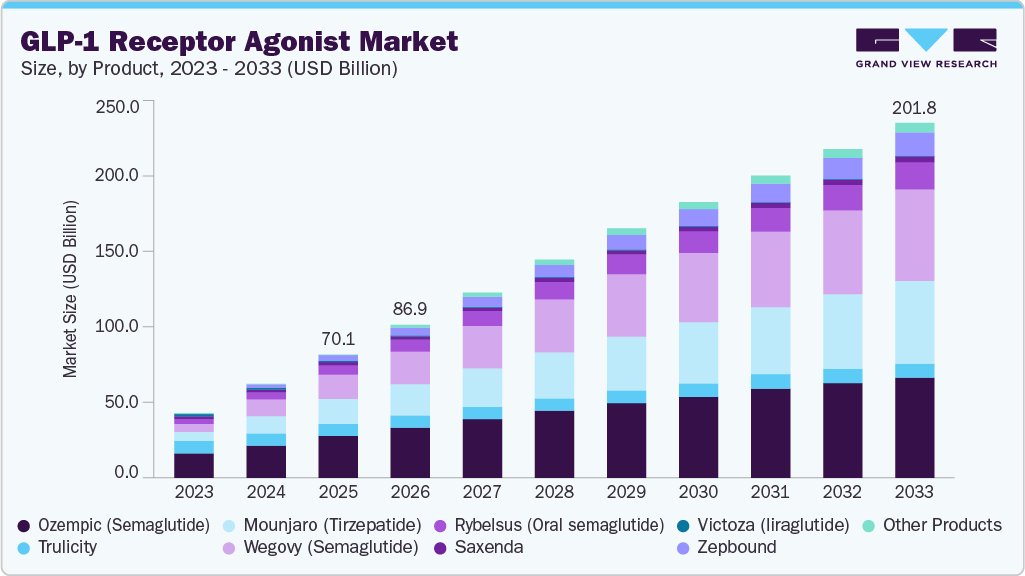

The global GLP-1 receptor agonist market size was estimated at USD 70.08 billion in 2025 and is projected to reach USD 201.79 billion by 2033, growing at a CAGR of 12.78% from 2026 to 2033. The launch of new glucagon-like peptide 1 (GLP-1) receptor agonist products, a robust product pipeline for both diabetes & obesity applications, and the high efficacy of these drugs are anticipated to propel market growth.

Key Market Trends & Insights

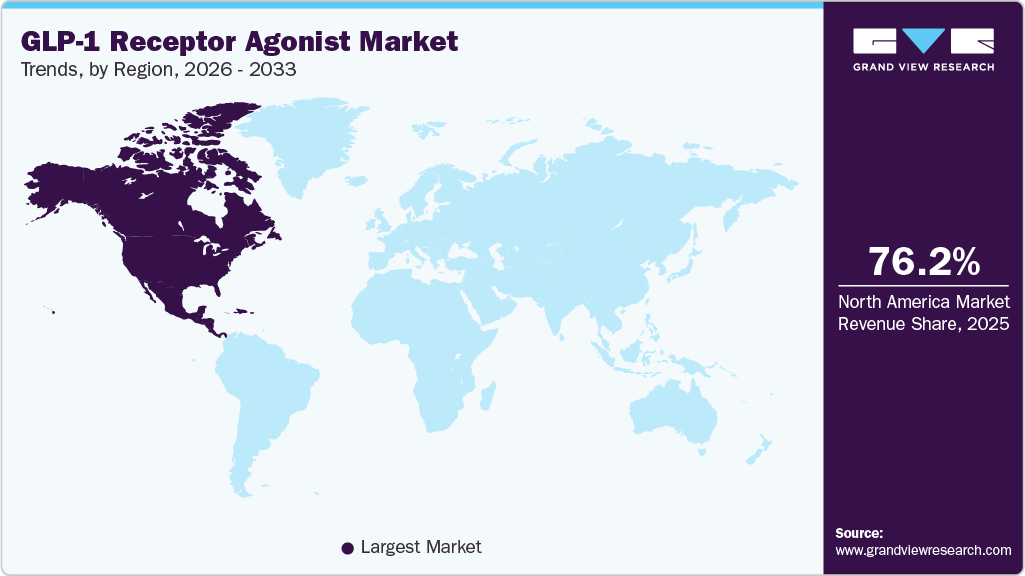

- The North America GLP-1 receptor agonist market held the largest revenue share of 76.19% in 2025.

- The GLP-1 receptor agonist industry in the U.S. is expected to grow significantly from 2026 to 2033.

- By product, the Ozempic (semaglutide) segment held the highest market share of 37.77% in 2025.

- By application, the type 2 diabetes mellitus segment held the highest market share in 2025.

- By route of administration, the parenteral segment held the highest market share in 2025.

- By distribution channel, the retail pharmacies segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 70.08 Billion

- 2033 Projected Market Size: USD 201.79 Billion

- CAGR (2026-2033): 12.78%

- North America: Largest market in 2024

In May 2024, Innovent Biologics announced that its type 2 diabetes candidate, mazdutide, outperformed Eli Lilly’s Trulicity (dulaglutide) in a Phase III trial. The study established that mazdutide was superior in glycemic control and provided numerous cardiometabolic benefits, comprising weight loss & improvements in blood lipid levels, liver enzymes, serum uric acid, & blood pressure.Other companies, such as Boehringer Ingelheim International GmbH, Carmot Therapeutics, Inc., D&D Pharmatech, Eli Lilly and Company (Lilly), and Hanmi Pharm. Co., Ltd, are also involved in developing new glucagon-like peptide 1 drugs. For instance, in October 2023, Carmot Therapeutics, Inc. published preliminary results from the single ascending dose (SAD) phase of an ongoing Phase 1 clinical trial for CT-996, an oral small molecule GLP-1 receptor agonist (RA) that is presently being assessed in a first-in-human clinical trial in individuals who are overweight or obese. Thus, increasing research in the field of GLP-1 receptor agonists is expected to drive market growth.

Moreover, the rising prevalence of obesity and diabetes is expected to drive the growth of the GLP-1 receptor agonist industry. The overweight and obese population is at a high risk of developing diabetes and cardiovascular illness. Worldwide obesity rates are rising, and it is widely acknowledged that this is one of the major public health issues of the present day. According to the World Heart Federation's global estimate, almost 2.3 billion children and adults worldwide suffer from obesity and overweight. Additionally, according to the Obesity Action Coalition (OAC), over 90% of individuals diagnosed with type 2 diabetes are either overweight or have some degree of obesity. Therefore, the rising obese and diabetes populations are driving the demand for GLP-1 receptor agonist drugs for treatment worldwide.

The high advantages associated with the use of GLP-1 drugs over other medicines, along with increasing investment in the R&D of new GLP-1 drugs, are driving market growth. Several GLP agonists have been linked to weight loss or weight neutrality, which is advantageous for people with diabetes since obesity frequently makes the disease worse. The lowering of appetite and the delayed stomach emptying contribute to the weight loss effect. Moreover, in November 2023, Novo Nordisk announced its intention to invest approximately 16 billion Danish kroner in developing GLP-1 drugs. This is roughly equivalent to USD 2.32 billion (€2.14 billion). These initiatives are anticipated to drive the market's growth.

Market Concentration & Characteristics

The degree of innovation in the market includes technological advancement in the field of medical research and development. For example, GLP-1 receptor agonists have recently been combined with other unique bioactive peptides. For instance, the sequences of GLP-1 and glucose-dependent insulinotropic polypeptide (GIP) are combined in tirzepatide, a single molecule, to form a so-called co-agonist that is effective in treating patients with diabetes.

To improve their position in the market, a number of firms participate in mergers and acquisitions. By using this tactic, businesses can enhance their proficiency, diversify their offerings, and boost their capacities. For instance, in December 2023, Roche acquired Carmot Therapeutics (CRMO.O) for USD 2.7 billion in upfront payments, adding the company to the roster of competitors vying to take on Novo Nordisk and Eli Lilly and Company, the industry leaders in weight-loss medication manufacturing.

Regulatory bodies are becoming more aware of the importance of real-world evidence (RWE) in completing the picture of clinical trial data to support post-marketing surveillance and regulatory decisions. Information about the long-term efficacy, safety, and usage patterns of GLP-1 receptor agonists in actual clinical practice can be gained via observational studies, electronic health records, and patient registries.

There are currently seven GLP-1 receptor agonists on the market: semaglutide, liraglutide, exenatide, lixisenatide, dulaglutide, and oral semaglutide. Healthcare practitioners also recommend alternative antidiabetic drugs such as metformin, DPP-4 inhibitors, sulfonylureas, SGLT-2 inhibitors, or insulin to patients where GLP-1 receptor agonists are deemed unsuitable or poorly tolerated.

Expanding regional markets makes it easier for both developed and developing nations to access effective medications. These strategies include collaborating with local healthcare providers, promoting early diagnosis and treatment of diabetes, and offering reimbursement options tailored to the needs of different healthcare systems.

Product Insights

The Ozempic segment dominated the GLP-1 receptor agonist market, accounting for a 37.77% share in 2025. Ozempic is a brand-name U.S. FDA-approved prescription drug used to treat adults with type 2 diabetes. The increasing population of type 2 diabetes and the high safety and efficacy of the drug compared to other available GLP-1 receptor agonist drugs are positively impacting the adoption of the drug. In March 2024, Novo Nordisk A/S’s drug Ozempic demonstrated a delay in the development of chronic kidney disease (CKD) and reduced the risk of death and cardiac events by 24% in patients with diabetes. This clinical trial result encourages physicians to prescribe Ozempic to children and adolescents with type 2 diabetes as a course of treatment, thereby boosting drug adoption worldwide.

Zepbound is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to the worldwide approval of the drug and high demand resulting from its high efficacy and tolerability. In August 2024, Eli Lilly and Company achieved a significant supply milestone by launching single-dose vials of Zepbound, one of its widely popular weight-loss medications. These new vials are expected to be priced at least 50% lower than the existing versions of Mounjaro and Zepbound.

Application Insights

The type 2 diabetes mellitus segment dominated the GLP-1 receptor agonist industry, with an 80.28% share in 2025, and is expected to grow at a significant CAGR over the forecast period. This can be attributed to the increased prevalence of type 2 diabetes mellitus and the wide availability of GLP-1 receptor agonists for its treatment. According to the World Health Organization (WHO), type 2 diabetes accounts for more than 95% of all the diabetes cases worldwide. Type 2 diabetes is referred to as adult-onset or non-insulin-dependent disease and is exclusively found in adults. Still, it is becoming increasingly common in children due to changes in eating habits. Currently, several GLP-1 receptor agonist drugs, including Dulaglutide (Trulicity), Exenatide (Byetta), Exenatide extended-release (Bydureon), and Liraglutide (Victoza), are used to treat patients with type 2 diabetes mellitus. Thus, the rising incidence of type 2 diabetes is anticipated to boost demand for GLP-1 drugs used for its treatment.

The obesity segment is anticipated to grow significantly during the forecast period. This growth can be attributed to the rising obese population and the approval of a new GLP-1 receptor agonist drug for its treatment worldwide. According to a research study released in 2024 by the NCD Risk Factor Collaboration (NCD-RisC), globally over 880 million adults and 159 million children and adolescents between the ages of 5 and 19 years are affected by obesity. Currently, high-dose liraglutide and semaglutide are given to obese patients as per the U.S. FDA-mentioned dosage form due to the weight-loss effects of these GLP-1 agonists. Thus, approval and launch of new GLP-1 drugs for the treatment of obesity is expected to drive market growth.

Route Of Administration Insights

The parenteral segment led the GLP-1 receptor agonist industry, accounting for the largest share of 92.58% in 2025, and is expected to grow at the fastest CAGR from 2026 to 2033. This dominance can be attributed to the wide availability of GLP-1 agonists for treating patients with diabetes and their high advantages over other drug administrations, such as high efficacy. Some of the parenteral GLP-1 receptor drugs approved for treatment include Dulaglutide (Trulicity), Exenatide extended release (Bydureon base), Exenatide (Byetta), Semaglutide (Ozempic), Liraglutide (Victoza, Saxenda), Lixisenatide (Adlyxin), and Semaglutide (Rybelsus). The worldwide approval of new parenteral drugs is expected to drive market growth.

The oral route of administration segment is anticipated to grow rapidly over the forecast period. Oral GLP-1 receptor agonist plays a significant role in treating patients with type 2 diabetes. Currently, Semaglutide (Rybelsus) is approved by the U.S. FDA to treat patients with diabetes. In May 2023, as part of the global OASIS initiative, Novo Nordisk released the major findings from OASIS 1, a Phase 3a trial. 667 individuals with obesity or overweight participated in the 68-week OASIS 1 effectiveness and safety trial, which compared once-daily oral semaglutide 50 mg for weight control with a placebo. At week sixty-eight, an oral semaglutide 50 mg was shown to provide a statistically significant and superior weight loss when compared to placebo. The positive results from such studies are anticipated to drive market growth.

Distribution Channel Insights

Retail pharmacies dominated the GLP-1 receptor agonist market, accounting for a 54.72% share in 2025, as they serve as the primary point of access for patients seeking chronic metabolic therapies. The wide geographic presence of retail chains supports the consistent availability of GLP-1 products, which helps meet the rising demand among patients with diabetes and obesity. Strong pharmacist support improves patient adherence, especially for injectable formulations that require guidance. Retail outlets also benefit from established reimbursement processes that streamline prescription fulfillment. Increased consumer footfall boosts prescription conversion rates, which strengthens their market share. Growing awareness programs and patient counseling services in retail settings further reinforce their lead in the distribution landscape.

The online pharmacies segment is anticipated to grow rapidly over the forecast period. The primary growth driver of the segment is the expansion of internet connectivity. Furthermore, patients seeking a hassle-free way to purchase medications and healthcare items are drawn to online platforms due to their ease of use, accessibility, and increasing digitization, influencing segment growth. Another factor propelling the growth of online pharmacies is the ease of getting prescriptions and over-the-counter treatments from home, with doorstep delivery available. Thus, the growing number of diabetes cases is anticipated to drive market growth during the forecast period.

Regional Insights

The North America GLP-1 receptor agonist market accounted for a 76.19% share in 2025. Established brands, including liraglutide (Victoza), dulaglutide (Trulicity), exenatide (Byetta/Bydureon), and semaglutide (Ozempic), dominate North America. These drugs have gained significant traction among patients and healthcare professionals due to their proven ability to reduce cardiovascular risk, enhance glycemic management, and promote weight loss.

U.S. GLP-1 Receptor Agonist Market Trends

The U.S. GLP-1 receptor agonist industry accounted for the largest revenue share of North America in 2025. Type 2 diabetes accounts for the majority of diabetes cases in the U.S., which has one of the highest prevalence rates of the disease worldwide. It is becoming increasingly severe due to the increased prevalence of obesity and sedentary lifestyles, which is increasing the need for efficient treatments like GLP-1 receptor agonists. Furthermore, the high adoption of the medication is further driving market growth. For instance, according to a poll published by the American Medical Association in 2024, around 16% of U.S. adults, 1 in 8 individuals, have used GLP-1 drugs, with the major drug used being semaglutide, marketed as Ozempic or Wegovy.

Europe GLP-1 Receptor Agonist Market Trends

The Europe GLP-1 receptor agonist industry was a lucrative region in 2025. The region has a sizable population base, including an elderly population that is particularly vulnerable to diabetes and obesity. Due to this demographic trend, the demand for GLP-1 Receptor Antagonists has surged in Europe.

The GLP-1 receptor agonist market in the UK is projected to expand in the future. Pharmaceutical companies continually devise innovative ways to formulate GLP-1 receptor agonists, aiming to increase patient compliance and convenience. For instance, semaglutide has been developed and commercialized under brand names like Wegovy to treat patients with obesity. This drug approval is expected to drive market growth.

The France GLP-1 receptor agonist market is affected by patient preferences and adherence to treatment plans. Patients' decisions and adherence to treatment may be influenced by variables such as side effect profiles, frequency of doses, and mode of administration (e.g., injectable vs. oral). Thus, the development and commercialization of new, safe, and effective GLP-1 drugs are expected to boost market growth.

The GLP-1 receptor agonist market in Germany is expected to grow over the forecast period due to the large availability of GLP-1 drugs for the treatment of diabetes and obesity. The German market offers several GLP-1 receptor agonists, including Ozempic, Victoza, Trulicity, and Byetta/Bydureon. Numerous factors, including price, dose frequency, safety profile, and efficacy, influence a medication's competitive market share in Germany.

Asia Pacific GLP-1 Receptor Agonist Market Trends

The Asia Pacific GLP-1 receptor agonists industry is anticipated to witness growth over the forecast period. The region's growing healthcare sector, sizable target population, and high unmet clinical needs are some factors projected to provide significant growth potential. For instance, key companies such as Novartis AG and Eli Lilly and Company, operating in the region, continuously focus on developing innovative GLP-1 Receptor Agonist solutions for the treatment of diabetes and obesity.

The GLP-1 receptor agonists market in China is anticipated to rise dramatically due to factors including the country's growing urbanization, changing lifestyles, rising type 2 diabetes prevalence, and the expansion of its healthcare system. Furthermore, key players operating in the market constantly focus on developing novel therapeutics. For instance, in April 2024, Aurisco Pharmaceutical launched a state-of-the-art peptide manufacturing facility in Yangzhou, China, which was set to commence operations in mid-2024.

The Japan GLP-1 receptor agonist market is expected to grow over the forecast period. Japan's rising aging population and changing lifestyle are driving the prevalence of type 2 diabetes and fueling demand for GLP-1 receptor agonist drugs in the country.

Latin America's GLP-1 Receptor Agonist Market Trends

Latin America's GLP-1 receptor agonist industry is projected to experience rapid growth over the forecast period. The region has a rapidly growing population and increasing urbanization rates. Urbanization often leads to lifestyle changes such as dietary habits, tobacco use, and stress, which can contribute to the prevalence of diabetes.

The GLP-1 receptor agonist market in Brazil is expected to grow over the forecast period. This growth can be attributed to the rising awareness of the importance of diabetes diagnosis and treatment among the Brazilian population. As a result, individuals are becoming more proactive in seeking preventive care and treatment for diabetes diseases, driving the demand for GLP-1 Receptor Agonists in the country.

Middle East & Africa GLP-1 Receptor Agonist Market Trends

The growth of the Middle East & Africa GLP-1 receptor agonist industry is driven by the high prevalence of diseases due to numerous factors, such as poor health hygiene practices, growing use of GLP drugs, and inadequate access to diabetic care.

The GLP-1 receptor agonist market in Saudi Arabia is expected to witness growth, driven by initiatives undertaken to raise awareness of diabetes and obesity among the general population through educational efforts and public health campaigns. As a result, the government is focusing on offering safe and low-cost treatment for diabetes and the obese population. This is expected to drive demand for GLP-1 receptor agonists in the country.

Key GLP-1 Receptor Agonist Company Insights

Some leading players operating in the GLP-1 receptor agonist market include AstraZeneca, Sanofi, Novo Nordisk A/S, and Eli Lilly and Company. Key players utilize their existing customer bases in the region to prioritize maintaining high-quality standards and gain access to a large market share. This strategy is particularly useful for brands that have already established a strong market position. These players are heavily investing in infrastructure, allowing them to process & analyze a large volume of samples efficiently. Moreover, companies undertake various strategic initiatives with other companies and distributors to strengthen their presence.

Hanmi Pharm. Co., Ltd, Eccogen, and D&D Pharmatech are some of the emerging market players. These companies focus on securing funding support from government bodies and healthcare organizations, leveraging novel launches to capitalize on previously untapped avenues.

Key GLP-1 Receptor Agonist Companies:

The following are the leading companies in the GLP-1 receptor agonist market. These companies collectively hold the largest market share and dictate industry trends.

- Eli Lilly and Company

- Sanofi

- Novo Nordisk A/S

- AstraZeneca

Recent Developments

-

In August 2024, Eli Lilly and Company announced that Tirzepatide (Zepbound and Mounjaro) reduced the risk of developing type 2 diabetes by 94% in adults with prediabetes and obesity or overweight, according to the SURMOUNT-1 study. The 176-week trial demonstrated an average weight loss of 22.9% with the 15 mg dose. In addition, Tirzepatide demonstrated consistent safety and tolerability.

-

In July 2024, Amylyx Pharmaceuticals acquired Avexitide, a GLP-1 receptor agonist, from Eiger Biopharmaceuticals, Inc., with FDA breakthrough therapy designation for treating Postbariatric Hypoglycemia (PBH) and congenital hyperinsulinism. Avexitide showed significant efficacy in reducing severe hypoglycemic events in Phase 2 trials and is set to enter Phase 3 trials for PBH in early 2025.

-

In February 2024, Eli Lilly and Company anticipated launching Mounjaro, its highly successful diabetic medication and obesity treatment, in India as early as next year if it passes an ongoing regulatory evaluation. This product is expected to positively impact the growth of the Indian market.

-

In January 2024, Novo Nordisk A/S announced research alliances with two U.S. biotech firms. As part of its efforts to keep ahead of big pharma in discovering more medicines for cardiometabolic disorders.

-

In November 2023, Novo Nordisk A/S announced that it planned to introduce its immensely popular anti-obesity medicine, Wegovy, in Japan on February 22, marking its first launch in Asia, even as it struggles to keep up with demand in existing regions.

GLP-1 Receptor Agonist Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 86.93 billion

Revenue forecast in 2033

USD 201.79 billion

Growth rate

CAGR of 12.78% from 2026 to 2033

Actual data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, route of administration, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Eli Lilly and Company; Sanofi; Novo Nordisk A/S; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to Country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GLP-1 Receptor Agonist Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global GLP-1 Receptor Agonist market report based on product, application, route of administration, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Ozempic

-

Trulicity

-

Mounjaro

-

Wegovy

-

Rybelsus

-

Saxenda

-

Victoza

-

Zepbound

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Type 2 Diabetes Mellitus

-

Obesity

-

-

Route of administration Outlook (Revenue, USD Million, 2021 - 2033)

-

Parenteral

-

Oral

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global GLP-1 receptor agonist market size was estimated at USD 70.08 billion in 2025 and is expected to reach USD 86.93 billion in 2026.

b. The global GLP-1 receptor agonist market is expected to grow at a compound annual growth rate of 12.78% from 2026 to 2033 to reach USD 201.79 billion by 2033.

b. North America dominated the GLP-1 receptor agonist market with a share of 78.72% in 2025. This is attributable to increased usage of GLP-1 products and rise in R&D expenditure by government.

b. Some key players operating in the GLP-1 receptor agonist market include Eli Lilly and Company, Sanofi, Novo Nordisk A/S, and AstraZeneca.

b. Key factors that are driving the market growth include formulation advancements of GLP-1 receptor agonist coupled with presence of robust product pipeline.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.