- Home

- »

- Electronic & Electrical

- »

-

Hair Dryer Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Hair Dryer Market Size, Share & Trends Report]()

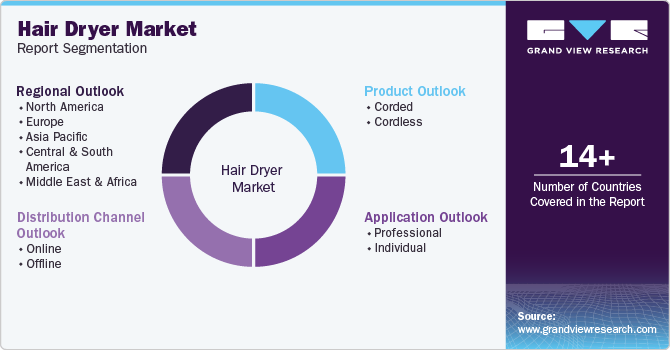

Hair Dryer Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Corded, Cordless), By Application (Professional, Individual), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-184-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hair Dryer Market Summary

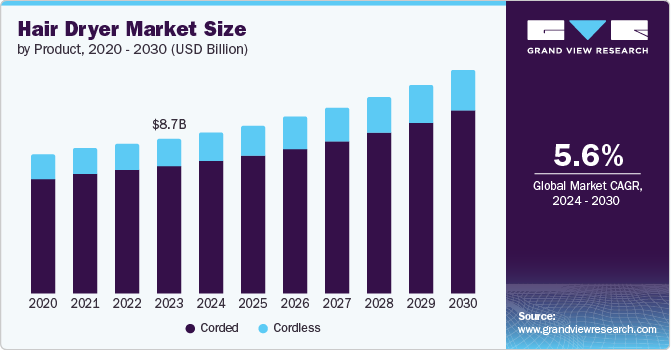

The global hair dryer market size was estimated at USD 8.72 billion in 2023 and is projected to reach USD 12.57 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. The key factors driving the demand for hair dryers are improving living standards and greater emphasis on physical appearance.

Key Market Trends & Insights

- North America hair dryer market accounted for a revenue share of 33.57% in 2023.

- The hair dryer market in the U.S. is expected to grow at a CAGR of 4.9% from 2024 to 2030.

- By product, the corded hair dryer accounted for a revenue share of 82.56% in 2023.

- By application, the hair dryer for individuals accounted for a revenue share of 61.31% in 2023.

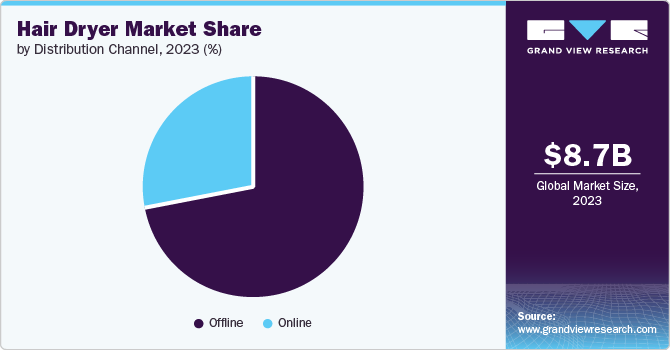

- By distribution channel, Sales through offline channels such as hypermarkets & supermarkets, department stores, and electronic stores, among others, accounted for a revenue share of 71.73% in 2023 in the market.

Market Size & Forecast

- 2023 Market Size: USD 8.72 Billion

- 2030 Projected Market Size: USD 12.57 Billion

- CAGR (2024-2030): 5.6%

- North America: Largest market in 2023

Evolving fashion trends in hair care and styling, coupled with rising hair styling trends featured in movies and on fashion runways, are considerably impacting the sales of hair dryers globally across all age groups. Hair dryers help style, curl, straighten, volumize, or flatten the hair using heat, thus, further expected to augment its growth and demand during the forecast period.

The market growth is primarily fueled by technological advancements, rising consumer awareness regarding hair care, and a growing emphasis on personal grooming. The integration of innovative features such as infrared technology, ionic drying, and tourmaline components has significantly enhanced the performance and efficiency of hair dryers, catering to the increasing demand for faster and healthier hair-drying solutions.

In addition, the influence of social media and beauty influencers has propelled the demand for aesthetically pleasing and user-friendly hair dryers, driving manufacturers to focus on design and ergonomics. As consumers become more discerning about product quality and functionality, the market continues to thrive. The surge in demand for premium and customizable options is contributing to the industry's overall growth.

An increasing number of professional salons worldwide is expected to be a key factor driving the sales of hair dryers. In addition, rising awareness about personal grooming is propelling product demand. Major salon chains are investing in the developing regions of Asia Pacific to increase their customer base, and several salons are opting for professional hair appliances, including hair dryers. Thus, the rising number of professional hair salons, particularly in emerging markets, is anticipated to contribute to the market growth over the forecast period.

The recent surge in the launch of eco-friendly and sustainable hair dryer models is emerging as a compelling market driver, reshaping the landscape of the hair care industry. As environmental consciousness takes center stage globally, consumers actively seek products that align with their commitment to sustainability. This paradigm shift hasatalyzed hair dryer manufacturers to respond to the demand for greener alternatives, which is further expected to drive the demand and growth of the eco-friendly and sustainable market during the forecast period.

Hair dryer companies are diversifying their offerings by entering the hair care product market. Expanding beyond traditional styling tools, these companies are introducing new product lines, such as shampoos, conditioners, and treatments, to provide comprehensive solutions for consumers' hair care needs. This strategic expansion allows them to cater to a broader range of customer demands and establish a more prominent presence in the overall hair care industry. For instance, in September 2023, RevAir broadened its product range, moving beyond its signature "reverse air" hairdryer. The brand, recognized for its 2018 debut and a 2022 version, ventured into hair care with two new collections named extreme hydration and boost fullness.

Product Insights

The corded hair dryer accounted for a revenue share of 82.56% in 2023. Its reliability and consistent performance make it a preferred choice among consumers. Unlike their cordless counterparts, corded hair dryers provide a continuous power source, ensuring uninterrupted and efficient drying, particularly for those with longer hair or specific styling requirements. Thus, they drove market demand during the forecast period. Furthermore, another significant driver is the affordability and accessibility of corded hair dryers. Corded models are generally more budget-friendly compared to high-end cordless alternatives. This makes corded hair dryers a popular choice for a wide range of consumers, including students, budget-conscious individuals, and those who prioritize value for money in their personal care appliances, thus further augmenting the market growth.

The market is expected to grow at a CAGR of 6.0% from 2024 to 2030. Technological innovations in battery technology have played an important role in fueling the growth of the market. Advances in lithium-ion batteries, in particular, have enabled manufacturers to create cordless hair dryers with longer battery life and faster charging capabilities. These improvements contribute to the overall performance of cordless hair dryers, making them more viable and attractive to consumers who value both convenience and functionality, thus driving the market growth during the forecast period.

Application Insights

The hair dryer for individuals accounted for a revenue share of 61.31% in 2023. Numerous companies are strategically introducing new hair dryer models in developing countries. The beauty and personal care industry in developing countries has been experiencing notable growth over the past few years, driven by increasing disposable incomes, changing consumer lifestyles, and a rising emphasis on grooming and personal appearance. As these countries undergo rapid urbanization and modernization, there is an increased awareness and demand for advanced grooming tools, including hair dryers, among individuals. This is expected to drive the demand and growth for hair dryers for individuals during the forecast period.

The hair dryer for professionals is expected to grow at a CAGR of 5.9% from 2024 to 2030. The use of hair dryers in salons is experiencing a notable increase, driven by several factors that reflect changing trends in the beauty and grooming industry. One prominent factor contributing to the increased use of hair dryers in salons is the growing demand for professional styling and customized hair treatments. Clients increasingly seek personalized and efficient hair care services, and hair dryers are pivotal in achieving diverse styles and meeting individual preferences, which is expected to contribute to the market growth of hair dryers for professionals during the forecast period.

Distribution Channel Insights

Sales through offline channels such as hypermarkets & supermarkets, department stores, and electronic stores, among others, accounted for a revenue share of 71.73% in 2023 in the market. Many consumers prefer to physically examine and test hair dryers before making a purchase decision, assessing factors such as weight, ergonomics, and additional features that may not be as evident in an online shopping environment. This hands-on experience fosters a sense of confidence and satisfaction among consumers, driving sales through offline distribution channels during the forecast period.

Sales of hair dryers through online channels are expected to grow with a CAGR of 6.3% from 2024 to 2030. Online channels offer convenience, allowing customers to browse, compare, and purchase hair dryers from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers. Moreover, online retailers typically offer a much broader range of hair dryers equipped with different technologies and advanced features compared to physical stores. Consumers have access to an extensive selection, allowing them to find products that precisely meet their preferences and requirements.Thus, due to all these factors, sales of hair dryers through online channels are expected to drive high sales growth during the forecast period.

Regional Insights

North America hair dryer market accounted for a revenue share of 33.57% in 2023. North America has the largest market for hair dryers in the world, particularly owing to a large number of consumers who are more aware and conscious about personal grooming and self-care. Furthermore, as consumers in North America have a higher disposable income compared to the rest of the world, especially those in the U.S. and Canada, the tendency of purchasing and replacement of old hair dryers with high-end hair dryers is greater in the region. As a result, market players in North America are launching advanced and premium products, in response to the high demand from consumers. For instance, in January 2024, L’Oréal revealed AirLight Pro, a groundbreaking hair-drying tool co-developed with Zuvi, at CES 2024 (Consumer Technology Association). Combining infrared light tech and wind, it delivers smoother hair with faster drying and up to 31% less energy consumption, showcasing a blend of innovation and sustainability in hair care.

U.S. Hair Dryer Market Trends

The hair dryer market in the U.S. is expected to grow at a CAGR of 4.9% from 2024 to 2030 Personal grooming is a significant trend in the U.S., with both men and women investing in grooming products. The desire to maintain a well-groomed appearance drives the demand for high-quality hair dryers. The trend is particularly strong among millennials and Gen Z, who prioritize personal care. Furthermore, the rise of e-commerce platforms has made it easier for consumers to access a wide range of hair dryers. Online shopping offers convenience, better pricing, and a broader selection, which is expected to contribute to increase in sales of hair dryers in the U.S. during the forecast period.

Asia Pacific Hair Dryer Market Trends

The hair dryer market in Asia Pacific is expected to grow at a CAGR of 6.2% from 2024 to 2030. The Asia Pacific region is experiencing rapid urbanization, leading to a growing middle class with increasing purchasing power. Urban consumers are more likely to invest in personal grooming products, including hair dryers, to keep up with modern lifestyle demands. Furthermore, there is a rising beauty consciousness among consumers in Asia Pacific. The influence of social media, beauty influencers, and K-beauty trends has heightened the awareness of grooming and personal care. Hair dryers are seen as essential tools for achieving stylish and well-groomed looks. All these factors are expected to drive the market in the region in coming years.

Europe Hair Dryer Market Trends

The hair dryer market in Europe is expected to grow at a CAGR of 5.7% from 2024 to 2030. There is a growing emphasis on sustainability and eco-friendliness in Europe. Consumers are increasingly looking for products that have a lower environmental impact. Hair dryers with energy-efficient technologies, recyclable materials, and eco-friendly packaging are gaining popularity. Furthermore, European consumers appreciate innovation in product design. Hair dryers with ergonomic designs, lightweight bodies, and user-friendly features are in demand, which is further expected to contribute to the market growth in Europe during the forecast period.

Key Hair Dryer Company Insights

The market is characterized by numerous well-established and emerging players. Manufacturers are incorporating advanced technologies such as ionic, ceramic, and tourmaline into their hair dryers. These technologies help reduce frizz, enhance shine, and protect hair from heat damage. Furthermore, manufacturers are focusing on creating lightweight and ergonomically designed hair dryers that are easier to handle and use. These designs help reduce user fatigue, especially for professional stylists who use hair dryers for extended periods. In addition, Manufacturers are diversifying their product lines to cater to both professional salons and individual consumers and are also offering customizable options, such as different nozzles and attachments, allows users to tailor their hair drying experience.

Key Hair Dryer Companies:

The following are the leading companies in the hair dryer market. These companies collectively hold the largest market share and dictate industry trends.

- Conair Corporation

- Spectrum Brands Inc. (Remington)

- Dyson Limited

- Koninklijke Philips N.V.

- Panasonic Holdings Corporation

- Revlon Inc.

- Ghd hair (Jemella Ltd.)

- Braun GmbH

- Helen of Troy Limited

- Harry Josh Pro Tools

Recent Developments

-

In July 2024, XSOOH introduced its new hair dryer, the ‘XSOOH High-Speed Hair Dryer’. This model features a revolutionary 110,000 RPM brushless DC motor and wind speeds of up to 22 m/s, reducing drying time from 20 minutes to just 5 minutes. In addition, it incorporates intelligent heat control technology that continuously monitors air temperature, ensuring a safe and gentle drying process. The hair dryer also includes a tri-color light ring and hot and cold air circulation functions, which enhance the drying experience and promote frizz-free, healthy hair.

-

In March 2024, Dyson introduced the ‘Supersonic Nural’ hair dryer and has labelled it as the ‘most intelligent hair dryer‘. This hair dryer features Scalp Protect Mode, a system that uses sensors to manage heat flow, protecting the scalp. It also includes a capsule illumination system that indicates whether it is safe to use based on temperature. In addition, the hair dryer boasts features like Attachment Learning and Pause Detect to minimize heat damage and enhance the styling experience. The Dyson Supersonic Nural comes with five smart attachments, including the Gentle Air and Flyaway Smoother, designed for various hair types.

-

In January 2024, L'Oréal Groupe launched a new hair-drying tool called AirLight Pro at CES 2024. Developed in partnership with hardware startup Zuvi, the tool uses a combination of infrared-light technology and wind for smoother, hydrated hair and faster drying. It also consumes up to 31% less energy. AirLight Pro delivers visually smoother and more hydrated hair, and it has been tested on multiple hair types.

-

In September 2023, Philips launched the 7000 series of hair dryers in Singapore with thermos-shield advanced technology and 30% faster drying that prevents hair from overheating. The product comes with hot and cold modes and adjustable fan speeds for year-round comfort.

Hair Dryer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.06 billion

Revenue forecast in 2030

USD 12.57 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Korea

Key companies profiled

Conair Corporation; Spectrum Brands Inc. (Remington); Dyson Limited; Koninklijke Philips N.V.; Panasonic Holdings Corporation; Revlon Inc.; Ghd hair (Jemella Ltd.); Braun Gmbh; Helen of Troy Limited; Harry Josh Pro Tools

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hair Dryer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hair dryer market report based on product, application, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Corded

-

Cordless

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional

-

Individual

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hair dryer market size was estimated at USD 8.72 billion in 2023 and is expected to reach USD 9.06 billion in 2024.

b. The global hair dryer market market is expected to grow at a compounded growth rate of 5.6% from 2024 to 2030 to reach USD 12.57 billion by 2030.

b. Corded hair dryer dominated the hair dryer market with a share of 82.6% in 2023. Corded hair dryers do not rely on battery power, allowing for uninterrupted usage during styling sessions. Furthermore, corded hair dryers are often more cost-effective than cordless models.

b. Some key players operating in the hair dryer market include Conair Corporation; Spectrum Brands Inc. (Remington); Dyson Limited; Koninklijke Philips N.V.; Panasonic Holdings Corporation; Revlon Inc.; Ghd hair (Jemella Ltd.); Braun GmbH; Helen of Troy Limited; and Harry Josh Pro Tools.

b. Key factors that are driving the hair dryer market growth include the increasing number of professional salons across the globe, rising awareness about personal grooming, and changing lifestyles due to hectic work schedules are also significantly boosting the product demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.