- Home

- »

- Biotechnology

- »

-

Glycomics Market Size, Share, Growth & Trends Report 2030GVR Report cover

![Glycomics Market Size, Share & Trends Report]()

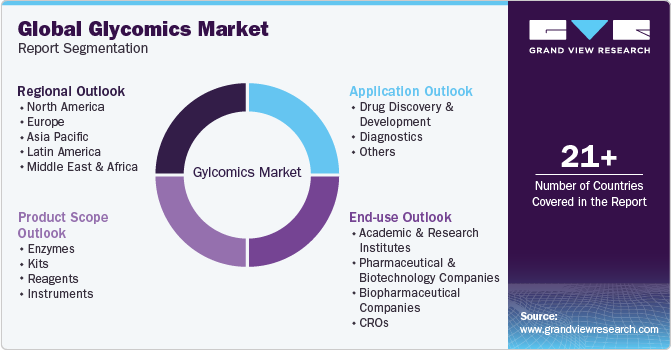

Glycomics Market Size, Share & Trends Analysis Report By Product (Enzymes, Kits, Reagents, Instruments), By Application (Drug Discovery & Development, Diagnostics), By End Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-452-9

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Glycomics Market Size & Trends

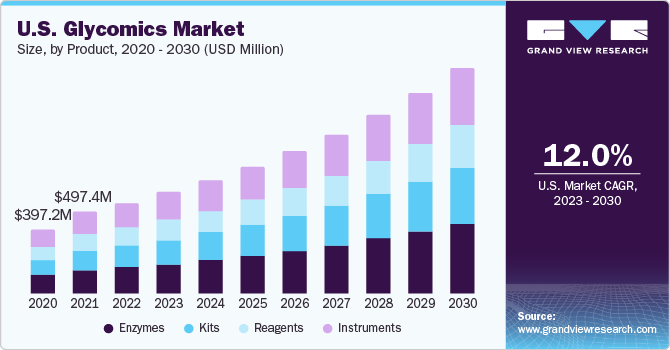

The global glycomics market size was valued at USD 1.65 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.6% from 2023 to 2030. Technological advancements in glycomics instruments are one of the major factors driving the global market. Rising investment in research by the government along with the increasing focus of pharmaceutical and biotechnology companies on novel drug development, is further contributing to the industry expansion. In addition, the rising focus on glycobiology research studies is also contributing to the growth of the market. For instance, Lebrilla League, of University of California is making significant efforts to advance clinical glycomics.

The glycobiology field gained significant momentum in recent times owing to its numerous applications in various areas, including diagnostics, drug discovery, and personalized medicine. Moreover, increasing interest in understanding the role of glycomics in disease profiling and biological processes has significantly fueled the research & development activities in the glycomics research area. For instance, in April 2021, the Canadian Glycomics Network and BridgeBio Pharma, Inc. Collaborated to translate scientific research in glycomics into potential treatments for patients with genetic diseases.

Moreover, increasing investments from governments and non-profit organizations have enabled researchers to develop novel glycomics and glycobiology tools. Moreover, ongoing funding programs to explore the potential of glycomics in diagnostics and precision medicine have further propelled industry uptake. For instance, in July 2020 GlycoNet, a Canadian Network of Centers of Excellence, received funding of USD 16.3 million to strengthen its efforts on glycomic research for the benefit of human health. This funding was awarded to GlycoNet as it has the strongest group of glycan researchers in glycobiology field.

Rising focus on glycobiology research has led to high growth of the glycomics market. Huge investments in this field have enabled academic researchers to develop new tools. As per many researchers, glycans are essential in biological processes; research on them helps researchers understand biology more comprehensively without specializing inglycobiology. This provides a wide set of potential applications for glycan analysis.

For instance, in September 2021, Investigators at the University of California San Diego developed a tool that permits glycomics datasets to be examined using AI and other machine learning methods.The investigators named the approach as GlyCompare. It takes a systems-level perception that accounts for shared biosynthetic pathways of glycans within and across samples. With this approach, the researchers aim to develop clinical breakthroughs in cancer diagnostics.

Product Insights

Enzymes segment accounted for the largest market share of 29.2% in 2022 and is expected to witness fastest growth during 2023-2030. Factors such as the wide application of enzymes in glycan-based research, diagnostics, and drug discovery are some of the factors contributing to the growth of the market. Various research studies indicate the epigenetic regulation of these enzymes in various cancer cells, thus resulting in the formation of glycan structures that are one of the most used mechanisms used by the cancerous cells to evade immune responses in a host. Genetic engineered cell models have been designed by researchers to understand the functions of specific glycan cancer epitopes. One such instance is the overexpression of glycosyltransferases that results in the characterization of function and biosynthesis of cancer-associated epitopes, such as STn, T, Tn, and ST.

Moreover, advances in protein modification technologies and enzyme engineering have led to the development of more efficient and specific enzymes for glycomics applications. These advancements have expanded the scope of enzymes in glycan-related research and production.

Instrument segment held the second-largest revenue share of 27.0% in 2022 and its high growth is driven by the increasing adoption of instruments in diagnostic testing and drug discovery. In addition, technological advancements in terms of accuracy and turnaround time and increasing efforts from market players to introduce novel glycan-based instruments further support market expansion.

Application Insights

The market based on the application segment was dominated by the drug discovery & development segment with a market share of 42.3% in 2022. This is primarily owing to the increasing number of R&D activities being conducted and rising government funding in research related to glycomics and proteomics. Advancements in glycobiology research, including advanced glycan profiling methods and analytical techniques, have paved the way for understanding the role of glycans in the identification of novel drug targets. Furthermore, the rising collaboration between market players to understand the role of glycan in the development of therapeutics for various disorders is projected to support segment growth. For instance, in April 2021 BridgeBio Pharma, Inc. and Canadian Glycomics Network (GlycoNet) collaborated to discover potential treatments for genetic conditions through glycomics research.

Whereas the diagnostics segment is projected to exhibit the fastest growth rate of 14.9% during 2023-2030. Factors such as the high prevalence of chronic disorders, rising demand for personalized medicine, and advancements in glycan analysis technologies are projected to drive segment growth. Advancements in glycan analysis, such as glycan microarrays, mass spectrometry, and lectin-based assays improved the detection specificity of glycan-based biomarkers.

End-use Insights

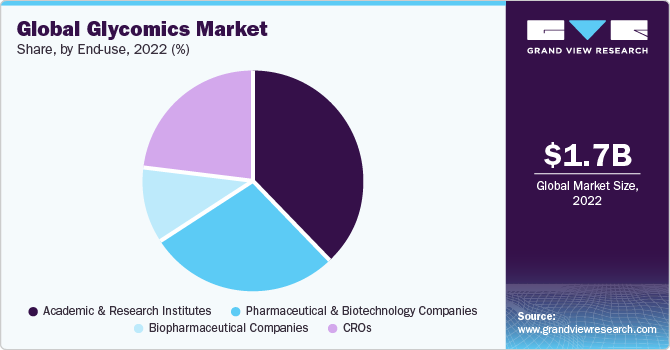

The academic and research institutes captured the largest market share of 38.2% in 2022. This large share can be attributed to the extensive adoption of glycan structure data analysis by research centers. Increasing preference of glycobiology field for training & educational purposes is also a factor contributing to the segment expansion. In addition, glycomics products have a wide range of applications in biomedical research, drug discovery & development, immunology, cell biology, and biochemistry, expected to fuel market growth in the near future. Government bodies sponsor certain organizations to work in collaboration with academic institutions, which has led to an increase in the penetration of glycomics techniques.

The biopharmaceutical companies segment is projected to register the fastest growth rate of 15.5% during the forecast period. Factors such as increasing efforts by biopharmaceutical companies for developing advanced therapeutics coupled with significant investments done by market players to adopt glycan-based methodologies in drug development are projected to support segment expansion.

Regional Insights

North America dominated the industry with a share of 39.1% in 2022. The market is collectively driven by the developed economies, advanced healthcare infrastructure, presence of key players and various strategic initiatives undertaken by them. In addition, growing demand for advanced therapeutics, and increasing government support in the form of funding for R&D activities is another factor supporting regional industry growth. For instance, in April 2023 NIH introduced a program called Glycoscience to promote glycobiology research in glycan science.

Europe is expected to witness the fastest growth in the global market. High disease burden and supportive research infrastructure with the presence of world-class universities and research institutes are projected to fuel the regional market. In addition, the availability of research grants and funding programs has allowed biopharmaceutical companies and academic institutions to conduct more extensive glycomics studies and explore potential applications in healthcare.

Key Companies & Market Share Insights

The key players in the market are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues. Glycan systems in the glycobiology field have a crucial role in understanding various biological systems, and this helped manufacturers to develop novel therapeutics and precise diagnostics kits. One such kit is Glysite; Glysite is an immunofluorescence kit that can profile and characterize complex glycans in biological systems. Some of the prominent key players in the global glycomics market include:

-

Thermo Fisher Scientific, Inc.

-

Merck KgaA

-

Agilent Technologies Inc.

-

Bruker

-

New England Biolabs

-

Shimadzu Corporation

-

Waters Corporation

-

Takara Bio Inc

-

Asparia Glycomics

-

RayBiotech Life, Inc.

Glycomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.89 billion

Revenue forecast in 2030

USD 4.92 billion

Growth rate

CAGR of 14.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KgaA; Agilent Technologies Inc.; Bruker; New England Biolabs; Shimadzu Corporation; Waters Corporation; Takara Bio Inc; Asparia Glycomics; RayBiotech Life, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Glycomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global glycomics market report on the basis of product, application, end use, and region:

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymes

-

Glycosidases

-

Neuraminidases

-

Glycosyltransferases

-

Sialyltransferases

-

Others

-

-

Kits

-

Glycan Labeling Kits

-

Glycan Purification Kits

-

Glycan Release Kits

-

Others

-

-

Reagents

-

Glycoproteins

-

Monosaccharides

-

Oligosaccharides

-

Others

-

-

Instruments

-

Mass Spectrometers

-

HPLC

-

MALDI-TOF

-

Array Systems

-

Others

-

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Biopharmaceutical Companies

-

CROs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global glycomics market size was estimated at USD 1.65 billion in 2022 and is expected to reach USD 1.89 billion in 2023.

b. The global glycomics market is expected to grow at a compound annual growth rate of 14.6% from 2023 to 2030 to reach USD 4.92 billion by 2030.

b. Enzymes dominated the glycomics market with a share of 29.2% in 2022. This is attributable to frequent usage in drug discovery and diagnostic testing applications.

b. Some key players operating in the glycomics market include Thermo Fisher Scientific, Inc.; Merck KGaA; Agilent Technologies; Bruker; New England Biolabs; Danaher; Shimadzu Corporation; and Takara Bio, Inc.

b. Key factors that are driving the glycomics market growth include technological advancements, rising investments in research by various government bodies, and the development of novel drugs by pharmaceutical and biotechnology companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."