- Home

- »

- Next Generation Technologies

- »

-

GPS Tracker Market Size & Share, Industry Report, 2030GVR Report cover

![GPS Tracker Market Size, Share, & Trends Report]()

GPS Tracker Market (2025 - 2030) Size, Share, & Trends Analysis Report By Type (Standalone Trackers, OBD Devices), By Component (Hardware, Software, Services), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-607-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

GPS Tracker Market Summary

The global GPS tracker market size was estimated at USD 4.04 billion in 2024 and is projected to reach USD 9.83 billion by 2030, growing at a CAGR of 17.4% from 2025 to 2030, driven by technological advancements, increased demand for asset tracking, and growing concerns around security and safety. One of the primary growth drivers is the increasing adoption of GPS tracking systems in logistics and transportation.

Key Market Trends & Insights

- North America dominated the GPS tracker market and accounted for over 23.0% share in 2024.

- The GPS tracker market in the U.S. is expected to grow significantly at a CAGR of 15.5% from 2025 to 2030.

- By type, the standalone trackers segment dominated the market and accounted for the revenue share of over 30.0% in 2024.

- By component, the hardware segment dominated the market and accounted for the revenue share of over 47.0% in 2024.

- By application, the fleet tracking segment dominated the market and accounted for the revenue share of over 38.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.04 Billion

- 2030 Projected Market Size: USD 9.83 Billion

- CAGR (2025-2030): 17.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the primary growth drivers is the increasing adoption of GPS tracking systems in logistics and transportation. As supply chain visibility becomes a priority, companies leverage GPS trackers to monitor fleets, improve delivery accuracy, and reduce fuel consumption. This is especially relevant in industries where timely delivery and operational efficiency are critical. The rising adoption of e-commerce has further accelerated the need for real-time shipment tracking, pushing logistics providers to invest heavily in GPS tracking solutions. Moreover, businesses across sectors such as construction, mining, and agriculture are implementing GPS tracking to monitor equipment usage, reduce downtime, and prevent theft. Integrating GPS with other technologies like AI, big data, and cloud computing enables predictive maintenance and advanced analytics, adding further value to GPS solutions. As regulatory compliance and environmental concerns grow, companies also turn to GPS tracking to optimize routes and reduce emissions, supporting sustainability goals. These diverse applications and innovations continue making GPS trackers indispensable across multiple industries, sustaining their global market expansion.

GPS trackers are widely used for vehicle theft prevention, monitoring high-value cargo, and ensuring the safety of individuals, such as children, elderly family members, and employees working in remote locations. The integration of advanced technologies such as IoT, AI, and cloud computing has enhanced the functionality of GPS tracking devices, making them more reliable and accessible. This technological evolution has also led to the development of compact, affordable, and user-friendly tracking solutions, broadening their appeal to commercial and consumer markets. For instance, in June 2024, Monimoto, a Lithuanian tech firm, launched the Monimoto 9, a next-gen GPS tracker designed to protect motorcycles, ATVs, trailers, boat engines, and more. The device is built for rugged outdoor use and has a compact, water- and dust-resistant design. It includes a rechargeable battery that lasts up to 12 months, offering reliable, long-term asset protection.

The agricultural sector is undergoing a significant transformation with the integration of digital technologies, particularly precision farming, which is emerging as a major growth driver for the global GPS tracker industry. Precision agriculture involves using advanced tools and technologies to monitor and optimize field-level management regarding crop farming. Among these tools, GPS tracking systems play a central role by enabling real-time location data, geofencing, and route optimization, contributing to smarter, data-driven farm decision-making. GPS trackers are increasingly being adopted to guide autonomous or semi-autonomous agricultural machinery such as tractors, harvesters, and sprayers. This allows for highly accurate field navigation, which minimizes overlap, reduces fuel consumption, and optimizes input usage such as seeds, fertilizers, and pesticides.

Type Insights

The standalone trackers segment dominated the market and accounted for the revenue share of over 30.0% in 2024. The increasing use of personal tracking solutions is a significant segment driver. With growing concerns about the safety of children, elderly individuals, and lone workers, demand is surging for compact standalone GPS trackers that can operate without pairing with a smartphone. These devices often feature SOS buttons, fall detection, and two-way communication, offering peace of mind to families and caregivers. The standalone tracker market for health and personal safety is particularly vibrant in regions with aging populations, such as Japan and parts of Europe.

The advance trackers segment is anticipated to grow at a CAGR of 19.3% during the forecast period due to the rising need for enhanced safety and monitoring solutions, particularly in transportation, defense, and personal safety sectors. Advanced trackers offer additional features such as geo-fencing, tamper alerts, engine diagnostics, and emergency response functionalities, which make them indispensable for managing high-value assets and ensuring driver or personal safety. This has increased adoption among governments, logistics companies, and high-risk industry operators.

Component Insights

The hardware segment dominated the market and accounted for the revenue share of over 47.0% in 2024. The segment is further bifurcated into GPS chips, batteries, display units, and antennas. The continuous evolution of GPS and communication technologies is a major driver for hardware growth. Modern GPS trackers now incorporate multi-constellation GNSS support (GPS, GLONASS, Galileo, BeiDou), enabling higher accuracy and faster signal acquisition even in urban canyons or dense foliage.

The software segment is expected to grow significantly over the forecast period. The segment is further bifurcated into real-time tracking and data analytics software. Advanced Analytics and AI Integration represent GPS tracking software's most significant growth drivers. Modern platforms now incorporate machine learning algorithms that analyze historical and real-time data to predict maintenance needs, optimize routes, and identify risky driving behaviors. These intelligent systems can process vast amounts of data from multiple sources, including weather conditions, traffic patterns, and vehicle diagnostics, to provide comprehensive operational insights.

The services segment is expected to grow significantly over the forecast period. It is further bifurcated into installation, integration, maintenance, and support consulting services. Companies increasingly require professional assistance to deploy complex tracking solutions that integrate with existing fleet management systems, ERP platforms, and IoT ecosystems. The transition to cloud-based tracking solutions has particularly boosted demand for migration services, with many organizations seeking help to move from legacy systems to modern platforms.

Application Insights

The fleet tracking segment dominated the market and accounted for the revenue share of over 38.0% in 2024. Fleet operators are under constant pressure to reduce operational expenses, and GPS tracking solutions provide measurable savings across multiple cost centers. These systems enable fuel savings through optimized routing and reduced idling time, while maintenance costs decrease through predictive maintenance alerts and better service scheduling. The ability to monitor harsh driving behaviors like rapid acceleration and hard braking further contributes to lower vehicle wear-and-tear expenses.

The asset tracking segment is expected to grow at a significant CAGR over the forecast period, owing to the increasing value of mobile and remote assets, particularly in logistics, construction, agriculture, and oil & gas sectors. Businesses are increasingly investing in GPS-enabled asset tracking solutions to monitor the real-time location, movement, and usage patterns of valuable equipment, vehicles, and containers, helping reduce theft, loss, and unauthorized use.

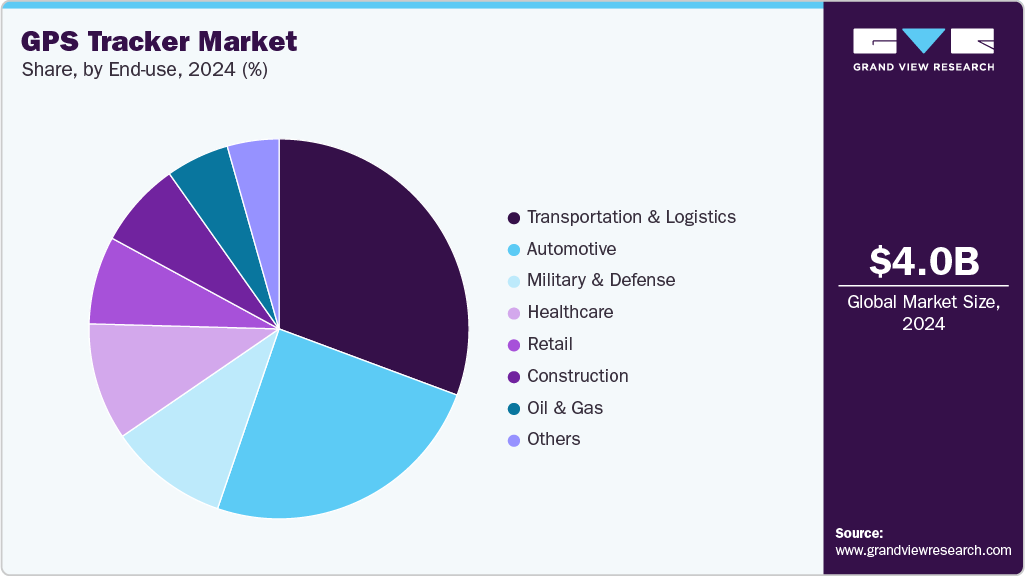

End Use Insights

The transportation & logistics segment dominated the market and accounted for the revenue share of nearly 30.0% in 2024, driven by the need for enhanced operational efficiency, supply chain visibility, and real-time fleet monitoring. As global trade volumes rise and e-commerce continues to accelerate, logistics service providers are under pressure to deliver faster, safer, and more reliable services, making GPS tracking a critical component of modern fleet management. Moreover, GPS trackers allow logistics companies to monitor the exact location of their vehicles, optimize delivery routes, and provide accurate estimated time of arrival (ETA) to customers.

The military & defense segment is expected to grow at a significant CAGR over the forecast period. Armed forces and defense agencies across the world are heavily investing in GPS tracking technologies to enhance situational awareness, improve operational efficiency, and ensure the security of personnel and assets in both peacetime and combat environments. The growing importance of real-time intelligence, surveillance, and reconnaissance (ISR) in modern warfare is significantly driving demand for robust, secure GPS tracking systems.

Regional Insights

North America dominated the GPS tracker market and accounted for over 23.0% share in 2024, driven by the region’s strong technological infrastructure, early adoption of telematics, and increasing demand across multiple industries such as transportation, logistics, automotive, healthcare, and defense. A major growth driver is the expanding logistics and fleet management industry, where GPS trackers are essential for real-time vehicle monitoring, route optimization, and fuel efficiency improvements.

U.S. GPS Tracker Market Trends

The GPS tracker market in the U.S. is expected to grow significantly at a CAGR of 15.5% from 2025 to 2030, owing to the widespread adoption of fleet management systems across logistics, transportation, construction, and public services. U.S.-based logistics firms and delivery providers are under constant pressure to increase operational efficiency, reduce costs, and comply with federal mandates, such as the Electronic Logging Device (ELD) rule, which has fueled demand for GPS-enabled vehicle tracking systems. These trackers help businesses monitor driver behavior, optimize routes, and ensure regulatory compliance, making them essential tools in day-to-day operations.

Europe GPS Tracker Market Trends

The GPS tracker market in Europe is anticipated to grow considerably from 2025 to 2030. Regulations such as the EU Mobility Package and tachograph directives require transport operators to implement digital solutions, including GPS trackers for route compliance, driver monitoring, and working hour tracking, thereby significantly driving market demand.

The UK GPS tracker market is expected to grow rapidly in the coming years, driven by increased investment in intelligent transport systems (ITS) and the government’s commitment to modernizing public infrastructure. The push toward smart mobility solutions, including congestion reduction initiatives and clean air zones in cities, has led to the widespread adoption of GPS tracking in public transport, taxis, and shared mobility services.

The GPS tracker market in Germany held a substantial market share in 2024. The rise of Industry 4.0 and automation in manufacturing is creating demand for GPS-enabled asset tracking to monitor mobile equipment and optimize inventory management across large industrial campuses and logistics centers. Germany's role as a major automotive hub also drives the integration of GPS tracking in vehicle diagnostics, predictive maintenance, and remote immobilization systems.

Asia Pacific GPS Tracker Market Trends

The GPS tracker market in Asia Pacific is expected to be the fastest-growing, with a CAGR of 19.3% from 2025 to 2030. This growth is fueled by rapid urbanization, rising smartphone penetration, and booming e-commerce logistics, particularly in Southeast Asia and India. The region’s growing informal and SME-dominated transport sector increasingly turns to affordable GPS tracker solutions to enhance route efficiency, reduce fuel costs, and improve delivery precision without large IT investments.

The Japan GPS tracker market is expected to grow rapidly in the coming years. Given its exposure to earthquakes and tsunamis, Japan’s proactive approach to disaster preparedness and emergency management is driving the use of GPS trackers for monitoring emergency vehicles, coordinating evacuation plans, and maintaining communication continuity during crises.

The GPS tracker market in China held a substantial market share in 2024, fueled by the country’s massive logistics and express delivery industry, which leads the world in parcel volume. The government’s focus on digital transportation and national vehicle tracking regulations, especially for commercial vehicles and hazardous materials, accelerates the adoption of GPS devices across fleets. China’s investment in autonomous driving and smart highways is also a major driver, as GPS tracking forms the foundation for real-time positioning, vehicle-to-infrastructure communication, and traffic optimization.

Key GPS Tracker Company Insights

Key players in the GPS tracker industry are Garmin Ltd., Geotab Inc., Verizon Connect, Trimble Inc., and TomTom International BV. These companies focus on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key GPS Tracker Companies:

The following are the leading companies in the GPS tracker market. These companies collectively hold the largest market share and dictate industry trends.

- ATrack Technology Inc.

- Broadcom

- Collins Aerospace

- Garmin Ltd.

- Geotab Inc.

- Hexagon AB

- MiTAC Holdings Corp

- Orbcomm Inc.

- Qualcomm Technologies, Inc.

- Shenzhen Concox Information Technology Co., Ltd.

- Sierra Wireless, Inc.

- Texas Instruments Incorporated

- TomTom International BV

- Trimble Inc.

- Verizon Connect

Recent Developments

-

In March 2025, Xona Space Systems announced a new partnership with Trimble Inc. to integrate Trimble's correction services with Xona's PULSAR, a high-performance navigation service. The collaboration aims to deliver secure, high-precision positioning for a range of applications, including geospatial, low-power mobile, and IoT. Initial satellite launches are slated for late 2026, with service expected to begin in 2027 via the PULSAR satellite network.

-

In January 2025, Garmin launched its new Montana series of handheld GPS navigators, which includes the Montana 710, 710i, and 760i models. These devices feature 5-inch color touchscreen displays that are glove-friendly and built for durability, making them ideal for outdoor activities such as hiking, mountain biking, and off-road riding. The Montana series offers versatile mounting options for ATVs, boats, cars, motorcycles, and RVs, allowing users to take them on various vehicles. Preloaded with TopoActive maps, the devices provide detailed information on terrain, elevations, coastlines, rivers, and landmarks, ensuring reliable guidance for all adventures.

-

In December 2024, Geotab Inc. announced a strategic partnership with Aerotrans, an Indonesia-based transportation company, to improve operational efficiency and support sustainability objectives. Using Geotab's advanced telematics platform, Aerotrans aims to gain real-time access to key fleet data, including vehicle performance, driving behavior, fuel efficiency, and maintenance trends. These insights will help optimize fleet management, reduce costs, enhance safety, and drive data-driven decision-making for improved operational performance.

GPS Tracker Report Scope

Report Attribute

Details

Market size in 2025

USD 4.41 billion

Revenue forecast in 2030

USD 9.83 billion

Growth rate

CAGR of 17.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, component, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

ATrack Technology Inc.; Broadcom; Collins Aerospace; Garmin Ltd.; Geotab Inc.; Hexagon AB; MiTAC Holdings Corp; Orbcomm Inc.; Qualcomm Technologies, Inc.; Shenzhen Concox Information Technology Co., Ltd.; Sierra Wireless, Inc.; Texas Instruments Incorporated; TomTom International BV; Trimble Inc.; Verizon Connect

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global GPS Tracker Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the GPS tracker market report based on type, component, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Standalone Trackers

-

OBD Devices

-

Advance Trackers

-

Data Loggers

-

Data Pushers

-

Data Pullers

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

GPS Chips

-

Batteries

-

Display Units

-

Antennas

-

-

Software

-

Real-Time Tracking Software

-

Data Analytics Software

-

-

Services

-

Installation & Integration

-

Maintenance & Support

-

Consulting Services

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Tracking

-

Commercial Tracking

-

Asset Tracking

-

Fleet Tracking

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Transportation & Logistics

-

Automotive

-

Healthcare

-

Retail

-

Construction

-

Military & Defense

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global GPS tracker market size was estimated at USD 4.04 billion in 2024 and is expected to reach USD 4.41 billion in 2025

b. The global GPS tracker market is expected to grow at a compound annual growth rate of 17.4% from 2025 to 2030 to reach USD 9.83 billion by 2030

b. The hardware segment dominated the market and accounted for the revenue share of over 47.0% in 2024. The segment is further bifurcated into GPS chips, batteries, display units, and antennas. The continuous evolution of GPS and communication technologies is a major driver for hardware growth.

b. Some key players operating in the GPS tracker market include ATrack Technology Inc., Broadcom, Collins Aerospace, Garmin Ltd., Geotab Inc., Hexagon AB, MiTAC Holdings Corp, Orbcomm Inc., Qualcomm Technologies, Inc., Shenzhen Concox Information Technology Co., Ltd., Sierra Wireless, Inc., Texas Instruments Incorporated, TomTom International BV, Trimble Inc., Verizon Connect

b. Factors such as the increasing adoption of GPS tracking systems in logistics and transportation are anticipated to accelerate the market growth. As supply chain visibility becomes a priority, companies leverage GPS trackers to monitor fleets, improve delivery accuracy, and reduce fuel consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.