- Home

- »

- Agrochemicals & Fertilizers

- »

-

Glufosinate Ammonium Market Size & Share Report, 2030GVR Report cover

![Glufosinate Ammonium Market Size, Share & Trends Report]()

Glufosinate Ammonium Market (2024 - 2030) Size, Share & Trends Analysis Report By Crop (Non-GM Crops, Genetically Modified (GM) Crops), By Form (Dry, Liquid), By Application (Non-Agricultural, Agricultural), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-477-2

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glufosinate Ammonium Market Size & Trends

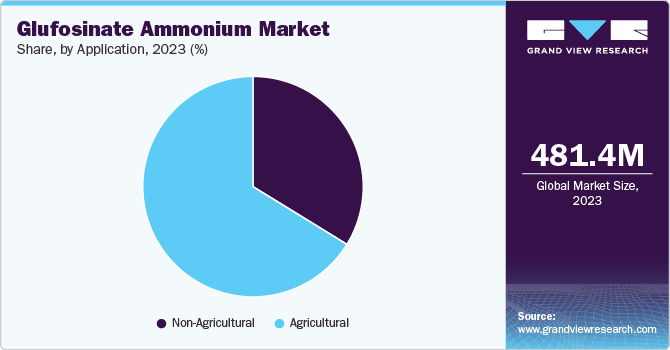

The global glufosinate ammonium market size was estimated at USD 481.4 million in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030.Glufosinate ammonium is currently attracting significant interest due to its high efficiency, low toxicity, and ease of decomposition. It is utilized in both agricultural and non-agricultural settings.

The production of various organic herbicides by Streptomyces soil bacteria that hinder the function of glutamine synthetase (GS), an enzyme vital for glutamine synthesis and ammonia detoxification, has garnered attention. The market is expanding due to its diverse range of applications and high efficacy. Additionally, the conversion of Bialaphos, a naturally occurring herbicide, into glufosinate by plants has been noted. Furthermore, it is anticipated that the flourishing agriculture industry will also contribute to the growth of the market in the forecast period.

Drivers, Opportunities & Restraints

Glufosinate ammonium, a broad-spectrum herbicide, has seen significant market growth driven by its efficiency in controlling a wide range of annual and perennial weeds, grasses, and broadleaf plants. This growth can be attributed to its unique mode of action, which inhibits the enzyme glutamine synthetase, leading to the accumulation of toxic levels of ammonia in plant cells, effectively killing the weed without harming the crop genetically modified to resist it. Farmers are continuously seeking effective solutions to manage weed resistance to glyphosate and other herbicides, and glufosinate ammonium presents a viable alternative.

Moreover, the tightening regulations on the use of non-selective herbicides due to environmental and health concerns have also propelled the product demand. Its relatively lower toxicity and quicker degradation in the soil compared to other herbicides make it an attractive option for sustainable agriculture practices.

Additionally, the expanding research and development activities aimed at formulating new glufosinate ammonium-based herbicides that are more effective and have lower impact on non-target species have further bolstered its market growth. As consumers and regulatory bodies push for more environmentally friendly agricultural inputs, the market for glufosinate ammonium is expected to continue expanding, driven by its effectiveness, safety profile, and role in integrated weed management strategies.

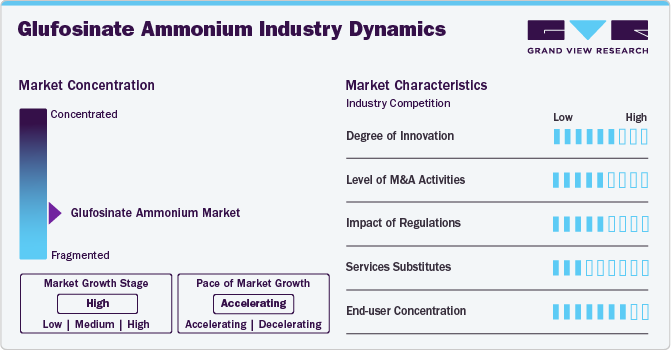

Market Concentration & Characteristics

The market is moderately fragmented, with a considerable number of players governing the market share.

The competitive landscape for glufosinate ammonium is increasingly dynamic, characterized by the participation of both global and regional players. The demand for this herbicide has surged due to its effectiveness in controlling a wide range of weeds, coupled with its lower toxicity and environmental impact compared to traditional herbicides. Major companies in the sector are focusing on expanding their production capabilities, enhancing their product portfolio through research and development, and adopting aggressive marketing strategies to strengthen their market position.

Strategic collaborations, mergers, and acquisitions are also common as companies aim to broaden their geographical reach and diversify their offerings. Furthermore, the growing emphasis on sustainable agricultural practices has led to innovations in herbicide formulations, including those based on glufosinate ammonium, to meet regulatory standards and farmer preferences.

Crop Insights

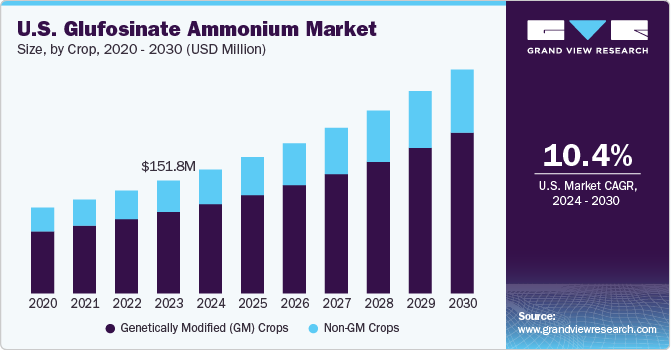

“Genetically Modified (GM) Crops segment is expected to witness growth at 9.9% CAGR”

The GM crops segment of the market was valued at USD 349.9 million in 2023 and is projected to reach USD 675.9 million by 2030. Glufosinate ammonium plays a significant role in the cultivation of genetically modified (GM) crops, particularly those engineered to be resistant to this herbicide. This resistance allows farmers to directly apply this herbicide to the fields of GM crops without damaging the crops themselves.

For non-genetically modified (non-GM) crops, glufosinate ammonium helps manage a broad spectrum of weeds. It is crucial for farmers to apply this herbicide before the crops emerge or after they have been harvested to prevent any potential harm to the plants. This pre-emergent or post-harvest application strategy is effective in controlling weeds without affecting the growth of the non-GM crops.

Form Insights

“Dry segment is expected to witness growth at 10.1% CAGR”

The liquid segment of the market was pegged at USD 192.04 million in 2023 and is projected to reach USD 374.24 million by 2030. Liquid formulation facilitates convenient handling, mixing, and application, providing farmers and applicators with an efficient and user-friendly weed control solution. Also, it allows for precise measurement and dilution to achieve the desired concentration, ensuring effective weed management across diverse environments and crop systems.

The dry form of glufosinate ammonium, typically found as granules or powders, provides an alternative method of weed control that is valued for its ease of storage and longevity. Dry formulations require proper mixing with water before application, allowing users to control the concentration and volume applied to the target area. While handling and measuring may require more attention to avoid inhalation and ensure accurate dosage, the dry form is often preferred for its stability and reduced risk of spillage.

Application Insights

“Agricultural segment is expected to witness highest growth at 10% CAGR”

The agricultural segment accounted for the largest revenue share of 66.2% of the market in 2023. The product is employed both before and after the emergence of crops and weeds, providing flexibility in application strategies. It spans across several key agricultural crops including soybeans, corn, cotton, and canola, especially those genetically modified to be resistant to glufosinate, allowing for selective weed control without harming the crop.

In non-agricultural settings, it is commonly used for weed control in public and private spaces such as parks, gardens, roadways, and industrial sites. Its efficacy in managing a wide range of weed species makes it an ideal choice for maintaining clean and aesthetically pleasing environments in urban areas.

Regional Insights

“North America. is expected to witness a market growth of CAGR 6.9%”

North America has widely adopted genetically modified (GM) crops, particularly those engineered to tolerate glufosinate-based herbicides. According to the United States Department of Agriculture (USDA), herbicide-resistant crops are extensively cultivated, with adoption rates reaching 94% for soybeans, 92% for cotton, and 89% for corn as of 2022.

U.S. Glufosinate Ammonium Market Trends

In the U.S., the use of glufosinate ammonium has been on the rise, reflecting broader trends in agricultural practices and pest management. This increase is partly due to the growing adoption of genetically modified (GM) crops that are engineered to be resistant to glufosinate, allowing farmers to use the herbicide for weed control without harming the crop itself.

Asia Pacific Glufosinate Ammonium Market Trends

The shift towards glufosinate ammonium in the Asia Pacific can also be attributed to concerns over weed resistance to other herbicides, such as glyphosate. With the emergence of glyphosate-resistant weed populations, the product presents an alternative mode of action, helping to diversify weed management strategies and mitigate resistance issues.

Europe Glufosinate Ammonium Market Trends

The European Union's regulatory stance on genetically modified (GM) crops and pesticides is one of the most rigorous in the world, which significantly influences the adoption and application of glufosinate ammonium across European agriculture.

Key Glufosinate Ammonium Company Insights

Some of the key players operating in the market include Bayer AG, Syngenta, BASF SE among others.

-

Founded in 1863 and headquartered in Leverkusen, Germany, Bayer AG operates in over 90 countries and has a strong presence in both developed and emerging markets. The company operates in three main segments: Pharmaceuticals, Consumer Health, and Crop Science, with the latter being significantly bolstered by its acquisition of Monsanto in 2018, one of the largest deals in the company's history.

-

BASF SE, headquartered in Ludwigshafen, Germany, is one of the world's largest and most diversified chemical companies. Established in 1865, BASF has a rich history of innovation and development in various sectors, including materials, chemicals, surface technologies, industrial solutions, nutrition & care, and agricultural solutions. The company's portfolio includes plastics, performance products, chemicals, crop protection products, and oil and gas.

Key Glufosinate Ammonium Companies:

The following are the leading companies in the glufosinate ammonium market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Syngenta

- BASF SE

- Aventis

- Certis

- Fargro

- Hoechst

- Lier Chemical

- Jiangsu Huangma

- Dow AgroSciences

Recent Developments

-

In July 2024, BASF plans to halt the production of the active ingredient glufosinate-ammonium (GA) at the Knapsack and Frankfurt sites in Germany by the end of 2024 citing economic reasons..

-

In January 2024, The U.S. EPA has approved label expansions for glufosinate-ammonium, allowing effective weed control for specialty crops such as avocados, figs, melons, hops, squashes, tomatoes, tropical fruits, and grasses grown for seed in the Pacific Northwest.

Glufosinate Ammonium Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 526.3 million

Revenue forecast in 2030

USD 925.0 million

Growth rate

CAGR of 9.9% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo tons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Crop, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Thailand; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Lier Chemical; Bayer AG; Syngenta; BASF SE; Aventis; Certis; Fargro; Hoechst; Lier Chemical; Jiangsu Huangma; Dow AgroSciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

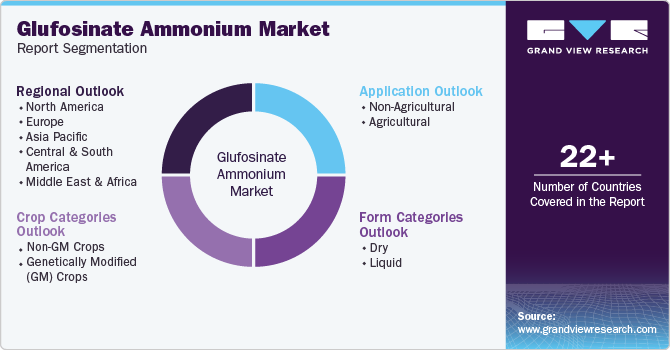

Global Glufosinate Ammonium Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global glufosinate ammonium market report based on crop, form, application, and region:

-

Crop Categories Outlook (Volume, Kilo Tons; Revenue, USD Million; 2018 - 2030)

-

Non-GM Crops

-

Genetically Modified (GM) Crops

-

-

Form Categories Outlook (Volume, Kilo Tons; Revenue, USD Million; 2018 - 2030)

-

Dry

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Non-Agricultural

-

Agricultural

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global glufosinate ammonium market size was estimated at USD 481.4 million in 2023 and is expected to reach USD 526.34 million in 2024.

b. The global glufosinate ammonium market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 925.0 million by 2030.

b. North America dominated the glufosinate ammonium market with a share of 38.1% in 2023. This is attributable to widely adopted genetically modified (GM) crops, particularly those engineered to tolerate glufosinate-based herbicides.

b. Some key players operating in the glufosinate ammonium market include Lier Chemical, Bayer AG, Syngenta, BASF SE, Aventis, Certis, Fargro, Hoechst, Lier Chemical, Jiangsu Huangma, and Dow AgroSciences.

b. The market growth is driven by the herbicide's effectiveness in controlling a wide range of weeds and plants, attributed to its unique mode of action inhibiting the enzyme glutamine synthetase. This effectively kills the weed without harming genetically modified crops.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.