- Home

- »

- Automotive & Transportation

- »

-

Golf Cart Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Golf Cart Market Size, Share & Trends Report]()

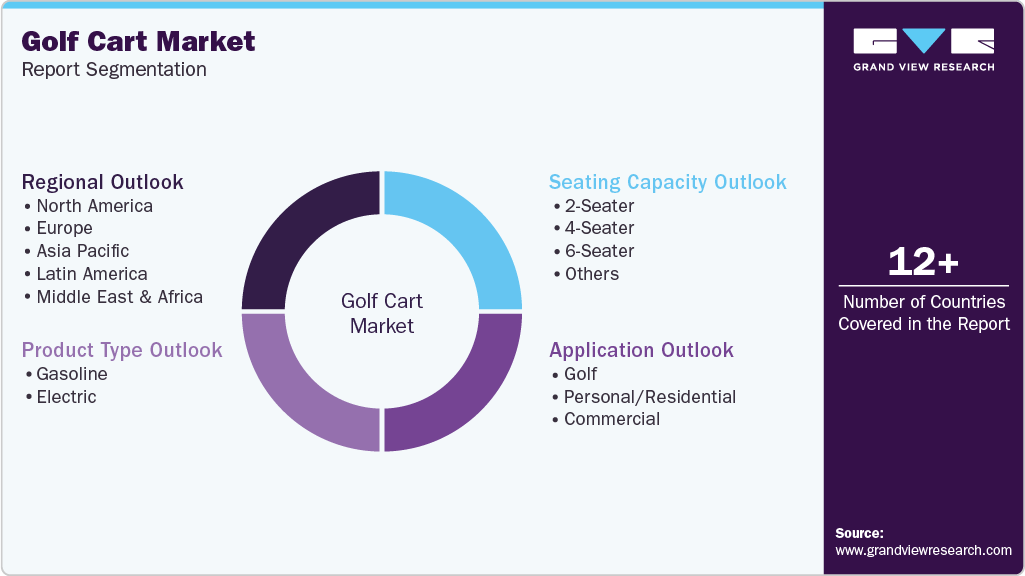

Golf Cart Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Gasoline, Electric), By Seating Capacity (2-Seater, 4-Seater, 6-Seater), By Application (Golf, Personal/Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-637-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Golf Cart Market Summary

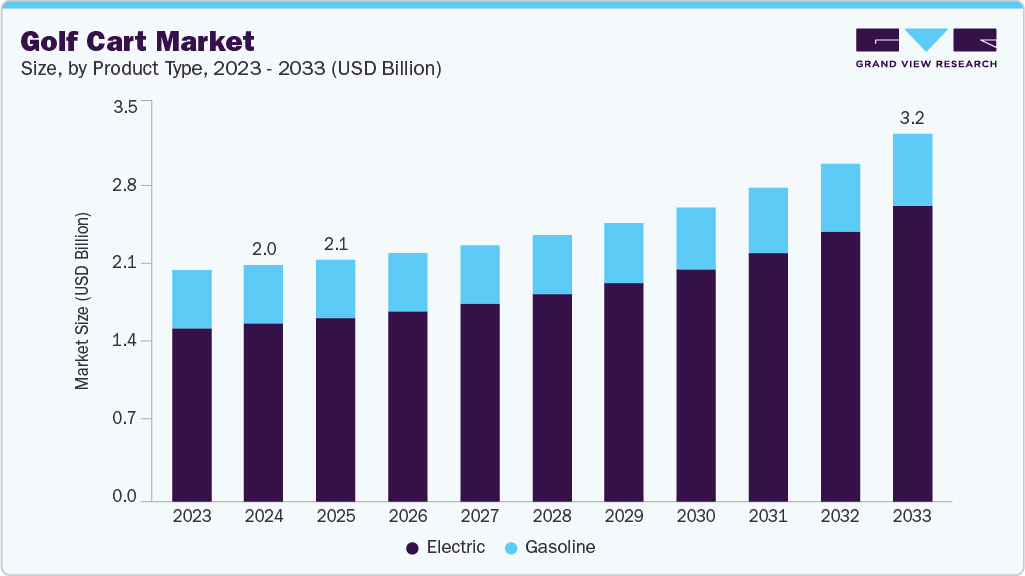

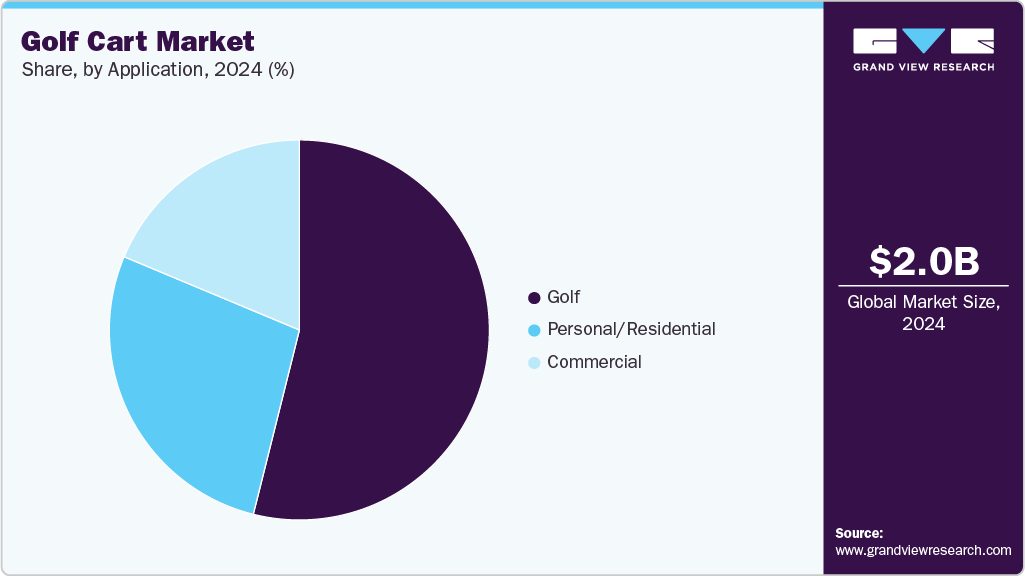

The global golf cart market was estimated at USD 2.06 billion in 2024 and is projected to reach USD 3.21 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. The rising demand for low-speed, energy-efficient mobility solutions in gated communities, resorts, industrial campuses, airports, and urban areas drives the market's growth.

Key Market Trends & Insights

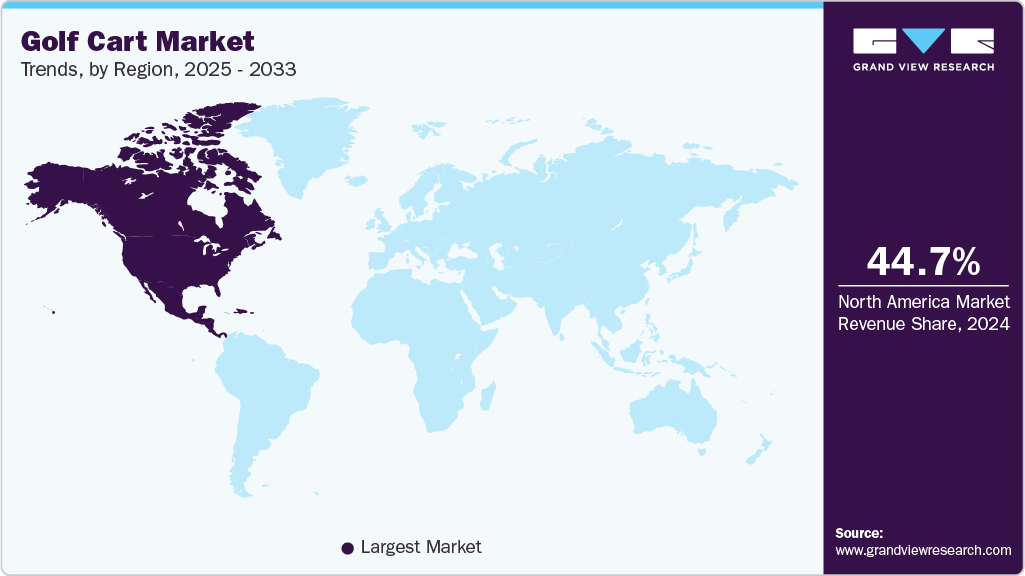

- The North America golf cart market accounted for a 44.7% share of the overall market in 2024.

- The golf cart industry in the U.S. held a dominant position in 2024.

- By product type, the electric segment accounted for the largest share of 75.4% in 2024.

- By seating capacity, the 4-seater segment held the largest market share in 2024.

- By application, the golf segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.06 Billion

- 2033 Projected Market Size: USD 3.21 Billion

- CAGR (2025-2033): 5.4%

- Asia Pacific: Fastest growing market

- North America: Largest market in 2024

Increasing tourism and recreational infrastructure, particularly in regions like Asia Pacific and the Middle East, has also fueled the need for golf carts. Technological advancements are reshaping the golf cart industry, with battery technology, connectivity, and design innovations. The shift from lead-acid to lithium-ion batteries enhances range, charging speed, and operational efficiency. Some manufacturers are integrating smart features such as GPS tracking, IoT-based fleet management, digital displays, and regenerative braking systems.In addition, the emergence of solar-powered carts and hybrid models reflects the market’s move toward cleaner, self-sustaining energy sources. Customization and luxury upgrades are also gaining popularity, especially in high-end resorts and private properties.

Investment in the golf cart market is robust, with traditional manufacturers and new entrants expanding production capacities and R&D capabilities. Companies such as Textron (E-Z-GO), Yamaha, and Club Car focus on innovation and product diversification to maintain their market position. Strategic partnerships, acquisitions, and establishing regional manufacturing hubs, particularly in Asia Pacific, are driving down production costs and improving supply chain resilience. Venture capital interest is also rising in specialized electric mobility startups offering smart, eco-friendly, and street-legal golf carts.

The regulatory landscape is pivotal in shaping the market's future. Governments across the U.S., Europe, and parts of Asia support electric mobility through incentives, subsidies, and emission norms, promoting electric over gasoline-powered carts. In addition, low-speed vehicle (LSV) classification in some regions enables golf carts to operate legally on public roads, further expanding their market potential. Safety regulations, battery disposal standards, and urban planning policies increasingly guide product development and deployment strategies.

Despite strong growth drivers, the market faces several restraints. The high initial cost of electric and lithium-ion powered carts can deter price-sensitive buyers. Infrastructural limitations hinder adoption, such as insufficient charging networks in rural or emerging areas. Furthermore, saturation in mature markets such as North America limits organic growth in the traditional segment.

Product Type Insights

The electric segment accounted for the largest share, 75.4%, in 2024. The global shift toward cleaner and more sustainable transportation fuels the growth of the market. Governments and private institutions increasingly favor electric carts over gasoline-powered ones due to their zero tailpipe emissions, low noise pollution, and reduced environmental footprint. In regions such as North America, Europe, and parts of Asia Pacific, stringent emission norms and green transportation policies are accelerating the replacement of conventional gas carts with electric alternatives in golf courses, resorts, and commercial facilities.

The gasoline segment is expected to grow at a significant CAGR during the forecast period. The superior power output and range offered by gasoline fuels the growth of the market. Gasoline-powered golf carts are favored in applications that require higher torque, longer travel distances, and operation over hilly or uneven terrain, such as in large resorts, farms, construction sites, or outdoor recreational areas. These carts can typically run longer without recharging or battery replacement, making them ideal for off-grid or high-usage conditions where electric charging infrastructure is limited or unavailable.

Seating Capacity Insights

The 4-seater segment held the largest market share of 54.1% in 2024. One of the primary growth drivers for the 4-seater segment is its rising demand in gated communities, resorts, and retirement villages, where residents and guests frequently use golf carts for short-distance travel. The 4-seater configuration is ideal for families, small groups, or service staff moving within large private properties or residential zones. As these communities expand, especially in North America, Asia Pacific, and parts of the Middle East, the demand for multi-passenger carts that offer comfort and practicality continues to grow.

The 6-seater segment is expected to grow at a significant CAGR during the forecast period. The rising demand for event logistics and venue management fuels the segment's growth. Organizers often rely on 6-seater carts to move staff, VIPs, or guests quickly and comfortably at large events, such as festivals, exhibitions, or weddings. Their ability to carry more passengers per trip helps reduce congestion and optimize fleet use, especially in time-sensitive settings.

Application Insights

The golf segment dominated the market in 2024. The expansion and modernization of golf courses, particularly in developing regions such as Asia Pacific and the Middle East, drive the market's growth. Countries such as China, India, and the UAE are investing heavily in building golf resorts and luxury golf communities as part of broader efforts to attract high-end tourism and international events. These new and upgraded facilities are increasingly adopting fleets of golf carts to enhance player convenience and operational efficiency on the course.

The commercial segment is projected to grow at a significant CAGR of 6.9% over the forecast period. The rising emphasis on sustainability and green mobility in corporate and commercial operations. With increasing regulations around emissions and growing awareness about environmental impact, many businesses are opting for electric golf carts to align with their sustainability goals. Electric models produce zero tailpipe emissions and operate quietly, making them suitable for indoor and outdoor commercial use, especially in noise-sensitive zones such as hospitals and resorts.

Regional Insights

The North America golf cart market held the largest revenue share in 2024. The growth in the region is driven by high demand from golf courses, gated communities, retirement homes, and commercial establishments. The area benefits from mature infrastructure, strong manufacturer presence, and increasing adoption of electric golf carts for sustainability compliance.

U.S. Golf Cart Market Trends

The U.S. golf cart market held a dominant position in 2024 due to the widespread application of golf carts beyond golf courses. Growing usage in residential communities, resorts, universities, and healthcare campuses is fueling demand.

Europe Golf Cart Industry Trends

The Europe golf cart industry was identified as a lucrative region in 2024. Europe’s golf cart market is witnessing steady growth, supported by a rise in golf tourism, eco-friendly mobility trends, and deployment in hospitality and industrial facilities. Several countries are adopting electric carts to meet EU carbon reduction targets and urban emission norms.

The UK golf cart market is expected to grow rapidly in the coming years due to increased interest in both golf and low-emission transport alternatives. Golf carts are widely used in clubs, leisure parks, and heritage estates. With a strong policy push toward reducing vehicle emissions, electric golf carts are gaining momentum.

The Germany golf cart industry held a substantial market share in 2024. The growth in the country is attributed to growing use of golf carts in both recreational and commercial sectors, particularly in large industrial campuses and event venues. The market is being driven by demand for sustainable and compact transportation options in compliance with Germany’s strong environmental regulations.

Asia Pacific Golf Cart Market Trends

The Asia Pacific golf cart market is anticipated to grow at the fastest CAGR of 6.7% during the forecast period. The growth of the market in the region is supported by rapid urbanization, infrastructure development, and expansion of tourism and resort facilities. Countries in the region are increasingly using golf carts in smart city projects, large commercial complexes, and eco-tourism zones.

The Japan golf cart industry is expected to grow rapidly in the coming years. The growth is driven bytechnological innovation and a strong emphasis on clean energy transport solutions. The country is witnessing increased adoption of golf carts in aging communities, amusement parks, and industrial parks.

The China golf cart market held a substantial market share in 2024. The growth of the market in the region is attributed to rising demand from commercial zones, airports, tourist attractions, and real estate developments. The country is also a leading manufacturing hub for electric golf carts, which enhances market competitiveness and scalability.

Key Golf Cart Company Insights

Some of the key companies in the golf cart market include Yamaha Golf Car, CLUB CAR, LLC, Garia ApS, Polaris Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Yamaha Golf Car, a division of Yamaha Motor Company, has been a player in the golf car industry since launching its first model, the YG292, in 1975. Yamaha Golf Car is renowned for innovation, introducing industry firsts such as the G-3 Sun Classic in 1985, which popularized the “Neighborhood Vehicle” concept, and later advancements, including the first 48-volt electric golf car and electronic fuel injection technology.

-

Club Car, LLC is a player in the design and manufacture of electric and gas-powered golf carts, utility vehicles, and personal vehicles. Club Car has expanded its product portfolio beyond golf cars to include commercial and consumer utility vehicles, emphasizing superior safety, quality, and performance. Club Car operates a worldwide network of more than 350 distributors and dealers. It serves clients including the PGA of America, the PGA TOUR Tournament Players Club (TPC) Network, and the European Tour.

Key Golf Cart Companies:

The following are the leading companies in the golf cart market. These companies collectively hold the largest market share and dictate industry trends.

- Yamaha Golf Car

- CLUB CAR, LLC

- Textron Specialized Vehicles Inc.

- HDK

- Garia ApS

- Polaris Inc.

- Star EV Corporation, USA

- Columbia Vehicle Group Inc.

- Evolution Electric Vehicles

- Melex

Recent Developments

-

In March 2025, Yamaha developed a five-seater electric golf cart featuring in-house lithium iron phosphate (LFP) battery technology, which offers high reliability, extended lifespan, and superior thermal stability. The two models, G30Es (electromagnetically guided) and G31EPs (manually operated), both measure 144.5 inches in length, 49.5 inches in width, and 73 inches in height, with an 84.25-inch wheelbase. They come with battery options of 4 kWh or 6 kWh, allowing users to select based on driving range and course needs.

-

In February 2024, LOBO EV Technologies Ltd., a Chinese company specializing in electric vehicles, including e-bicycles, e-mopeds, and electric shuttles, launched a solar-powered golf cart to meet the growing demand for sustainable transportation solutions. The initial production batch of 33 units has already been sold to customers in the U.S., marking LOBO’s third successful export of golf carts to this market. The solar-powered golf cart features high-efficiency solar panels with a 40V output and 270W power rating, capable of charging up to 80% of the battery through sunlight alone, promoting eco-friendly travel.

Golf Cart Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.11 billion

Revenue forecast in 2033

USD 3.21 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report seating capacity

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, seating capacity, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Yamaha Golf Car; CLUB CAR, LLC; Textron Specialized Vehicles Inc.; HDK; Garia ApS; Polaris Inc.; Star EV Corporation, USA; Columbia Vehicle Group Inc.; Evolution Electric Vehicles; Melex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Cart Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global golf cart market report based on product type, seating capacity, application, and region:

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Gasoline

-

Electric

-

-

Seating Capacity Outlook (Revenue, USD Billion, 2021 - 2033)

-

2-Seater

-

4-Seater

-

6-Seater

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Golf

-

Personal/Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.