- Home

- »

- Advanced Interior Materials

- »

-

Graphic Paper Market Size And Share, Industry Report, 2030GVR Report cover

![Graphic Paper Market Size, Share & Trends Report]()

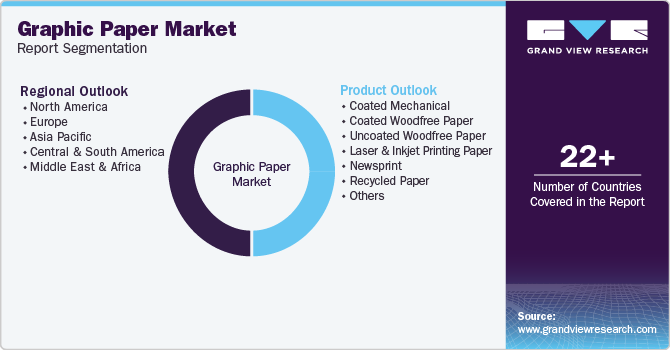

Graphic Paper Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Coated Mechanical, Coated Woodfree Paper, Uncoated Woodfree Paper, Newsprint), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-506-6

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 – 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Graphic Paper Market Summary

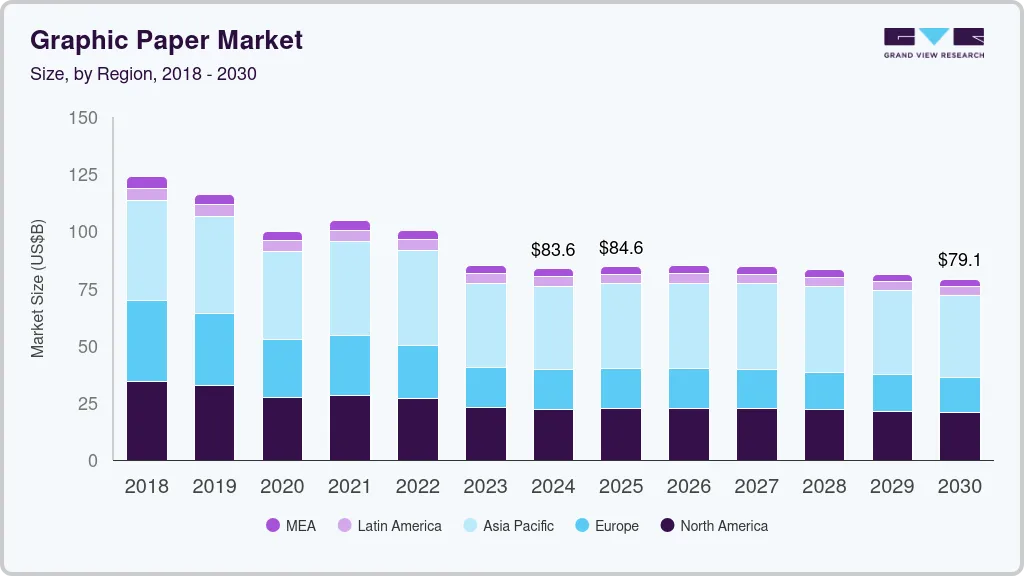

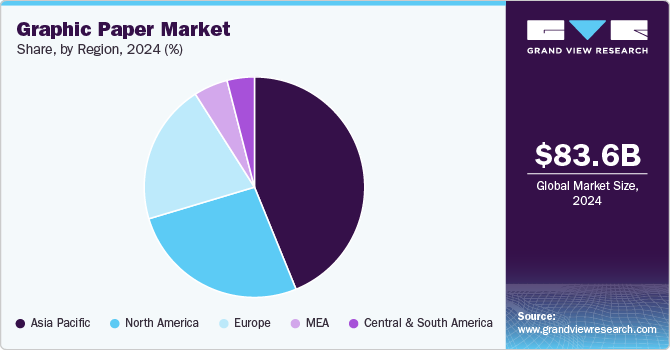

The global graphic paper market size was estimated at USD 83.6 billion in 2024 and is projected to reach USD 79.1 billion by 2030, declining at a CAGR of -1.3% from 2025 to 2030. The graphic paper industry faces significant restraints due to the ongoing digital transformation, which has reduced the demand for traditional print media such as newspapers, magazines, and office paper.

Key Market Trends & Insights

- Asia Pacific dominated the graphic paper market with the largest revenue share of 43.8% in 2024.

- The India graphic paper market accounted for revenue of 29.1% in 2024 and is projected to experience at a gradual decline in CAGR during the forecast period.

- By product, the uncoated woodfree paper segment led the market with the largest revenue share of 26.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 83.6 Billion

- 2030 Projected Market Size: USD 79.1 Billion

- CAGR (2025-2030): -1.3%

- Asia Pacific: Largest market in 2024

The shift towards digital communication, advertising, and media consumption has led to a consistent decline in the use of graphic paper, particularly in developed markets. Businesses and individuals increasingly rely on digital formats, reducing their dependence on printed materials and contributing to the market's shrinking consumer base. This trend is especially pronounced in sectors like publishing and corporate communication, where digital alternatives offer cost savings and convenience.

Fluctuating raw material prices, especially for wood pulp, further negatively affect the graphic paper industry. Rising production costs, driven by raw material shortages and increasing energy prices, make it challenging for manufacturers to maintain competitive pricing. In addition, strict environmental regulations in regions like Europe and North America have increased compliance costs, requiring companies to adopt sustainable practices, invest in energy-efficient processes, and source eco-friendly raw materials. These added costs can erode profit margins and hinder the market's growth.

Moreover, the industry’s reliance on large-scale infrastructure and machinery demands significant capital investments. As demand for graphic paper declines, manufacturers face underutilized production capacities and challenges in scaling down operations without incurring losses. In addition, the competitive pressure from alternative materials and digital technologies makes it difficult for graphic paper producers to differentiate their offerings and maintain a stable customer base.

The market also faces difficulties in adapting to rapidly changing consumer and industry trends. The demand for high-quality printing materials, such as those used in luxury magazines or promotional materials, remains niche and subject to economic fluctuations, thereby negatively affecting product demand.

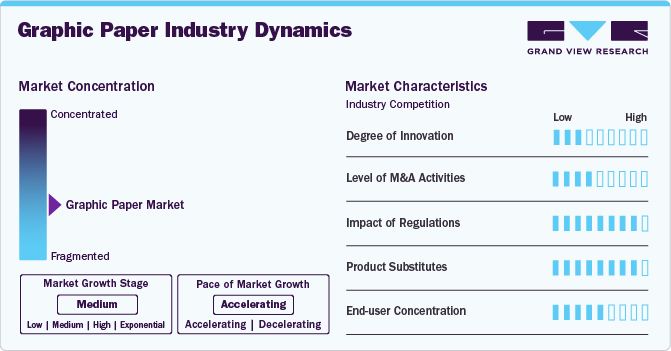

Market Concentration & Characteristics

The market growth stage is low, and the pace is declining. The market exhibits a moderate degree of innovation, primarily driven by the need for sustainability and cost-efficiency. Innovations in paper coating and treatment technologies are also enhancing print quality and durability, catering to niche segments such as luxury packaging and premium publishing. Despite these advancements, the pace of innovation is relatively slower compared to digital alternatives, limiting the market's ability to regain its competitiveness against electronic media.

Mergers and acquisitions in the graphic paper industry are primarily aimed at consolidation to combat declining demand and overcapacity. Larger players are acquiring smaller firms to expand their geographical presence, streamline operations, and gain access to advanced technologies. In addition, M&A activities focus on diversification into related segments, such as specialty or packaging papers, to mitigate the impact of shrinking graphic paper demand.

Environmental regulations have a significant impact on the graphic paper industry, particularly in developed regions like Europe and North America. Governments are imposing stringent standards on deforestation, carbon emissions, and waste management, requiring manufacturers to adopt sustainable sourcing practices and energy-efficient production methods. Compliance with these regulations often increases operational costs, pressuring profit margins.

The graphic paper indusry faces intense competition from digital media, the most prominent substitute. The rise of e-books, online advertising, and digital communication has drastically reduced the reliance on traditional print materials, including newspapers and magazines. Moreover, electronic devices, such as tablets and e-readers, offer cost-effective and environmentally friendly alternatives to printed materials. While recycled and premium paper products attempt to differentiate themselves, the convenience and affordability of digital substitutes pose a persistent challenge to market growth.

The graphic paper industry end-user concentration is moderately high, with significant demand stemming from the publishing, advertising, and corporate sectors. Industries such as print media, including newspapers and magazines, account for a substantial portion of consumption, though this segment is declining due to digital transformation. Demand from premium publishing and luxury packaging remains niche, while institutional buyers like educational institutions and government organizations contribute to consistent but limited demand.

Product Insights

The uncoated woodfree paper segment led the market with the largest revenue share of 26.7% in 2024. This paper is manufactured from chemical pulp similar to coated woodfree paper; however, it lacks a coating, resulting in a more porous surface that can yield richer ink absorption and offers a matte appearance, making it suitable for drawing, printing, and writing applications. Uncoated woodfree graphic paper. It is often used for printing high-end publications and books where a natural feeling is desired. Its uncoated surface also offers better printability for images and texts. The absence of coating also means that the paper is more environmentally friendly than coated graphic papers and can be easily recycled, aligning with sustainable printing practices.

Coated mechanical graphic paper is highly used in publishing and printing industries. It is designed to deliver high-quality print, preferably for applications that require sharp text and vibrant images. It is produced by applying a coating to mechanical pulp paper that improves its surface properties and printability. Coated mechanical graphic paper is generally more affordable than coated wood-free papers, making them attractive for large-scale print runs. Improvements in coating technologies and printing techniques are improving the quality and performance of coated mechanical paper.

Coated woodfree graphic paper generated a revenue of USD 15.3 billion in 2024. It is made from chemically bleached wood pulp, free from mechanical pulp, and has a smooth surface and high brightness, which is attained by the application of calcium carbonate or kaolin clay coatings. These enhance the paper’s printability, offering excellent color reproduction, sharp image quality, and a matte or glossy finish, making it preferable for high-end printing applications, including brochures, magazines, and advertising material. Coated woodfree graphic paper also offers superior opacity than coated mechanical paper, making it an ideal choice for high-end printing applications.

Laser and inkjet printing papers are typically coated to resist high pressure and heat formed by laser printers. This coating helps in achieving sharp images and text by preventing smudging and ensuring quick drying. Laser printing graphic papers commonly have a smooth surface to facilitate the transfer of toner, which adheres well to the paper’s surface due to its coating. Whereas inkjet printing paper is designed to absorb liquid ink rather than toner. It generally has a special coating which allows for better ink absorption and prevents the ink from spreading.

Regional Insights

The graphic paper market in North America has been experiencing a significant decline owing to the rising shift towards electronic communication and digital media. Despite the decrease in consumption, certain markets, including specialty papers and high-quality printing, have shown slight growth. The reduction in demand has led to consolidation among producers, which has, in turn, affected their production capacities.

U.S. Graphic Paper Market Trends

The graphic paper market in the U.S. is expected to experience a steady decline with a CAGR of -1.7% during the forecast period. Newspapers, magazines, and traditional advertising materials have seen a sharp reduction in demand, driven by widespread internet access and a preference for eco-friendly, paperless solutions. The market's contraction is further accelerated by the rising costs of raw materials and stringent environmental regulations.

Asia Pacific Graphic Paper Market Trends

Asia Pacific dominated the graphic paper market with the largest revenue share of 43.8% in 2024. Countries like China and India have seen a decline in traditional writing and printing paper owing to the digital transformation; however, there is still a significant demand for graphic paper in sectors such as education, packaging, and administration, which is likely to lower the negative impact. However, fluctuating prices of raw materials, especially pulp, are expected to affect the market adversely.

The India graphic paper market accounted for revenue of 29.1% in 2024 and is projected to experience at a gradual decline in CAGR during the forecast period, owing to digital adoption accelerates, particularly in urban areas. The increasing reliance on digital media for news, education, and communication has significantly impacted the demand for newspapers, magazines, and office paper. However, rural regions, where internet penetration remains lower, continue to sustain a modest demand for printed materials, particularly in local language newspapers and educational content.

The graphic paper market in China is contracting due to the rapid shift towards digital platforms across industries, driven by government initiatives promoting digital transformation. The rise of e-commerce and online advertising has reduced the dependence on print media, significantly impacting the demand for graphic paper

Europe Graphic Paper Market Trends

The graphic paper market in Europe has been facing reduced demand, primarily due to the digitization of media and the reduction in printed advertising. However, few countries in the region, including Germany and the UK, have maintained slow demand for certain types of graphic papers, such as labeling and packaging materials. However, rising production costs, including raw material and energy prices, have added further pressure on the manufacturers, thereby impacting the market negatively over the forecast period.

The UK graphic paper market is expected to decline at a CAGR of -2.2% over the forecast period. The decline in demand for newspapers, office papers, and traditional advertising materials is driven by growing digital literacy and government initiatives encouraging digital adoption. In addition, the focus on sustainability and environmental awareness has led many businesses to shift to paperless operations, further reducing graphic paper consumption. Despite the overall decline, high-quality graphic paper for luxury publishing and niche marketing campaigns continues to see limited demand.

The graphic paper market in France is contracting as digital communication replaces traditional print media across industries. The decline in newspaper and magazine readership, coupled with the growing popularity of online advertising, has significantly impacted demand. Environmental regulations in France are also encouraging businesses to adopt sustainable alternatives, such as digital platforms, further exacerbating the decline. However, the market retains a minor demand for specialized, high-quality graphic paper in luxury publishing and cultural or artistic print projects.

Central & South America Graphic Paper Market Trends

The graphic paper market in Central and South America is anticipated to grow at a significant CAGR of -0.4% from 2025 to 2030. Urban areas are rapidly transitioning to digital media, reducing demand for print newspapers, magazines, and office paper. However, rural regions, where internet access is limited, still rely on traditional print materials. Economic challenges in the region also constrain investment in the print sector, further hindering growth. Despite the decline, segments such as premium packaging and high-quality printing retain modest demand.

Middle East & Africa Graphic Paper Market Trends

The graphic paper market in the Middle East & Africa is anticipated to grow at a significant CAGR from 2025 to 2030. Technological advancements and the widespread availability of affordable digital devices have resulted in the reduced demand for graphic paper in the Middle East. Consumers and businesses are adopting digital alternatives for advertising, reading, and communication which has reduced the dependence on traditional printed materials. In addition, the growing emphasis on sustainability and decreasing paper waste is also likely to contribute to the declining demand, thereby negatively impacting the market growth.

Key Graphic Paper Company Insights

Some of the key players operating in the market are International Paper Company, Stora Enso Oyj, UPM-Kymmene Corporation, Nippon Paper Industries Co., Ltd., and Sappi Limited

-

International Paper Company produces a wide range of graphic paper products used in publishing, office applications, and advertising. With operations in more than 24 countries, International Paper focuses on sustainability by integrating recycled materials into its production processes and reducing environmental impact. Its extensive distribution network and emphasis on high-quality products have solidified its position as a market leader.

-

Stora Enso produces newsprints, coated, and uncoated papers, catering to various sectors such as publishing and office applications. Stora Enso is heavily invested in sustainable practices, focusing on minimizing its carbon footprint and expanding its range of recycled paper products. Its strong European market presence and diverse product portfolio make it a leader in the industry.

Nine Dragons Paper Holdings Limited., Mondi Group, Smurfit Kappa Group, Domtar Corporation, and Resolute Forest Product are some of the emerging market participants in the graphic paper industry.

-

International Paper Company produces a wide range of graphic paper products used in publishing, office applications, and advertising. With operations in more than 24 countries, International Paper focuses on sustainability by integrating recycled materials into its production processes and reducing environmental impact. Its extensive distribution network and emphasis on high-quality products have solidified its position as a market leader.

-

Stora Enso produces newsprints, coated, and uncoated papers, catering to various sectors such as publishing and office applications. Stora Enso is heavily invested in sustainable practices, focusing on minimizing its carbon footprint and expanding its range of recycled paper products. Its strong European market presence and diverse product portfolio make it a leader in the industry.

Key Graphic Paper Companies:

The following are the leading companies in the graphic paper market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper Company

- Stora Enso Oyj

- UPM-Kymmene Corporation

- Nippon Paper Industries Co., Ltd.

- Sappi Limited

- Nine Dragons Paper Holdings Limited

- Mondi Group

- Smurfit Kappa Group

- Domtar Corporation

- Resolute Forest Products

Recent Developments

-

In May 2023, UPM Communication Papers closed its Hürth newsprint mill and shut down one fine paper machine at Nordland Papier (PM 3) in Dörpen, Germany. This is expected to result in annual reductions of 330,000 tonnes of newsprint paper capacity and 280,000 tonnes of uncoated fine paper capacity in UPM’s portfolio.

Graphic Paper Market Report Scope

Report Attribute

Details

Market size in 2025

USD 84.6 billion

Revenue Forecast in 2030

USD 79.1 billion

Growth rate

CAGR of -1.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume million/billion, Tons and Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Africa; Saudi Arabia

Key companies profiled

International Paper Company; Stora Enso Oyj; UPM-Kymmene Corporation; Nippon Paper Industries Co.; Ltd.; Sappi Limited; Nine Dragons Paper Holdings Limited; Mondi Group; Smurfit Kappa Group; Domtar Corporation; Resolute Forest Products

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Graphic Paper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global graphic paper market report based on product and region.

-

Product Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Coated Mechanical

-

Coated Woodfree Paper

-

Uncoated Woodfree Paper

-

Laser and Inkjet Printing Paper

-

Newsprint

-

Recycled Paper

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global graphic paper market size was estimated at USD 83.6 billion in 2024 and is expected to reach USD 84.6 billion in 2025.

b. The graphic paper market is expected to grow at a compound annual growth rate of -1.3% from 2025 to 2030, reaching USD 79.1 billion by 2030.

b. The commercial application dominated the market based on applications and was valued at USD 22.3 billion in 2024. It lacks a coating, resulting in a more porous surface that can yield richer ink absorption and offers a matte appearance, making it suitable for drawing, printing, and writing applications.

b. Key players operating in the graphic paper market are International Paper Company, Stora Enso Oyj, UPM-Kymmene Corporation, Nippon Paper Industries Co., Ltd., Sappi Limited, Nine Dragons Paper Holdings Limited, Mondi Group, Smurfit Kappa Group, Domtar Corporation, and Resolute Forest Products.

b. The key factors declining the graphic paper market include the ongoing digital transformation, which has reduced the demand for traditional print media such as newspapers, magazines, and office paper. The shift towards digital communication, advertising, and media consumption has led to a consistent decline in the use of graphic paper.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.