- Home

- »

- Distribution & Utilities

- »

-

Green Power Transformer Market Size, Industry Report 2030GVR Report cover

![Green Power Transformer Market Size, Share & Trends Report]()

Green Power Transformer Market (2025 - 2030) Size, Share & Trends Analysis Report By Voltage (Low Voltage, High Voltage), By Phase (Three Phase, Single Phase), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Power Transformer Market Summary

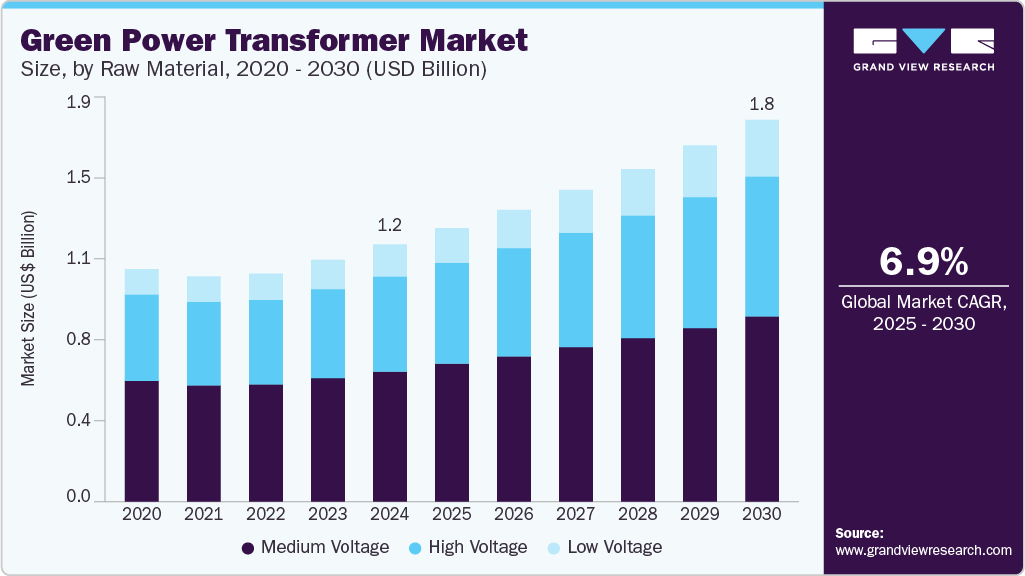

The global green power transformer market size was estimated at USD 1.22 billion in 2024 and is anticipated to reach USD 1.81 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The demand for green power transformers is likely to grow significantly in the coming years, driven by the modernization of power grids.

Key Market Trends & Insights

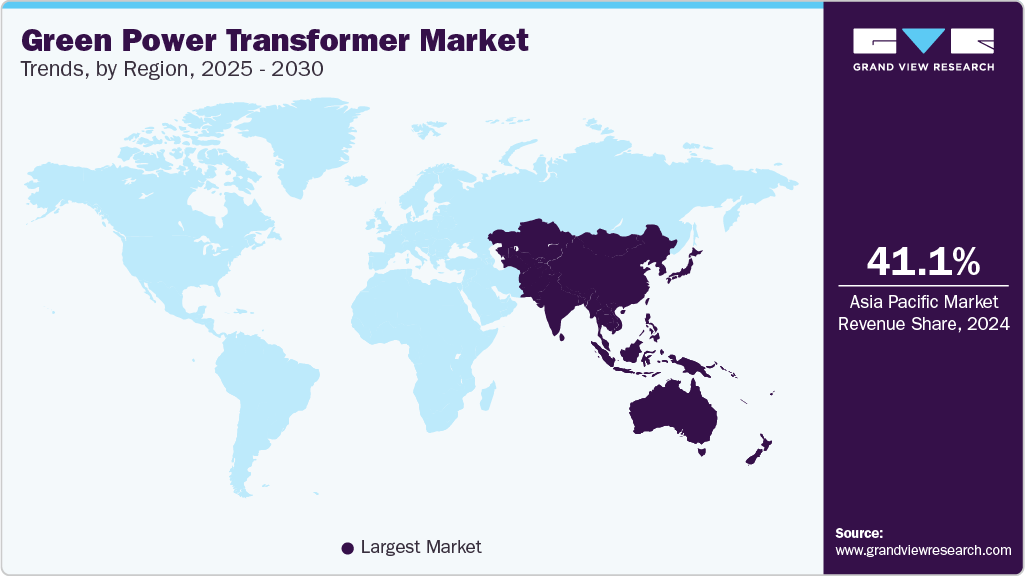

- Asia Pacific held over 41.10% revenue share of the global green power transformer market.

- By voltage, medium voltage segment held the largest revenue share of over 50.40% in 2024.

- By phase, three Phase segment held over 90% revenue share of the global green power transformer market.

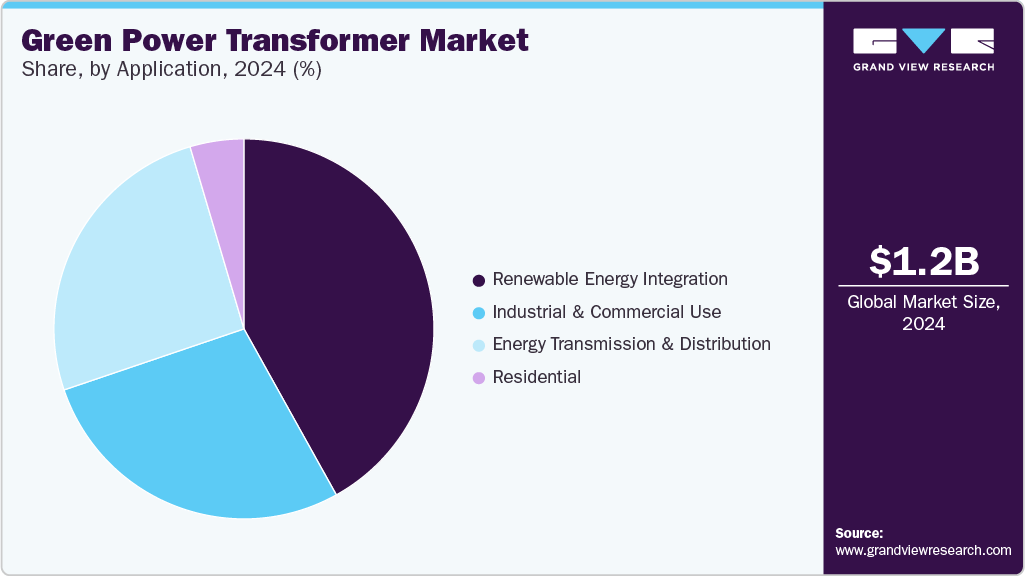

- By application, renewable energy integration segment held the revenue share of over 41.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.22 Billion

- 2030 Projected Market Size: USD 1.81 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

The integration of renewable energy sources such as wind and solar, and the rising need for energy-efficient transmission and distribution infrastructure. Governments worldwide are introducing robust emission regulations and offering incentives for clean energy solutions, further boosting the need for sustainable and low-loss transformer technologies.

In addition, advancements in transformer materials and smart grid technologies improve energy efficiency and operational reliability, making green power transformers more viable for widespread deployment. This growth is expected to be particularly strong in regions like Asia Pacific, North America, and Europe, where grid modernization efforts and large-scale renewable energy projects are accelerating.

Drivers, Opportunities & Restraints

The global transition to renewable energy and the push for grid modernization are key market drivers. Governments and utilities are investing in sustainable infrastructure to meet net-zero targets, leading to the widespread integration of solar, wind, and other renewable energy sources. This shift requires efficient and environmentally friendly transformers to handle variable power loads while minimizing energy loss. Furthermore, urbanization and industrial electrification create new demand for low-emission, high-efficiency transformer systems.

Emerging opportunities lie in developing smart transformers integrated with digital monitoring systems and eco-friendly insulating materials such as ester fluids. These innovations enhance grid reliability, reduce maintenance costs, and align with environmental regulations. Expansion into underserved and developing regions with aging power infrastructure also offers significant growth potential for green transformer manufacturers.

However, the high initial cost of green power transformers compared to conventional models remains a notable restraint. This is compounded by limited awareness and adoption in cost-sensitive markets. Challenges in raw material procurement and the need for specialized manufacturing capabilities may also limit short-term scalability and affect producers' profit margins.

Voltage Insights

Medium voltage transformers held the largest revenue share of over 50.40% in 2024. Medium voltage transformers are the cornerstone of the market, driven primarily by their critical role in renewable energy integration and urban grid distribution. These transformers are widely used in solar and wind energy projects, enabling efficient, clean power transmission from generation sites to distribution networks. Supportive government policies focused on clean energy expansion, grid modernization, and reduced transmission losses continue to drive adoption across developed and emerging economies.

High voltage transformers also play a vital role, particularly in long-distance power transmission and large industrial applications, where efficiency and reliability are paramount. Their growing use in inter-regional grid connectivity strengthens their market position. Meanwhile, low-voltage transformers are gaining traction in residential and small commercial installations, especially as rooftop solar systems and smart home technologies become more prevalent. Together, these segments reflect a global shift toward energy-efficient infrastructure and sustainable power delivery.

Phase Insights

Three Phase held over 90% revenue share of the global green power transformer market. The three-phase green power transformer segment is the largest, supported by its wide use in utility-scale renewable energy projects, industrial operations, and commercial infrastructure. Its ability to handle higher loads with greater efficiency makes it the preferred choice for large-scale power transmission and distribution, particularly in wind and solar farms where stable and reliable energy flow is essential.

Meanwhile, the single-phase segment has emerged as the fastest-growing category. This trend is driven by increasing deployment in residential and small commercial renewable energy systems, where compact design and lower capacity needs align with the benefits of single-phase transformers. The rising popularity of rooftop solar installations, localized power solutions, and supportive government policies continues to bolster the segment’s rapid expansion.

Application Insights

Renewable Energy Integration segment held the revenue share of over 41.92% in 2024. The demand for green power transformers is driven by the accelerating integration of renewable energy sources such as solar and wind into national grids. As countries aim to reduce carbon emissions and increase reliance on clean energy, the need for efficient transformers that can handle variable loads and reduce energy loss has become critical. Green power transformers connect renewable generation to transmission infrastructure while maintaining grid stability and improving overall efficiency.

In parallel, the energy transmission and distribution sector is witnessing steady growth as utilities upgrade aging infrastructure to meet modern performance standards. These transformers help reduce transmission losses and comply with increasingly strict environmental regulations. Demand is also rising across industrial and commercial sectors, where businesses seek to lower energy costs and meet sustainability targets. Adopting rooftop solar systems and smart energy networks in the residential segment creates new opportunities for compact and eco-friendly transformer solutions.

Regional Insights

Asia Pacific held over 41.10% revenue share of the global green power transformer market. Large-scale investments in renewable energy infrastructure and ongoing grid modernization efforts in countries like China, India, and Japan primarily drive the Asia Pacific (APAC) market. Governments across the region are aggressively promoting clean energy through policy support, emission reduction targets, and incentives for energy-efficient technologies. As a result, demand for environmentally friendly, high-efficiency transformers is rising sharply. The region also benefits from a strong manufacturing base and the presence of leading transformer producers, positioning APAC as a key contributor to global market growth.

North America Green Power Transformer Market Trends

The green power transformer market in North America is expected to grow significantly over the forecast period. Large-scale grid modernization initiatives and the accelerating shift toward renewable energy sources such as wind and solar drive the North American green power transformer market. Government incentives, clean energy mandates, and rising environmental awareness push utilities and industries to adopt energy-efficient, low-emission transformer solutions. The region is also experiencing increased investment in smart grid infrastructure and interconnection upgrades, fueling the demand for green power transformers supporting reliable and sustainable electricity transmission.

Europe Green Power Transformer Market Trends

The green power transformer market in Europe is driven by the region’s aggressive decarbonization targets and strong policy support for clean energy infrastructure. The European Union’s Green Deal and Net-zero commitments are accelerating investments in renewable energy projects, particularly wind and solar, requiring efficient and eco-friendly power transmission systems. Moreover, Enhanced efficiency regulations and grid reliability standards push utilities to replace conventional transformers with low-loss, sustainable alternatives. The presence of key transformer manufacturers and a growing emphasis on energy efficiency across industrial and commercial sectors further strengthens the region’s market growth.

Latin America Green Power Transformer Market Trends

The green power transformer market in Latin America is driven by the region’s growing investment in renewable energy projects, particularly solar and wind, which require efficient and reliable transmission infrastructure. As countries aim to expand clean energy capacity and reduce grid losses, demand for low-loss, environmentally friendly transformers is rising. Government initiatives supporting energy transition and efforts to modernize outdated grid systems are further propelling the adoption of green power transformers across the region.

Middle East & Africa Green Power Transformer Market Trends

The green power transformer market in the Middle East and Africa (MEA) is driven by the region’s growing focus on diversifying energy sources through large-scale solar and wind projects. As countries seek to reduce reliance on fossil fuels and improve energy security, investments in clean energy infrastructure are accelerating. Green power transformers are increasingly deployed to support efficient power transmission and grid stability across these renewable installations. Government-backed initiatives to modernize aging grid systems and enhance energy efficiency also create strong demand for sustainable transformer technologies throughout the region.

Key Green Power Transformer Insights

Some key players operating in the market include Siemens Energy, Schneider Electric, ABB Ltd, and General Electric. These companies actively invest in research and development, enhance manufacturing capabilities, and enter strategic collaborations to meet rising demand and comply with evolving energy efficiency standards.

Key Green Power Transformer Companies:

The following are the leading companies in the green power transformer market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens Energy

- Schneider Electric

- ABB Ltd

- General Electric

- Eaton Corporation

- Mitsubishi Electric Corporation

- Hitachi Energy

- Wilson Transformer Company

- Crompton Greaves (CG Power and Industrial Solutions)

- SPX Transformer Solutions, Inc.

Recent Developments

- In February 2025, Siemens Energy announced the opening of a new power transformer manufacturing facility in Charlotte, North Carolina. The facility will focus on producing eco-friendly, low-loss transformers designed to support renewable energy integration and grid modernization across the U.S. This expansion is expected to help utilities and industries meet growing clean energy demands while creating over 500 new jobs in the region.

Green Power Transformer Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.30 billion

Revenue forecast in 2030

USD 1.81 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Voltage, application, phase, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Siemens Energy; Schneider Electric; ABB Ltd; General Electric; Eaton Corporation; Mitsubishi Electric Corporation; Hitachi Energy; Wilson Transformer Company; Crompton Greaves (CG Power and Industrial Solutions); SPX Transformer Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Power Transformer Market Report Segmentation

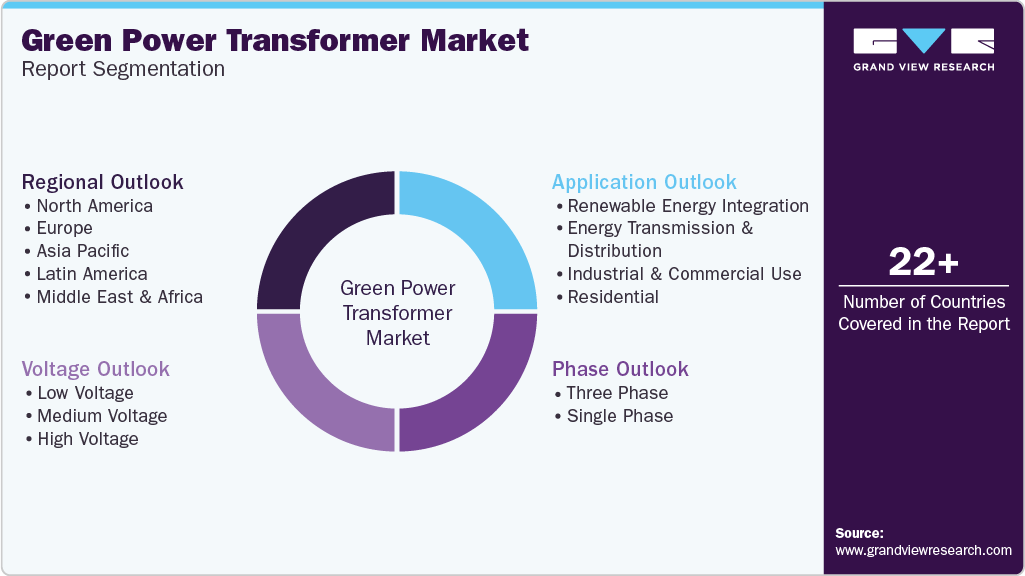

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green power transformer market report based on voltage, application, phase, and region:

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Renewable Energy Integration

-

Energy Transmission & Distribution

-

Industrial & Commercial Use

-

Residential

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Three Phase

-

Single Phase

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global green power transformer market size was estimated at USD 1.22 billion in 2024 and is expected to reach USD 1.30 billion in 2025.

b. The global green power transformer market is expected to grow at a compound annual growth rate of 6.85% from 2025 to 2030 to reach USD 1.81 billion by 2030.

b. Based on Voltage segment, Medium Voltage held the largest revenue share of more than 50.0% in 2024 owing to its optimal balance between efficiency and cost-effectiveness and thus are very suitable for renewable energy integration and urban power distribution where compact, efficient systems are essential.

b. Some of the key vendors of the global green power transformer market include Siemens Energy, ABB Ltd., General Electric, Schneider Electric, and Eaton Corporation, among others.

b. The key factors driving the green power transformer market include rapidly expanding renewable energy sources such as solar and wind. These require reliable and efficient transformers to manage voltage regulation and ensure stable power transmission. Green power transformers are critical in integrating intermittent renewable energy into the grid, enhancing grid stability, and improving energy efficiency in modern power networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.