- Home

- »

- Advanced Interior Materials

- »

-

Hardfacing Welding Market Size And Share Report, 2030GVR Report cover

![Hardfacing Welding Market Size, Share & Trends Report]()

Hardfacing Welding Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Submerged Arc Welding, Flux Cored Arc Welding, Shielded Metal Arc Welding), By End Use (Metalworking, Shipbuilding, Mining Industry), And By Segment Forecasts

- Report ID: GVR-4-68040-447-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hardfacing Welding Market Size & Trends

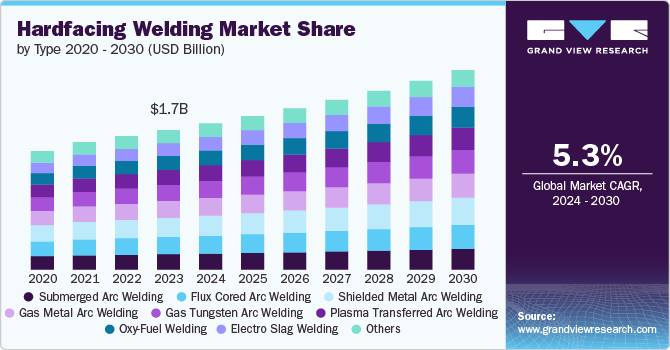

The global hardfacing welding market size was estimated at USD 1.73 billion in 2023 and is forecasted to grow at a CAGR of 5.3% from 2024 to 2030. This growth is attributed to its ability to improve the durability and lifespan of industrial components in industries including mining, oil & gas, construction, and manufacturing. Hardfacing protects surfaces exposed to high wear, abrasion, and corrosion, which reduces requirement for frequent replacements and downtime. With industries pushing for higher efficiency, cost savings, and extended equipment lifecycles, the adoption of hardfacing techniques is further expected to increase.

Advancements in technology have led to the integration of seamless fabrication, design, and inspection of welding technology with information technology is likely to continue. In addition, market players such as Kennametal, Inc. develop new process technology in-house and focus on delivering innovative solutions to customers. They also provide solutions to address customers’ productivity requirements and manufacturing challenges.

The hardfacing welding market is extremely competitive in nature and characterized by the presence of several regional and international players. Prominent players use various strategies including business expansion, new product launches, and acquisitions to enhance their market position. These players provide various hardfacing products like electrodes, wires, powder, equipment, machines, and other welding consumables. The products are used to reduce the wear & tear of equipment in various industries such as agriculture, power generation, iron & steel, mining, and crushing.

Type Insights

Shielded metal arc welding (SMAW) dominated the market with a revenue share of 13.7% in 2023 and is further expected to grow at a significant rate over forecast period. The rise in the adoption of shielded metal arc welding (SMAW) technology in the shipping and construction industries is anticipated to fuel the growth of this segment of the market during the forecast period. As shielded metal arc welding (SMAW) technology offers ease of movement, it is considered ideal for usage in the construction and development of steel structures.

Demand for gas tungsten arc welding (GTAW) manufacturing is expected to grow at a significant rate over the period of 2024-2030. Growing demand for welding components and bodies of vehicles is fueling the growth of gas tungsten arc welding (GTAW) segment of the U.S.A. hardfacing welding market. The gas tungsten arc welding (GTAW) process is used in applications wherein the cost and the quality of the welded joints are a priority. The rise in the number of research and development activities related to gas tungsten arc welding (GTAW) technology in the country is anticipated to make this technology fast and cost-effective for use in the nuclear and aerospace industries.

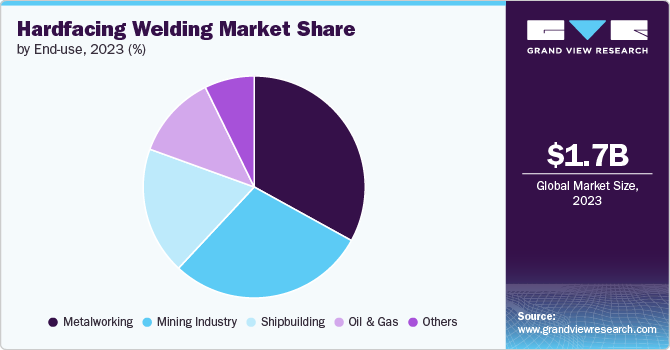

End Use Insights

Metalworking application accounted for the largest revenue share of 33.0% in 2023. Hardfacing welding techniques are widely employed in metalworking applications as they can help in extending the life of machine parts that undergo continuous wear and tear, as well as enable their reconditioning. These techniques typically involve the hardfacing of base metals such as nickel-based alloys, carbon, manganese steel, and copper-based alloys.

Oil & gas applications are anticipated to grow at a fastest rate over the forecast period. Oil & gas plants involve the use of complex infrastructures such as pipelines, rigs, and platforms. This leads to the surged requirement of hardfacing welding techniques for the maintenance of existing plants and the construction of new ones.

Regional Insights

North America dominated the hardfacing welding market with a revenue share of 25.8% in 2023. The region's strong industrial base, particularly in sectors like mining, oil & gas, agriculture, and construction, which heavily rely on equipment exposed to high wear and tear. The growing focus on infrastructure development, energy production, and resource extraction in the U.S. and Canada is expected to drive the requirement for more durable machinery and components, fueling the adoption of hardfacing to extend equipment lifespans.

U.S. Hardfacing Welding Market Trends

The hardfacing welding market in the U.S. is growing at a CAGR of 5.5% over the forecast period. The demand for hardfacing welding is anticipated to rise due to the robust growth in heavy industries like oil & gas, mining, and agriculture. These sectors heavily rely on machinery and equipment that experience significant wear and tear. Hardfacing helps extend the service life of these components, reducing downtime and maintenance costs, which is critical for industries seeking to maintain competitiveness and efficiency. The push for sustainable manufacturing practices is also likely to drive the adoption of wear-resistant coatings like hardfacing.

Europe Hardfacing Welding Market Trends

Europe hardfacing welding market is growing at a CAGR of 5.1% from 2024-2030. The region’s focus on advanced manufacturing and automotive industries is anticipated to increase the adoption of hardfaceing welding. With European manufacturers seeking to optimize production efficiency, the need for longer-lasting components is rising. In addition, region’s strong regulatory emphasis on sustainability and resource efficiency is likely to encourage companies to invest in technologies that extend the life of machinery, making the product an attractive solution.

Asia Pacific Hardfacing Welding Market Trends

The Hardfacing Welding market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. Rapid industrialization, particularly in China, India, and Southeast Asia, is expected to drive the demand for hardfacing welding. The booming construction, mining, and heavy equipment sectors are key contributors, as these industries require machinery that can withstand harsh operating conditions.

Key Hardfacing Welding Company Insights

Some of the key players operating in the market include Illinois Tool Works Inc. and The Lincoln Electric Company.

-

Illinois Tool Works Inc. was established in 1912 and is headquartered in Illinois, U.S. The company operates across seven segments, including welding, polymers & fluids, construction products, food equipment, test & measurement and electronics, specialty products, and automotive Original Equipment Manufacturers (OEMs). The welding segment of the company includes arc welding equipment, consumables, and accessories. The company’s welding segment serves general industrial markets like shipbuilding, fabrication, industrial capital goods, and others.

-

The Lincoln Electric Company was founded in 1895 and is headquartered in Ohio, U.S. It is a manufacturer of cutting, welding, and brazing products. The company designs, develops, and manufactures assembly and cutting systems, automated joining, arc welding products, and plasma and oxyfuel cutting equipment. The company serves markets such as energy, heavy industries, automotive & transportation, structural steel construction and infrastructure, and general metal fabrication.

Waldun and Arc Specialties are some of the emerging participants in the hardfacing welding market.

-

Arc Specialties designs and builds custom equipment and automated manufacturing systems. The company offers products for hard automation, hardfacing, inspection, joining applications, plasma cutting, and other such applications and serves industries like oil & gas, research, defense, and consumer. The company also provides process development services, manufacturing automation assessment, and technical services.

-

Waldun supplies quality wear solutions and offers products such as wear parts, wear plates, and automated welding and cutting equipment. The company provides hardfacing welding machines for plasma hardfacing and Flux Cored Arc Welding (FCAW) hardfacing.

Key Hardfacing Welding Companies:

The following are the leading companies in the hardfacing welding market. These companies collectively hold the largest market share and dictate industry trends.

- Waldun

- Illinois Tool Works Inc.

- The Lincoln Electric Company

- Arc Specialties

- Kjellberg Finsterwalde Group

- DAIHEN Corporation

- Polymet

- F.W. Winter Inc. & Co.

- ESAB Corporation

- Welding Alloys Group

Recent Developments

-

In April 2023, Welding Alloys announced the acquisition of UK based wear-resistant products manufacturer, Premier Technical Ltd. This acquisition is expected to expand its presence in the UK and allow both companies to provide an extended range of wear-resistant solutions to customers in numerous industries such as cement, mining, steelmaking, and power generation.

Hardfacing Welding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.81 billion

Revenue forecast in 2030

USD 2.48 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Waldun; Illinois Tool Works Inc.; The Lincoln Electric Company; Arc Specialties; Kjellberg Finsterwalde Group; DAIHEN Corporation; Polymet; F.W. Winter Inc. & Co.; ESAB Corporation; Welding Alloys Group.

Customization scope

Free report customization (equivalent up to 8 analysts orking days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hardfacing Welding Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the hardfacing welding market based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Submerged Arc Welding (SAW)

-

Flux Cored Arc Welding (FCAW)

-

Shielded Metal Arc Welding (SMAW)

-

Gas Metal Arc Welding (GMAW)

-

Gas Tungsten Arc Welding (GTAW)

-

Plasma Transferred Arc Welding (PTAW)

-

Oxy-Fuel Welding (OFW)

-

Electro Slag Welding (ESW)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Metalworking

-

Shipbuilding

-

Mining Industry

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global hardfacing welding market size was estimated at USD 1.73 billion in 2023 and is expected to reach USD 1.81 billion in 2024.

b. The global hardfacing welding market is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2030 to reach USD 2.48 billion by 2030.

b. Shielded metal arc welding (SMAW) accounted for the largest revenue share of over 13.6% in 2023. The rise in the adoption of shielded metal arc welding (SMAW) technology in the shipping and construction industries is anticipated to fuel the growth of this segment of the market during the forecast period.

b. Some key players operating in the hardfacing welding market include Waldun, Illinois Tool Works Inc., The Lincoln Electric Company, Arc Specialties, Kjellberg Finsterwalde Group, DAIHEN Corporation, Polymet, F.W. Winter Inc. & Co., ESAB Corporation, Welding Alloys Group.

b. The key factors that are driving the market growth are the product’s ability to improve the durability and lifespan of industrial components in industries including mining, oil & gas, construction, and manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.