- Home

- »

- Advanced Interior Materials

- »

-

Green Steel Market Size And Share, Industry Report, 2030GVR Report cover

![Green Steel Market Size, Share & Trends Report]()

Green Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Production Technology (EAF, Hydrogen-based DR), By End-use (Construction, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-400-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Green Steel Market Summary

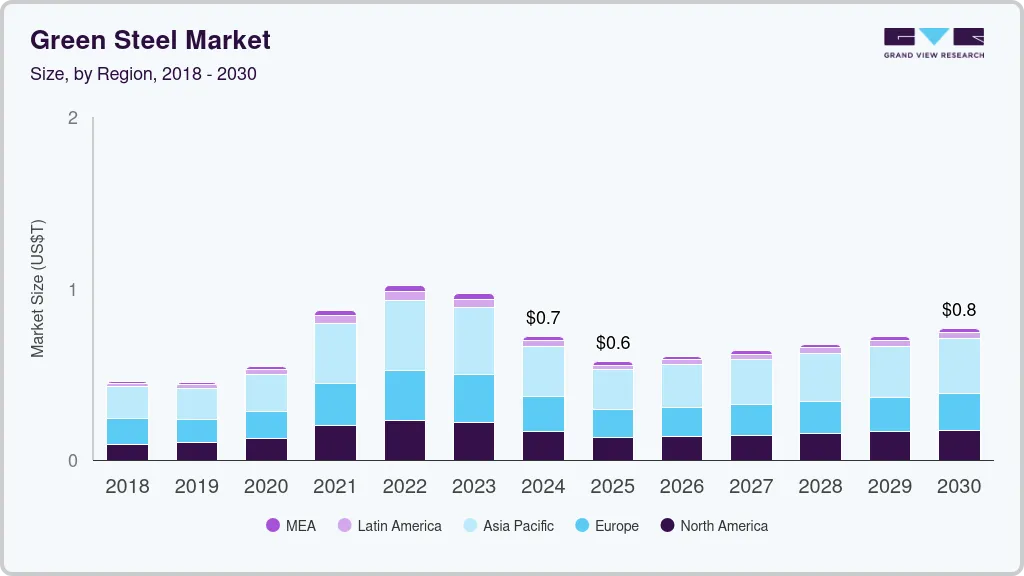

The global green steel market size was estimated at USD 718.30 billion in 2024 and is projected to reach USD 766.76 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. This growth is significantly driven by the increasing demand for sustainable manufacturing practices and the reduction of carbon footprints in the steel industry.

Key Market Trends & Insights

- Asia Pacific was the largest revenue generating market in 2024.

- Canada is expected to register the highest CAGR from 2025 to 2030.

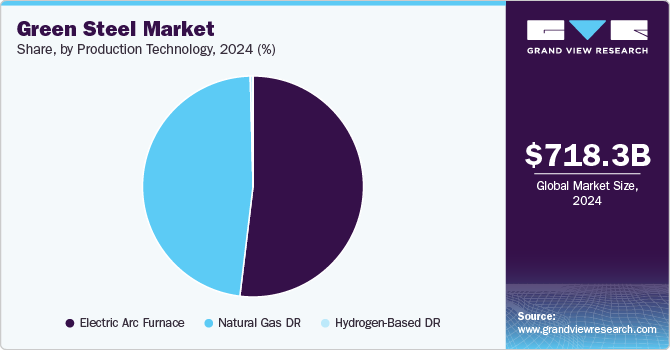

- By production technologyt, EAF segment dominates the market due to its efficiency and lower carbon emissions compared to traditional blast furnaces.

- By end use, the building and construction segment is projected to see substantial growth.

Market Size & Forecast

- 2024 Market Size: USD 718.30 Billion

- 2030 Projected Market Size: USD 766.76 Billion

- CAGR (2025-2030): 6.0%

- Asia Pacific: Largest market in 2024

Price Trends of Green Steel

The green steel market has seen notable price fluctuations, largely influenced by the availability and cost of raw materials and the adoption rate of new technologies. In 2022, prices surged due to heightened demand from environmentally conscious manufacturers and supply chain disruptions caused by geopolitical tensions. However, in 2023, prices began to stabilize as technological advancements improved production efficiency and new policies incentivized the use of green steel. By 2024, the market observed a price decline, reflecting broader stabilization in the commodities market and increased production capacity.

Production Technology Insights

EAF technology dominates the market due to its efficiency and lower carbon emissions compared to traditional blast furnaces. EAF is widely adopted in the building and construction industry, with a strong push for sustainable materials. The use of scrap in EAF further enhances its environmental benefits, making it a preferred choice for manufacturers aiming to meet stringent sustainability standards.

Hydrogen-based direct reduction is a cutting-edge technology in green steel production that uses hydrogen as a reducing agent instead of traditional carbon sources. This method produces water vapor as a byproduct instead of CO2, significantly reducing carbon emissions. Leading companies like SSAB, ArcelorMittal, and HYBRIT are investing heavily in hydrogen-based technologies, aligning global decarbonization targets. With ongoing advancements and pilot projects, hydrogen DRI is poised to play a crucial role in revolutionizing the industry’s carbon reduction efforts.

End-use Insights

The automotive and transportation sector leads the green steel market as it adopts eco-friendly materials to meet emission reduction targets and cater to environmentally conscious consumers. In 2023, major automakers, including AB Volvo and BMW AG, collaborated with green steel manufacturers to incorporate eco-friendly materials into vehicle bodies and chassis.

The building and construction segment is emerging as an important end-use sector for green steel, which is projected to see substantial growth due to the increasing shift towards sustainable materials in urban infrastructure projects. As global cities aim to lower their carbon footprints, green steel is becoming integral in building frameworks, bridges, and high-rise structures.

Regional Insights

The North America green steel market is characterized by increasing investments in sustainable technologies and a strong focus on reducing industrial emissions. The construction and automotive sectors are pivotal consumers, with green steel being integral to infrastructure projects and EV manufacturing. Government incentives and corporate sustainability commitments further propel market growth in the region.

U.S. Green Steel Market Trends

The U.S. green steel market is essential for industries such as construction and automotive, driven by stringent environmental regulations and the growing demand for sustainable materials. The push for green infrastructure and the automotive sector's transition to EVs are significant growth drivers. Technological innovations and investments in renewable energy sources enhance the market's outlook.

Asia Pacific Green Steel Market Trends

The Asia Pacific green steel market is growing rapidly, driven by investments in sustainable manufacturing and heightened environmental awareness. China, Japan, and South Korea are leaders in production, with demand rising in automotive, construction, and electronics sectors. Government policies promoting carbon neutrality and the adoption of advanced production technologies such as EAF and hydrogen-based steelmaking are key drivers, further fueling market expansion.

Europe Green Steel Market Trends

Europe is a major market for green steel, with significant contributions from countries like Germany and Sweden. The region's growth is underscored by robust regulatory frameworks promoting sustainable manufacturing and substantial investments in green steel production technologies. The European Union's Green Deal and other environmental initiatives are key drivers of market growth, fostering an ecosystem conducive to green steel adoption.

Key Green Steel Company Insights

Some of the key players operating in the market include ArcelorMittal, SSAB, and ThyssenKrupp AG.

-

ArcelorMittal, based in Luxembourg, leads green steel production with initiatives like the ‘XCarb’ program, which aims to reduce carbon emissions. The company is expanding its market presence through strategic partnerships and investments.

-

SSAB, located in Sweden, produces fossil-free steel through its HYBRIT initiative, using hydrogen instead of coal to transform the steel industry.

-

ThyssenKrupp AG, based in Germany, focuses on green steel via its ‘Steel for the Future’ program, emphasizing sustainable practices and technological advancements.

Key Green Steel Companies:

The following are the leading companies in the green steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- China BaoWu Steel Group Corporation Limited

- Emirates Steel Arkan

- Nippon Steel Corporation

- Nucor Corporation

- Outokumpu

- Salzgitter AG

- SSAB

- Tata Steel

- thyssenkrupp AG

- voestalpine AG

Recent Developments

-

In February 2024, Salzgitter Flachstahl GmbH (Salzgitter), a subsidiary of Salzgitter AG and Octopus Energy’s generation arm, signed a long-term Power Purchase Agreement (PPA) to enable the future production of green steel.

-

In January 2024, ArcelorMittal launched the XCarb Program, which focuses on achieving carbon-neutral steel production by leveraging innovative technologies and increasing the use of renewable energy sources. The initiative includes investments in hydrogen-based steelmaking and partnerships with key industry stakeholders to advance sustainable steel production.

-

In October 2023, Nippon Steel announced its Green Transformation Initiative, which aims to reduce carbon dioxide emissions by 30% by 2030 and achieve carbon neutrality by 2050. The strategy involves adopting new technologies, increasing the use of renewable energy, and enhancing energy efficiency across its production processes.

-

In March 2023, the HYBRIT Initiative by SSAB, LKAB, and Vattenfall is a partnership that aims to revolutionize steel production by using hydrogen instead of coal, significantly reducing carbon emissions. The initiative represents a major step towards fossil-free steel production and highlights the potential for large-scale industrial decarbonization.

-

In March 2023,Midrex Technologies, Inc., a subsidiary of Kobe Steel, is set to provide and erect the MIDREX Flex reduction facility for ThyssenKrupp Steel Europe AG at their Duisburg location in Germany. This installation is expected to boast an annual production capability of 2.5 million tons.

Green Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 572.97 billion

Revenue forecast in 2030

USD 766.76 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Production technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East, Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Russia, Sweden, China, India, Japan, South Korea, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

SSAB, ArcelorMittal, thyssenkrupp AG, Nucor Corporation, Outokumpu, voestalpine AG, Emirates Steel Arkan, Nippon Steel Corporation, China BaoWu Steel Group Corporation Limited, Salzgitter AG, Tata Steel

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Green Steel Market Report Segmentation

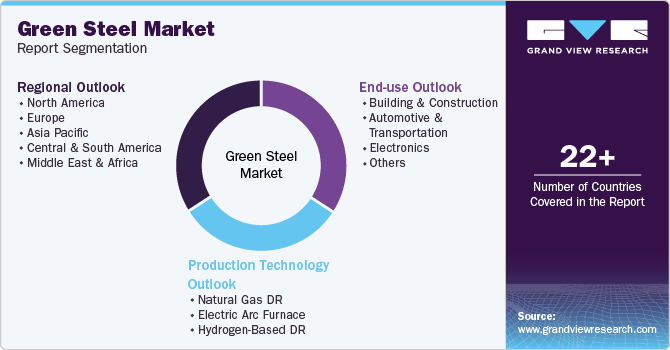

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global green steel market report based on production technology, end-use, and region.

-

Production Technology Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Natural Gas DR

-

Electric Arc Furnace

-

Hydrogen-Based DR

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Russia

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global green steel market size was estimated at USD 718.30 billion in 2024 and is expected to reach USD 572.97 billion in 2025.

b. The global green steel market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 766.76 billion by 2030.

b. By end use, automotive & transportation dominated the green steel market in 2023.

b. Some of the key vendors of the global green steel market are SSAB, Baowu Steel Group, Nucor Corporation, ThyssenKrupp AG, Outokumpu, Nippon Steel Corporation, ArcelorMittal, voestalpine AG, Emirates Steel Arkan, Salzgitter AG, and Tata Steel among others

b. The key factor driving the growth of the global green steel market is increasing demand for sustainable manufacturing practices and the reduction of carbon footprints in the steel industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.