- Home

- »

- Automotive & Transportation

- »

-

Hand Truck And Dolly Market Size, Industry Report, 2030GVR Report cover

![Hand Truck And Dolly Market Size, Share & Trends Report]()

Hand Truck And Dolly Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Hand Trucks, Dolly), By Material (Steel, Aluminum, Plastics), By Sales Channel, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-621-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hand Truck And Dolly Market Summary

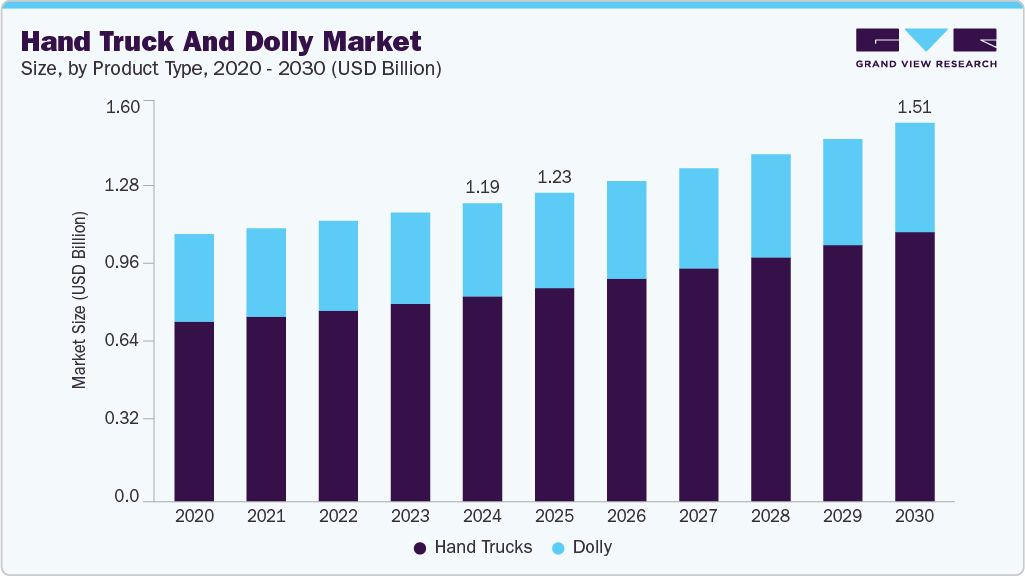

The global hand truck and dolly market size was estimated at USD 1.19 billion in 2024 and is projected to reach USD 1.51 billion by 2030, growing at a CAGR of 4.2% from 2025 to 2030. Factors such as the growth of e-commerce and last-mile delivery, and rising demand in warehousing and industrial automation can be attributed to the market growth.

Key Market Trends & Insights

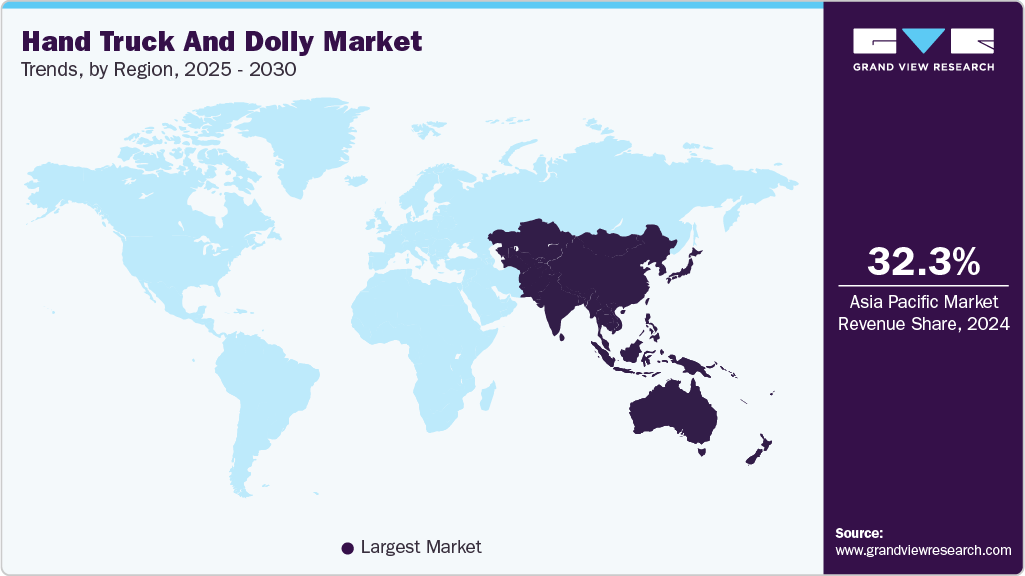

- Asia Pacific dominated the hand truck and dolly market with the largest revenue share of 32.29% in 2024.

- The hand truck and dolly market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By product, the hand trucks segment led the market with the largest revenue share of 68.8% in 2024.

- By material, the steel segment accounted for the largest market revenue share in 2024.

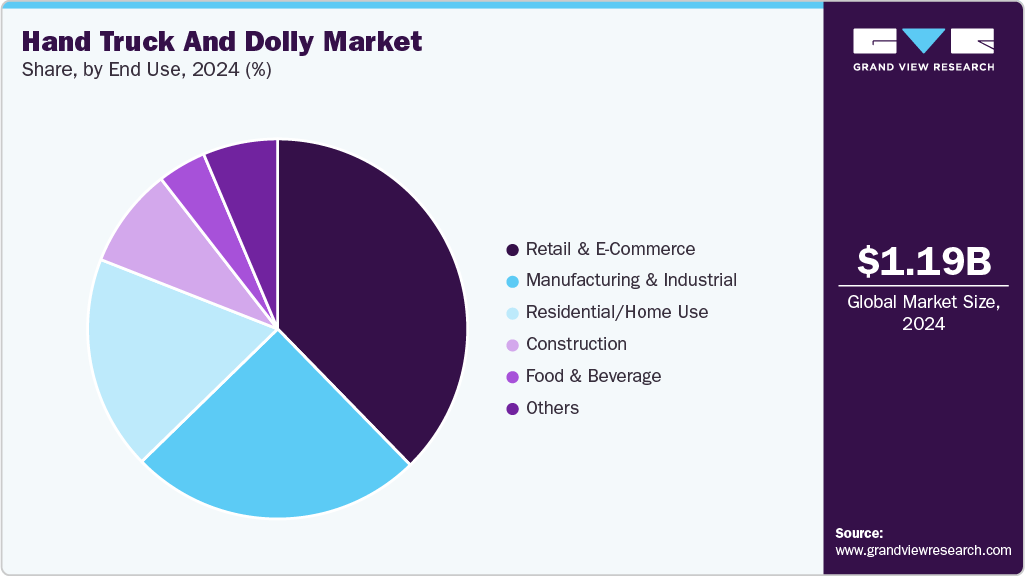

- By end use, the retail & e-commerce segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.19 Billion

- 2030 Projected Market Size: USD 1.51 Billion

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

In addition, shifts toward lightweight and durable materials and growth in do-it-yourself (DIY) and home improvement activities are further expected to contribute to the growth of the hand truck and dolly industry. These trends reflect the evolving demands across industries and user segments, making hand trucks and dollies essential tools in modern material handling solutions.The rapid expansion of e-commerce and modern retail channels across the globe is driving the market growth. With consumers increasingly turning to online platforms for their shopping needs, there has been a corresponding surge in order fulfillment volumes. This shift has led to the proliferation of fulfillment centers, regional distribution hubs, and last-mile delivery networks, all of which require efficient manual handling solutions for moving goods swiftly and safely. Hand trucks and dollies are essential tools in these environments, enabling warehouse personnel and delivery workers to transport parcels, boxes, and goods of various sizes with reduced physical strain and increased productivity.

Manufacturers are increasingly focusing on developing hand trucks and dollies using lightweight, high-strength materials such as aluminum and advanced polymers. This trend is driven by end-users’ preference for equipment that offers durability without adding unnecessary weight. Lightweight designs reduce fatigue for operators, improve maneuverability in tight spaces, and extend product lifespan, making them particularly attractive in retail, healthcare, and hospitality sectors. In addition, the ease of transport and storage provided by these materials enhances operational efficiency in fast-paced environments.

The hand truck and dolly industry is experiencing significant growth opportunities due to evolving requirements in last-mile delivery operations. This development stems primarily from increased e-commerce activity and changing consumer delivery expectations, which are driving demand for specialized material handling equipment. Furthermore, workplace safety regulations and a growing awareness of ergonomics are influencing the design and functionality of hand trucks and dollies. Manufacturers are responding by incorporating features such as adjustable handles, pneumatic tires, stair-climbing mechanisms, and anti-slip grips to minimize injury risks and ensure ease of use. This emphasis on ergonomic design is improving worker productivity and reducing workers’ compensation claims, making these innovations highly valued in industrial and commercial applications.

The growing adoption of automated material handling solutions presents a significant challenge for the hand truck and dolly industry. In addition, limited awareness and adoption in emerging markets, where manual labor is still widely relied upon, restrict market expansion. Durability concerns associated with inexpensive products can also affect consumer trust and brand loyalty. Furthermore, fluctuations in raw material prices, particularly metals and polymers, can impact production costs and pricing strategies, creating uncertainty for manufacturers and distributors.

Product Type Insights

The hand trucks segment led the market with the largest revenue share of 68.8% in 2024. The growth of the hand trucks segment is primarily fueled by increasing demand from the logistics, warehousing, and retail sectors. Known for their simplicity, durability, and capability to move stacked loads vertically, hand trucks are well-suited for routine manual handling tasks. Their versatility and efficiency make them a practical choice for both heavy-duty and general-purpose material handling needs across a wide range of industries, further supporting the segment's growth.

The dolly segment is expected to register at the fastest CAGR over the forecast period. A dolly, characterized by its four wheels, flat platform, and dual-axle design, offers a distinct structural advantage over traditional hand trucks. The segment's growth is being driven by the increasing use of dollies for transporting various heavy or bulky items, such as boxes, furniture, pianos, luggage, and small vehicles. Enhancements such as foldable frames and noise-reducing wheels are improving user convenience and functionality. Moreover, the rising emphasis on mobility and ease of use in material handling continues to support the expanding adoption of dollies across commercial and residential applications.

Material Insights

The steel segment accounted for the largest market revenue share in 2024. These steel models are specifically designed to perform in demanding environments, offering reliable performance and extended service life where durability is critical. Steel hand trucks and dollies provide a strong, durable solution for handling heavy loads, making them particularly well-suited for industrial and commercial use. Growing demand for heavy-duty equipment in sectors such as logistics, manufacturing, and construction is a key factor driving the segment's expansion.

The Aluminum segment is expected to register at the fastest CAGR of 5.1% during the forecast period.The aluminum hand trucks and dollies segment is witnessing strong growth, particularly in industries that prioritize lightweight, easy-to-maneuver, and corrosion-resistant equipment, including retail, logistics, manufacturing, hospitality, and parcel delivery. Aluminum’s high strength-to-weight ratio makes it well-suited for repetitive, long-distance handling tasks. The rising demand for portable and efficient material handling tools, driven by the rapid expansion of e-commerce and last-mile delivery services, continues to propel the growth of this segment.

Sales Channel Insights

The offline segment accounted for the largest market revenue share in 2024. Despite the rise of e-commerce, offline channels remain essential in the hand truck and dolly industry, particularly for bulk buyers and commercial users who prefer in-person evaluation, immediate availability, and personalized consultation. Hardware stores, industrial supply distributors, and specialty retailers continue to attract customers seeking expert guidance and durable, ready-to-use equipment. The ability to physically inspect build quality and dimensions is a critical factor for buyers with specific operational requirements, thereby driving the segment’s growth.

The online segment is expected to grow at the fastest CAGR over the forecast period.The growth of the online segment is being driven by rising digital adoption, the convenience offered by e-commerce platforms, and manufacturers increasingly embracing direct-to-consumer strategies. Both businesses and individual buyers are turning to online channels for their extensive product variety, competitive pricing, and fast delivery capabilities. In addition, the expansion of B2B e-commerce, especially within logistics, warehousing, and retail sectors, is further boosting demand through streamlined procurement processes and enhanced accessibility.

End Use Insights

The retail & e-commerce segment accounted for the largest market revenue share in 2024. The growth of the retail and e-commerce segment was primarily driven by the rapid growth of online shopping and the need for efficient in-store logistics. Furthermore, the vast availability of retail hand trucks and dollies in the market can be attributed to the segment’s growth. For instance, Dutro provides a range of all-steel dollies and hand trucks specifically developed for use in the retail trade. Some of the products include Retail Hand Truck 137, Retail Hand Truck RET50S, Retail Hand Truck RET51S, Retail Hand Truck RET52S, Retail Hand Truck 138, and Retail Hand Truck 132E.

The food & beverage segment is expected to register at the fastest CAGR during the forecast period.The food and beverage industry increasingly relies on corrosion-resistant, easy-to-clean, and hygienic hand trucks and dollies, often made from plastic or aluminum. Distribution centers, supermarkets, commercial kitchens, and restaurants use these tools for daily stock movement, delivery operations, and cold storage transfers. The growth of grocery delivery services and food logistics is also expanding the need for compact, maneuverable models, thereby driving demand for hand trucks and dollies in the food and beverage industry.

Regional Insights

Asia Pacific dominated the hand truck and dolly market with the largest revenue share of 32.29% in 2024 and is expected to register at the fastest CAGR from 2025 to 2030. The region’s growth is driven by rapid industrialization, urbanization, and the expansion of logistics and warehousing infrastructure. Countries across the region are investing in supply chain modernization, which is increasing the demand for efficient material handling equipment. The growth of e-commerce is also fueling the need for lightweight, versatile transport tools across distribution hubs and retail sectors.

India Hand Truck and Dolly Market Trends

The hand truck and dolly market in India is expected to grow at the fastest CAGR during the forecast period. In India, the hand trucks and dollies industry is gaining traction due to the rapid growth of the logistics sector, infrastructure development, and the expanding footprint of organized retail. Government initiatives such as Make in India and improvements in industrial corridors are fostering greater demand for material handling solutions.

The China hand truck and dolly market held a substantial market share in 2024. A strong manufacturing base and extensive logistics networks drive the country’s market growth. The country's large-scale industrial operations and urban distribution centers require robust, scalable material handling solutions. Continuous investment in smart logistics and warehouse automation has spurred demand for advanced, ergonomic equipment, thereby driving the market’s growth.

North America Hand Truck and Dolly Market Trends

The hand truck and dolly market in North America is anticipated to grow at a substantial CAGR of 3.6% during the forecast period, due to evolving supply chain dynamics and increasing demand for efficient logistics solutions. The rise of urban warehousing and micro-fulfillment centers is further creating a need for compact, maneuverable equipment such as hand trucks and dollies that can operate in confined spaces.

The hand truck and dolly market in the U.S. accounted for the largest market revenue share in North America in 2024, driven by its expansive e-commerce sector, advanced logistics infrastructure, and emphasis on workplace ergonomics. Furthermore, the rise of urban warehousing and micro-fulfillment centers is fueling the demand for compact and ergonomic hand trucks and dollies that can navigate tight spaces.

Europe Hand Truck and Dolly Market Trends

The hand truck and dolly market in Europe is expected to register at a notable CAGR from 2025 to 2030. The European market for hand trucks and dollies is characterized by strong demand from mature industries, a high emphasis on workplace safety, and stringent regulatory standards for manual handling. The growth of e-commerce and third-party logistics providers has heightened the need for reliable and ergonomic equipment across warehouses and fulfillment centers.

The UK hand truck and dolly market is expanding rapidly, driven by the ongoing transformation of the retail and logistics sectors, along with increasing demand from SMEs and urban distribution hubs. The need for quick and efficient handling solutions in last-mile delivery and courier services is driving adoption.

The hand truck and dolly market in Germany held a substantial market share in 2024, driven by the country’s well-established industrial base and high standards for efficiency and safety in material handling. The automotive, manufacturing, and construction sectors generate steady demand for heavy-duty transport tools. In addition, the push for digital logistics and smart warehouses is expected to further drive the demand for ergonomic and high-performance handling solutions, thereby driving the market’s growth.

Key Hand Truck and Dolly Company Insights

Some of the key companies in the hand truck and dolly industry include Magline, Inc., Harper Trucks, Inc., and B&P Manufacturing, among others. These companies maintain strong brand recognition through broad distribution networks and a focus on innovation. These companies also focus on material advancements, such as the use of lightweight aluminum and foldable designs for enhanced portability.

-

Magline, Inc. specializes in innovative, lightweight, and ergonomically designed hand trucks, dollies, and carts that help customers transport loads up to 1,500 pounds more safely and efficiently. The company’s flagship Magliner brand offers more than 4 million configurations, including the iconic Gemini convertible hand truck, widely used in route delivery for beverages, food service, parcel delivery, and numerous other industries such as rental, entertainment, vending, manufacturing, and warehousing.

-

B&P Manufacturing’s product lineup includes modular hand trucks that allow customers to customize frames, noses, wheels, handles, and accessories, as well as bulk delivery carts, portable curb and walk ramps, and various specialty trucks designed for ergonomic efficiency and reduced user fatigue.

Key Hand Truck And Dolly Companies:

The following are the leading companies in the hand truck and dolly market. These companies collectively hold the largest market share and dictate industry trends.

- Magline, Inc.

- Harper Trucks, Inc.

- B&P Manufacturing

- Wesco Industrial Products, LLC.

- BIL Group

- Milwaukee Hand Trucks

- The Hand Truck Company

- WOODEVER INDUSTRIAL CO., LTD.

- Cosco Home & Office Products

- Shunhe

Recent Developments

-

In January 2025, Lifting Equipment Store USA (LES) announced a strategic partnership with Vestil Manufacturing Corp. to enhance its material handling solutions offering. Over recent months, LES, with Vestil’s collaboration, introduced more than 600 new product lines-totaling over 6,000 SKUs-on their website, aimed at improving workplace efficiency and safety.

-

In January 2024, Magline, Inc., a manufacturer of heavy-duty hand trucks, carts, and dollies based in Standish, Michigan, is expanding its operations by renovating a 70,000-square-foot vacant facility adjacent to its current headquarters. This USD 875,000 investment will increase manufacturing, warehousing, and distribution capacity, enabling the company to serve more customers and continue its growth.

Hand Truck And Dolly Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.23 billion

Revenue forecast in 2030

USD 1.51 billion

Growth rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, material, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; and South Africa

Key companies profiled

Magline, Inc.; Harper Trucks, Inc.; B&P Manufacturing; Wesco Industrial Products, LLC.; BIL Group; Milwaukee Hand Trucks; The Hand Truck Company; WOODEVER INDUSTRIAL CO., LTD.; Cosco Home & Office Products; Shunhe.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hand Truck And Dolly Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hand truck and dolly market report based on product type, material, sales channel, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hand Trucks

-

Dolly

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Plastics

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-Commerce

-

Manufacturing & Industrial

-

Construction

-

Food & Beverage

-

Residential/Home Use

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hand truck and dolly market size was estimated at USD 1.19 billion in 2024 and is expected to reach USD 1.23 billion in 2025.

b. The global hand truck and dolly market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 1.51 billion by 2030.

b. The hand trucks segment accounted for the largest share of 68.8% in 2024. The growth of the hand trucks segment is primarily fueled by increasing demand from the logistics, warehousing, and retail sectors.

b. Some key players operating in the hand truck and dolly market include Magline, Inc., Harper Trucks, Inc., B&P Manufacturing, Wesco Industrial Products, LLC., BIL Group, Milwaukee Hand Trucks, The Hand Truck Company, WOODEVER INDUSTRIAL CO., LTD., Cosco Home & Office Products, and Shunhe.

b. Factors such as growth of e-commerce and last-mile delivery and rising demand in warehousing and industrial automation can be attributed to the growth of the hand truck and dolly market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.