- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Greece Liquid Dietary Supplements Market Report, 2033GVR Report cover

![Greece Liquid Dietary Supplements Market Size, Share & Trends Report]()

Greece Liquid Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamin, Botanicals, Minerals, Collagen), By Type (OTC, Prescribed), By Application, By End User, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-694-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Greece Liquid Dietary Supplements Market Summary

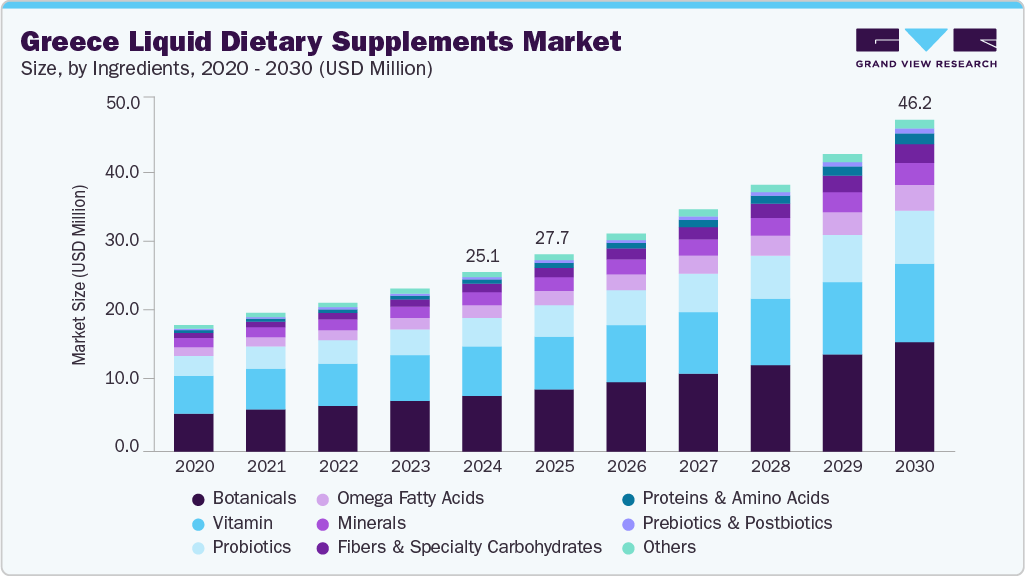

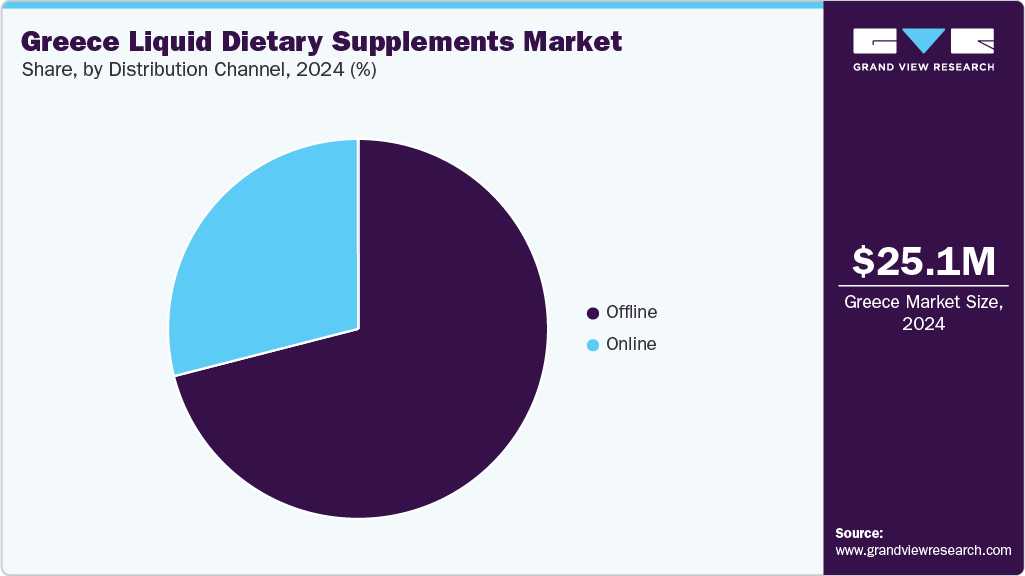

The Greece liquid dietary supplements market size was estimated at USD 25.1 million in 2024 and is projected to reach USD 46.2 billion by 2030, growing at a CAGR of 10.8% from 2025 to 2030. A confluence of health-conscious consumer behavior, demographic trends, and economic factors is shaping the market.

Key Market Trends & Insights

- By ingredient, the liquid botanical dietary supplements segment accounted for the largest revenue share of 31.2% in 2024.

- By application, the bone & joint health segment accounted for a revenue share of 12.2% in 2024.

- By distribution channel, the offline segment accounted for a revenue share of 70.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.1 Million

- 2030 Projected Market Size: USD 46.2 Million

- CAGR (2025-2030): 10.8%

A growing preference for convenient and fast-absorbing supplement formats has driven demand for ready-to-drink (RTD) vitamins, minerals, and botanical blends. This trend aligns with broader European consumer habits, particularly among urban populations and working adults seeking to maintain wellness in fast-paced lifestyles. Economic pressures, especially inflation, have made consumers more price-sensitive, resulting in a shift toward e-commerce channels that offer competitive pricing, bundled deals, and broader product availability. There's also a growing focus on undernutrition, particularly among seniors and children, prompting increased usage of liquid nutrition supplements in clinical and home-care settings. The demand for functional ingredients such as collagen, probiotics, and plant-based extracts further underscores a move toward holistic health solutions. These dynamics, combined with evolving regulatory oversight in the EU, are encouraging manufacturers to innovate while remaining cost-effective and compliant.

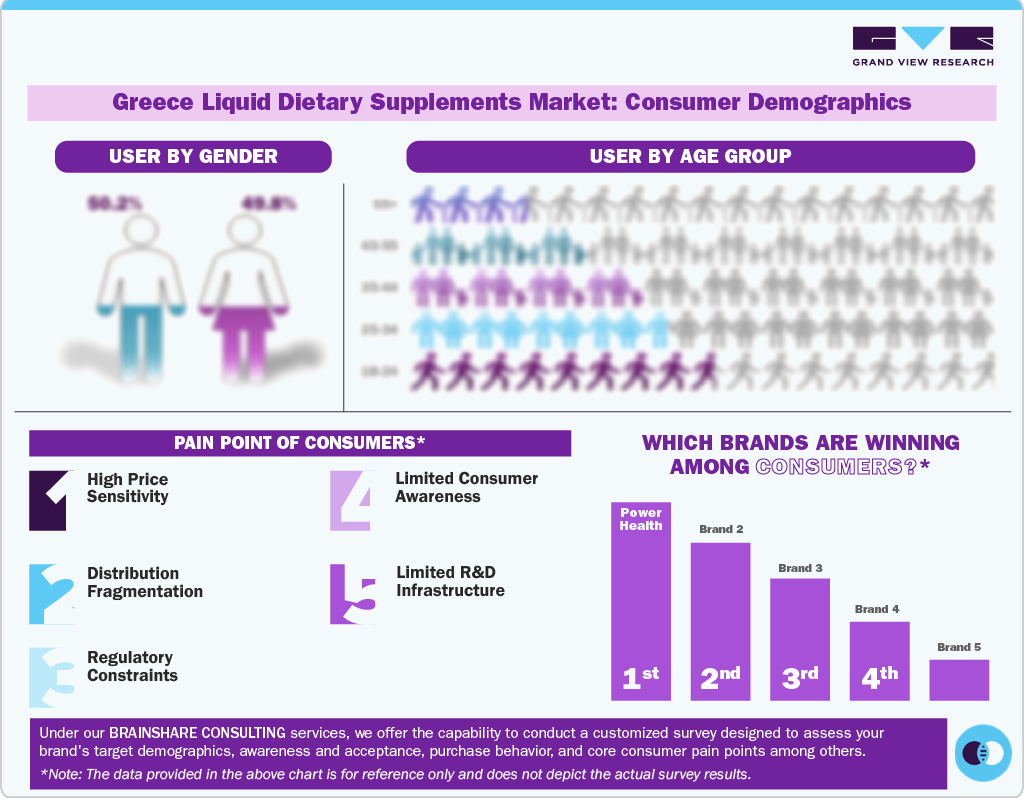

Consumer Insights

The consumer trends in Greece are primarily influenced by the growing ubiquity of technology-driven devices such as smartphones, increasing utilization of e-commerce websites, and significant growth in awareness. In 2023, the total population of Greece was 10,242,908. In 2023, individuals aged 15 to 64 accounted for 68.2% of the total population. Consumers in this age group are likely to influence demand for liquid dietary supplements in Greece. In addition, the rising incidence rate of complex health issues such as Ischemic heart disease, stroke, respiratory infections, Chronic obstructive pulmonary disease, and others are anticipated to generate notable growth in demand for supplements designed for specific applications.

Consumers prioritize clear labeling, clinical validation, and product quality over influencer marketing or promotional hype. Pharmacies are viewed as reliable access points to safe and effective supplements, reinforcing their role as the dominant distribution channel.

Ingredients Insights

The botanicals segment dominated the Greece liquid dietary supplements market and accounted for a revenue share of 31.2% in 2024. Growth of this segment is primarily driven by a rising preference for natural, plant-based health solutions. Liquid botanical formulations such as elderberry, turmeric, and herbal tinctures are increasingly popular due to their ease of use, quick absorption, and association with functional benefits like immune support, digestive health, and anti-inflammatory properties. In Greece, the demand for liquid botanical supplements is further fueled by shifting demographics and lifestyle patterns. An aging population, urbanization, and time-constrained consumers are driving the adoption of ready-to-drink, plant-based products that combine convenience with wellness.

Additionally, economic pressures and rising product prices have made consumers more cost-conscious, prompting a shift toward online platforms where liquid botanicals are accessible through promotional deals and bundled offerings. The Greek Herbalist, a boutique brand, produces small batch “oxymels”, traditional herbal syrups combining apple cider vinegar, Greek honey, and botanicals like elderberry, turmeric, sage, rosemary, and mountain tea. These are positioned for immune and overall wellness benefits.

The proteins & amino acids segment is likely to experience the fastest growth during the forecast period. This segment is largely driven by the country’s growing health, fitness, and wellness culture. These supplements are particularly popular among recreational and professional athletes, as well as aging adults aiming to preserve muscle mass and support recovery. The appeal of liquid protein formats lies in their ease of consumption, rapid absorption, and convenience, often seen in ready-to-drink (RTD) shakes and amino acid infusions.

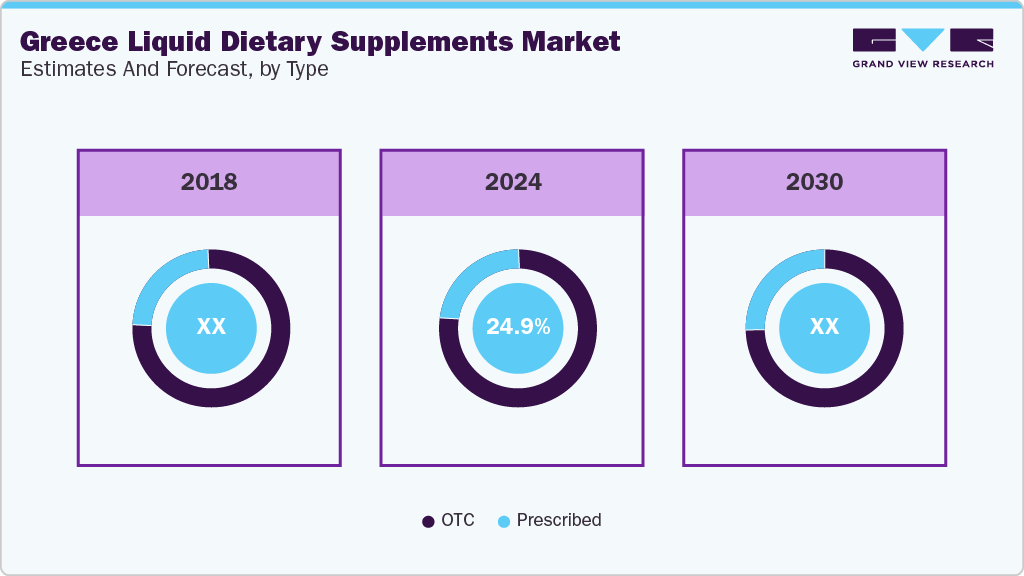

Type Insights

In 2024, the OTC segment accounted for the largest revenue share of the market. This growth can be attributed to the rising consumer interest in preventive health, especially for immunity, digestion, and general wellness. The demand for convenient formats like drops, syrups, and ready-to-drink (RTD) shots is increasing due to their ease of use and faster absorption. Economic pressures and inflation have made consumers more price-sensitive, shifting toward e-commerce and digital pharmacies for better deals. VIAN S.A. is ranked the No. 1 OTC distributor in Greece, specializing in non-prescription drugs, parapharmaceuticals, medical devices-and by extension, supplementary product lines including liquids.

The prescribed liquid dietary supplements are expected to grow at the fastest CAGR from 2025 to 2030. This growth can be attributed to the clinical necessity, particularly for elderly, post-operative, and chronically ill patients requiring targeted nutritional support. The adoption of e-prescription systems has streamlined prescribing, improved traceability, and enhanced compliance among both physicians and patients. Additionally, many prescribed liquid supplements qualify for reimbursement through the national healthcare system, making them more accessible and cost-effective.

Application Insights

The bone & joint health segment dominated the Greece dietary supplements market in 2024. The growth is driven by an aging population, rising osteoporosis rates, and increasing health awareness. Consumers are seeking fast-absorbing, easy-to-consume liquid formats containing ingredients like calcium, vitamin D, collagen, glucosamine, and chondroitin. This trend aligns with the broader European market, which is experiencing steady growth in functional and ready-to-drink supplements. While capsules and tablets remain common, demand for liquid formulations is rising due to their superior bioavailability and ease of use, especially among seniors. Power Health is at the forefront of innovation in Greece’s liquid dietary supplements market with products such as liquid collagen, specifically formulated to support joint flexibility and bone strength. These supplements are particularly popular among older adults, thanks to their high bioavailability, rapid absorption, and ease of consumption.

On the basis of application, the prenatal health segment is expected to grow at the fastest CAGR of 16.0% from 2025 to 2030. This segment is expanding due to rising maternal awareness and the demand for easily absorbed, gentle formulations during pregnancy. Products such as Vitabiotics Pregnacare Liquid, which contain essential nutrients such as folic acid, iron, and vitamin D, are popular among expectant mothers who prefer tablet alternatives-especially during morning sickness. Liquid formats offer superior bioavailability and ease of ingestion, making them ideal for women with heightened nutritional needs.

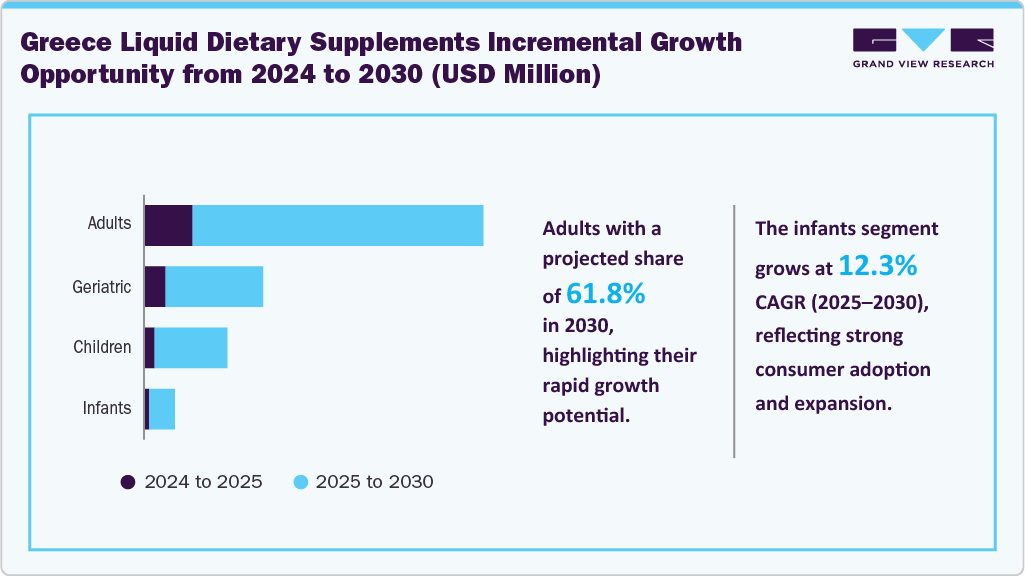

End User Insights

The adult segment had the largest market share, 62.9% in 2024. This segment's growth is driven by rising health awareness, especially around immunity, energy, and stress management. Adults increasingly prefer liquid formats for their convenience, faster absorption, and ease of use, particularly those with pill fatigue or digestive sensitivities. The growing popularity of liquid multivitamins, protein-rich formulas, and herbal blends reflects this shift.

The infant segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of this segment is driven by heightened awareness of early-life nutrition and the need for safe, easy-to-administer formats. Products like Natures Aid Vitamin D3 Drops, offering the recommended 400 IU dose for bone development, are popular among parents, especially for breastfed infants during low-sunlight months. Liquid supplements are favored for their gentle dosing, often administered via pacifiers or mixed with milk, ensuring better compliance. The Greek company PharmaLead Vitorgan offers Oral Drops that combine vitamin D₃ and vitamin K₂ in a 20 mL liquid format, suited for children over 1 year age with gluten-free, lactose-free formulations and registered with Greek authorities.

Distribution Channel Insights

The offline distribution segment held the largest revenue share of the market in 2024. Physical stores offer expert guidance, particularly important for sensitive categories like infant and prenatal supplements. Pharmacies and supermarkets also ensure compliance with EU safety and labeling standards, reinforcing product credibility. With over 15,000 pharmacies across the country, accessibility remains high. In-store promotions and loyalty programs further incentivize purchases, making offline channels a preferred option despite the rise of e-commerce.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. This growth is attributed to the rising digital literacy and increased internet penetration, especially post-pandemic, which have encouraged consumers to shift toward e-commerce platforms for health-related purchases. Convenience, price comparisons, and access to a wider product variety are major advantages boosting online sales. Social media marketing, influencer endorsements, and the use of subscription models by brands have made digital platforms a preferred choice, particularly among younger and urban populations.

Key Greece Liquid Dietary Supplements Company Insights

Some of the key companies in the Greece liquid dietary supplements industry include Power Health, JMN Pharmaceutical, and Pharmacros.

-

Power Health is known for its innovative, fast-absorbing formats like syrups and mouth-dissolving granules. Its emphasis on natural, preservative-free ingredients and convenient delivery forms aligns well with modern consumer preferences.

-

JMN Pharmaceutical is a key player in Greece’s liquid supplements sector. JMN has become a trusted name in liquid dietary supplements in the Greek market through its strong distribution network spanning pharmacies, supermarkets, and online channels.

Key Greece Liquid Dietary Supplements Companies:

- Power Health

- JMN Pharmaceutical

- Pharmacros

Greece Liquid Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.7 million

Revenue forecast in 2030

USD 46.2 million

Growth rate

CAGR of 10.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, type, application, end user, and distribution channel

Key companies profiled

Power Health, JMN Pharmaceutical, Pharmacros

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Greece Liquid Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Greece liquid dietary supplements market report based on ingredients, type, application, end user, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.