- Home

- »

- Power Generation & Storage

- »

-

Grid-scale Battery Storage Market Size, Industry Report 2030GVR Report cover

![Grid-scale Battery Storage Market Size, Share & Trends Report]()

Grid-scale Battery Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Lead Acid, Lithium-Based, Others), By Application (Renewable Integration, Ancillary Services), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-643-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Grid-scale Battery Storage Market Summary

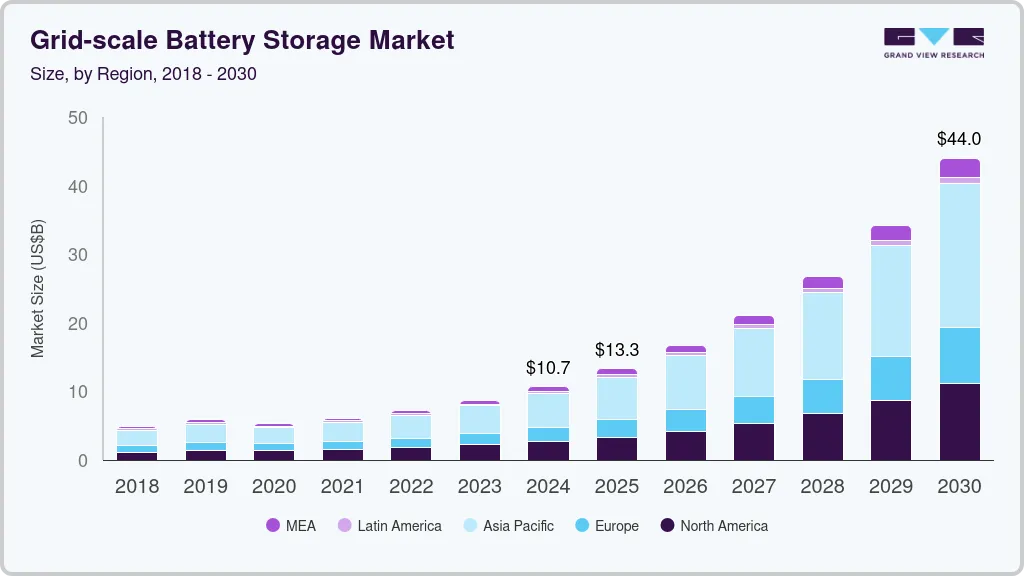

The global grid-scale battery storage market size was estimated at USD 10.69 billion in 2024 and is projected to reach USD 43.97 billion by 2030, growing at a CAGR of 27.0% from 2025 to 2030. This growth is attributed to the increasing deployment of renewable energy sources, such as solar and wind, which necessitates effective energy storage solutions to manage supply and demand fluctuations.

Key Market Trends & Insights

- The Asia Pacific grid-scale battery storage market dominated the global market and accounted for the largest revenue share of 46.6% in 2024.

- The grid-scale battery storage market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024.

- By type, the lithium-based battery led the market and accounted for the largest revenue share of 85.0% in 2024.

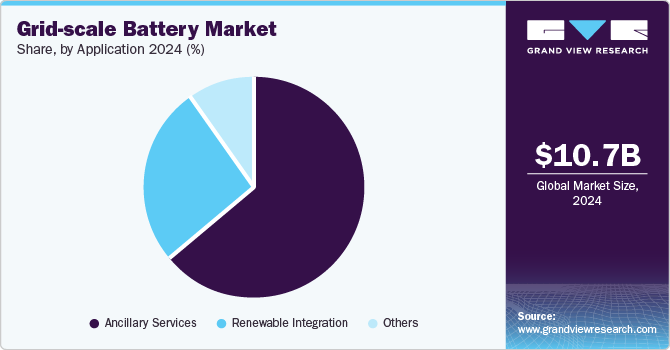

- By application, ancillary services dominated the market and accounted for the largest revenue share of 63.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.69 Billion

- 2030 Projected Market Size: USD 43.97 Billion

- CAGR (2025-2030): 27.0%

- Asia Pacific: Largest market in 2024

In addition, grid-scale batteries enhance grid stability by storing excess energy during peak production and releasing it during high demand. Furthermore, advancements in battery technologies, particularly lithium-ion, have improved efficiency and reduced costs, making these systems more viable for utilities aiming to transition away from fossil fuels.

Grid-scale battery technology is crucial in enabling utilities and grid operators to store energy for future use. A Battery Energy Storage System (BESS) collects energy from power plants or the grid and discharges it when necessary, addressing the growing demand for renewable energy integration. The market for grid-scale batteries is expanding due to significant advancements in battery technology, which have led to lower production costs and improved performance. Innovations in materials, such as nickel-rich layered oxides and lithium iron phosphate, enhance energy density while reducing costs. Moreover, shifting towards molten salt batteries presents new opportunities, offering sustainability benefits and reducing reliance on critical materials.

The advantages of grid-scale batteries include their ability to provide energy arbitrage, allowing operators to charge during low-price periods and discharge during peak demand, thus generating revenue. In addition, they help mitigate renewable energy curtailment by efficiently managing the supply-demand balance. As renewable energy sources such as solar and wind become more prevalent, grid-scale batteries are essential for maintaining grid stability and reliability. They can store excess energy generated during peak production times and release it when demand increases, effectively replacing smaller natural gas generators.

Furthermore, grid-scale batteries support the integration of variable renewable energy sources, enhancing the overall flexibility of power systems. They allow for better coordination of generation resources by charging during surplus generation and discharging during high-demand periods. As these technologies evolve, the grid-scale battery market is expected to grow significantly, contributing to a cleaner and more resilient energy landscape while facilitating the transition away from fossil fuels.

Type Insights

The lithium-based battery led the market and accounted for the largest revenue share of 85.0% in 2024. This growth is attributed to advancements in battery technology and decreasing costs. Lithium-ion batteries are favored for their high energy density, long cycle life, and quick charging capabilities, making them ideal for balancing supply and demand in renewable energy applications. Manufacturing costs have significantly declined as production scales up, enhancing their economic viability. Furthermore, battery chemistry and materials innovations continue to improve performance, further driving the adoption of energy storage systems worldwide.

The lead-acid battery segment is expected to grow at a CAGR of 22.8% over the forecast period, owing to its established presence and cost-effectiveness. Lead-acid batteries are known for their reliability and recyclability, which appeals to operators looking for sustainable solutions. In addition, their ability to provide backup power and ancillary services makes them suitable for various applications within grid-scale storage. Furthermore, their lower initial investment costs and ease of recycling contribute to their ongoing relevance in the market as utilities seek to enhance grid stability and resilience.

Application Insights

Ancillary services dominated the market and accounted for the largest revenue share of 63.7% in 2024, driven by the increasing demand for grid reliability and stability. As renewable energy sources such as wind and solar become more prevalent, they introduce variability and uncertainty in power generation. Grid-scale batteries provide essential ancillary services such as frequency regulation and voltage support, helping to maintain balance in the electricity supply. Furthermore, regulatory frameworks are evolving to incorporate these services, incentivizing the deployment of battery storage systems to enhance grid performance and resilience.

Renewable integration applications are expected to grow at a CAGR of 28.3% over the forecast period, owing to the urgent need for efficient energy storage solutions that facilitate the transition to cleaner energy sources. Grid-scale battery storage systems play a crucial role in capturing excess energy generated during peak production periods and releasing it during high demand. In addition, this capability optimizes the use of renewable resources and helps reduce reliance on fossil fuels. Furthermore, supportive government policies and declining battery costs are accelerating the adoption of grid-scale storage, enabling a more sustainable and flexible energy infrastructure seamlessly integrating diverse renewable energy sources.

Regional Insights

The North America grid-scale battery storage market is expected to grow at a CAGR of 27.2% over the forecast period, owing to favorable government policies, technological advancements, and increasing investments in renewable energy. In addition, the region's well-established electricity grid infrastructure supports the integration of renewable sources such as solar and wind, enhancing the need for effective energy storage solutions. Furthermore, the declining costs of battery technologies, particularly lithium-ion batteries, have made these systems more economically viable. Moreover, as utilities seek to improve grid reliability and flexibility, the demand for grid-scale battery systems is expected to continue rising.

U.S. Grid-Scale Battery Storage Market Trends

The grid-scale battery storage market in the U.S. held the dominant position in the North American market and accounted for the largest revenue share in 2024, driven by strong regulatory support and financial incentives. Furthermore, key initiatives such as the Federal Energy Regulatory Commission (FERC) Orders promote energy storage participation in wholesale markets, encouraging utilities to adopt battery systems for ancillary services such as frequency regulation. Moreover, the growing deployment of renewable energy sources further drives the need for energy storage solutions to manage supply and demand fluctuations.

Asia Pacific Grid-Scale Battery Storage Market Trends

The Asia Pacific grid-scale battery storage market dominated the global market and accounted for the largest revenue share of 46.6% in 2024. This growth is attributed to the increasing demand for electricity and a strong shift toward renewable energy sources. Countries such as China and India are leading this transition, with significant solar and wind energy investments. In addition, the region's rapid urbanization and industrialization further amplify energy needs, prompting the adoption of grid-scale battery systems to enhance grid reliability and support renewable integration. Government initiatives and technological advancements in battery production also expand the market.

The grid-scale battery storage market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its position as a global leader in renewable energy deployment. The Chinese government has implemented supportive policies and financial incentives to promote energy storage technologies, facilitating the integration of renewable resources into the grid. Furthermore, advancements in lithium-ion battery technology have significantly reduced costs while improving performance, making large-scale energy storage solutions more accessible. Moreover, China's ambitious renewable energy targets drive increased investment in grid-scale battery projects.

Europe Grid-Scale Battery Storage Market Trends

Europe grid-scale battery storage market is expected to experience substantial growth over the forecast period, owing to its ambitious climate goals and increasing reliance on renewable energy sources. In addition, the European Union's commitment to achieving carbon neutrality by 2050 has spurred investments in energy storage technologies as a means to balance intermittent renewable generation. Furthermore, regulatory frameworks promoting energy efficiency and sustainability encourage utilities to adopt grid-scale batteries for ancillary services and renewable integration, further driving market growth.

The growth of the grid-scale battery storage market in Germany is fueled as part of the country's Energiewende (energy transition) initiative, which aims to increase renewable energy usage. In addition, Germany's focus on phasing out nuclear power has heightened the need for reliable energy storage solutions to manage fluctuations from wind and solar sources. Furthermore, Government incentives and innovative projects such as virtual power plants that combine multiple battery systems foster a conducive environment for grid-scale battery adoption, ensuring a stable and resilient energy supply.

Key Grid-scale Battery Storage Company Insights

Some of the key players in the market include BYD Co. Ltd., Sumitomo Electric Industries, Ltd., Samsung SDI Co. Ltd., and others. These companies are adopting various strategies to enhance their market presence. Strategies include strategic partnerships to leverage complementary strengths and expand technological capabilities. In addition, companies also focus on new product launches to introduce innovative battery solutions that cater to evolving market demands. Furthermore, mergers and acquisitions are utilized to consolidate resources, enhance market share, and accelerate research and development efforts. These strategies collectively aim to improve competitiveness and drive growth within the rapidly evolving energy storage sector.

-

General Electric (GE) manufactures advanced battery systems, including its proprietary Durathon and Reservoir platforms, designed to store and distribute energy effectively. The company operates in the energy sector, providing technologies that facilitate the integration of renewable energy sources into existing power infrastructures. Their products cater to various applications, including peak demand management, grid stabilization, and renewable energy integration.

-

Mitsubishi Electric Corporation manufactures a range of battery technologies, including lithium-ion and flow batteries, to optimize energy management in electrical grids. The company operates within the energy and automation sectors, focusing on enhancing the efficiency and reliability of power systems. Their offerings are designed to facilitate renewable energy integration, improve grid flexibility, and provide ancillary services to support modern electrical infrastructure.

Key Grid-scale Battery Storage Companies:

The following are the leading companies in the grid-scale battery storage market. These companies collectively hold the largest market share and dictate industry trends.

- NGK Insulators Ltd.

- BYD Co. Ltd.

- Sumitomo Electric Industries, Ltd.

- Samsung SDI Co. Ltd.

- General Electric

- GS Yuasa Corp.

- LG Chem Ltd.

- Mitsubishi Electric Corp.

- Panasonic Corp.

- ABB Group

- Hitachi Ltd.

- Fluence Energy

Recent Developments

-

In January 2024, LG Energy Solution Vertech announced plans to construct 10 grid-scale battery storage facilities across the United States. This initiative aims to significantly enhance energy storage capabilities, supporting the country’s renewable energy goals while reducing carbon emissions by an estimated 16 million pounds annually. The projects will utilize lithium-ion batteries and advanced software for performance analytics. CEO Jaehong Park emphasized that these developments align with the growing demand for energy storage solutions as investments in renewable energy increase.

-

In June 2023, LGEN Sol announced successfully commissioning a grid-scale battery storage project in India. This facility is designed to enhance energy security and support the integration of renewable sources into the power grid. With a capacity of 100 megawatts, it aims to store excess energy generated during peak production times and release it when demand surges, thereby stabilizing the grid. This initiative reflects a significant step towards advancing India’s renewable energy transition through effective grid-scale battery storage solutions.

Grid-scale Battery Storage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.29 billion

Revenue forecast in 2030

USD 43.97 billion

Growth rate

CAGR of 27.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Chile, UAE, South Africa, and Morocco.

Key companies profiled

NGK Insulators Ltd.; BYD Co. Ltd.; Sumitomo Electric Industries, Ltd.; Samsung SDI Co. Ltd.; General Electric; GS Yuasa Corp.; LG Chem Ltd.; Mitsubishi Electric Corp.; Panasonic Corp.; ABB Group; Hitachi Ltd.; Fluence Energy.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Grid-scale Battery Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global grid-scale battery storage market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead-Acid

-

Lithium-Based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ancillary Services

-

Renewable Integration

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Chile

-

-

Middle East & Africa

-

UAE

-

South Africa

-

Morocco

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.