- Home

- »

- Consumer F&B

- »

-

Green Cardamom Market Size, Share, Industry Report, 2030GVR Report cover

![Green Cardamom Market Size, Share & Trend Report]()

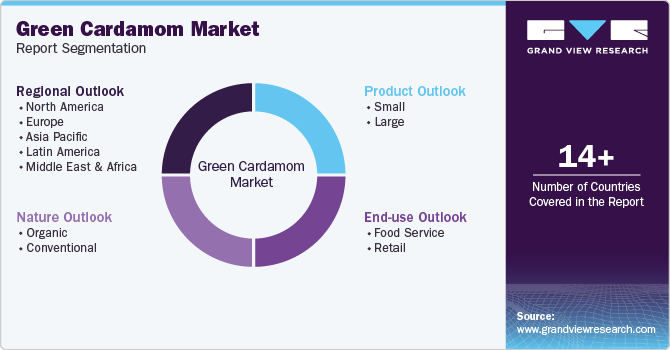

Green Cardamom Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Small, Large), By Nature (Organic, Conventional), By End-use (Food Service, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-411-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Cardamom Market Summary

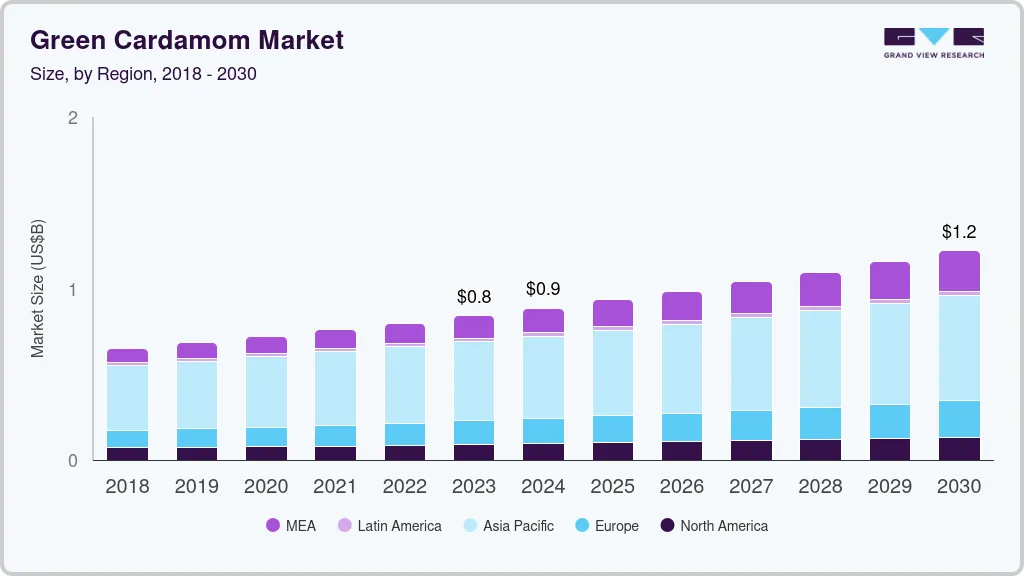

The global green cardamom market size was estimated at USD 841.1 million in 2023 and is projected to reach USD 1,220.3 million by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The market growth is primarily driven by increasing consumer demand for natural and organic products and the expanding popularity of ethnic and exotic flavors in global cuisine.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- In terms of segment, small accounted for a revenue of USD 841.1 million in 2023.

- Small is the most lucrative product segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 841.1 Million

- 2030 Projected Market Size: USD 1,220.3 Million

- CAGR (2024-2030): 5.5%

- Asia Pacific: Largest market in 2023

E-commerce has made green cardamom more accessible to a wider audience, boosting its demand. In addition, government support in key producing countries like India and Guatemala has enhanced cultivation practices, ensuring a steady supply and contributing to market expansion.

The demand for organic cardamom has increased due to the growing trend for sustainable and organic goods. Organic cardamom is more affordable and appeals to customers who are concerned about their health and the environment.

As awareness of health and wellness continues to rise, people are increasingly seeking products that are free from artificial additives and chemicals. Green cardamom, being a natural spice, aligns with this trend. Consumers are drawn to its perceived purity and the numerous health benefits associated with it, such as its digestive and antioxidant properties. This demand is particularly strong in regions where organic products are highly valued, such as North America and Europe. It is also utilized in herbal medications and nutritional supplements. People are growing aware of the health advantages of natural spices.

The globalization of food culture has increased interest in ethnic and exotic flavors, with green cardamom gaining popularity. Consumers in emerging economies are becoming increasingly open to trying out high-end spices like green cardamom as their disposable incomes increase. Originally a staple in Indian, Middle Eastern, and Scandinavian cuisines, green cardamom is now embraced in Western markets for its unique flavor. The spice is used in various culinary applications, from traditional dishes like Indian biryani and Middle Eastern coffee to innovative products such as spiced lattes and gourmet chocolates. Western food companies are capitalizing on this trend by introducing products that feature green cardamom as a key ingredient, catering to consumers' adventurous palates. This growing popularity of ethnic flavors has expanded the market reach of green cardamom, making it a sought-after spice in both retail and food service sectors.

Government support and initiatives in key cardamom-producing countries, such as India and Guatemala, have significantly contributed to the market growth. In India, the Spices Board (Ministry of Commerce and Industry, Government of India) serves as the flagship organization for the development and global promotion of Indian spices, including green cardamom. The Spices Board implements various programs to support farmers and improve cultivation practices, such as providing subsidies for irrigation, conducting training programs, and investing in research to develop higher-yielding and disease-resistant crop varieties. These efforts have increased the productivity and quality of green cardamom, making it more competitive in the global market.

Product Insights

The small segment led the market with the largest revenue share of 61.4% in 2024. Small green cardamom is highly valued for its intense flavor and aromatic properties, making it a preferred choice in culinary applications worldwide. Its unique taste is essential in various traditional dishes, desserts, and beverages, particularly in South Asian and Middle Eastern cuisines. As global cuisine trends embrace these flavors, the demand for small green cardamom has grown significantly.

The large segment is projected to grow at the fastest CAGR of 6.0% from 2025 to 2030, driven by the rising consumer demand for small and natural products driven by health and environmental concerns. Health-conscious consumers are increasingly seeking small alternatives to avoid synthetic pesticides and chemicals, and small green cardamoms meet this need.

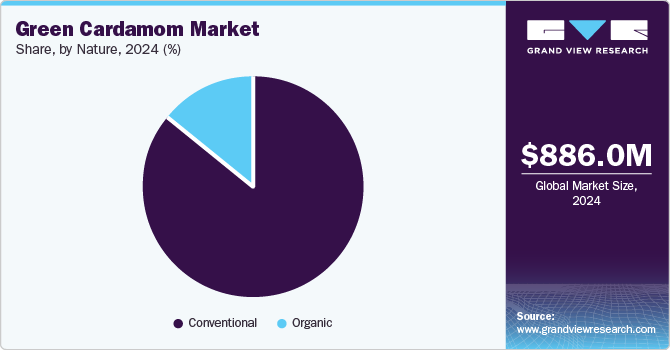

Nature Insights

Based on nature, the conventional segment led the market with the largest revenue share of 84.3% in 2024. Conventional farming methods typically involve lower production costs than organic practices, allowing for competitive pricing. The broad market acceptance and extensive use of conventional green cardamom across various industries, such as food and beverages, contribute to its consistent demand.

The organic segment is projected to grow at the fastest CAGR of 6.9% from 2025 to 2030. The growth in demand for organic green cardamom is driven by increasing consumer preference for natural and sustainably sourced products and heightened awareness of environmental and health concerns. Organic green cardamom appeals to health-conscious consumers seeking products free from synthetic chemicals and pesticides, aligning with broader trends toward organic and clean-label foods. Its perceived health benefits, combined with its appeal in premium and artisanal markets, further boost demand.

End Use Insights

Based on end use, the retail segment led the market with the largest revenue share of 74.7% in 2024. The expanding popularity of home cooking, the demand for healthier ingredients, and consumer interest in expensive and distinctive spices are the primary drivers of the segment's dominance.

The demand for green cardamom has surged due to the rising popularity of home cooking. Consumers have become more interested in quality and unique spices. Additionally, they are progressively seeking nutritious components. Cardamom is a key component in many Asian and Middle Eastern dishes, and it can be used sweet or savory. In Ayurvedic treatment, it is also prized for its ability to balance the body's doshas and enhance digestive health. Retailers are capitalizing on the popularity of gourmet cooking and global cuisines by offering green cardamom as a high-quality, versatile ingredient in both whole and ground forms.

The food service segment is anticipated to grow at the fastest CAGR of 7.3% from 2025 to 2030. Green cardamom's growth in the food service industry is driven by its ability to enhance flavor profiles and differentiate menu offerings, coupled with the increasing trend of incorporating exotic and premium ingredients in restaurant dishes. Chefs and food service providers use green cardamom to add a distinctive, aromatic quality to a range of dishes, from savory entrees to desserts and beverages, appealing to diners seeking unique and upscale dining experiences.

Regional Insights

The North America green cardamom market is projected to grow at a CAGR of 5.7% from 2025 to 2030. The green cardamom market differs by area, with demand and supply affected by local culture, cuisine, and economic considerations. North American consumers are increasingly exploring diverse and exotic cuisines, leading to a higher demand for spices like green cardamom. This trend is evident in the popularity of ethnic foods in restaurants and grocery stores, where green cardamom is used to enhance the flavor of dishes such as Indian curries, Middle Eastern stews, and Scandinavian baked goods.

U.S. Green Cardamom Market Trends

The U.S. green cardamom market is projected to grow at the fastest CAGR of 6.0% from 2025 to 2030. The market is mainly driven by rising demand in the food and beverage sector, particularly in specialty and ethnic cuisines, as well as the natural and organic food market. The spice's popularity is bolstered by increasing consumer awareness of its health benefits, such as aiding digestion and reducing inflammation, and its use in wellness products and specialty beverages like chai lattes and craft cocktails. The growing ethnic population from regions where cardamom is a staple, along with the expansion of the gourmet food market and a focus on sustainability and ethical sourcing, are further contributing to its demand.

Europe Green Cardamom Market Trends

The European green cardamom market is projected to grow at a significant CAGR of 6.6% from 2025 to 2030. Cardamom is widely imported and consumed in Europe, particularly in UK, Germany, the Netherlands, and Scandinavian countries. Food processing accounts for 80-90 percent of imported spices. The spice's increasing use in gourmet cooking and specialty beverages, such as chai and spiced lattes, reflects a growing consumer interest in exotic flavors. Germany, the UK, the Netherlands, Sweden, France, and Finland stand out as the most promising European markets for green cardamom exporters from developing countries. These nations feature high import volumes, well-established spices and herbs markets, and a growing demand for cardamom driven by expanding ethnic cuisines and traditional recipes.

Asia Pacific Green Cardamom Market Trends

Asia Pacific dominated the green cardamom market with a market revenue share of 54.2% in 2024. The Asia Pacific region is one of the world's leading producers of cardamom, which explains its supremacy. India is the primary cardamom-producing nation in Asia-Pacific. In January 2025, cardamom prices in India rose to a fresh high of USD 36.1 per kg after a 5-year gap. It is also one of the world's largest producers of cardamoms. The market in the area is expected to develop due to factors such as rising consumer expenditure on food and drinks, internet shopping, the availability of cardamom essential oil, and an increasing demand for natural ingredients. Growing health awareness in the region is also boosting demand, as consumers increasingly value cardamom for its digestive and antioxidant properties, leading to its incorporation into Ayurvedic medicines and herbal supplements.

Latin America Green Cardamom Market Trends

The Latin American green cardamom market is estimated to develop at a CAGR of 5.6% between 2025 and 2030. Guatemala and India are the two largest producers and exporters of organic cardamom, with Guatemala producing tiny cardamom and India producing both varieties. Ground cardamom is a solid market, notably in Guatemala, where 46% of the market is shipped to France.

At the Anuga trade fair, Fedecovera, a leading Guatemalan cooperative, showcased its organic green cardamom products. Fedecovera has been certified organic since 2006 and continues to emphasize sustainability and high quality in its offerings

Key Green Cardamom Company Insights

The market is characterized by intense competition driven by product quality, pricing strategies, and supply chain efficiencies. It is dominated by a few large producers who control significant portions of production and distribution. Still, smaller regional players also play a vital role, particularly in niche and local markets. Innovation in product offerings, such as organic or sustainably sourced cardamom, has become a key differentiator, appealing to environmentally conscious consumers.

Some of the key companies in the green cardamom industry include Vandanmedu Green Gold Cardamom Producer Company Limited, Adrianna Springs Impex Pvt Ltd., Cardex S.A., MAS Enterprises Ltd., Nani Agro Foods, Synthite Industries, VLC Spices, Vora Spice Mills LLP, Eastmade Spices & Herbs Private Limited and Ashapura Agrocomm Private Limited.

-

Established in 1994, MAS Enterprises Ltd specializes in cultivating, processing, and exporting spices, especially green cardamom. Its hallmark product, MAS Cardamom, is widely sold, and it is acknowledged as the top exporter in foreign markets.

-

VLC Spices is a global food company that produces high-quality products for the global food industry, ensuring safety and efficient delivery. Its diverse range of products includes whole spices, ground spices, and blended spices. Operating near the port, it delivers across India and exports internationally.

Key Green Cardamom Companies:

The following are the leading companies in the green cardamom market These companies collectively hold the largest market share and dictate industry trends.

- Vandanmedu Green Gold Cardamom Producer Company Limited

- Adrianna Springs Impex Pvt Ltd.

- Cardex S.A.

- MAS Enterprises Ltd

- Nani Agro Foods

- Eastmade Spices & Herbs Private Limited

- Ashapura Agrocomm Private Limited.

- Synthite Industries

- VLC Spices

- Vora Spice Mills LLP

Recent Developments

-

In August 2024, 2 new cardamom varieties, IISR Manushree, and IISR Kaveri, were introduced by the Prime Minister of India, Narendra Modi. These 2 new varieties of cardamom are developed at the Indian Council of Agricultural Research (ICAR)

Green Cardamom Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 933.7 million

Revenue forecast in 2030

USD 1,220.3 million

Growth Rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, nature, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Netherlands; Sweden; Finland; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Vandanmedu Green Gold Cardamom Producer Company Limited; Adrianna Springs Impex Pvt Ltd.; Cardex S.A; MAS Enterprises Ltd; Nani Agro Foods; Royal Spices; Sunlite India Agro Producer Company Ltd.; Synthite Industries; VLC Spices; Vora Spice Mills LLP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Cardamom Market Report Segmentaton

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global green cardamom market report based on product, end use, nature, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Large

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Retail

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Netherlands

-

Sweden

-

Finland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.