- Home

- »

- Medical Devices

- »

-

Guide Extension Catheter Market Size & Trends Report, 2030GVR Report cover

![Guide Extension Catheter Market Size, Share & Trends Report]()

Guide Extension Catheter Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Stainless Steel, Platinum Iridium), By Size (0.056, 0.057, 0.066, Others), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-987-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

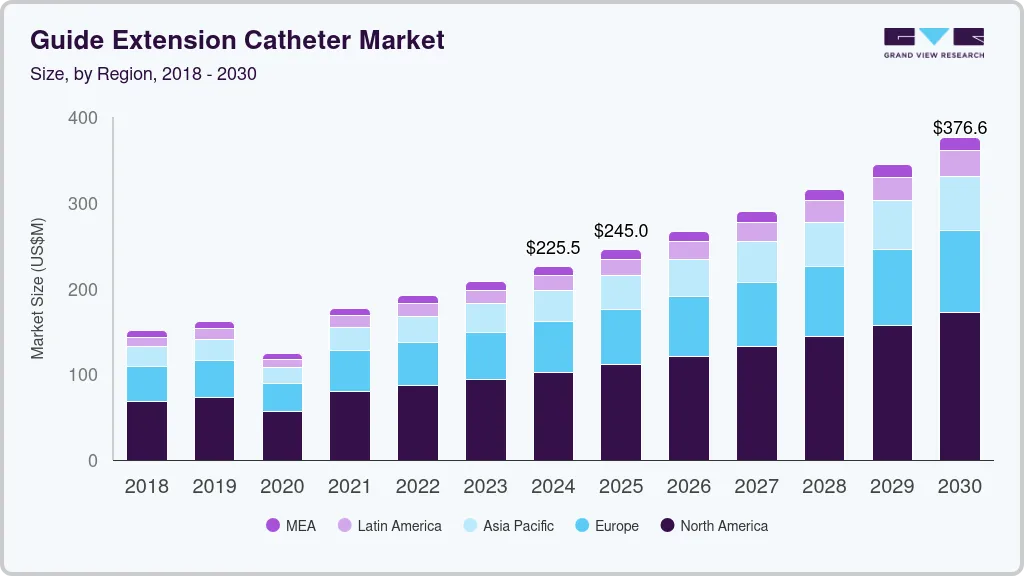

The global guide extension catheter market size was estimated at USD 225.5 million in 2024 and is projected to reach USD 376.6 million by 2030, growing at a CAGR of 9% from 2025 to 2030. Increasing demand for minimally invasive procedures such as chronic total occlusion percutaneous coronary interventions CTO-PCI, coupled with rising prevalence of target diseases, are the factors expected to drive growth of the market for guide extension catheters during the forecast period. Moreover, technological advancements are likely to contribute to the market growth. Peripheral diseases are interlinked with other chronic conditions, such as diabetes.

The growing demand for minimally invasive procedures can also be attributed to recent technological innovations (for instance, the use of antimicrobial coating and miniaturized catheters) to prevent the risk of restenosis. These procedures have higher adoption rates and are becoming standard techniques in general surgery due to the use of advanced technologies and innovative coated catheters available in the market. Thus, the growing preference for minimally invasive surgeries is expected to drive the growth of the guide extension catheters market during the forecast period.

The outbreak of COVID-19 in the year 2020, has negatively impacted the guide extension catheters market by directly affecting the demand & production, creating a disruption in the supply chain and increasing the financial burden on the firms. As a result of COVID-19 emergency cases, hospitals were forced to free up capacity and resources for potential patients, resulting in a considerable decrease in the number of routine & elective procedures, such as cardiac catheterization procedural volume.

According to National Center for Biotechnology Information in 2021, both coronary angiography and Percutaneous Coronary Intervention (PCI) volumes decreased by 64.0% in April 2020 as compared to April 2019. Hence, guide extension catheter unit sales and revenues went significantly lower in 2020. However, these revenues are expected to rise as facility capacity usage improves and resumes all the semi-elective to non-urgent procedures.

Moreover, the market is likely to witness significant growth during the forecast period due to the high prevalence of cardiovascular diseases, resumption of postponed cardiovascular procedures, increased demand for improved healthcare systems, presence of well-established healthcare facilities, technological advancements as well as companies executing innovative strategies to intensify their revenue.

Boston Scientific Corporation, for instance, reported a significant decrease in annual revenues in its Interventional Cardiology segment, which includes coronary stent devices, in 2020, but the company performed relatively well in the first quarter of 2021, reporting revenue growth of approximately 7.0%, globally, compared to the first quarter of 2020. Similarly, in 2021, Medtronic is recovering in terms of its annual revenue as well as coronary & peripheral vascular segment revenue. The company experienced a rise of 4.16% in its total revenue from 2020 to 2021.

CVDs have become one of the major causes of mortality and morbidity worldwide during the last three decades. Coronary Artery Disease (CAD), arrhythmias, peripheral vascular disease, and congenital heart defects are the major CVDs prevalent across the globe. Guide extension catheters are majorly used for the treatment of such diseases. For instance, for the treatment of CAD, a catheter-based interventional procedure is recommended by professionals. In this procedure, a catheter is used to open the blockage of coronary arteries, which increases the blood flow to the heart.

Furthermore, for the treatment of peripheral vascular diseases, angioplasty is recommended. In this procedure, the catheter is inserted through the blood vessel to examine the affected artery, which then reopens the artery and flattens the blockage of the artery wall. Guide extension catheters offer extra support for equipment delivery during complex coronary interventions such as calcified vessels, tortuous arteries, and distal lesions. Thus, increasing cases of CVDs are anticipated to drive the number of cardiac catheterizations, angioplasty, and Percutaneous Coronary Intervention (PCI), thereby boosting demand for guide extension catheters during the forecast period.

Moreover, according to a report published by the CDC in 2021, in the U.S., heart disease is a leading cause of death in both genders and members of the majority of racial & ethnic groups. Furthermore, CVD claims 1 life every 34 seconds in the U.S. In addition, as per a similar source, in 2020, 697,000 people in the U.S. died as a result of heart disease, i.e., 1 in every 5 deaths.

Similarly, as per a report published by the World Atlas, Russia has the highest prevalence of CVDs, and around 57.0% of the mortality in the country is due to CVDs. As a result, it is projected that rising CVD cases globally will increase demand for angioplasty, cardiac catheterization, and PCI. Guide extension catheters increase guide backup support and are crucial during such procedures. This is further anticipated to increase demand during the forecast period.

The U.S dominated the global market with the highest revenue share of 85.53% in 2021, owing to the high prevalence of cardiovascular-related disorders along with the presence of key market players in the country. Moreover, rapid technological advancements, coupled with the frequent launches of new & innovative products, are among the key factors fueling the market growth during the forecast period. Furthermore, the presence of well-defined regulatory guidelines and reimbursement policies for coronary intervention procedures is boosting revenue generation in the country.

The CMS offers favorable healthcare insurance policies for various cardiovascular procedures, which may increase the number of patients opting for such services. Coronary intervention procedures, such as PTA, cardiac catheterization, and PCI, are covered under the policies issued by CMS. For every procedure, certain specific criteria need to be fulfilled for Medicare coverage. The CMS has also announced to cover certain angioplasty procedures performed in ASCs from January 2020, and it will be covered under Medicare Hospital Outpatient Prospective Payment System and ASC Payment System Final Rule.

Besides, growing interest in complex PCI patients with regard to the development of specialized equipment and treatment methods is another important factor that will propel the market expansion in the near future. The industry is also being driven by the development of specific devices and treatment methods for patients who would otherwise undergo Coronary Artery Bypass Graft surgery (CABG) or be managed medically. For instance, in April 2021, Seigla Medical, Inc., announced CE Mark for LiquID Guide Catheter Extension for use in coronary and peripheral vasculature interventions.

In addition, Seigla announced the completion of the first PCI cases using the LiquID device. Similarly, in February 2022, Teleflex Incorporated, announced that the U.S. FDA has cleared an expanded indication for its specialty catheters and coronary guide wires for use in crossing chronic total occlusion percutaneous coronary interventions (CTO PCI). Thus, key market players are making continuous efforts to launch new technologically advanced products in the market and maintain their position.

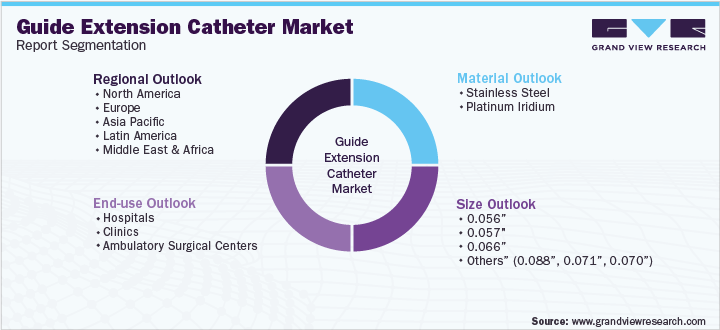

Size Insights

Based on the size, the guide extension catheter market is segmented into 0.056”, 0.057", 0.066”, and others. The others which include 0.088”, 0.071”, and 0.070” sized catheters segments led the market and accounted for more than 44.6% share of the global revenue in 2021 and is also expected to expand at a highest compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. These types of catheters are generally used to open large blocked blood vessels and allow enhanced blood flow.

Also, such catheters increase guide backup support and are crucial in complex PCI procedures, particularly in cases of severe calcification and tortuosity. Moreover, they are utilized in both femoral and radial approaches for native coronary, graft, and peripheral interventions with success rates above 90.0%. Thus owing to the superior deliverability of these catheters, the others segment is expected to at a significant rate in the forecast period.

Furthermore, the increasing cases of cardiovascular diseases across the globe are one of the major factors contributing to the segment growth during the forecast period. For instance, as per the report published by the World Heart Federation in 2018, 80.0% of the deaths in low to middle-income countries were caused due to cardiovascular diseases. Similarly, as per the World Health Organization (WHO) in 2018, around 17.9 million deaths occur globally due to CVDs.

Therefore, such factors are anticipated to propel the demand for cardiac catheterization, angioplasty, and other interventional procedures, which in turn triggers the demand for other catheters segment.

Material Insights

Based on the material, the guide extension catheter market is segmented into stainless steel and platinum-iridium. The stainless steel catheters segment led the market and accounted for more than 77.0% share of the global revenue in 2021 and is also expected to grow at the highest compound annual growth rate (CAGR) of 8.9% from 2022 to 2030.

As stainless steel is the most preferred material for the production of cardiac catheters due to various advantages associated with it, such as enhanced flexibility and biocompatibility as compared to other materials. Moreover, excellent mechanical properties, biocompatibility, corrosion resistance, and workability are the reasons for the preference for stainless steel guide extension catheters over any other material. These associated benefits including ease of use, low risk of migration, and reduced rate of infection and complications, will significantly drive the segment growth during the forecast period.

Also, these catheters support minimally invasive surgical procedures and offer reduced healing time which results in a decreased hospital stay. Due to this reason, stainless steel guide extension catheters are highly adopted and preferred by professionals for complex PCI procedures. Thus, regulatory agencies are increasing approvals for stainless steel-based cardiac catheters across various regions due to its several advantages. Moreover, guide extension catheters include an inner coating of PTFE liner to provide low-friction passage for other catheters or devices. This is expected to fuel the market growth during the forecast period.

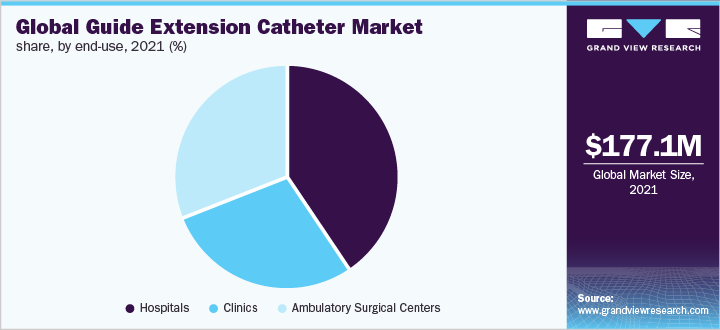

End-Use Insights

The hospitals segment accounted for the leading revenue share of more than 40.0% in 2021 owing to deeper product penetration, a large volume of surgical procedures, and rising patient footfall. For instance, as per the CDC in 2018, coronary heart disease is the most common type of cardiovascular disease and more than 370,000 people die every year in the U.S. It also reported around 735,000 Americans have a heart attack every year. Angioplasty, PCI, and cardiac catheterization are majorly recommended for the treatment of such problems, thus an increase in cases of such diseases is expected to augment the hospital admission rate.

In addition, the rising number of hospitals across the globe is also anticipated to surge the segment growth during the forecast period. For instance, as per the report published by the American Hospital Association in 2019, around 6,210 hospitals were reported in the U.S. in 2018, of which 2,968 are non-government not-for-profit community hospitals and 972 are state and local government community hospitals.

The ambulatory surgical centers segment is expected to expand at the highest CAGR during the forecast period. Ambulatory surgery facilities sometimes referred to as outpatient surgery centers, are frequently chosen by patients having less involved surgeries that only need a brief hospital stay. Rapid healing is possible with minimally invasive interventional techniques, which also have a short hospital stay.

Thus, patients opting for such procedures generally prefer to choose ambulatory surgical centers. For instance, Percutaneous Transluminal Coronary Angioplasty (PTCA) and Percutaneous Transluminal Angioplasty (PTA) are minimally invasive interventional procedures, which allow rapid healing, and the patients can get back to their normal life within a short period of time. Currently, demand for minimally invasive procedures is increasing across the globe owing to its several advantages, which in turn demand the ambulatory surgical centers is also anticipated to rise. Therefore, significant segment growth is expected during the forecast period.

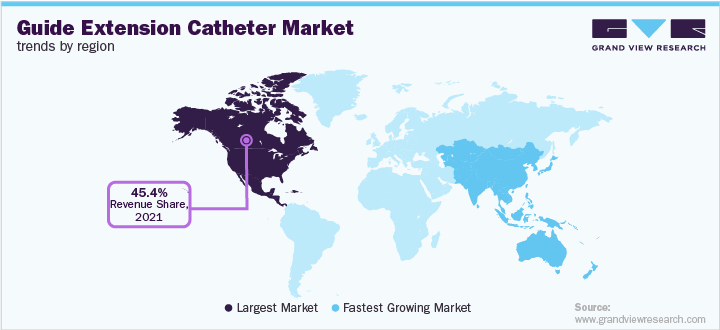

Regional Insights

North America dominated the market with the largest revenue share of over 45.41% in 2021. Increasing demand for minimally invasive procedures such as CTO-PCI, coupled with the rising prevalence of the target diseases is expected to drive the growth of the market in the region. Moreover, the occurrence of high healthcare spending with efficient reimbursement policies as well as government regulatory approvals are some of the other factors propelling the market growth in the region.

Furthermore, the high incidence of cardiovascular disorders in this region has created a greater demand for guide extension catheters. For instance, according to the CDC, each year, around 805,000 people in the U.S. suffer from a heart attack. Thus, North America is expected to maintain its dominance throughout the forecast period. Moreover, the annual per capita healthcare expenditure in the U.S. is the highest in the world (USD 11,172, on average, in 2018), with healthcare costs growing between 4.2% and 5.8% annually during the past five years. This is likely to propel the Guide Extension Catheter market in this region.

The Asia-Pacific is expected to register the fastest growth in the global guide extension catheter market during the forecast period. The rising prevalence of cardiac diseases has created a demand for these catheters in APAC countries. As per the article published in the inaugural issue of JACC: Asia, over half (58.0%) of all CVD deaths globally in 2019 occurred in Asian countries, accounting for 10.8 million deaths. Most CVD deaths were due to ischemic heart disease (IHD) (47.0%) or stroke (40.0%).

Furthermore, with some of the highest diabetes rates in the world, India and China have been the most afflicted countries. Diabetes claimed the lives of about 1.5 million people in 2019, according to a WHO estimate. The population of ASEAN countries is expected to reach 693,000 by 2025. According to the British Medical Journal, the incidence rate of diabetes and cardiovascular disease would likely reach 20.0% by 2025.

Thus, the gradual adoption of technologically advanced products and increasing awareness among people regarding the treatment of cardiac diseases are the factors anticipated to promote market growth during the forecast period.

Key Companies & Market Share Insights

Competition in the guide extension catheter market is expected to be high during the forecast period. These companies have extensive resources, market expertise, and distribution network, and are involved in deploying strategic initiatives to increase market share and profits. For instance, key players are adopting various strategies, such as mergers & acquisitions, partnerships, and product launches to strengthen their strong foothold in the market.

Moreover, the key companies are investing profoundly in research and development to launch new, innovative, and technologically advanced products in the market. For instance, in February 2020, Teleflex Medical OEM acquired IWG High-Performance Conductors, Inc.-a manufacturer of wire components and medical tubing. With this acquisition, the company expanded its product offerings under its interventional business.

Moreover, in May 2019, in order to aid in complicated coronary cases, Medtronic introduced the Telescope Guide Extension Catheter. Access to distal lesions and additional backup support is made possible by this product. This may expand the customer base and market share of the company. Some of the prominent players in the global Guide Extension Catheter Market include:

-

Boston Scientific Corporation

-

Medtronic

-

QXMédical

-

Teleflex Incorporated

-

Seigla Medical, Inc.

-

IMDS (Interventional Medical Device Solutions)

-

Nipro Corporation

-

Terumo Corporation

Guide Extension Catheter Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 376.6 million

Growth rate

CAGR of 9% from 2025 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Size, material, End-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Mexico, Colombia, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Boston Scientific Corporation, Medtronic, QXMédical, Teleflex Incorporated, Seigla Medical, Inc., IMDS (Interventional Medical Device Solutions), Nipro Corporation, and Terumo Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Guide Extension Catheter Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Guide Extension Catheter Market report based on the size, material, End-use, and region:

-

Size Outlook (Revenue USD Million; 2018 - 2030)

-

0.056”

-

0.057"

-

0.066”

-

Others” (0.088”, 0.071”, 0.070”)

-

-

Material Outlook (Revenue USD Million; 2018 - 2030)

-

Stainless Steel

-

Platinum Iridium

-

-

End-use Outlook (Revenue USD Million; 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global guide extension catheter market size was estimated at USD 177.07 million in 2021 and is expected to reach USD 191.72 billion in 2022.

b. The global guide extension catheter market is expected to grow at a compound annual growth rate of 8.81% from 2022 to 2030 to reach USD 376.58 million by 2030.

b. North America dominated the guide extension catheter market with a share of 45.41% in 2021. This is attributable to various factors such as well-established healthcare infrastructure, high prevalence of cardiovascular disorders, and rapid adoption of technologically advanced products coupled with constant research and development initiatives in the region.

b. Some key players operating in the guide extension catheter market include Boston Scientific Corporation, Medtronic, QXMédical, Teleflex Incorporated, Seigla Medical, Inc., IMDS (Interventional Medical Device Solutions), Nipro Corporation, Terumo Corporation

b. Key factors that are driving the guide extension catheter market growth include the rising prevalence of cardiovascular diseases (CVDs), favorable reimbursement policies for coronary intervention procedures, rising incidence of diabetes globally, and the launch of new product lines in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.