- Home

- »

- Beauty & Personal Care

- »

-

Hair Color Spray Market Size, Share & Growth Report, 2030GVR Report cover

![Hair Color Spray Market Size, Share & Trends Report]()

Hair Color Spray Market Size, Share & Trends Analysis Report By End-user (Male, Female, Children), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-206-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hair Color Spray Market Size & Trends

The global hair color spray market size was estimated at USD 2.23 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030. The growing consumer awareness of personal wellness and appearance, coupled with an increased focus on personal grooming, is fueling the demand for hair color sprays. This trend is particularly evident among men, who are increasingly embracing hair color as part of their grooming routine. In addition, the need for quick and convenient solutions to conceal grey hair, driven by an aging population and busy lifestyles, is further boosting the demand for hair color sprays, especially in Asian and Western countries.

The coronavirus pandemic led to a surge in at-home hair coloring, with one in three women dyeing their hair for the first-time during quarantine, according to a survey commissioned by Garnier in 2021. Garnier responded to this trend by leveraging social media, engaging influencers, and experts, and launching educational content like how-tos and live Q&A sessions. This strategy, including online color tools like the Virtual Shade Selector, resulted in a 9.4% increase in hair color sales for Garnier in 2020 compared to 2019. This trend suggests a promising outlook for the market, as consumers continue to seek convenient and effective at-home hair coloring solutions.

The trend of using semi-permanent hair dye, especially among Gen Zers, is growing as a form of self-expression. These dyes provide a short-term solution for changing hair colors, appealing to those who want frequent changes without committing to permanent dyes. The expansion of product offerings, such as L'Oréal Paris' Colorista Temporary 1-Day Hair Color Spray, reflects this trend. This shift is beneficial for the market, as it meets the demand for temporary and easily changeable hair color options, suggesting a potential increase in demand for these products.

The market is driven by the growing concern over greying hair, as people seek quick and convenient solutions to conceal grey strands. According to a June 2022 survey by OnePoll in partnership with L’Oreal Paris, half of men currently have grey hair, with two-fifths expressing self-consciousness about it. Most men with grey hair worry that it makes them look older, and many are concerned about others' opinions. Hair color sprays like dpHUE Color Touch-Up Spray cater to this need, offering a temporary formula that dries quickly and provides precise application for root coverage, addressing both cosmetic and psychological concerns, thus driving the market forward.

The market is propelled by a steady stream of new product launches, meeting diverse consumer needs and preferences for convenient and innovative hair coloring solutions. For instance, popular hair color brand Clairol introduced its Root Touch Up Color + Volume 2-in-1 Spray in January 2023. This versatile temporary root touch-up spray adds volume and rapidly covers gray areas. With a damage-free formula, the product offers cover root regeneration and gives the appearance of fuller-looking hair.

Market Concentration & Characteristics

The market has shown a significant degree of innovation, with brands introducing new formulations, application methods, and colors to cater to diverse consumer preferences. Innovations such as quick-drying formulas, precise application nozzles, and a wide range of vibrant shades have enhanced the appeal of hair color sprays, driving market growth.

Regulations play a crucial role in the global market, ensuring the safety and efficacy of products. Under the FD&C Act, color additives must be FDA-approved for their intended use in cosmetics, including hair color sprays. This regulation helps protect consumers from harmful ingredients and ensures that products are safe for use as directed. In addition, the FDA can take action against products that contain harmful ingredients, further safeguarding consumer health.

The market faces competition from various substitutes, including traditional hair dyes, hair chalks, and temporary hair color gels. These substitutes offer consumers alternative ways to achieve temporary or semi-permanent hair color changes, impacting the demand for hair color sprays.

The market exhibits a broad end-user concentration, ranging from individuals seeking to cover grey hair to trend-conscious consumers, including Gen Zers, looking for temporary and easily changeable hair color options. This diversity in end-users underscores the market's appeal across various demographics and preferences, driving its overall growth and innovation.

End-user Insights

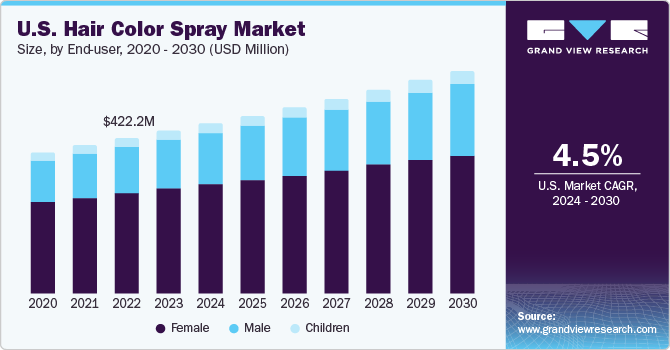

Based on end-user, the females segment held the market with the largest revenue share of 65.2% in 2023. This dominance is attributed to women being the primary consumers of hair color products and their growing preference for temporary and innovative coloring solutions. A 2022 poll by OnePoll for Better Natured revealed that the average female Gen Xer has not worn her natural hair color since 2019, with half of the respondents dyeing their hair a different color for two to six years. This trend positively impacts the market, indicating a sustained demand for these products among women seeking versatile and trendy hair coloring options.

The males segment is expected to grow at a fastest CAGR of 6.2% from 2024-2030. Future demand for hair color spray is expected to be driven by men's growing interest in personal care and grooming as well as the growing market for male-focused beauty products. 96% of men purchase grooming products for themselves, according to a September 2022 blog post by the Global Cosmetic Industry. Moreover, they purchase goods that are advertised in various ways. Of the things purchased, 87% are made especially for men, while 42% are from unisex brands. This shift suggests that cultural views of male beauty standards are changing, driving men to explore and purchase goods that meet their unique wants and preferences.

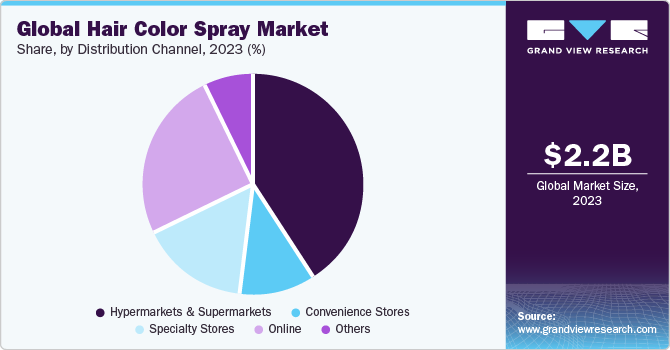

Distribution Channel Insights

Based on distribution channel, the hypermarkets & supermarkets segment led the market with the largest revenue share of 40.7% in 2023. Hypermarkets and supermarkets dominate the sales channel of the market due to their extensive reach, offering a wide variety of brands and products under one roof. This convenience, coupled with promotional activities and discounts often available in these stores, makes them preferred destinations for consumers looking to purchase hair color sprays. In March 2022, Everpro Gray Away launched its line of hair color sprays called NEW Gray Away Root Cover Up Sprays. The products were made available in different hypermarkets & supermarkets such as Target, Walgreens, and Walmart

The online segment is expected to grow at a fastest CAGR of 5.9% in the forecast period. In April 2022 YouGov’s newest tool, Global Profiles, revealed consumers’ purchase preferences within the beauty products sector. Around 10% of consumers said that they tend to make all their purchases for health and beauty products online while about 22% revealed that they shop mostly online. The demand for hair color sprays through online channels is expected to rise in the future due to the convenience of online shopping, wider product selection, and increasing digitalization of retail.

Regional Insights

The North America dominated the market with the revenue share of 25% in 2023. Rapidly changing fashion trends and a growing desire for experimentation with the looks in driving demand for hair color sprays in the region. Also, hair color spray offers a cost-effective way of temporary hair coloring which is further expected to fuel its demand in North America.

U.S. Hair Color Spray Market Trends

The hair color spray market in the U.S. is expected to grow at a fastest CAGR of 4.5% from 2024 to 2030. Endorsement and usage of hair color spray by celebrities have greatly influenced the target audience in the country. Also, continuous product innovations in the formulation for catering to the youth are further expected to fuel the product demand in the U.S.

Asia Pacific Hair Color Spray Market Trends

The hair color spray market in Asia Pacific held the revenue share of 33.9% in 2023. The high demand for hair color sprays in Asia Pacific can be attributed to the region's growing beauty consciousness and the desire for quick, convenient hair color solutions that align with fast-paced lifestyles. The rising demand for unconventional hair colors in India for instance, including deep wine, caramel brown, burgundy, and beige, is driven by a cultural shift among young Indians, influenced by prominent hairdressers and social media platforms like Instagram, encouraging a trend towards blonde and brunette shades over traditional black and dark brown. With market players foraying with diverse shades to cater to consumers' evolving needs, the market is set to rise in Asia Pacific.

Middle East & Africa Hair Color Spray Market Trends

The hair color spray market in Middle East & Africa is set to grow at a fastest CAGR of about 5.7% in the forecast period. The rise of the natural hair movement in Africa has spurred a significant shift in the beauty market, leading to a growing demand for hair care products tailored to Afro-textured hair. The emergence of female entrepreneurs offering consumer-centric hair care brands, alongside the perception that smaller manufacturers provide tailor-made products using natural ingredients, is set to drive the market growth in Africa.

Key Hair Color Spray Company Insights

The market is highly fragmented with the presence of numerous top and regional companies across major economies. Multinational companies such as Coty Inc., L'Oréal S.A., and Henkel AG & Co. KGaA compete with local brands that offer consumer-centric products at competitive prices, driving innovation and product diversity in the market.

Key Hair Color Spray Companies:

The following are the leading companies in the hair color spray market. These companies collectively hold the largest market share and dictate industry trends..

- Coty Inc

- Amka Products (Pty) Ltd

- L'Oréal S.A.

- HenkelAG & Co. KGaA

- Kenra Professional

- Punky International, Inc.

- Revlon Inc.

- Estee Lauder Companies

- Unilever

- Honasa Consumer Pvt. Ltd.

Recent Developments

-

In January 2023, Clairol, a brand under Coty Inc., introduced its Root Touch Up Color + Volume 2-in-1 Spray. This product is a versatile temporary root touch-up spray that provides instant coverage for grays while adding volume to the hair. It effectively conceal root regrowth and enhances the appearance of fuller hair, all without causing damage

-

In May 2022, Matrix, a brand under L'Oréal S.A., introduced the So Silver All-in-One Toning Leave-In and Brass Off Sprays. The Brass Off spray includes a buildable toning formula with blue dyes to combat brassiness in highlighted or lightened brunette hair. In contrast, the So Silver spray contains violet dyes in a buildable formula to eliminate unwanted yellow tones in blonde and grey hair

-

In March 2022, Everpro Gray Away launched its Gray Away Root Cover-Up Sprays that target multiple hair concerns with a one-step color solution. The product comes in five shades ensuring easy matching with various hair colours. They effectively conceal roots with a natural finish that blends seamlessly, providing 24-hour wear without detection. Plus, they protect hair health by preventing damage from color treatments due to their gentle, reflective pigment formulas

Hair Color Spray Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.35 billion

Revenue forecast in 2030

USD 3.19 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actuals

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; France; Germany; Italy; UK; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

Coty Inc; Amka Products (Pty) Ltd; L'Oréal S.A.; Henkel AG & Co. KGaA; Kenra Professional; Punky International, Inc.; Revlon Inc.; Estee Lauder Companies; Unilever; Honasa Consumer Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hair Color Spray Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hair color spray market report based on the end-user, distribution channel, and region.

-

End-user Outlook (Revenue, USD Billion, 2018 - 2030)

-

Male

-

Female

-

Children

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hair color spray market size was estimated at USD 2.23 billion in 2023 and is expected to reach USD 2.35 billion in 2024.

b. The global hair color spray market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 3.19 billion by 2030.

b. Asia Pacific dominated the hair color spray market with a share of around 33% in 2023. The high demand for hair color sprays in the region can be attributed to the region's growing beauty consciousness and the desire for quick, convenient hair color solutions that align with fast-paced lifestyles.

b. Some key players operating in the hair color spray market include Coty Inc.; Amka Products (Pty) Ltd; L'Oréal S.A.; Henkel AG & Co. KGaA; Kenra Professional; Punky International, Inc.; Revlon Inc.; Estee Lauder Companies; Unilever; Honasa Consumer Pvt. Ltd.

b. Key factors that are driving the hair color spray market growth include the growing consumer awareness of personal wellness and appearance, increased focus on personal grooming, and the need for convenient hair coloring solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."