- Home

- »

- Homecare & Decor

- »

-

Golf Equipment Market Size, Share & Growth Report, 2030GVR Report cover

![Golf Equipment Market Size, Share & Trends Report]()

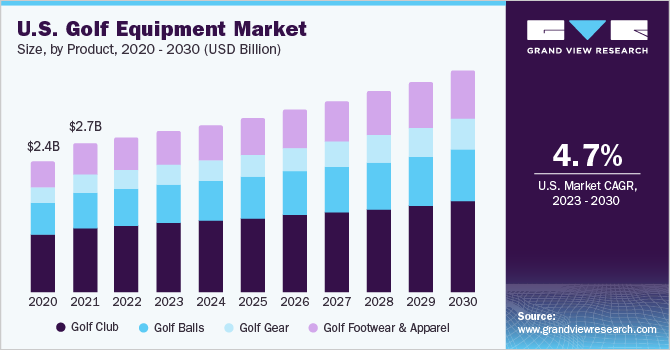

Golf Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Golf Club, Golf Balls, Golf Gear, Golf Footwear & Apparel), By Distribution Channel (Sporting Goods Retailer, On-course Shops, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-334-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global golf equipment market size was valued at USD 7.48 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The growth of the global market is primarily driven by rising disposable income, an increase in the number of golf courses, especially in high-income countries, and golf tourism across the globe. Additionally, the presence of more women on golf courses would present considerable development prospects in the coming years. The industry's major players are also concentrating on developing innovative golf equipment, which is expected to further support market expansion. The worldwide virus spread impacted the global market significantly on account of worldwide lockdowns that were imposed to curb the virus' spread. The golf equipment market has been facing a major setback as most were on the verge of closing.

According to the report by NGF, minority courses were open (approx. 44%). For instance, Titleist, with its Carlsbad club assembly plant and Fairhaven ball plants was shut down. It also had furloughed workers whose jobs couldn’t be done remotely. However, in the coming years, the global market is expected to witness strong growth resulting in ever-grown demand for golf equipment. Additionally, rising investments and funding in the golf industry is expected to play an important in the market growth making constructive addition to the market growth in the coming years.

In recent years, there is a significant development in golf tourism as a result of the expansion of golf courses across the world, coupled with the increasing number of golf tournaments. This is expected to increase the adoption of various golf equipment and augment the overall demand. Various countries are actively taking initiatives to drive golf tourism in their respective regions. For instance, in India, the tourism minister announced that the government would support efforts aiming to bring in more foreign golfers to the country’s approximately 220 golf courses.

About 74.0% of the global golf courses are located in major countries including Canada, the U.S., Japan, England, Germany, Australia, France, South Africa, Sweden, and Scotland. Approximately 55.0% of the world golf supply is generated from North and South America, with the U.S. being the top position holder for the same. Some of the biggest brands in the golf equipment market such as TaylorMade, Callaway, Titleist, and Ping have continued to hike up their prices on their new product launches. This scenario has given way to new and small brands that offer quality equipment at factory-marked prices.

Golf lately has become a leisure activity thereby making it a lifestyle sport. Factors such as the development and expansion of new golf courses, along with increasing government initiatives to promote golf tourism have popularized this sport, thereby ramping up the demand for its associated equipment. Moreover, premium resorts and hotels are incorporating sporting activities in their hospitality facilities, golf being one of them. The establishment of miniature golf courses to increase the inflow of patrons and endorse it as a healthy leisure activity is contributing to the rising sales of golf equipment.

Product Insights

The golf club segment dominated the golf equipment products market with a share of around 45.7% in 2022. Customizable and assorted golf clubs are becoming popular among consumers, which is anticipated to boost the demand for golf clubs over the forecast period. Innovation in clubs by the manufacturers, such as hybrid clubs made of higher-lofted woods and iron, is gaining popularity among consumers, thereby driving their demand. The extended durability of iron clubs can considerably affect the product repurchase cycle, which is acting as a restraint for the growth of the segment.

The golf gear segment is predicted to have a CAGR of 6.5% during the forecast period. Purchasing pattern of golf gear among players is increasing owing to the growing trend of professionalism. Online discounts on various websites are one of the prominent factors for the growth of the segment. Increasing demand for custom products by individuals is further projected to boost segment growth. Technological advancements have led manufacturers to design custom products with great efficiency and variety, resulting in shorter lead times. Key manufacturers operating in the market are launching innovative golf gear to attract more golfers. For instance, in January 2022, Callaway Golf launched a new Rogue Family of irons, hybrids, fairway woods, and drivers. Such initiatives are further expected to drive demand in the coming years.

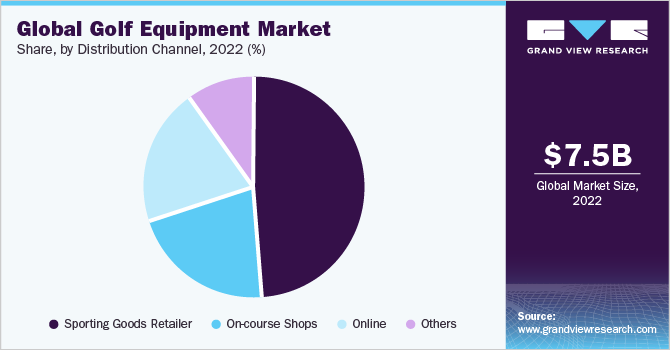

Distribution Channel Insights

In terms of revenue, the sporting goods retailer segment as a distribution channel dominated the largest share of around 48.5% in 2022. The availability of various brands in one place helps in easy price and specification comparison which is therefore a driving factor for people to make purchases of golf equipment from such stores. These retailers are generally present inside the golf courses thereby generating maximum revenue. Such kinds of retailers also provide discounts on taking club membership which drives the purchasing decision of consumers.

The online distribution channel is anticipated to have the highest CAGR of 6.2% during the forecast period. Products such as golf balls, headgear, gloves, and cart are mostly purchased online since it does not require any technical specification checks. As per an independent survey it was found that price, easy and free return and easy ordering and shipment are the three major prime factors why retail shoppers are switching to online channels.

Regional Insights

North America dominated the global market with a share of around 53.4% in 2022 driven by the rising trend of sporting activities across the region. A rigid supply chain in the region is boosting the sales of golf equipment. Maximum sales take place via offline distribution channels. Sporting goods retailers and department & discount stores together account for 80.0% of the sales. These retailers are present inside the golf course, thereby increasing sales. The online segment is also one of the major factors responsible for market growth.

Asia Pacific is expected to register the highest CAGR of 5.9% from 2023 to 2030. The growth is primarily driven by rising consumer expenditure. Asia Pacific offers strong growth potential for golf equipment owing to the rising golf-playing population and increasing disposable income of the middle class. The sales of golf equipment are majorly driven by an increasing number of golf tournaments and a growing number of participants. The major factor for the high number of professional players in the region is the time players spend on perfecting their swings by using the desired equipment such as clubs, gloves, and other gear to achieve it. The aforementioned factors are expected to augment the demand for golf equipment among individuals.

Key Companies & Market Share Insights

The market is characterized by the presence of a few established players and new entrants. Many big players are increasing their focus on the growing trend of the golf equipment market. Players in the market are diversifying their service offering to maintain market share.

-

In May 2023, the Ladies Professional Golf Association (LPGA) introduced low-cost golf clubs, accessories, and footwear for female beginners and children. Select products will be sold exclusively at Walmart, improving women and girls' access to entry-level golf equipment.

-

In January 2023, Callaway Golf, a pioneer in the design, manufacture, and innovation of golf equipment, has unveiled its new Paradym Family of Woods and Irons. crafted for a total performance shift from an unmatched distance, forgiveness, and entirely new product constructions.

-

In May 2022, Cool Clubs, the world's leader in personalized golf club fitting technology, has introduced SpinLaunch, a new golf equipment testing statistic.

Some of the prominent players operating in the global golf equipment market include:

-

Callaway

-

SRI Sports Limited

-

Acushnet Holding Corp.

-

Taylormade

-

Titleist

-

Clevaland

-

Mizuno

-

Wilson

-

Odyssey

-

Ping

Golf Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.81 billion

Revenue forecast in 2030

USD 11.01 billion

Growth Rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Callaway; SRI Sports Limited; Acushnet Holding Corp.; Taylormade; Titleist; Clevaland; Mizuno; Wilson; Odyssey; Ping

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Golf Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global golf equipment market report based on products, distribution channels,s and regions.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Golf Club

-

Golf Balls

-

Golf Gear

-

Golf Footwear & Apparel

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Sporting Goods Retailer

-

On-course Shops

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global golf equipment market size was estimated at USD 7.48 billion in 2022 and is expected to reach USD 7.81 billion in 2023.

b. The global golf equipment market is expected to grow at a compounded growth rate of 5.0% from 2023 to 2030 to reach USD 11.01 billion by 2030.

b. The golf club segment dominated the global golf equipment market with a share of 45.7% in 2022. Customizable and assorted golf clubs are becoming popular among consumers, which is anticipated to boost the demand for golf clubs over the forecast period.

b. Some of the key players operating in the golf equipment market include Callaway, SRI Sports Limited, Acushnet Holding Corp., Taylormade, Titleist, Cleveland, Mizuno, Wilson, Odyssey, and Ping.

b. Key factors that are driving the golf equipment market growth include rising disposable income, an increase in the number of golf courses, especially in high-income countries, and golf tourism.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.