- Home

- »

- Advanced Interior Materials

- »

-

Gypsum Plaster Market Size & Share, Industry Report, 2030GVR Report cover

![Gypsum Plaster Market Size, Share & Trends Report]()

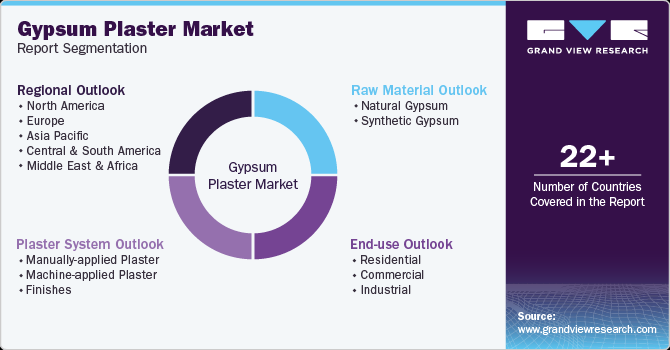

Gypsum Plaster Market (2025 - 2030) Size, Share & Trends Analysis Report By Plaster System (Manually-applied, Machine-applied, Finishes), By Raw Material (Natural, Synthetic), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-533-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Gypsum Plaster Market Summary

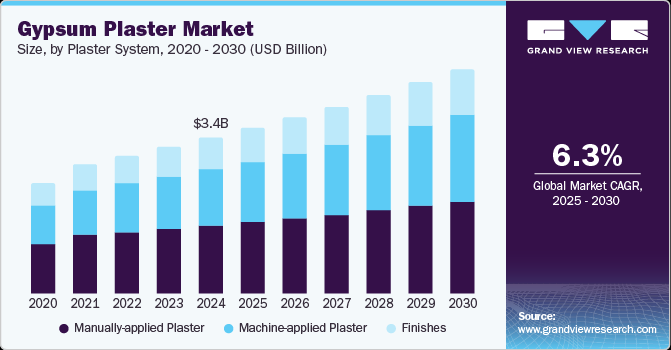

The global gypsum plaster market size was estimated at USD 3.41 billion in 2024 and is projected to reach USD 4.92 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. One of the primary factors propelling market expansion is the growing adoption of gypsum-based materials in residential, commercial, and industrial construction.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 46.7% in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- By plaster system, the manually applied plaster segment led the market and accounted for the largest revenue share of 46.3% in 2024.

- By raw material, the natural gypsum segment led the market and accounted for the largest revenue share of 67.7% in 2024.

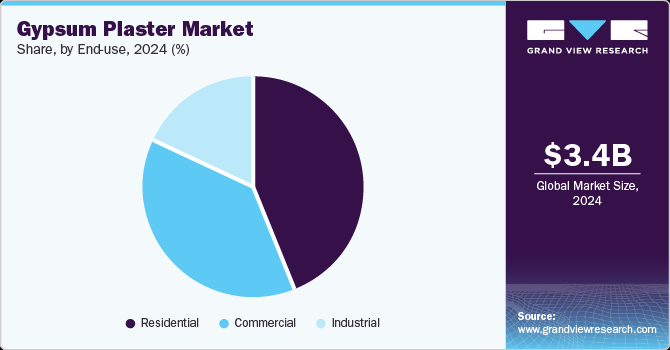

- By End use, the residential segment dominated the market and accounted for the largest revenue share of 44.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.41 Billion

- 2030 Projected Market Size: USD 4.92 Billion

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

Gypsum plaster is widely preferred due to its superior fire resistance, acoustic insulation properties, and ease of application compared to traditional cement plaster. In addition, the rapid pace of urbanization and infrastructure development in emerging economies is further driving the demand for gypsum plaster in large-scale construction projects.

Technological advancements in gypsum production and processing techniques are also crucial to market growth. The development of lightweight and enhanced-strength gypsum plasters has improved their application in modern construction, making them suitable for a wider range of structural and decorative uses. Furthermore, the availability of pre-mixed and ready-to-use gypsum plaster products simplifies construction, reduces labor costs, and accelerates project timelines, increasing market adoption.

In addition, the expanding renovation and remodeling sector, particularly in developed regions such as North America and Europe, is boosting the demand for gypsum plaster. Homeowners and commercial property owners are increasingly opting for gypsum-based solutions for interior finishes, owing to their smooth texture, aesthetic appeal, and durability. The growing focus on modular and prefabricated construction techniques is another factor driving the market, as gypsum plaster offers fast-setting and easy-to-handle properties, making it an ideal choice for prefabricated building components.

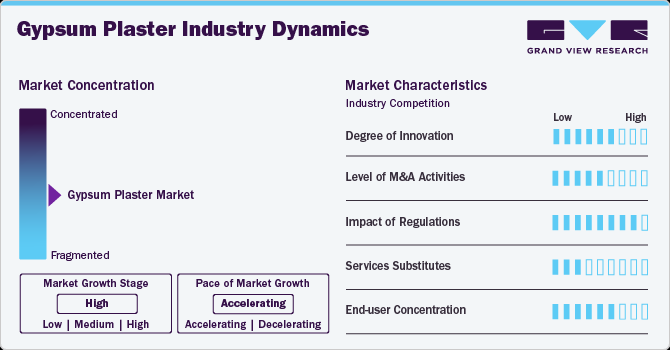

Market Concentration & Characteristics

The global gypsum plaster industry exhibits a moderate to high market concentration, with key players dominating the industry through advanced manufacturing processes, product diversification, and strategic partnerships. The degree of innovation in the market is notable, driven by the development of lightweight, high-strength, and environmentally sustainable gypsum plaster variants. Companies are investing in enhanced formulations, such as quick-setting and moisture-resistant gypsum plasters, to meet the evolving demands of modern construction. Furthermore, innovations in automated application techniques and ready-mix gypsum plasters have improved efficiency and reduced labor dependency, further strengthening the market’s competitive landscape. The presence of both multinational corporations and regional manufacturers ensures a balance between large-scale production capabilities and localized supply chains, contributing to steady market growth.

Regulations play a critical role in shaping the gypsum plaster industry, as governments worldwide emphasize sustainable construction practices, fire safety standards, and low-carbon building materials. Regulatory bodies such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) promote using gypsum plaster for its recyclability, energy efficiency, and reduced environmental impact. However, the market faces competition from service substitutes like cement plaster, lime plaster, and synthetic wall coatings, which are preferred in certain applications due to regional preferences and cost considerations. The end-use concentration is high in the construction sector, with demand driven by residential, commercial, and industrial infrastructure projects. However, the growing trend of prefabricated and modular construction has increased the utilization of gypsum plaster, reinforcing its position as a key material in contemporary building practices.

Plaster System Insights

The manually applied plaster segment led the market and accounted for the largest revenue share of 46.3% in 2024, driven by its widespread use in residential, commercial, and industrial construction projects. Traditional hand-applied plastering remains preferred among builders and contractors due to its cost-effectiveness, ease of application, and flexibility in achieving smooth and customized finishes. Skilled laborers favor manually applied gypsum plaster for its better workability, improved adhesion to various surfaces, and suitability for intricate architectural detailing. In addition, the rising demand for high-quality interior finishes in both new construction and renovation projects is contributing to the expansion of this segment.

Machine-applied plaster is expected to grow at the fastest CAGR of 7.4% over the forecast period, driven by the increasing demand for efficient and labor-saving construction solutions. The adoption of mechanized plastering techniques is rising as the construction industry seeks to enhance productivity, reduce manual labor dependency, and improve the uniformity of plaster applications. Machine-applied plaster offers significant time savings and cost efficiency, making it an attractive choice for large-scale residential, commercial, and industrial projects. Furthermore, the growing shortage of skilled labor in many regions has prompted contractors and developers to invest in automated plastering technologies to ensure consistent quality and faster project completion.

Raw Material Insights

The natural gypsum segment led the market and accounted for the largest revenue share of 67.7% in 2024. Natural gypsum, a mineral primarily composed of calcium sulfate dihydrate, is extensively mined and processed to produce high-quality gypsum plaster. The increasing preference for natural gypsum-based plaster is attributed to its consistent chemical composition, minimal processing requirements, and lower environmental impact, making it a preferred choice for construction applications. Moreover, the abundant global reserves of natural gypsum, particularly in regions such as North America, the Middle East, and Asia-Pacific, ensure a steady and reliable supply for the growing construction industry.

Synthetic gypsum is expected to grow at the fastest CAGR of 6.5% over the forecast period. Synthetic gypsum, a byproduct of industrial processes such as flue gas desulfurization (FGD) in coal-fired power plants, is increasingly being utilized as a sustainable alternative to natural gypsum. The rising focus on reducing industrial waste and promoting circular economy initiatives has led to a surge in demand for synthetic gypsum, as it helps divert waste from landfills and minimize resource depletion. In addition, government regulations and environmental policies encouraging industries to adopt sustainable practices have further propelled the utilization of synthetic gypsum in plaster production.

End-use Insights

The residential segment dominated the market and accounted for the largest revenue share of 44.0% in 2024. The rising emphasis on sustainable and energy-efficient housing solutions contributes to expanding gypsum plaster usage in the residential sector. With stringent environmental regulations and green building certifications, homebuilders and developers are shifting towards low-carbon, recyclable materials that align with energy conservation goals. Gypsum plaster offers low thermal conductivity, improving insulation and reducing energy consumption in residential spaces. This aligns with homeowners' and developers' increasing preference for eco-friendly and cost-effective construction materials.

Commercial is expected to grow at the fastest CAGR of 7.4% over the forecast period, driven by the increasing demand for high-quality interior finishes in modern commercial buildings. Gypsum plaster is widely used in office spaces, hotels, shopping malls, hospitals, and educational institutions due to its smooth finish, fire resistance, and durability. The rising aesthetic and functional interior design trend in commercial establishments further fuels demand, as gypsum plaster allows for intricate architectural detailing while maintaining structural integrity. Furthermore, the need for faster construction timelines in commercial projects has led to adopting pre-mixed and quick-setting gypsum plaster solutions, which help reduce labor costs and project completion time.

Regional Insights

The gypsum plaster market in North America is expected to grow at a significant CAGR over the forecast period. The growing construction industry in North America, driven by both residential and commercial building projects, is a significant factor driving the market. With urbanization and population growth, there is a constant need for new housing and commercial spaces, further driving the demand for gypsum-based products. Furthermore, technological advancements and manufacturing processes have led to the development of high-performance gypsum plaster products that offer improved durability, faster setting times, and enhanced finish quality, making them more attractive to builders and contractors.

U.S. Gypsum Plaster Market Trends

The U.S. gypsum plaster market is driven by the growing demand for eco-friendly and sustainable building materials. As environmental concerns continue to rise, construction companies are turning to materials with lower carbon footprints and greater resource efficiency. Gypsum plaster stands out as an environmentally friendly option because it is often made from natural gypsum, an abundant mineral that can be easily recycled. Nevertheless, the production process of gypsum plaster consumes less energy than that of traditional cement production, further reducing its environmental impact.

Asia Pacific Gypsum Plaster Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 46.7% in 2024, driven by rapid urbanization and infrastructure development across key economies such as China, India, Japan, and Southeast Asia. The rising demand for affordable and high-quality construction materials in residential, commercial, and industrial projects is a major factor propelling market expansion. Governments in the region are investing heavily in smart city initiatives, housing projects, and commercial infrastructure, increasing the need for efficient and sustainable building materials like gypsum plaster. Moreover, the growing middle-class population and rising disposable incomes have contributed to increased demand for modern housing and high-end interior finishes, further supporting market growth.

The gypsum plaster market in China is expected to grow significantly over the forecast period. Technological advancements in gypsum extraction, processing, and manufacturing also contribute to market growth. Developing enhanced-strength, lightweight, and ready-to-use gypsum plaster formulations improves construction efficiency and reduces labor costs. In addition, the expansion of gypsum mining and production facilities within China, coupled with advancements in automated production technologies, is ensuring a steady supply of high-quality gypsum plaster products at competitive prices.

Europe Gypsum Plaster Market Trends

The gypsum plaster market in Europe is driven by the rising trend of renovation and refurbishment activities. Many European countries, particularly those with older building stocks, such as the UK, Germany, and France, focus on updating and upgrading their existing infrastructure. Gypsum plaster plays a significant role in these renovations due to its ease of application, smooth finish, and versatility in both aesthetic and functional aspects. The growing popularity of interior design trends that emphasize clean, modern, and minimalist spaces has further fueled the use of gypsum plaster in renovations. Furthermore, gypsum plaster's ability to provide a smooth surface ideal for paint and wallpapering has made it the go-to material for interior wall finishing, contributing to its dominance in the European market.

Germany gypsum plaster market dominated the European market in 2024. Germany's competitive advantage in the global market for innovation and technology impacts the gypsum plaster industry. The growing integration of advanced technologies, such as automation and 3D printing in construction, has increased the efficiency and scalability of applying gypsum plaster. Applying gypsum plaster quickly and efficiently reduces labor costs and time, particularly in large-scale projects. This technological advancement, coupled with continuous product innovations—such as improved moisture resistance and enhanced durability has further driven the material's adoption in a variety of projects.

Latin America Gypsum Plaster Market Trends

The gypsum plaster market in Latin America is expected to show significant growth over the forecast period. The growing demand for fire-resistant building materials in Latin America has significantly driven the market. Gypsum plaster possesses excellent fire-resistant properties, which make it an essential material in ensuring the safety and compliance of buildings with stringent fire safety regulations. This is particularly important in Latin American countries that are prone to natural disasters, such as earthquakes and wildfires, where construction standards are becoming more stringent. As the need for fire-resistant materials rises, gypsum plaster's safety features make it an attractive option for developers looking to meet these evolving regulations, thereby driving its use in a wide variety of construction applications.

Middle East & Africa Gypsum Plaster Market Trends

The gypsum plaster market in MEA is witnessing considerable growth, owing to the increasing adoption of green building construction across Middle East & Africa. Many MEA countries have started to adopt stricter environmental regulations, such as energy efficiency standards and certifications for sustainable construction practices. This growing awareness and adoption of green building practices contributes to the heightened preference for materials like gypsum plaster, which is energy-efficient, recyclable, and does not contribute significantly to pollution. The ability of gypsum plaster to help regulate interior temperature and humidity, along with its ability to act as an effective sound barrier, makes it a key element in achieving sustainability goals in modern construction projects. As environmental regulations tighten and builders seek more energy-efficient alternatives to traditional materials, gypsum plaster is positioned as a vital component in meeting these demands.

Key Gypsum Plaster Company Insights

Some key players operating in the market include Saint-Gobain, Global Gypsum Company Co. Ltd.

-

Saint-Gobain is a global player in producing and distributing building materials, including gypsum-based products. The company’s extensive range of plaster and drywall solutions are well-regarded for their quality, performance, and sustainability. Saint-Gobain focuses on providing innovative, energy-efficient solutions that meet the demands of modern construction, especially in regions with stringent environmental regulations. Their gypsum products are widely used in residential, commercial, and industrial applications.

-

Global Gypsum Company is a major manufacturer and supplier of gypsum plaster products with a strong presence in various international markets. Known for producing high-quality gypsum plaster, its products are used in a wide range of applications, including wall coatings, ceilings, and decorative finishes. The company focuses on delivering superior products and services to meet the needs of residential and commercial construction projects while prioritizing eco-friendly manufacturing processes.

Escayescos, SL, and USG Corporation are some of the emerging market participants.

-

Escayescos, SL is a Spanish company specializing in manufacturing gypsum plaster and related products for the construction industry. The company offers a wide range of plaster solutions for interior and exterior applications, particularly emphasizing high-quality finishes and decorative plaster. Escayescos’ innovative approach to gypsum production makes it a significant player in the regional market, and its focus on both residential and commercial sectors has enabled it to expand its presence in the European and global markets.

-

USG Corporation is a leading building materials manufacturer, including gypsum-based products, in the United States. Known for its high-performance drywall systems, joint compounds, and plaster products. Their products are widely used in residential and commercial construction due to their durability, ease of installation, and superior finish. USG’s commitment to innovation and sustainability is reflected in its eco-friendly product offerings, including low-VOC and energy-efficient solutions.

Key Gypsum Plaster Companies:

The following are the leading companies in the gypsum plaster market. These companies collectively hold the largest market share and dictate industry trends.

- Saint-Gobain

- Knauf Gips KG

- Global Gypsum Company Co. LTD

- Escayescos, SL

- USG Corporation

- James Hardie Industries plc

- Georgia-Pacific Gypsum II LLC

- YOSHINO GYPSUM CO., LTD

- Vg-orth GmbH & Co. KG

- LA MARUXIÑA

Recent Developments

-

In December 2024, BUA Group unveiled its new gypsum plaster plant, marking a significant milestone in the West African construction industry. The state-of-the-art facility, designed to produce high-quality gypsum plaster, aims to meet the growing demand for construction materials in the region. With this move, BUA Group seeks to enhance local production capabilities, reduce reliance on imports, and contribute to developing the Nigerian and broader West African construction markets. The plant’s launch is expected to strengthen the gypsum plaster supply chain, drive economic growth, and support the construction of infrastructure projects across the region.

Gypsum Plaster Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.62 billion

Revenue forecast in 2030

USD 4.92 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Plaster system, raw material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Saint-Gobain; Knauf Gips KG; Global Gypsum Company Co. LTD; Escayescos, SL; USG Corporation; James Hardie Industries plc; Georgia-Pacific Gypsum II LLC; YOSHINO GYPSUM CO., LTD; Vg-orth GmbH & Co. KG; LA MARUXIÑA

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Gypsum Plaster Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global gypsum plaster market report based on plaster system, raw material, end-use and region.

-

Plaster System Outlook (Revenue, USD Million, 2018 - 2030)

-

Manually-applied Plaster

-

Machine-applied Plaster

-

Finishes

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Gypsum

-

Synthetic Gypsum

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global gypsum plaster market size was estimated at USD 3.41 billion in 2024 and is expected to reach USD 3.62 billion in 2025.

b. The global gypsum plaster market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 4.92 billion by 2030.

b. The manually applied plaster segment led the market and accounted for the largest revenue share of 46.3% in 2024, driven by its widespread use in residential, commercial, and industrial construction projects.

b. Some of the key players operating in the gypsum plaster market include Saint-Gobain, Knauf Gips KG, Global Gypsum Company Co. LTD, Escayescos, SL, USG Corporation, James Hardie Industries plc, Georgia-Pacific Gypsum II LLC, YOSHINO GYPSUM CO., LTD, Vg-orth GmbH & Co. KG, and LA MARUXIÑA

b. The key factors driving the gypsum plaster market include the growing demand for lightweight and durable construction materials, increasing urbanization, and rising infrastructure development projects globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.