- Home

- »

- Food Additives & Nutricosmetics

- »

-

Glycerol Monostearate Market Size, Industry Report, 2030GVR Report cover

![Glycerol Monostearate Market Size, Share & Trends Report]()

Glycerol Monostearate Market (2025 - 2030) Size, Share & Trends Analysis Report By Purity (<90%, >90%), By Application (Emulsifier, Thickener, Preservative), By End-use (Food & Beverages, Personal Care & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-196-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Glycerol Monostearate Market Summary

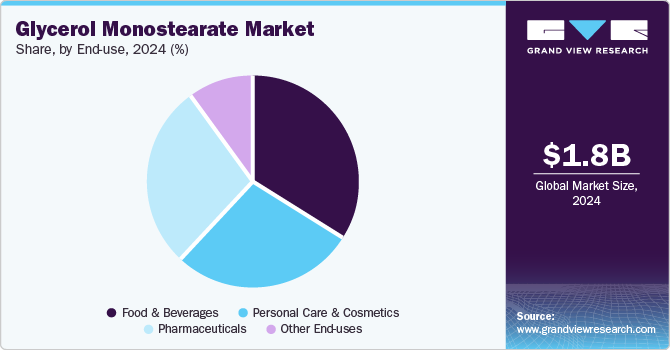

The global glycerol monostearate market size was estimated at USD 1,771.1 million in 2024 and is projected to reach USD 2,539.9 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The growth is primarily driven by the increasing demand for bio-based emulsifiers and the growing awareness regarding the benefits of glycerol monostearate in various end-user industries such as personal care & cosmetics, food & beverages, and pharmaceuticals.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, South Africa is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, <90% accounted for a revenue of USD 1,074.6 million in 2024.

- >90% is the most lucrative purity segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,771.1 Million

- 2030 Projected Market Size: USD 2,539.9 Million

- CAGR (2025-2030): 6.4%

- Asia Pacific: Largest market in 2024

Manufacturers are investing in research and development (R&D) to enhance the quality, purity, and efficiency of glycerol monostearate, thereby expanding its potential applications. For instance, advancements in production processes have led to the availability of high-purity glycerol monostearate, which is preferred in pharmaceutical and food applications due to its compliance with stringent quality standards.

Glycerol monostearate, also known as GMS, is a versatile emulsifier and stabilizer that is widely used in these industries. Its ability to improve the texture, stability, and appearance of products has made it a popular ingredient. The market growth is driven by factors such as increasing consumer demand for convenience foods and the growing awareness of the benefits of natural and organic products. Glycerol monostearate, being a natural substance derived from plant or animal sources, aligns well with this consumer trend. This demand for clean-label products has prompted manufacturers to incorporate glycerol monostearate in their formulations, thereby driving the market growth.

One of the key drivers of the GMS market in China is the rapid growth and evolution of the country's economy. Since China began to open up and reform its economy in 1978, its GDP growth has averaged almost 10% a year, leading to significant improvements in living standards and increased consumer spending power. This has resulted in a significant growth in demand for products offered by personal care & cosmetics industries as well as an increase in the consumption of processed food products. This phenomenon has led to an increase in the usage of GMS, thus acting as a major growth driver for the industry in China.

A notable opportunity for the glycerol monostearate market lies in the food and beverage sector, where glycerol monostearate is utilized as an emulsifier and stabilizer in the production of a wide range of products, including bakery items, dairy products, and confectionery. As consumers seek clean-label and sustainable products, the demand for glycerol monostearate in food applications is expected to rise, creating opportunities for manufacturers to expand their product offerings and cater to the evolving needs of the food industry.

The regulatory scenario for the GMS market is influenced by the standards and guidelines established by regulatory authorities such as the Food and Drug Administration (FDA) in the United States, European Food Safety Authority (EFSA) in the European Union. GMS is commonly used as an emulsifier, stabilizer, and thickening agent in various food and beverage products. As a result, regulatory standards play a crucial role in shaping the market landscape. For instance, the FDA regulates the use of glycerol monostearate as a food additive and sets specific limits on its application in food products to ensure consumer safety.

Purity Insights

The <90% segment dominated the global market and accounted for the largest revenue share of 58.0% in 2024. GMS with a purity of less than 90% contains impurities or lower levels of the desired compound. Impurities can vary depending on the production process and quality control measures. The inclusion of impurities in their chemical structure renders them different physical properties, such as melting and boiling points, then the pure form of GMS. Applications for GMS with less than 90% purity may still exist in fields where stringent GM purity requirements are not required. The <90% glycerol monostearate finds applications in the food industry as it helps improve the texture, consistency, and shelf life of food products. In the baked goods segment, GMS is used in the production of baked goods such as bread, cakes, and pastries. It helps increase the volume of bakery products while enhancing the moisture retention of these products.

The >90% segment is expected to grow at the fastest CAGR of 7.2% over the forecast period. It is composed of glycerol and stearic acid. It possesses a distinctive white hue and a waxy texture, accompanied by a subtle fragrance, and showcases the characteristics of being insoluble in water while demonstrating solubility in organic solvents. It is widely utilized across an array of industries including food, pharmaceuticals, and cosmetics, it fulfills essential roles as a stabilizer, thickening agent, and emulsifier.

Application Insights

Emulsifiers dominated the global glycerol monostearate (GMS) market and accounted for the largest revenue share of 40.9% in 2024. As an ester of stearic acid and glycerol, GMS has both hydrophilic and lipophilic characteristics, making it an efficient emulsifier. Its ability to form stable oil-in-water emulsions arises from its molecular structure, featuring a hydrophilic head and a lipophilic tail that blends with oily substances. This allows GMS to stabilize oil-water mixtures, preventing separation while also offering thickening properties that are valuable across various applications.

Thickener segment is expected to grow at CAGR of 7.3% over the forecast period. GMS also serves as an effective thickener in various industries due to its unique properties and mode of operation. GMS aligns its hydrophilic head toward water and its lipophilic tail toward oil, creating a stable interface between the two phases. This arrangement reduces interfacial tension, resulting in the formation of a thickened and stable product. GMS is commonly used as a thickener in ice cream, whipped toppings, and baked goods, as well as in cosmetic formulations such as creams and lotions.

End-use Insights

Food & beverages end use segment led the market and held the largest revenue share of 33.7% in 2024. Glycerol monostearate is used as a thickening agent, emulsifier, and preservative as well as an anticaking agent, in the food & beverages industry. The multifunctional nature of GMS has enabled them to become a widely used ingredient in various sub-industries within the food & beverages sector such as bakeries, beverages, packaged food, and others.

The personal care and cosmetics segment is expected to grow at a lucrative CAGR of 7.1% from 2025 to 2030. GMS is often utilized in lotions, creams, and moisturizers to provide a thicker and more luxurious feel. By acting as a thickening agent, GMS contributes to the stability and aesthetic appeal of these products. Glycerol monostearate also serves as a moisture agent in the personal care and cosmetics industry. It acts as a humectant, drawing moisture from the environment and binding it to the skin.

Regional Insights

North America glycerol monostearate market is expected to grow at the fastest CAGR of 6.9% over the forecast period, owing to the presence of major end-users in the region, along with a well-established food processing landscape fueled by the surged consumption of processed food. The well-developed pharmaceutical industry in North America has emerged as another large-scale end-user of glycerol monostearate as it is used to improve the emulsifying properties of drugs and medicines.

U.S. Glycerol Monostearate Market Trends

The glycerol monostearate market in the U.S. led the North American market and held the largest revenue share in 2024, driven by the growing trend towards clean and transparent product labels. In addition, consumers are increasingly seeking natural alternatives to synthetic additives, making GMS, derived from fats and oils, an attractive option for manufacturers. Furthermore, the rising demand for functional foods and nutraceuticals has spurred GMS usage in dietary supplements, sports nutrition products, and functional beverages.

Asia Pacific Glycerol Monostearate Market Trends

Asia Pacific glycerol monostearate market dominated the global market and accounted for the largest revenue share of 32.1% in 2024. This high share is attributable to industries present in the region. The major application scope for GMS includes pharmaceuticals, textiles, and paints & coatings. Large-scale industrial and economic growth in the region with leading economies such as India, China, Japan, and emerging countries such as Bangladesh and Vietnam have contributed to the GMS market in Asia Pacific.

The glycerol monostearate market in China dominated the Asia Pacific market with the largest revenue share in 2024, owing to rapid growth, driven by its sizable consumer base and increasing disposable income. In addition, this economic expansion has fueled demand for processed foods, skincare products, and pharmaceutical formulations, all of which utilize GMS. Furthermore, government initiatives promoting innovation and domestic production have bolstered the industry. China's evolving economy, which has seen an average GDP growth of nearly 10% annually since 1978, has significantly improved living standards, leading to higher consumer spending power and increased consumption of personal care products and processed foods.

Europe Glycerol Monostearate Market Trends

Europe glycerol monostearate market is expected to grow significantly over the forecast period. Glycerol monostearate is widely used as an emulsifier and stabilizer in various industries. Glycerol monostearate is commonly used in the food and beverages, personal care products, and pharmaceutical industries, as well as in various industrial applications. The growth of the regional market is driven by the rise in demand for GMS from the extensive personal care products and cosmetics industry of Europe.

The glycerol monostearate market in Germany is expected to be driven by the country's robust food and beverage sector, where GMS serves as a crucial emulsifier and stabilizer in various products, including bakery items and dairy goods. Furthermore, the nation's strong focus on research and development in the chemical industry has led to innovations in GMS applications, further driving market growth. Moreover, Germany's stringent regulations on food safety and labeling have increased the demand for natural emulsifiers such as GMS. The country's emphasis on sustainable and eco-friendly products has also boosted the adoption of GMS in various industries.

Key Glycerol Monostearate Company Insights

The GMS market exhibits a consolidated nature with a few of the major companies of companies accounting for the majority of market share. It is characterized by the different initiatives by companies to increase their competitiveness and market share. These companies are actively engaged in strategic initiatives such as mergers & acquisitions, product developments, regional expansions, and innovations to strengthen their market position.

-

Croda International plc primarily deals in specialty chemicals meant for two markets, namely consumer care and life sciences. It also offers biotechnology solutions, segmented into fragrances, home care, personal care, and specialist solutions.

-

Oleon NV is an international company that specializes in the production and distribution of oleochemicals. The company is part of the Avril group, a recognized player in the bio-based chemistry sector. Oleon offers a wide range of products, including fatty acids, glycerin, esters, dimers, technical oils, and specialty oleo chemicals.

Key Glycerol Monostearate Companies:

The following are the leading companies in the glycerol monostearate market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza Group AG

- Stepan Company

- Croda International Plc

- Evonik Industries AG

- Godrej Industries Limited

- AkzoNobel NV

- BASF SE

- The DOW Chemical Company

- Huntsman Corporation

- Wilmar International Limited

- Mitsubishi Chemical Corporation

- Kao Corporation

- Cargill, Incorporated

Recent Developments

-

In March 2023, Croda International plc, represented in India by its Indian subsidiary ‘ Croda India’, announced the decision to invest USD 5.4 million in building a greenfield manufacturing facility in Dahej, Gujarat. The new facility will aid in catering to the rising consumption of pharma and consumer care products.

-

In May 2022, Evonik Industries AG inaugurated its Applied Technology Center (ATC) in Sao Paulo, Brazil. The new facility would include new laboratories and two pilot plants, strengthening its interface & performance business line. Interface & Performance’s agro-business includes emulsifiers, wetting agents, antifoams, and dispersants. The facility is Evonik’s third regional Agro Hub after ones in the U.S. and Germany.

Glycerol Monostearate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.86 billion

Revenue forecast in 2030

USD 2.54 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Purity, application, end-use, region.

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Colombia; Saudi Arabia; South Africa.

Key companies profiled

Lonza Group AG; Stepan Company; Croda International Plc; Evonik Industries AG; Godrej Industries Limited; AkzoNobel NV; BASF SE; The DOW Chemical Company; Huntsman Corporation; Wilmar International Limited; Mitsubishi Chemical Corporation; Kao Corporation; Cargill, Incorporated.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycerol Monostearate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global glycerol monostearate market report based on, purity, application, end-use, and region.

-

Purity Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

<90%

-

>90%

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Emulsifier

-

Thickener

-

Preservative

-

Other Applications

-

-

End-use Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Personal Care & Cosmetics

-

Pharmaceuticals

-

Other End-Uses

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.