- Home

- »

- Automotive & Transportation

- »

-

Halal Logistics Market Size & Share, Industry Report, 2030GVR Report cover

![Halal Logistics Market Size, Share & Trends Report]()

Halal Logistics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Storage, Transportation, Monitoring Components), By End-use (Food & Beverages, Pharmaceuticals & Nutraceuticals, Cosmetic/Personal Care), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-273-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Halal Logistics Market Summary

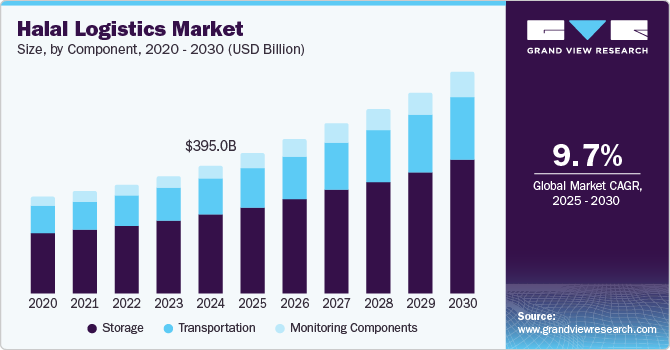

The global halal logistics market size was estimated at USD 395,013.0 million in 2024 and is projected to reach USD 686,826.6 million by 2030, growing at a CAGR of 9.7% from 2025 to 2030. This growth is significantly influenced by the increasing global Muslim population, which drives demand for products that comply with Islamic dietary laws.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Malaysia is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, storage accounted for a revenue of USD 265,624.4 million in 2024.

- Monitoring Components is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 395,013.0 million

- 2030 Projected Market Size: USD 686,826.6 million

- CAGR (2025-2030): 9.7%

- Asia Pacific: Largest market in 2024

With growing awareness of halal certification and compliance among consumers and regulatory bodies, businesses increasingly invest in specialized halal logistics solutions to ensure alignment with these standards.

E-commerce and cross-border trade in halal products are significantly driven by the large Muslim populations in regions such as the Middle East and Southeast Asia. For instance, according to the World Population Review, many countries in the region, including Egypt, Afghanistan, Syria, Pakistan, Turkey, and Iran, have over 90% of Muslims. Moreover, governments in these countries actively promote digital platforms to facilitate international trade of halal-certified goods, enhancing logistics frameworks and supporting market growth.

This trend is also complemented by a growing interest in halal offerings among non-Muslim populations, broadening the consumer base. For instance, according to Halal Monitoring Authority Canada, halal is recognized for its religious significance and a standard of choice among Muslim and non-Muslim consumers. A combination of these elements with the rising demand for halal certification, enhanced logistics capabilities, and increase in consumer spending positions the halal logistics industry for expansion in the coming years.

Component Insights

The storage segment dominated the market with a 61.5% share in 2024 due to the need for specialized facilities that ensure the integrity of halal products. These storage solutions are designed to maintain strict separation between halal and non-halal items, ensuring high hygiene standards. As consumer demand for halal-certified goods continues to rise, logistics providers are investing in compliant storage options to uphold certification and quality throughout the supply chain.

The monitoring components segment is projected to grow at the highest CAGR during the forecast period, driven by increasing demand for enhanced traceability and compliance within the halal logistics market. The integration of advanced technologies such as IoT devices and real-time tracking systems enables businesses to maintain oversight over halal products throughout their journey. For instance, Malaysia has developed the HalalTracer system, which combines GPS tracking technology with geofencing algorithms to monitor halal meat transportation. This focus on transparency meets consumer expectations for authenticity and ensures adherence to halal standards across all logistical operations.

End-use Insights

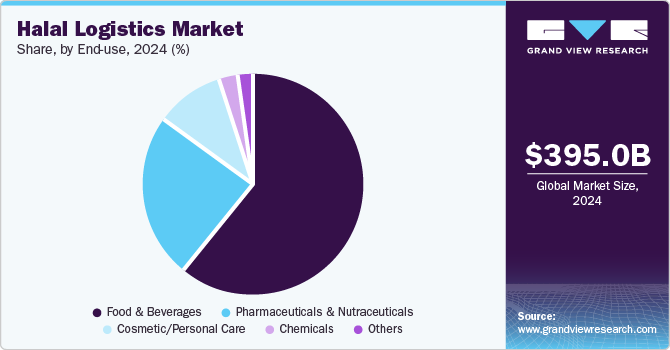

The food and beverages segment dominated the market with the largest revenue share in 2024. The stringent guidelines established by Islamic dietary laws necessitate specialized logistics solutions that ensure proper handling, storage, and transportation of these goods. As consumer preference shifts toward healthier and ethically sourced food options, there is a growing interest in halal products among both Muslim and non-Muslim consumers alike. A rise in global awareness regarding food safety and quality assurance practices further supports this trend.

The pharmaceuticals and nutraceuticals segment is expected to grow at a significant CAGR over the forecast period, driven by rising consumer awareness regarding halal-certified medical products and supplements. Healthcare organizations increasingly recognize the importance of halal compliance in pharmaceuticals, particularly as more consumers seek assurance that their medications align with their ethical and religious beliefs. This shift has led to a greater demand for specialized logistics services that cater to this sector, including temperature-controlled transport and secure handling practices.

Regional Insights

North America halal logistics market is anticipated to grow at a significant CAGR during the forecast period due to the increasing awareness of halal products among diverse consumer groups. As more non-Muslim consumers seek out halal options for ethical or health reasons, logistics companies are expanding their services to cater to this emerging demand. In addition, major retailers are beginning to include halal-certified products in their offerings, further driving market growth.

U.S. Halal Logistics Market Trends

U.S. halal logistics market dominated the regional market in 2024 due to a growing interest among Americans in halal-certified products. The rise of e-commerce has further facilitated access to these products through online platforms that specialize in or include halal offerings. Hence, logistics providers are responding by enhancing their capabilities in handling and distributing halal goods effectively while ensuring compliance with certification requirements.

Asia Pacific Halal Logistics Market Trends

Asia Pacific halal logistics market dominated the global market with a revenue share of 51.0% in 2024 due to the substantial Muslim population residing in countries such as Indonesia, Malaysia, and India. The region's growing demand for halal products has prompted logistics providers to enhance their services and infrastructure tailored specifically for halal compliance. Moreover, many governments within this region are actively promoting policies that support halal trade and certification processes, which further stimulates growth within the halal logistics industry.

For instance, in 2024, Vietnamese Prime Minister Pham Minh Chinh visited the UAE, Saudi Arabia, and Qatar to facilitate the increasing Vietnamese exports to the countries, particularly focusing on Halal-compliant products. This initiative aligned with the growing demand for Halal goods in these markets, reflecting Vietnam's commitment to expand trade relationships and cater to diverse consumer needs.

The Indonesia halal logistics market dominated the regional market in 2024. Driven by its status as one of the largest Muslim-majority countries, Indonesia is increasingly focusing on maintaining halal integrity throughout its supply chain. This has led to a surge in investments in logistics infrastructure to support this goal. Indonesian consumers are becoming more discerning about product sourcing and certification authenticity, prompting businesses to prioritize compliance.

Middle East and Africa Halal Logistics Market Trends

Middle East and Africa halal logistics market is expected to grow at a significant CAGR during the forecast period due to increasing investments in infrastructure and rising demand for halal products within the region. Governments are actively promoting initiatives that support halal trade by establishing regulatory frameworks that facilitate certification processes and enhance logistical frameworks necessary for compliance with Islamic standards. This growth trajectory reflects a commitment from both the public and private sectors toward developing robust supply chains that cater specifically to halal requirements.

Saudi Arabia halal logistics market dominated the regional market in 2024 due to its position as a key player in global trade and its commitment to maintaining high standards of halal compliance across various industries. The government’s strategic investments in logistics infrastructure have bolstered its capacity to handle the high volume of halal goods efficiently while ensuring adherence to strict regulatory requirements. Such developments reinforce Saudi Arabia's role within the global halal logistics industry while promoting sustainable growth aligned with international standards.

Key Halal Logistics Company Insights

The halal logistics market features several key players that shape its landscape, including Nippon Express Holdings, TIBA, MABKARGO SDN BHD, and YUSEN LOGISTICS CO., LTD. Nippon Express Holdings provides logistics solutions with temperature-controlled transport for halal products, while TIBA offers tailored logistics services to move halal-certified goods across borders efficiently. MABKARGO SDN BHD, a subsidiary of Malaysia Airlines, maintains the integrity of halal products during air freight with dedicated facilities and trained personnel, while YUSEN LOGISTICS CO., LTD. integrates halal compliance into its supply chain solutions, aligning operations with halal principles while meeting quality and safety demands. These companies play a significant role in shaping the halal logistics industry.

-

Nippon Express Holdings offers various services, including transportation, warehousing, and supply chain management. The company specializes in temperature-controlled transport solutions to ensure compliance with Islamic dietary laws. Its commitment to quality and adherence to halal standards makes it a reliable partner for businesses transporting halal products safely and efficiently.

-

TIBA provides customized logistics services tailored to the needs of the halal market. The company facilitates the movement of halal-certified goods across borders, ensuring that all operations comply with halal certification requirements. The company’s expertise in managing the complexities of halal logistics helps clients navigate international regulations while maintaining the integrity of their products throughout the supply chain.

Key Halal Logistics Companies:

The following are the leading companies in the halal logistics market. These companies collectively hold the largest market share and dictate industry trends.

- Nippon Express Holdings

- TIBA

- MABKARGO SDN BHD

- YUSEN LOGISTICS CO., LTD.

- TASCO

- Kontena Nasional Berhad

- SEJUNG SHIPPING CO., LTD.

- DB Schenker

- Al Furqan Shipping & Logistics LLC

- NORTHPORT (MALAYSIA) BHD

Recent Development

-

In September 2024, Malaysia announced a significant investment of around USD 888 million in the halal industry by China. This potential influx of capital was followed by discussions held during the Malaysia-China Halal Business Forum, where Malaysia's Deputy Prime Minister and a Malaysian delegation engaged with key players in the Chinese halal sector. The investment is expected to support multiple sectors, including herbal medicine, food and beverages, vaccines, cosmetics, and pharmaceuticals.

-

In May 2024, Nippon Express Holdings Co., Ltd. announced the acquisition of halal logistics certification from Nippon Asia Halal Association for its Fukuoka Chuo Logistics Center. This certification addresses the growing demand for halal products among export customers, particularly given the increasing interest in Japanese food products globally.

Halal Logistics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 433.25 billion

Revenue forecast in 2030

USD 686.83 billion

Growth rate

CAGR of 9.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, Russia, Oceania, Indonesia, India, Malaysia, China, Oceania, Brazil, Saudi Arabia, Egypt, UAE

Key companies profiled

TASCO; Nippon Express Holdings; TIBA; YUSEN LOGISTICS CO., LTD.; Kontena Nasional Berhad; SEJUNG SHIPPING CO., LTD.; DB Schenker; Al Furqan Shipping & Logistics LLC; NORTHPORT (MALAYSIA) BHD; MABKARGO SDN BHD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Halal Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global halal logistics market report based on component, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Storage

-

Warehouse

-

Container

-

-

Transportation

-

Maritime Logistics

-

Air Logistics

-

Land Logistics

-

-

Monitoring Components

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

-

Software

-

Services

-

Installation and Integration

-

Support and Maintenance

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceuticals and Nutraceuticals

-

Cosmetic/Personal Care

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Oceania

-

-

Asia Pacific

-

Indonesia

-

India

-

Malaysia

-

China

-

Oceania

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

Egypt

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.