- Home

- »

- Advanced Interior Materials

- »

-

Granite Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Granite Market Size, Share & Trends Report]()

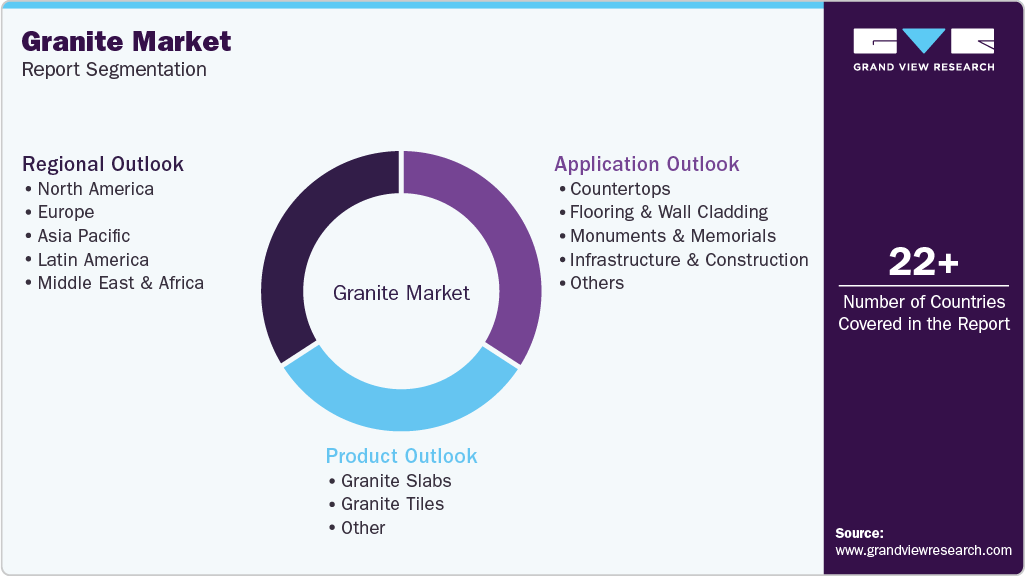

Granite Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Granite Slabs, Granite Tiles), By Application (Countertops, Flooring & Wall Cladding, Monuments & Memorials, Infrastructure & Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-632-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Granite Market Summary

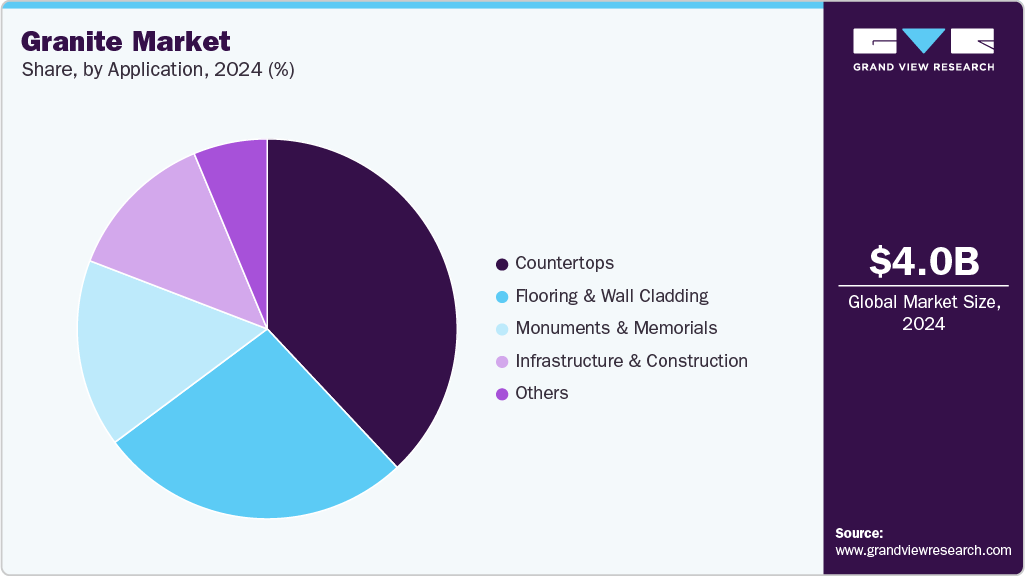

The global granite market size was estimated at USD 4.03 billion in 2024 and is projected to reach USD 6.42 billion by 2033, growing at a CAGR of 5.4% from 2025 to 2033. Increasing investments in infrastructure development and the expansion of the construction industry are expected to drive the market's growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the granite market with a revenue share of 51.4% in 2024.

- U.S. dominated the North America granite market’s revenue share of over 70.0% in 2024.

- By product, granite slabs dominated the market with a revenue share of over 54.0% in 2024.

- By application, the countertops segment held the largest share of over 38.0% of granite revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.03 Billion

- 2033 Projected Market Size: USD 6.42 Billion

- CAGR (2025-2033): 5.4%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

Due to its exceptional durability, aesthetic appeal, and resistance to weathering, granite is extensively used in the construction of commercial buildings, residential complexes, and public infrastructure such as bridges, pavements, and monuments. Granite slabs account for the largest share of the market due to their exceptional strength, long-lasting durability, and natural aesthetic appeal. Their wide availability in diverse colors, patterns, and finishes makes them a preferred choice for various architectural and structural applications. Whether used indoors or outdoors, granite slabs are favored in residential, commercial, and public projects for premium installations such as flooring, kitchen countertops, building facades, and memorial structures, areas where both durability and visual impact are essential.The growing complexity and scale of construction, especially in high-rise developments, urban infrastructure, and upscale real estate, further propels the demand for granite slabs. Their resistance to extreme weather conditions, heavy loads, and environmental wear makes them especially suitable for demanding applications such as pavements, bridges, railway platforms, and heavily trafficked public areas. In a market increasingly driven by sustainability, granite is gaining traction as a natural, eco-friendly material with a long service life and minimal maintenance needs, outpacing many synthetic substitutes.

Moreover, advances in fabrication and surface treatment technologies have enhanced its design versatility, enabling architects and designers to incorporate it into contemporary projects with greater precision and creativity. Its combination of functional resilience and timeless beauty ensures its continued relevance in shaping modern architecture and luxurious interiors. As the construction industry leans toward high-quality, sustainable, and visually distinct materials, slabs remain foundational, reinforcing their leading position in the market.

Drivers, Opportunities & Restraints

The growth of the granite industry is primarily driven by rapid urbanization, rising disposable incomes, and the increasing demand for durable and aesthetically pleasing building materials. As residential and commercial construction expands globally, particularly in emerging economies like India, Brazil, and Southeast Asia, the demand for natural stone products such as granite has surged. Additionally, government investments in infrastructure development, including airports, highways, public buildings, and smart cities, have significantly boosted the consumption of its large-scale projects. The rising popularity of premium interior design trends and their use in kitchens, bathrooms, and high-end flooring applications further fuels market growth.

There are substantial market growth opportunities through technological innovation and value-added product offerings. Integrating digital tools such as CNC cutting machines and 3D stone carving allows for more intricate designs and customization, appealing to modern architects and designers. Moreover, increasing adoption of granite in sustainable construction practices, due to its long lifespan and natural composition, presents a unique opportunity for eco-conscious developments. The growing hospitality sector, particularly in regions like the Middle East, Africa, and Southeast Asia, also provides a strong avenue for demand, especially for granite-based luxury decor and architectural finishes. Export opportunities are also expanding for countries with abundant reserves, such as India and Brazil, as global construction and renovation trends shift toward natural and exotic stones.

One of the significant challenges is the high cost of quarrying, transportation, and finishing granite, which makes it less accessible for low-budget projects. Environmental regulations and concerns over land degradation and carbon emissions from quarrying operations have led to stricter policies, slowing down production in certain regions. Additionally, the increasing popularity of engineered stones and alternative surfacing materials like quartz, porcelain, and ceramics, offering similar aesthetics with easier maintenance and lower costs, is creating stiff competition. Labor-intensive extraction processes and supply chain disruptions due to geopolitical issues or transportation limitations can hamper market stability and timely delivery.

Product Insights

Granite Slabs are the most dominant product segment in the market. These large, polished stone pieces are commonly used in high-end applications such as kitchen countertops, bathroom vanities, flooring, and wall cladding. The appeal lies in their aesthetic finish, seamless appearance, and structural strength. Slabs are especially valued for their heat resistance, scratch resistance, and non-porous surface when appropriately sealed, making them ideal for spaces exposed to heat and moisture. Their large size enables continuous, grout-free surfaces, which are both visually appealing and hygienic, key reasons for their preference in luxury homes, hotels, and premium office interiors.

Tiles serve as a more affordable and flexible alternative to slabs. These smaller, pre-cut tiles are easier to transport, install, and replace. They are widely used in residential and commercial applications, especially for flooring, bathrooms, and walls. Granite tiles offer a range of finishes, including polished, flamed, and honed, catering to functional and decorative purposes. Due to their anti-skid and easy-maintenance properties, they are ideal for high-footfall areas like lobbies, corridors, and kitchens. Their versatility and cost-efficiency make them popular in mid-range construction and renovation projects.

Application Insights

Countertops, particularly in kitchens and bathrooms, are one of the most popular uses of granite. The natural stone is highly favored in this segment due to its non-porous nature, resistance to heat and acid, and ability to resist scratches and stains. These properties make it ideal for food preparation areas and spaces exposed to moisture. Additionally, the wide variety of colors and grain patterns available in slabs allows homeowners and designers to match them with various interior themes, adding elegance and functionality simultaneously.

Infrastructure and construction are a rapidly growing segment, driven by global investments in public works. Granite is used in constructing bridges, railway platforms, airport terminals, curbstones, and building facades. The stone’s strength, low maintenance requirements, and resistance to environmental stress (like extreme heat, cold, and pollution) make it suitable for demanding infrastructure applications. Its durability makes it cost-effective over the long term, despite its higher initial installation cost.

Flooring and wall cladding form another primary application, especially in commercial buildings, luxury residences, and public spaces. Their durability under heavy foot traffic, moisture resistance, and availability in various finishes make them a practical and attractive option for flooring. It is particularly effective in hallways, entrances, hotel lobbies, and shopping malls. When used on walls, it enhances the aesthetics and adds a sense of permanence and luxury, often seen in institutional buildings and high-end interiors.

Regional Insights

North America remains a significant market driven by robust construction activity, urban redevelopment, and infrastructure investments across the United States and Canada. The U.S. dominates regional demand due to the widespread use of slabs in high-end residential and commercial projects. It is preferred for kitchen countertops, flooring, and wall cladding in upscale housing developments and renovation projects, especially in cities with aging infrastructure. Public infrastructure spending, such as the Biden administration’s focus on roads, public spaces, and government buildings, has increased the use of granite in pavements, monuments, and building facades.

U.S. Granite Market Trends

The U.S. granite market is driven by strong demand from the residential, commercial, and infrastructure sectors, making it the largest market in North America. Granite slabs are especially popular in upscale kitchen countertops, flooring, and wall applications due to their durability and natural elegance. With increasing investments in public infrastructure, including transport terminals, government buildings, and urban landscaping, it is widely used for pavements, facades, and monuments. The trend toward sustainable construction and premium interior design continues to boost the use of natural stone materials, while ongoing renovations and real estate developments further support granite consumption across key states like Texas, California, and New York.

Asia Pacific Granite Market Trends

Asia Pacific is the fastest-growing region in the market, driven by rapid urbanization, growing middle-class incomes, and large-scale infrastructure development across India, China, and Southeast Asia. Countries like India, one of the largest producers and exporters of slabs and tiles, have seen strong domestic and international demand. The use of granite tiles in mid-to large-scale residential housing and public sector projects, such as airports, railways, and government buildings, is accelerating. China’s real estate and urban development sectors also continue to utilize it for structural and decorative purposes in commercial and cultural landmarks. The rise in commercial construction and luxury tourism infrastructure, including hotels and malls, further supports regional market growth. The availability of cost-effective labor and vast natural reserves also helps Asia Pacific become a major supplier globally.

Europe Granite Market Trends

Architectural heritage preservation, sustainable construction standards, and demand for high-quality natural materials shape the Europe granite market. Countries such as Germany, France, Italy, and the UK emphasize using it in monuments, memorials, and historic restorations, given the stone’s long-lasting aesthetic and resistance to weathering. Slabs and cut-to-size products are widely used in public infrastructure, especially in urban planning projects, paving, and outdoor landscaping. The region also values locally sourced and eco-certified materials, which align well with its natural origin and low-maintenance profile. European architects often integrate green building designs, blending sustainability with luxury appeal.

Key Granite Company Insights

Some of the key players operating in the market include Able Group Berhad, Arizona Tile, Levantina, and Dakota Granite.

-

Able Group Berhad is a Malaysia-based company that processes, trades, and exports natural stones, including granite and marble. The company also undertakes installation and contracting for stone-related architectural works. Its vertically integrated operations cover quarrying, manufacturing, and property development. Able supplies materials to high-end residential, commercial, and infrastructure projects across Southeast Asia.

-

Founded in 1977, Arizona Tile is one of the largest independent stone and tile distributors in the United States. It offers over 230 varieties of granite, quartzite, marble, and other stones, as well as porcelain and ceramic tiles. Arizona Tile serves residential and commercial projects through showrooms and slab yards across multiple U.S. states.

-

Levantina is a global leader in natural stone production and distribution based in Spain. The company operates quarries in Spain and Brazil, producing granite, marble, and the popular sintered stone product Techlam. Levantina serves the construction, interior design, and architectural sectors worldwide.

-

Dakota Granite Company is a U.S.-based quarrier and fabricator of natural granite, known primarily for its signature Dakota Mahogany™. The company offers quarry blocks, slabs, memorials, and architectural products for domestic and international markets. It is vertically integrated with extraction, fabrication, and custom finishing capabilities.

Key Granite Companies:

The following are the leading companies in the granite market. These companies collectively hold the largest market share and dictate industry trends.

- Able Group Berhad

- American Marazzi Tile Inc.

- Arizona Tile

- Cambria

- Craig Baker Marble Co., Inc.

- Dakota Granite Company

- Granite Tops (Precision Tops)

- Levantina

- Precision Countertops

- Vangura Surfacing Products

Recent Developments

-

In January 2025, Able Group Berhad announced its continued investment in expanding processing capacity to support rising demand across Southeast Asia’s infrastructure and high-end residential sectors. The company highlighted its plans to strengthen in-house fabrication capabilities to reduce outsourcing costs and maintain competitive pricing. Subsequently, in March 2025, Able Group revealed upgrades to its Johor processing facility, including installing advanced stone-cutting and polishing machinery.

-

Arizona Tile continued to grow its U.S. presence by opening a new 60,000 sq ft showroom and distribution warehouse in Roseville, California, in June 2025. This facility marks a significant expansion in Northern California, offering access to over 130 natural stone varieties and 40+ porcelain and ceramic tile series. Earlier in the year, in February 2025, the company introduced a new line of granite products featuring anti-slip surface technology and quartz-infused options aimed at high-traffic commercial and outdoor applications.

-

In February 2025, Levantina Group finalized the sale of its O Porriño granite processing facility in Spain to Marcelino Group. The transaction followed extensive negotiations surrounding an employment restructuring process (ERE), ensuring continuity of granite operations under new management. This strategic move is part of Levantina’s broader effort to optimize its asset portfolio. Additionally, in April 2025, the company actively participated in Coverings 2025, a leading international stone and tile expo held in Orlando, Florida.

-

Dakota Granite Company entered 2025 with stable demand for its iconic Dakota Mahogany™ granite, particularly within North America's architectural and memorial segments. In January 2025, the company reported continued full-capacity operations, citing strong project pipelines in domestic public infrastructure and custom memorial orders. To support its expanding design offerings, Dakota Granite invested in new 5-axis CNC cutting equipment in May 2025, enhancing the precision and customization of architectural granite elements.

Granite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.22 billion

Revenue forecast in 2033

USD 6.42 billion

Growth rate

CAGR of 5.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France.; Italy; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Able Group Berhad; American Marazzi Tile Inc.; Arizona Tile; Cambria; Craig Baker Marble Co. Inc.; Dakota Granite Company; Precision Tops; Levantina; Precision Countertops; Vangura Surfacing Products

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Granite Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels from 2021 to 2033 and analyzes the latest trends in each sub-segment. For this study, Grand View Research has segmented the global granite market report by product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

Granite Slabs

-

Granite Tiles

-

Other

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

Countertops

-

Flooring & Wall Cladding

-

Monuments & Memorials

-

Infrastructure & Construction

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global granite market size was estimated at USD 4.03 billion in 2024 and is expected to reach USD 4.22 billion in 2025.

b. The global granite market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2033, reaching USD 6.42 billion by 2033.

b. By product, granite slabs dominated the market with a revenue share of over 53.0% in 2024.

b. Some of the key vendors in the global granite market are Able Group Berhad, American Marazzi Tile Inc., Arizona Tile, Cambria, Craig Baker Marble Co. Inc., Dakota Granite Company, Precision Tops, Levantina, Precision Countertops, and Vangura Surfacing Products.

b. The growth of the granite market is primarily driven by rapid urbanization, rising disposable incomes, and the increasing demand for durable and aesthetically pleasing building materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.