- Home

- »

- Advanced Interior Materials

- »

-

Graphene Market Size, Share, Trends & Growth Report 2030GVR Report cover

![Graphene Market Size, Share & Trends Report]()

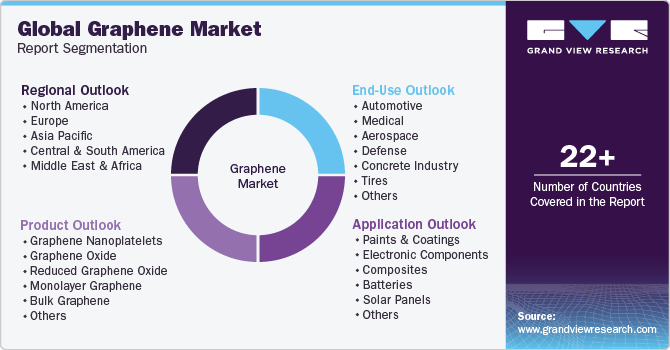

Graphene Market Size, Share & Trends Analysis Report By Product (Graphene Nanoplatelets, Graphene Oxide), By Application (Paints & Coatings, Electronic Components), By End-Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-788-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Graphene Market Size & Trends

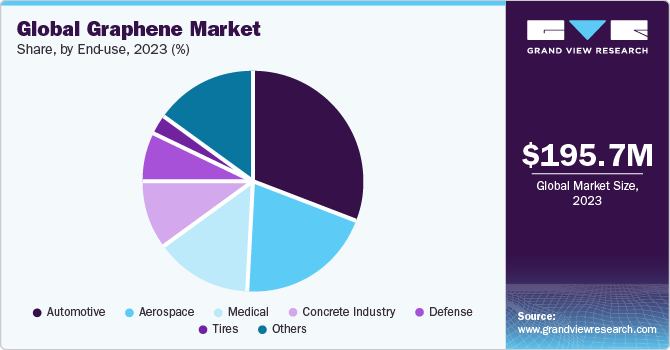

The global graphene market size was valued at USD 195.7 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 35.1% from 2024 to 2030. The growth of the market can be attributed to growing electronics industry in emerging economies and the high penetration of graphene in composite applications. The market is also expected to witness significant growth on account of increasing demand from research institutes and multinational companies for research and development.

Prominent players such as Talga Group, Inc.; Directa Plus S.p.A.; NanoXplore Inc.; and HAYDALE GRAPHENE INDUSTRIES PLC are investing significantly in research and development. These companies are working to make it more accessible for end-use industries.

Electronics industry is one of the key drivers for the market. The product finds application in various products of electronics industry such as batteries, capacitors, solar cells, computers, microchips, smartphones, and laptops. It is highly preferred in electronics owing to its exceptional properties including electrical conductivity, thermal conductivity, lightweight, and mechanical resilience, which make it capable of handling high voltages. These properties have made it an extremely important material in electronics industry, and it is expected to be a drop-in replacement for carbon nanotubes and silicon in various applications.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. Graphene market is characterized by a high degree of innovation owing to rising advancements driven by factors including research and development. Subsequently, innovative applications are constantly emerging, disrupting existing industries and creating new ones.

Graphene is a single layer of carbon atoms arranged in a hexagonal lattice, forming a two-dimensional structure. It is known for its exceptional properties, including high conductivity, mechanical strength, and flexibility. Its unique properties make it suitable for a wide range of applications, including electronics, energy storage, composites, sensors, and medical devices. Common production methods include mechanical exfoliation, chemical vapor deposition, and liquid-phase exfoliation. Ongoing research aims to enhance production efficiency, scalability, and cost-effectiveness. Innovations in production methods contribute to the widespread adoption of graphene-based materials.

The market operates within a complex regulatory landscape that encompasses environmental, health, and safety considerations. Regulatory bodies at both national and international levels play a crucial role in overseeing the production, handling, and application of graphene materials. These stringent regulations ensure the responsible development and use, addressing concerns related to environmental impact and potential health hazards. Compliance with these regulations is expected to benefits the market players to gain competitive advantage over its competitors.

Graphene and its applied products exhibit tremendous application potential in biomedical technologies, energy storage, composites & coatings, and water & wastewater treatment industries. Energy storage industry is anticipated to be one of the key forces driving adoption in future. Graphene-based batteries exhibit superior rate and energy capacity compared to traditional lithium-ion batteries. Thus, growing demand for energy storage products by electric vehicles, wind power, and solar energy sectors is expected to provide a major boost to research over the forecast period.

Product Insights

Graphene oxide dominated the market and accounted for a revenue share of 47.0% in 2023. It is an oxidized form of graphene with a large surface area and can be used as electrode material for capacitors, batteries, and solar cells. It is used with different polymers and materials to enhance the properties of composite materials, such as elasticity, conductivity, and tensile strength. It exists in the form of flakes attached to form a stable, thin structure that can be stretched, folded, and wrinkled. These structures are increasingly used in applications like ion conductors, hydrogen storage, and nanofiltration membranes.

In addition, graphene oxide is fluorescent, which makes it suitable for applications in bio-sensing and disease detection, antibacterial materials, and drug carriers. In addition, many electronic devices are fabricated using graphene oxide, such as graphene-based field effect transistors (GFET). Rising usage of graphene oxide in various end-use industries is anticipated to fuel the market’s demand.

Application Insights

Electronic component applications accounted for the largest market revenue share in 2023. This is attributable to its high permeability and strength, as well as lightweight. Properties such as thinness and conductivity, have led to its surged use in the development of semiconductors. Graphene-based devices have low manufacturing costs. As such, they are increasingly used in IoT networks, wearable healthcare monitoring systems, electric vehicles, etc.

Composite application is expected to register the fastest CAGR during the forecast period. Graphene-based composites are used in the construction, aerospace, and automotive industries, as well as in coatings, metals, and plastics. A majority of the near-term demand for comes from composite manufacturers. It is because graphene is being marketed as a replacement for carbon nanotubes owing to its ease of handling and enhanced capabilities. Graphene exhibits superior properties such as strength, flexibility, lightweight, and conductivity.

Composites are developed by harnessing the compatibility potential of graphene with existing products. Graphene is increasingly used as an additive in resin matrices and other materials to improve their mechanical properties such as thermal and electrical conductivity, durability, stiffness, flexibility, and fire and UV resistance. These factors are anticipated to fuel the demand for composites in the coming years.

End-Use Insights

The automotive end-use segment dominated the market in 2023. The automotive industry is one of the fastest-developing industries in the world. The growth of this industry can be attributed to the rising disposable income and increasing purchasing power of the middle-income population in emerging economies. As the global automotive industry is projected to grow in the coming years, the demand for graphene and products based on it is also expected to surge rapidly during the forecast period.

The global medical industry is one of the most significant consumers of graphene in the world as it has emerged as an innovative material in this industry owing to its potential to treat severe diseases such as cancer. Patients are injected with graphene particles that have been chemically altered to adhere to cancer cells. As this substance absorbs infrared light, radiation used to treat the tumor targets the damaged cells directly, sparing the rest of body and minimizing side effects for cancer patients. This in turn is expected to increase its usage in medical industry.

Regional Insights

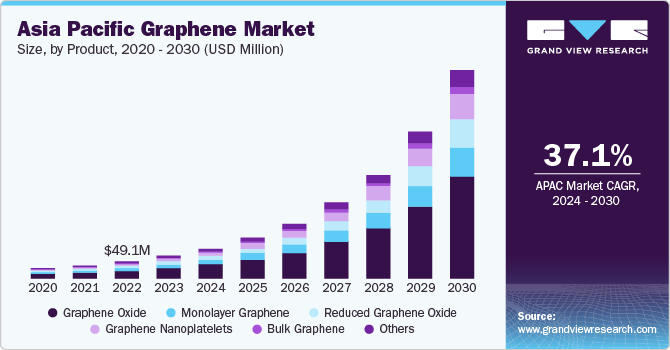

Asia Pacific dominated the market and accounted for a 32.9% share in 2023. Asia Pacific is one of the critical demand determining factors for the graphene owing to the presence of a large number of manufacturers and consumers. Increasing production volumes in various sectors including automobile, marine, defense, and aerospace are expected to drive the graphene industry in this region over the forecast period. China is expected to emerge as a prominent market over the forecast period due to favorable government support to promote investments in the manufacturing sector. The government has put forward strong policies to ensure support for graphene research and development.

North America is expected to witness significant growth in the composites sector owing to the rising demand from aircraft manufacturing and automobile industries. Large-scale aircraft manufacturers including Boeing are focusing on lightweight composite materials such as graphene to improve the efficiency and performance of their aircraft. The U.S. is the largest market in North America and one of the key exporters of graphene-based products to various countries that lack graphene production capabilities. The market has witnessed numerous collaborations among manufacturers and research institutions over the past few years owing to the increasing focus on research & development activities. The increasing end-use applications with the continuous advancements is further expected to boost the demand.

Key Companies & Market Share Insights

Some of the key players operating in the market include Nanoxplore Inc.; Telga Group, and Directa Plus S.p.A.

-

Nanoxplore Inc. is engaged in the manufacturing and distribution of graphene powder for use in various industrial markets. It offers customized and standard graphene-enhanced plastics and composites products for targeted industries such as transportation & automotive, energy storage & batteries, tires & rubbers, paints & coatings, electronic enclosure, and consumer packaging.

-

Talga Group is involved in the development of advanced materials, technology, and green graphite battery anode products that will contribute to a sustainable future.

Graphene Laboratories, Inc., GRAPHENE SQUARE INC, and ACS Material are some of the emerging market participants in the graphene market.

-

ACS Material is engaged in the production and development of advanced nanomaterials including graphene. It offers high-quality nanomaterial products and technical or service proposals for several industries such as ThermoFisher Scientific, 3M, Boeing, IBM, Bose, and Sandia National Laboratories.

-

Graphene Laboratories, Inc is a subsidiary of G6 Materials and is involved in the manufacturing of graphene-related products such as chemical vapor deposition graphene and graphene oxide. Furthermore, the company also provides customized graphene products as per the demand from industrial composites market.

Key Graphene Companies:

- Applied Graphene Materials

- 2D Carbon Graphene Material Co., Ltd.

- Thomas Swan & Co. Ltd.

- Graphene Laboratories, Inc.

- Graphensic AB

- GRAPHENE SQUARE INC

- AMO GmbH

- Talga Group

- ACS Material

- BGT Materials Limited, Ltd.

- CVD Equipment Corporation

- Directa Plus S.p.A.

- Grafoid Inc

- Graphenea

- NanoXplore Inc.

- HAYDALE GRAPHENE INDUSTRIES PLC

- Zentek Ltd.

Recent Developments

-

In July 2022, Thomas Swan signed an agreement with Concrene Ltd. Thomas Swan planned to use graphene nanoplatelets in various concrete dispersion handled by Concrene Ltd. to produce high-compressive strength concrete. The agreement was aimed at expanding the Thomas Swan product application base further on a global scale.

-

In May 2022, Imkemex (based in Mumbai, India) and Applied Graphene Materials initiated an exclusive distribution agreement. With this new alliance, AGM hopes to directly extend its commercial reach to the liquid resins, coatings, composites, and polymers industries in the region.

Graphene Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 256.7 million

Revenue forecast in 2030

USD 1,609.3 million

Growth Rate

CAGR of 35.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in (Tons), Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, End-Use, and Region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; Japan; India; Brazil

Key companies profiled

Applied Graphene Materials; 2D Carbon Graphene Material Co., Ltd.; Thomas Swan & Co. Ltd.; Graphene Laboratories, Inc.; Graphensic AB; GRAPHENE SQUARE INC; AMO GmbH; Talga Group; ACS Material; BGT Materials Limited, Ltd.; CVD Equipment Corporation; Directa Plus S.p.A.; Grafoid Inc; Graphenea; NanoXplore Inc.; HAYDALE GRAPHENE INDUSTRIES PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphene Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphene market report based on solution, technology, end-use, and region.

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Graphene Nanoplatelets

-

Graphene Oxide

-

Reduced Graphene Oxide

-

Monolayer Graphene

-

Bulk Graphene

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Electronic Components

-

Composites

-

Batteries

-

Solar Panels

-

Others

-

-

End-Use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Aerospace

-

Defense

-

Concrete Industry

-

Tires

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global graphene market size was estimated at USD 195.7 million in 2023 and is expected to reach USD 256.7 million in 2024.

b. The global graphene market is expected to grow at a compound annual growth rate of 35.1% from 2024 to 2030 to reach USD 1609.3 million by 2030.

b. The graphene oxide dominated the market with the volume share of 46.9% in 2023 owing to the rising penetration of the product in wide range of applications coupled with the possibility of large quantity production.

b. Some of the key players operating in the graphene market include ACS Material, LLC, BGT Materials Ltd., CVD Equipment Corp., Directa Plus SpA, Grafoid Inc., Graphenea, Graphene Laboratories, Inc., NanoXplore, Inc., Thomas Swan & Co. Ltd., 2D Carbon Graphene Material Co., Ltd.

b. The key factors that are driving the graphene market includes increasing application of the product in various end use industries such as automotive, construction, electronics, energy storage and coatings.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."