- Home

- »

- Next Generation Technologies

- »

-

Golf Ball Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Golf Ball Market Size, Share & Trends Report]()

Golf Ball Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (2-Piece, 3-Piece, 4-Piece), By Application (Leisure, Professional), By Region (North America, Europe, APAC, ROW), And Segment Forecasts

- Report ID: GVR-2-68038-650-9

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Ball Market Summary

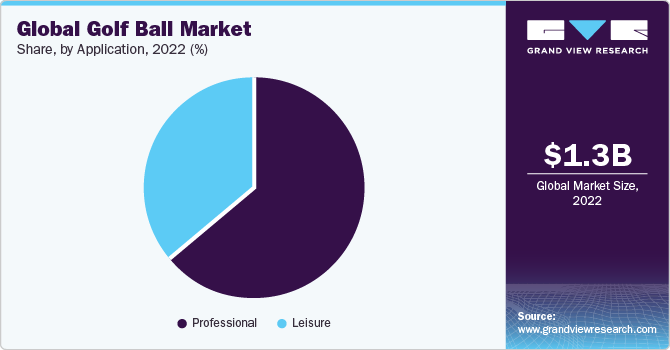

The global golf ball market size was valued at USD 1.31 billion in 2022 and is projected to reach USD 1.58 billion by 2030, growing at a CAGR of 2.4% from 2023 to 2030. Promotion of golf tourism, construction of new golf courses, and rising consumer disposable income are some of the key market drivers.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 37.9% in 2022.

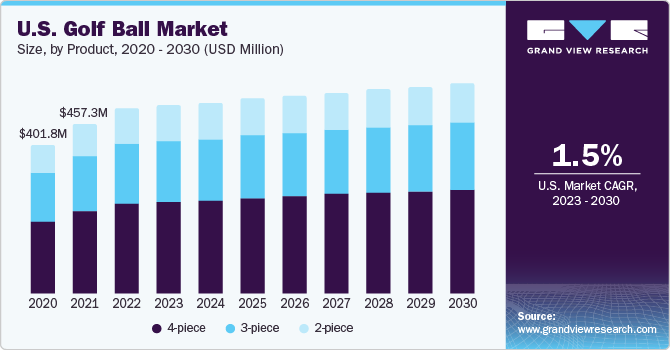

- Based on product, the 4-piece segment accounted for the largest revenue share of 37.7% in 2022.

- Based on product, the 2-piece segment is expected to grow at the fastest CAGR of 2.6% from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 1.31 billion

- 2030 Projected Market Size: USD 1.58 billion

- CAGR (2023-2030): 2.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Governments worldwide organize tournaments, workshops, and the construction of professional golf courses to encourage tourism. It is also attributed to market growth over the forecast period. Technological advancements in equipment and products are expected to impact market growth positively. For instance, the Seamless Cover Technology (SCT) allows the creation of a non-uniform joint around the ball. It enhances aerodynamics and accuracy. They have lesser aerodynamic drag, which allows golfers to achieve longer distances with their shots, even with minimum movement and spin.

Golf has been positioned as a lifestyle sport with an added element of prestige. It presents a sense of competition and an avenue for physical exercise apart from being a source of entertainment. Several countries encourage tourism by organizing golfing events to attract international and domestic tourists. Moreover, the sport is being used as an outlet not only for recreation but also as a part of community and regional development. Thus, enhanced favorability of the sport among the population is anticipated to drive the demand over the forecast period.

However, the market has witnessed a decline in the number of rounds played and the adoption of the sport in developed countries such as Canada, the U.S., and parts of Europe. This decline is attributed to the youth's diminishing interest in the sport owing to the long time spent completing a single game. Moreover, high initial capital investment is anticipated to affect the growth adversely.

Application Insights

The professional tournaments segment accounted for the largest revenue share of around 64.3% in 2022. High popularity and substantial investment by various organizations, governments, and other investors are accredited to this expansion. Several golf associations collaborate by organizing numerous events to promote the sport among the youth.

In the past couple of years, several similar programs have been initiated worldwide, encouraging the youth to adopt golf as a professional sport. Competitions, both professional and amateur, for instance, the PGA Tour, U.S. Open, and the Masters, require various types of golf balls, creating additional demand. It is ultimately expected to contribute to the overall growth of the golf ball market.

The leisure segment is estimated to register the fastest CAGR of 2.4% over the forecast period owing to the rising disposable income of the middle-class population, the construction of new golf courses, and substantial government investments and initiatives to promote tourism for this sport. Numerous resorts and hotels worldwide are developing miniature golf courses to attract more patrons. They also organize holidays and trips featuring this sport as the main attraction, endorsing it as a leisure activity.

Moreover, 9% of global travelers comprise junior golfers, that have created a niche market for leisure golf providers to offer miniature versions of the sport at a relatively lower cost. As a result, the leisure application segment market is anticipated to register considerable growth over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 37.9% in 2022. It is attributed to the large presence of golf courses in the region. For instance, as of August 2023, the region has approximately 13,916 golf courses. Furthermore, the region is saturated with several key players, such as Nike, Inc.; Callaway Golf Company; Dixon Golf, Inc.; and Bridgestone Golf, Inc.

Asia Pacific is expected to grow at the fastest CAGR of 3.4% during the forecast period. It is attributed to the growing population, disposable income, and extensive urbanization. For instance, Sports Marketing Surveys (SMS) said over 23.3 million individuals played golf in 2020.

Product Insights

The 4-piece segment accounted for the largest revenue share of 37.7% in 2022. Professional golfers' preference for greater stability and lower spin is anticipated to drive the segment growth. However, they are costlier than their 2-piece counterparts as they offer supplementary advantages such as greater aerial stability and control over the ball.

The 2-piece segment is expected to grow at the fastest CAGR of 2.6% during the forecast period. These balls are suitable for amateur golfers as they are more affordable. It is regarded as one of the most popular products among novice golfers owing to its lower cost and durability. Increased adoption by amateur players and rising recreational facilities across emerging markets are expected to boost the growth of the 2-piece series.

Key Companies & Market Share Insights

Recently, it has been observed that the adoption of golf as a sport and leisure activity is increasing in emerging markets, especially in Asian countries such as China and India. A rise in disposable incomes and an improved standard of living accompanied by a greater emphasis on leisure activities are anticipated to propel this growth.

Companies are undertaking collaborations with resorts and hotels across the globe to develop golf facilities and offer equipment in a bid to promote the sport. They also focus on engaging in mergers and acquisitions as a part of their business strategy to foster growth. For instance, in November 2021, Nassau Golf Co. Ltd, established in Korea, acquired TaylorMade Golf for an undisclosed amount. With the new entity TM Golf Ball Korea joining its other golf ball manufacturing locations, the agreement marks TaylorMade's third vertical integration in its golf ball industry.

Key Golf Ball Companies:

- Callaway Golf Company.

- Dixon Golf,

- Mizuno Corporation

- Bridgestone Golf, Inc.

- Sumitomo Rubber Industries, Ltd.

- TaylorMade Golf Co.Acushnet Holdings Corp.

Recent Developments

-

In February 2023, Acushnet Holdings Corp., a key player in the design, development, and manufacturing of golf products, acquired Club Glove brand from West Coast Trends, Inc. This strategic move allowed Acushnet Holdings Corp. to expand its portfolio and further strengthen its presence in the industry.

-

In January 2023, Bridgestone Golf announced the redesigned version of their popular e6 golf ball. Known as the longest-running and historically top-selling model in the company's lineup, the new e6 offers a softer and more satisfying feel upon impact while still delivering maximum distance. This upgrade is particularly appealing for value-minded players looking for optimal performance and affordability.

-

In January 2023, Titleist introduced new 2023 Pro V1 and Pro V1x golf balls for the PGA tour. Pro V1x enhances player performance by providing high fly, precision spin, and control over a wider range of distances

Golf Ball Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.34 billion

Revenue forecast in 2030

USD 1.58 billion

Growth rate

CAGR of 2.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World (RoW)

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; ROW

Key companies profiled

Callaway Golf Company.; Dixon Golf,; Mizuno Corporation; Bridgestone Golf, Inc.; Sumitomo Rubber Industries, Ltd.; TaylorMade Golf Co.; Acushnet Holdings Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Ball Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the golf ballmarket on the basis of product, application, and region:

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

2-piece

-

3-piece

-

4-piece

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Leisure

-

Professional

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

ROW

-

Latin America

-

Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global golf ball market size was estimated at USD 1.31 billion in 2022 and is expected to reach USD 1.34 million in 2023.

b. The global golf ball market is expected to grow at a compound annual growth rate of 2.4% from 2023 to 2030 to reach USD 1.58 billion by 2030.

b. North America region dominated the golf ball market with a share of 37.9% in 2022. This is attributable to the large presence of golf courses and golf facilities in the region.

b. Some key players operating in the golf ball market include Callaway Golf Company; Dixon Golf, Inc.; Mizuno Corporation; Bridgestone Golf, Inc.; Sumitomo Rubber Industries, Ltd.; TaylorMade Golf Company, Inc.; and Acushnet Holdings Corp.

b. Key factors that are driving the market growth include the promotion of golf tourism, construction of new golf courses, and rising consumer disposable income worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.