- Home

- »

- Organic Chemicals

- »

-

Glycol Ethers Market Size And Share, Industry Report, 2030GVR Report cover

![Glycol Ethers Market Size, Share & Trends Report]()

Glycol Ethers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (E-Series, P-Series), By Application (Paints & Coatings, Printing, Pharmaceuticals, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-002-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Glycol Ethers Market Size & Trends

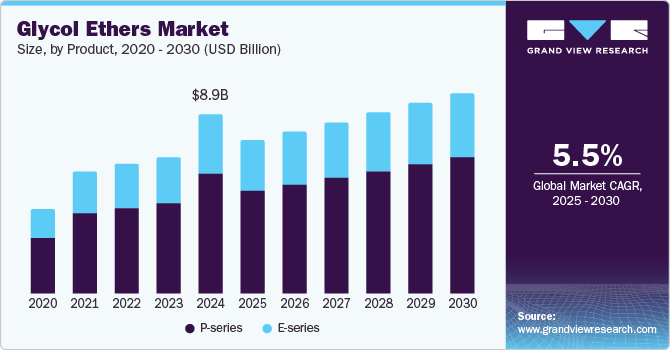

The global glycol ethers market size was valued at USD 8.9 billion in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2030, owing tothe increase in production of consumer electronics and rising demand from the paints & coatings industry.As the electronics industry grows, glycol ethers are crucial for cleaning and manufacturing processes, ensuring high performance and precision. The expanding construction, automotive, and industrial sectors are fueling demand for paints & coatings, where glycol ethers improve solvent properties, flow, and finish quality.

The shift toward products with low Volatile Organic Compounds (VOCs) and the growth of automotive and industrial manufacturing sectors are also anticipated to favor market growth. As industries increasingly prioritize sustainability and comply with stricter environmental regulations, there is a surge in demand for low-VOC glycol ethers, which offer effective solvent properties with reduced environmental impact. In the automotive and industrial sectors, glycol ethers are crucial in paints, coatings, and cleaning product formulations. The combined focus on high-quality, eco-friendly solutions and industrial growth is expected to propel market growth over the coming years.

Product Insights

The P-series segment held the largest revenue share in 2024, fueled by its versatile applications across various industries, including paints & coatings, cleaning products, and automotive. This category of glycol ethers offers superior solvency properties, which make them ideal for formulating effective, high-performance solutions. Their ability to enhance paint & coating formulations and their increasing demand in consumer and industrial products has driven their popularity. The low toxicity and environmental compatibility of the P-series further contribute to its dominance in the glycol ethers market.

The E-series glycol ethers market segment is expected to grow at the fastest CAGR over the forecast period, attributed to its increasing demand across various industries, particularly in paints, coatings, and cleaning products. E-series glycol ethers, known for their low toxicity and effective solvent properties, are becoming a preferred choice for environmentally conscious consumers and industries focused on sustainability. With stricter regulations on chemical emissions and a growing trend toward safer, eco-friendly solutions, the E-series segment is set to witness substantial growth in the coming years.

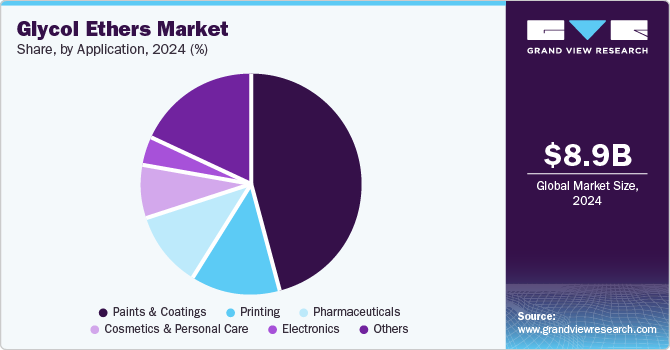

Application Insights

The paints & coatings segment held the largest share of 46.1% in 2024, owing to the essential role glycol ethers play in improving the performance and quality of paints. These solvents enhance flow, reduce viscosity, improve gloss, and provide better stability in various coatings. The rising demand for high-quality paints and coatings in industries like construction, automotive, and industrial manufacturing has significantly boosted the use of glycol ethers. Moreover, increasing consumer preference for eco-friendly, low-VOC formulations has been crucial in driving the demand for glycol ethers in the paints & coatings segment.

Thepharmaceuticals segment is anticipated to be the fastest-growing segment and record a CAGR of 6.1% from 2025 to 2030, with increasing demand for high-quality solvents in drug formulations and manufacturing processes. Glycol ethers are widely utilized as solvents in the production of oral, injectable, and topical medications due to their excellent solubility and stability properties. As the global pharmaceutical industry continues to grow, driven by rising healthcare needs and advancements in drug development, the demand for glycol ethers in pharmaceutical applications is projected to surge significantly, positively impacting the glycol ethers industry growth.

Regional Insights

North America is expected to emerge as the fastest-growing region and progress at a CAGR of 4.8% from 2025 to 2030, due to rising demand across industries such as automotive, construction, and pharmaceuticals. The focus of region on sustainability and strict environmental regulations, are driving the shift toward low-VOC glycol ethers, making them a preferred choice for manufacturing eco-friendly products. North America's well-established pharmaceutical sector relies heavily on glycol ethers for drug formulations. As industrial growth and consumer preferences for green solutions continue, North America is expected to record fast-paced growth in the coming years.

U.S. Glycol Ethers Market Trends

The U.S. held a considerable position in the glycol ethers industry in 2024, with growing demand for paints & coatings in various industries, including automotive, construction, and industrial applications. These solvents play a crucial role in improving performance, flow, and drying properties of coatings. The shift toward eco-friendly and sustainable solutions is encouraging the development of low-VOC glycol ethers. As consumers and manufacturers increasingly prioritize environmentally safe alternatives, the demand for greener glycol ether products is expected to expand, significantly contributing to the growth of the market.

The expansion of the pharmaceutical and personal care sectors and growth in industrial cleaning applications are projected to positively impact the Canada glycol ethers market over the forecast period. Glycol ethers are crucial in the formulation of personal care products like cosmetics, lotions, and fragrances, providing stability and performance. In addition, as pharmaceutical sector of Canada expands, glycol ethers are increasingly used in drug formulations and cleaning processes. The surging demand for effective cleaning agents in industries such as manufacturing and healthcare further boosts the need for glycol ethers, contributing to market expansion.

Europe Glycol Ethers Market Trends

Technological advancements in glycol ether formulations, focus on enhanced efficiency, performance, and sustainability, are various factors that are expected to drive the growth of the Europe glycol ethers market significantly. Innovations to reduce VOC emissions and improve product stability are gaining traction, particularly in environmentally-conscious industries. The rising demand from automotive and industrial sectors, where glycol ethers are used in paints, coatings, cleaning agents, and lubricants, further fuels market growth. As these sectors evolve with more advanced, eco-friendly solutions, the Europe glycol ethers market is anticipated to experience robust growth.

Germany is anticipated to accumulate sizable gains by 2030, propelled by demand from the electronics sector and the shift toward local & sustainable manufacturing. Glycol ethers are vital in cleaning, coating, and manufacturing electronics, ensuring precision and high performance. As the electronics industry in Germany continues to grow, the need for high-quality solvents will increase. Also, the trend toward sustainable and local production methods aligns with the demand for eco-friendly solvents like glycol ethers, which are increasingly favored for their low toxicity and environmental benefits, fueling market growth.

The growth of the personal care and pharmaceutical sectors is expected to significantly drive the UK glycol ethers market, as these solvents are essential in formulating products like cosmetics, skincare, and pharmaceuticals. Besides, tightening environmental regulations and increasing demand for eco-friendly solutions are pushing manufacturers to develop low-VOC, biodegradable glycol ethers. This shift toward sustainable products aligns with consumer preference for greener options, enhancing the market's growth prospects. As industries prioritize both performance and environmental responsibility, the UK glycol ethers market is set for expansion in the coming years.

Asia Pacific Glycol Ethers Market Trends

Asia Pacific glycol ethers market held the largest share of 50.3% in 2024. This can be attributed to the fast-paced industrialization, urbanization, and robust growth in key industries like automotive, construction, and pharmaceuticals. Countries such as China, India, and Japan are major consumers of glycol ethers due to their expanding manufacturing capabilities and demand for paints, coatings, and cleaning products. Additionally, the growing focus on low-VOC products and eco-friendly solutions aligns with regional regulatory shifts, further boosting market growth. The region's increasing industrial output and evolving consumer preferences continue to propel its dominance in the glycol ethers industry.

The growth in the automotive and construction sectors and the increasing demand for electronics and consumer goods are expected to significantly propel the size of the Asia Pacific glycol ethers market. As the automotive industry expands, glycol ethers are essential in paints and coatings for improved performance and durability. The booming electronics sector also relies on glycol ethers for cleaning and manufacturing processes. The rising production of consumer goods further fuels the demand for glycol ethers, particularly in coatings, cleaning agents, and formulations, favoring market growth across the region.

China is expected to emerge as the fastest-growing country in the region over the forecast period, driven by the growth of industrial manufacturing and a heightened focus on sustainability. As industries scale up production and adopt eco-friendly practices, glycol ethers are increasingly used as solvents in paints, coatings, cleaning agents, and personal care products. China's commitment to reducing carbon emissions and advancing green technologies is expected to elevate the demand for glycol ethers, promoting their use in cleaner, more sustainable manufacturing processes and accelerating market expansion.

The rising demand for eco-friendly products and the shift toward local production are expected to catalyze the growth of India glycol ethers market. As environmental concerns rise, industries are increasingly adopting low-VOC, sustainable glycol ethers to comply with stricter regulations and meet consumer preferences for green solutions. Simultaneously, India’s push for self-reliance and reduced dependence on imports is fostering the growth of domestic glycol ether production. This combination of sustainability initiatives and local manufacturing development is set to take the glycol ethers industry in India to new heights in the years ahead.

Key Glycol Ethers Company Insights

Some of the key companies in the glycol ethers market include BASF SE; LyondellBasell Industries Holdings B.V.; Eastman Chemical Company; Dow Chemical Company; Ineos Oxide; SABIC; NIPPON NYUKAZAI CO., LTD.; Sasol; FBC Chemicals; KH Neochem Co. Ltd.

-

BASF SE is a global chemical company that focuses on producing a wide range of products, including chemicals, plastics, performance materials, agricultural solutions, and industrial solutions.

-

Dow Chemical Company offers advanced materials, chemicals, and solutions for diverse industries, including packaging, electronics, infrastructure, and agriculture, focusing on performance, sustainability, and innovation to meet global challenges and customer needs.

Key Glycol Ethers Companies:

The following are the leading companies in the glycol ethers market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- LyondellBasell Industries Holdings B.V.

- Eastman Chemical Company

- Dow Chemical Company

- Ineos Oxide

- SABIC

- NIPPON NYUKAZAI CO., LTD.

- Sasol

- FBC Chemicals

- KH Neochem Co. Ltd.

Recent Developments

-

In September 2023, LyondellBasell introduced its +LC (Low Carbon) solutions, a new line of chemicals made from recycled and renewable feedstocks. These are aimed at helping businesses create more sustainable products and achieve emissions reduction targets.

-

In September 2022, INEOS expanded its P-Series Glycol Ether portfolio to address the increasing demand in key downstream markets and has successfully completed its first sales.

Glycol Ethers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.6 billion

Revenue forecast in 2030

USD 9.9 billion

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in Kilotons, USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Thailand, Indonesia, Malaysia, Brazil, Saudi Arabia

Key companies profiled

BASF SE; LyondellBasell Industries Holdings B.V.; Eastman Chemical Company; Dow Chemical Company; Ineos Oxide; SABIC; NIPPON NYUKAZAI CO., LTD.; Sasol; FBC Chemicals; KH Neochem Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

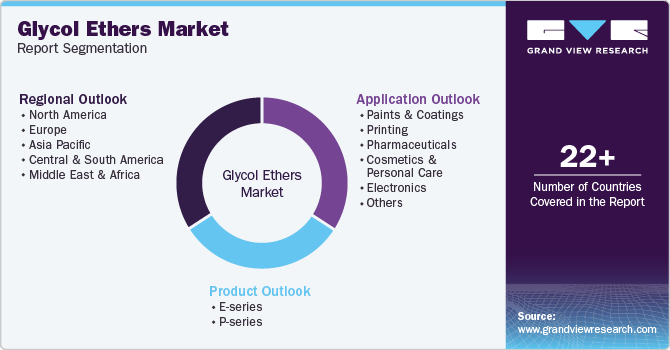

Global Glycol Ethers Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global glycol ethers market report based on product, application, and region:

-

Product Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

E-series

-

E-series Glycol Ether

-

Ethylene Glycol Propyl Ether

-

Ethylene Glycol Butyl Ether Acetate

-

Others

-

-

P-series

-

Methyl Ether

-

Butyl Ether

-

Methyl Ether Acetate

-

Others

-

-

-

Application Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Printing

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Electronics

-

Others

-

-

Regional Outlook (Revenue,Kilotons, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Indonesia

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.