- Home

- »

- Pharmaceuticals

- »

-

Guillain-Barre Syndrome Market Size, Industry Report, 2030GVR Report cover

![Guillain-Barre Syndrome Market Size, Share & Trends Report]()

Guillain-Barre Syndrome Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapeutic (Intravenous Immunoglobulin (IVIG)), By Type (AIDP), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-200-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Guillain-Barre Syndrome Market Summary

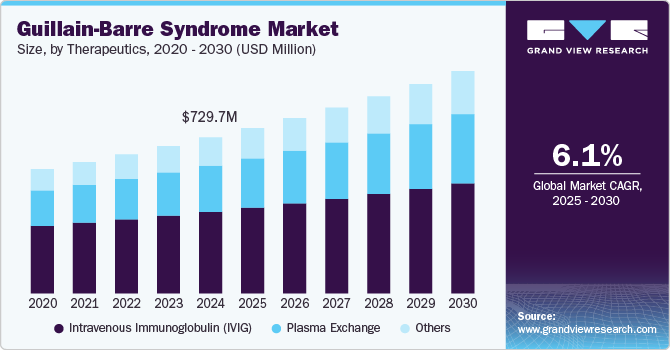

The global guillain-barre syndrome market size was estimated at USD 729.70 million in 2024 and is projected to reach USD 1,039.99 million by 2030, growing at a CAGR of 6.10% from 2025 to 2030. The rising incidence of GBS, particularly in regions with high rates of infectious diseases, is expected to significantly drive market growth over the forecast period.

Key Market Trends & Insights

- North America dominated the Guillain-Barre syndrome (GBS) market, with a global share of 44.24% in 2024.

- The U.S. accounted as the dominant region in North America registering a share of 69.75% in 2024.

- Based on product, the intravenous immunoglobulin (IVIG) segment accounted for the largest revenue share of 52.35% in 2024.

- Based on type, the Intravenous Immunoglobulin (IVIG) segment accounted for the largest revenue share of 40.85% in 2024.

- Based on the route of administration, the parenteral segment captured the largest revenue share at 65.75% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 729.7 Million

- 2030 Projected Market Size: USD 1,039.99 Million

- CAGR (2025-2030): 6.10%

- North America: Largest market in 2024

In addition, advancements in diagnostic techniques, coupled with increasing research and development (R&D) efforts for innovative treatments, are set to further accelerate the market expansion. Guillain-Barré syndrome (GBS) can affect individuals of any age, though it is most commonly observed in those between 30 and 50 years old. As a rare neurological disorder, it impacts approximately 100,000 people globally each year. In the U.S., CDC estimates suggest that around 3,000 to 6,000 new cases are diagnosed annually. Furthermore, in January 2025, at least 67 cases of Guillain-Barré Syndrome (GBS) have been reported in Pune, Maharashtra, raising concerns among health officials. Authorities are actively investigating the surge and monitoring the situation closely. Higher incidence rates in specific regions, particularly those with frequent infectious disease outbreaks, contribute to increased demand for diagnostic tools and therapeutic options.

Since GBS lacks a definitive cure, ongoing research into immunomodulatory therapies and novel treatment approaches presents opportunities for market expansion. These novel treatment approaches not only improve patient care but also expand the market by introducing innovative drugs, therapies, and medical technologies. Pharmaceutical and biotech companies investing in GBS research stand to gain a competitive advantage, while healthcare systems benefit from improved treatment options. As these therapies progress through clinical trials, the GBS market is expected to see increased investment, regulatory approvals, and commercialization of new therapies in the coming years.

A study conducted by the University of Minnesota in October 2023 found that individuals with COVID-19 face a higher risk of developing Guillain-Barré Syndrome (GBS). The study reported that approximately 67% of GBS patients had experienced respiratory or gastrointestinal infections within six weeks prior to their diagnosis. In addition, the average age of GBS patients was 56 years, regardless of gender, with 50% of the cases occurring in females.

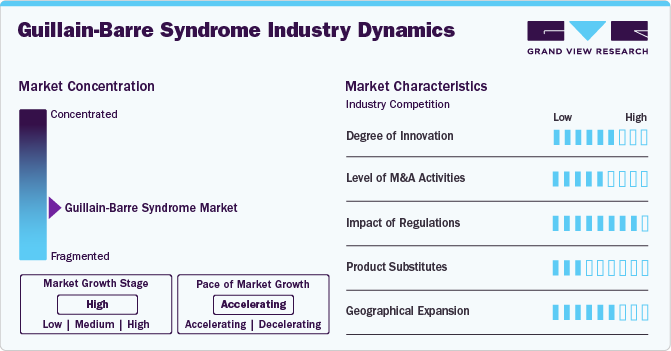

Market Concentration & Characteristics

The Guillain-Barré syndrome (GBS) market is experiencing continuous advancements, primarily driven by immunomodulatory therapies such as intravenous immunoglobulin (IVIG) and plasma exchange (plasmapheresis). These remain the gold standard treatments for GBS, helping to reduce the severity and duration of symptoms. In addition, research into next-generation immunotherapies, monoclonal antibodies, and complement inhibitors is expanding the treatment landscape.

Mergers and acquisitions (M&A) are actively shaping the GBS market, with leading pharmaceutical companies focusing on strengthening their neurology and immunology portfolios. Companies such as CSL Behring, Grifols SA, and Octapharma AG—key players in the IVIG market—are actively acquiring smaller biotech firms specializing in immunotherapy and plasma-based treatments. In addition, major pharmaceutical firms such as Takeda Pharmaceutical, Pfizer, and Biogen are investing in advanced neurology R&D to develop next-generation GBS treatments, including novel biologics and complement inhibitors.

Regulatory agencies such as the U.S. FDA, European Medicines Agency (EMA), and Japan’s PMDA play a critical role in approving and commercializing GBS treatments. IVIG and plasmapheresis require strict regulatory oversight due to plasma collection standards, donor screening, and safety concerns. Clinical trials for novel therapies, including monoclonal antibodies and gene therapies, must meet rigorous efficacy and safety benchmarks, often leading to lengthy approval processes.

GBS treatment alternatives remain limited, as there are no definitive cures for the disorder. The primary substitutes for IVIG and plasma exchange include corticosteroids and emerging immunomodulatory drugs, but their effectiveness varies by subtype. The market also faces some competition from experimental therapies, such as stem cell transplants and complement inhibitors.

Geographical Expansion: Leading pharmaceutical companies are expanding their presence in regions with a higher incidence of GBS, particularly in areas prone to infectious disease outbreaks, which are known triggers for GBS. North America and Europe continue to be key markets, driven by strong healthcare infrastructure and advanced R&D investments.

Product Insights

Based on product, the Guillain-Barre syndrome (GBS) market has been categorized into intravenous immunoglobulin (IVIG), plasma exchange, and others. The intravenous immunoglobulin (IVIG) segment accounted for the largest revenue share of 52.35% in 2024. IVIG is the primary infusion-based treatment for patients with Guillain-Barré syndrome (GBS). It involves administering donor-derived immunoglobulins directly into the bloodstream via IV infusion. These healthy antibodies help neutralize and dilute the harmful autoantibodies responsible for attacking the peripheral nerves. For optimal effectiveness, IVIG treatment should be initiated within two to four weeks of symptom onset, as early intervention can significantly improve recovery outcomes and reduce disease severity. The high demand for plasma-derived immunoglobulins fuels investments in plasma collection, processing, and distribution.

The plasma exchange segment is expected to exhibit the fastest growth in the market over the forecast period. Plasma exchange (plasmapheresis) is a crucial treatment for Guillain-Barré Syndrome (GBS), particularly in severe cases. It works by removing harmful autoantibodies and immune complexes from the bloodstream, preventing further nerve damage and accelerating recovery. This procedure is highly effective when administered within the first two weeks of symptom onset, making it a critical early intervention strategy.

Type Insights

Based on type, the Guillain-Barre syndrome (GBS) market has been categorized into acute inflammatory demyelinating polyneuropathy (AIDP), chronic inflammatory demyelinating polyradiculoneuropathy (CIDP), miller fisher syndrome (MFS), acute motor axonal neuropathy (AMAN), and Others. The Intravenous Immunoglobulin (IVIG) segment accounted for the largest revenue share of 40.85% in 2024. Acute inflammatory demyelinating polyneuropathy (AIDP) is the most common form of Guillain-Barré syndrome (GBS), accounting for the majority of GBS cases worldwide. AIDP primarily affects the peripheral nervous system, leading to rapid muscle weakness, paralysis, and, in severe cases, respiratory failure. The increasing recognition and diagnosis of AIDP have significantly contributed to the growth of the GBS market, driving demand for effective treatment options such as intravenous immunoglobulin (IVIG) and plasma exchange (plasmapheresis).

The Chronic inflammatory demyelinating polyradiculoneuropathy (CIDP) segment is expected to exhibit the fastest growth in the market over the forecast period. Chronic inflammatory demyelinating polyradiculoneuropathy (CIDP) is a rare, chronic form of Guillain-Barré Syndrome (GBS) that typically presents with a slow and progressive onset of nerve inflammation leading to weakness, numbness, and loss of motor function. The growing awareness and diagnosis of CIDP are major drivers of the GBS market, as treatment options, including intravenous immunoglobulin (IVIG), corticosteroids, and plasma exchange, become more widely utilized.

Route of Administration Insights

Based on the route of administration, the Guillain-Barre syndrome market has been categorized into parenteral and oral. The parenteral segment captured the largest revenue share at 65.75% in 2024. Parenteral are witnessing significant demand in the Guillain-Barre syndrome market, driven by their ability to deliver targeted, sustained therapeutic effects. Parenteral are known for their improved bioavailability and faster action, making them a preferred choice for both healthcare providers and patients seeking more effective disease management solutions.

Oral is the second largest segment in route of administration segment of Guillain-Barre Syndrome market. The oral route of administration is witnessing significant growth in the Guillain-Barre syndrome market due to its high patient compliance, ease of use, and non-invasive nature. Patients often prefer oral formulations over injectable or implantable options, as they eliminate the need for professional assistance during administration. Moreover, oral drugs are convenient for the long-term management of chronic conditions such as CIDP, where treatment adherence is crucial.

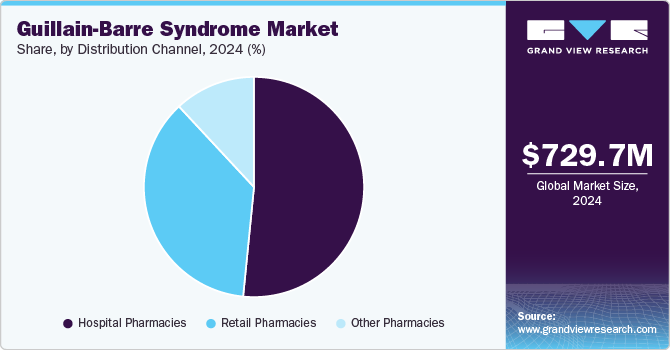

Distribution Channel Insights

Based on distribution channel, the Guillain-Barre syndrome market has been categorized into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held the largest revenue share of 51.58% in 2024. Hospital pharmacies are the primary sites for administering acute GBS treatments. Given the rapid progression of the disease, which can lead to paralysis and respiratory failure, the need for immediate access to effective therapies is paramount. IVIG therapy and plasmapheresis are typically administered in hospital settings, driving the increased demand for these treatments through hospital pharmacies. The critical role of hospital pharmacies in managing severe GBS cases is a key market driver.

The retail pharmacies is expected to grow at the considerable growth of over the forecast period. Retail pharmacies are increasingly playing a crucial role in the Guillain-Barré syndrome (GBS) treatment landscape, particularly in the management of chronic GBS cases and ongoing supportive therapies. Although hospital pharmacies are primarily responsible for acute interventions such as intravenous immunoglobulin (IVIG) and plasmapheresis, retail pharmacies offer accessibility, convenience, and a wider reach, making them a key player in ensuring long-term patient care. Retail pharmacies are also pivotal in dispensing maintenance medications, such as oral corticosteroids, pain management drugs, and rehabilitation drugs, to GBS patients during their recovery phase.

Regional Insights

North America dominated the Guillain-Barre syndrome (GBS) market, with a global share of 44.24% in 2024. The region's GBS market is seeing rapid growth driven by factors such as increasing awareness, advancements in treatment options, and rising diagnosis rates. The U.S. and Canada are leading the way in this market, where access to healthcare and improved diagnostic methods are contributing to an expanding market for GBS treatments. In addition, the increasing adoption of online pharmacies is enhancing accessibility to therapies across the region.

U.S. Guillain-Barre Syndrome Market Trends

The U.S. accounted as the dominant region in North America registering a share of 69.75% in 2024. A major driver of market growth is the rising disease rates in the U.S., which have significant links to autoimmune disorders such as GBS. One of the major drivers of market growth is the increasing number of GBS cases in the country. The Centers for Disease Control and Prevention (CDC) has reported rising cases, indicating a higher incidence of GBS. As the demand for effective treatments rises, therapies such as Intravenous Immunoglobulin (IVIG) and plasma exchange are expected to see significant usage.

Europe Guillain-Barre Syndrome Market Trends

The Guillain-Barre Syndrome (GBS) market in Europe is experiencing considerable growth, driven by increased awareness of the disease and a rise in diagnosed cases. Countries such as the UK, Germany, and France are witnessing a surge in GBS diagnoses, leading to greater demand for treatment options such as IVIG and plasma exchange. The rising focus on improving healthcare infrastructure and providing advanced treatment options is expected to contribute to further market growth.

The growth of the Guillain-Barre syndrome (GBS) market in the UK is primarily driven by the increasing number of GBS cases and a greater focus on the importance of early diagnosis and treatment. Public health initiatives and campaigns aimed at improving awareness are contributing to the rise in treatment demand. Both parenteral and oral therapies are being utilized in the UK market, with hospital pharmacies being the key distribution channel for intravenous treatments like IVIG and plasma exchange.

Germany has seen significant growth in the GBS market, mainly driven by increased awareness and recognition of the disease. Public health campaigns by both government and private organizations have played a crucial role in educating the public about the risks of GBS. The demand for IVIG and plasma exchange treatments is rising as awareness continues to grow, particularly for cases of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP) and acute motor axonal neuropathy (AMAN), both of which require intensive treatments.

The GBS market in France is experiencing significant growth due to greater access to advanced treatment options and an increasing number of GBS diagnoses. As the healthcare system continues to focus on improving access to essential treatments such as IVIG and plasma exchange, the French market is seeing more competitive dynamics, with both local and international players competing for market share. The treatment market is focused on both parenteral and oral therapies, with hospital pharmacies playing an important role in administering the treatments.

Asia Pacific Guillain-Barre Syndrome Market Trends

In the Asia Pacific region, the GBS market is expanding rapidly, particularly in countries such as China, India, Japan, and Australia. Increasing awareness of GBS and its associated risks, along with the development of healthcare infrastructure, is driving the growth of the market. The rise in diagnosed cases across these regions is contributing to greater demand for therapies such as IVIG and plasma exchange, which are crucial for managing the more severe forms of GBS, such as AIDP and AMAN.

The GBS market in Japan is growing due to lifestyle changes and increasing awareness of GBS-related health risks. As awareness of the disease increases, there is greater demand for effective treatments such as IVIG and plasma exchange, which are administered parenterally in clinical settings. Hospital pharmacies are essential for providing these treatments to patients.

China is witnessing significant growth in the GBS market, driven by the increasing awareness of GBS and the growing demand for treatment options. As more people are diagnosed with GBS, both IVIG and plasma exchange are becoming more widely used, especially in the treatment of Miller Fisher Syndrome (MFS), a rare variant of GBS. The market is also benefiting from growing access to healthcare infrastructure, including hospital pharmacies, which provide essential treatment services for patients.

Latin America Guillain-Barre Syndrome Market Trends

In Latin America, countries such as Brazil are seeing significant growth in the GBS market. The region is experiencing a rising number of GBS cases, which is increasing the demand for effective treatment options. Both IVIG and plasma exchange are used to treat patients, especially for subtypes such as CIDP and AMAN, which require intensive therapy. Healthcare systems in Brazil and other Latin American countries are improving, and hospital pharmacies are central to the administration of these treatments.

Brazil is experiencing notable growth in the Guillain-Barré syndrome (GBS) market due to a combination of increased awareness, better healthcare access, and a rising number of diagnosed cases. The growing demand for treatment options such as Intravenous Immunoglobulin (IVIG) and plasma exchange is driving market growth, especially for patients suffering from severe forms of GBS, such as acute inflammatory demyelinating polyneuropathy (AIDP), chronic inflammatory demyelinating polyradiculoneuropathy (CIDP), and acute motor axonal neuropathy (AMAN).

Middle East & Africa Guillain-Barre Syndrome Market Trends

The MEA region is also witnessing growth in the GBS market, with countries such as Saudi Arabia, South Africa, UAE, and Kuwait seeing rising demand for GBS treatments. The healthcare infrastructure is evolving, and public health campaigns are focusing on increasing awareness of GBS and its treatments. Hospital pharmacies in these countries play an essential role in administering IVIG and plasma exchange treatments, which are the cornerstone of GBS management.

Saudi Arabia’s Guillain-Barré syndrome (GBS) market is growing rapidly, primarily due to rising awareness of the disease, improving healthcare infrastructure, and a greater number of diagnosed cases. The kingdom’s focus on healthcare development, as outlined in the Vision 2030 Health Sector Transformation Program, has led to better access to advanced treatments and an emphasis on early diagnosis and intervention. This is fueling the demand for treatments like Intravenous Immunoglobulin (IVIG) and plasma exchange.

Key Guillain-Barre Syndrome Company Insights

Some prominent players in the global market are CSL Behring LLC, Grifols SA, F. Hoffmann-La Roche Ltd, and Takeda Pharmaceutical Company Limited. The market is shaped by mergers, acquisitions, and partnerships, along with significant investments in research & development to address unmet needs and expand treatment options.

Meanwhile, emerging companies in the GBS market are targeting niche areas, including personalized treatment approaches for Guillain-Barré syndrome. This involves tailoring therapies to individual patient needs, considering factors such as disease severity, genetic predisposition, and treatment response. In addition, some companies are working on novel drug delivery mechanisms to improve the efficacy and convenience of treatments, such as oral immunoglobulins or new methods for more efficient plasma exchange.

Key Guillain-Barre Syndrome Companies:

The following are the leading companies in the guillain-barre syndrome Market. These companies collectively hold the largest market share and dictate industry trends.:

- AbbVie Inc.

- Biogen

- Cadila Pharmaceuticals

- CSL

- F. Hoffmann-La Roche Ltd.

- GSK plc

- Grifols S.A.

- LGM Pharma

- Merck & Co., Inc.

- Octapharma AG

- Pfizer Inc.

- Takeda Pharmaceutical Company Limited

Recent Developments

-

In December 2024, Hansa Biopharma initiated enrollment for a Phase II trial investigating imlifidase as a potential treatment for Guillain-Barré Syndrome (GBS). The trial aims to evaluate the safety, tolerability, and efficacy of imlifidase when used in combination with the standard Intravenous Immunoglobulin (IVIG) treatment for GBS patients.

-

In October 2023, Annexon Inc. announced that the European Medicines Agency (EMA) granted orphan drug designation to ANX005 for the treatment of Guillain-Barré Syndrome (GBS). This strategic move is expected to significantly boost their ability to expand into untapped markets, enabling them to gain regulatory support and increased market visibility in regions with unmet medical needs for GBS treatments.

-

In March 2022, Annexon Biosciences presented preclinical data at the AAN 2022 conference, supporting their complement inhibitor programs for the treatment of Guillain-Barré Syndrome (GBS) and Huntington's Disease. The data showcased the potential of these complement inhibitors to address underlying immune system dysfunctions, which are key in the progression of GBS.

Guillain-Barre Syndrome Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 773.32 million

Revenue forecast in 2030

USD 1,039.99 million

Growth rate

CAGR of 6.10% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutics, type, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

AbbVie Inc.; Biogen; Cadila Pharmaceuticals; CSL; F. Hoffmann-La Roche Ltd.; GSK plc; Grifols S.A.; LGM Pharma; Merck & Co., Inc.; Octapharma AG; Pfizer Inc.; Takeda Pharmaceutical Company Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Guillain-Barre Syndrome Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Guillain-Barre Syndrome market report on the basis of therapeutics, type, route of administration, distribution channel and region:

-

Therapeutics Outlook (Revenue, USD Million, 2018 - 2030)

-

Intravenous Immunoglobulin (IVIG)

-

Plasma Exchange

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute inflammatory demyelinating polyneuropathy (AIDP)

-

Chronic inflammatory demyelinating polyradiculoneuropathy (CIDP)

-

Miller fisher syndrome (MFS)

-

Acute motor axonal neuropathy (AMAN)

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Guillain-Barre syndrome market size was estimated at USD 729.70 million in 2024 and is expected to reach USD 773.25 million in 2025.

b. The global Guillain-Barre syndrome market is expected to grow at a compound annual growth rate of 6.10% from 2025 to 2030 to reach USD 1,039.99 million by 2030.

b. Based on product, the intravenous immunoglobulin (IVIG) segment accounted for the largest revenue share of 52.35% in 2024. IVIG is the primary infusion-based treatment for patients with Guillain-Barré syndrome (GBS). It involves administering donor-derived immunoglobulins directly into the bloodstream via IV infusion.

b. Key players operating in the market are AbbVie Inc., Biogen, Cadila Pharmaceuticals, CSL, F. Hoffmann-La Roche Ltd., GSK plc, Grifols S.A., LGM Pharma, Merck & Co., Inc., Octapharma AG, Pfizer Inc., and Takeda Pharmaceutical Company Limited.

b. The Guillain-Barre syndrome (GBS) market driven by factors such as increasing prevalence of Guillain-Barré Syndrome (GBS), supportive government regulations and guidelines, and advancements in treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.