- Home

- »

- Healthcare IT

- »

-

Healthcare Business Collaboration Tools Market Report, 2030GVR Report cover

![Healthcare Business Collaboration Tools Market Size, Share & Trends Report]()

Healthcare Business Collaboration Tools Market Size, Share & Trends Analysis Report By Type (Conferencing Software, Communication & Coordination Software), By Deployment (Cloud, On-premises), By Facility Size, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-128-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

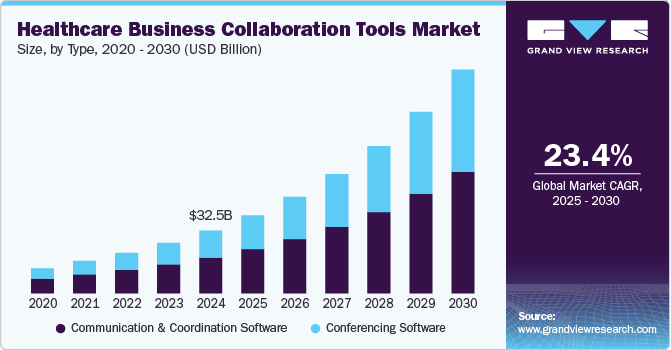

The global healthcare business collaboration tools market size was estimated at USD 32.53 billion in 2024 and is projected to grow at a CAGR of 23.4% from 2025 to 2030. The increasing demand for remote & real-team collaboration tools and the ongoing trend towards digitization & automation in healthcare workflows highlighted the growth of the healthcare business collaboration tools industry. These tools are integrated with digital technologies to improve communication, collaboration, and information sharing among healthcare professionals, organizations, and patients.

For instance, Jive Software, LLC, a software company, offers HIPAA-Compliant Communication and Collaboration software that simplifies critical communications for healthcare businesses.

Moreover, the adoption of digital collaboration solutions increased after the pandemic due to its benefits, such as efficient communication and collaboration among healthcare professionals. In addition, the growing importance of telehealth and remote patient care has boosted the demand for secure, real-time communication platforms that enable healthcare providers to collaborate across geographic boundaries.

The healthcare business collaboration tools industry derives added advantages from supporting technologies such as artificial intelligence (AI) with team collaboration software solutions, encouraging automation and enhancing intra-organizational communication. AI integration elevates the precision of voice and chat assistants while enabling real-time message translation.

As the adoption of telemedicine increased, collaboration tools are increasingly tailored to facilitate virtual patient care and remote medical consultations. These telehealth-friendly tools include secure document sharing, video conferencing, and remote diagnostic features, enabling healthcare professionals to provide timely care regardless of location. These factors are anticipated to propel market growth. For instance, in June 2024, Mitel Networks Corp. introduced Virtual Care Collaboration Service (VCCS), a healthcare collaboration platform in European markets such as France, Belgium, the Netherlands, Italy, the UK, and Switzerland for remote and in-patient care.

Moreover, the growing number of healthcare facilities, the shift to remote work, and the imperative to reduce physical contact emphasized the importance of secure, cloud-based collaboration tools to ensure continuity of operations and maintain compliance with evolving healthcare regulations. This surge in demand led to the rapid development and deployment of healthcare-specific collaboration solutions, adopting real-time communication, data exchange, and improved clinical workflows. According to the American Hospital Association, there are 6,120 hospitals in the U.S.

As the pandemic underscored the critical role of collaboration tools in healthcare crisis management and routine care delivery, their long-term relevance and adoption are expected to continue, shaping the future of healthcare communication and collaboration tools.

Market Concentration & Characteristics

The healthcare business collaboration tools industry is characterized by a high degree of innovation owing to the rise in the adoption of digital technologies or tools for communication and the growing adoption of various strategies by market players to develop healthcare business collaboration tools. For instance, in March 2022, Fraser Health collaborated with Calian, a Microsoft Gold Certified Partner. This collaboration platform is a central hub, encouraging improved patient communication, streamlined scheduling, seamless data exchange, and enhanced physician collaboration.

The healthcare business collaboration tools industry is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and expertise to capture a larger market share. Mergers and acquisitions (M&A) activities continue to shape the business landscape, with companies seeking strategic partnerships and acquisitions to enhance market presence and drive growth.

Regulating healthcare business collaboration tools involves navigating a complex landscape of laws and regulations created to ensure the integrity, security, and privacy of healthcare data while enabling effective communication and collaboration among healthcare providers, payers, patients, and technology providers. In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) regulates the privacy and security of Protected Health Information (PHI).

Several market players are expanding their business by launching new solutions in the market to expand their product portfolio. For instance, in January 2024, Thundercomm America Corporation introduced a new set of AI video conferencing solutions to enhance the efficiency and experience of various business communication and collaboration services, including healthcare.

Type Insights

By type, the communication & coordination software segment dominated the market with the largest revenue share in 2024. The demand for effective communication and coordination solutions has surged as healthcare evolves towards value-based care models and telehealth services. These tools enable rapid information exchange, care team collaboration, appointment scheduling, and patient engagement, ultimately leading to improved clinical outcomes and better patient experiences. Moreover, these tools encompass secure messaging platforms, real-time communication channels, and data-sharing capabilities, addressing the critical need for healthcare professionals to communicate seamlessly within and across organizations. In November 2024, Minds + Assembly collaborated with BOLDSCIENCE, a medical communications agency, to enhance its fully integrated healthcare communications and commercialization platform catering to biotech, medical device, pharma, and digital health clients.

The conferencing software segment in the healthcare business collaboration tools industry is anticipated to witness the fastest growth with a CAGR of 24.8% over the forecast period. The growth of this segment is attributed to the growing dependence on remote team meetings, virtual consultations, and telemedicine services. Healthcare providers have increasingly adopted conferencing solutions for conducting online patient visits, collaborative meetings among multidisciplinary care teams, and medical education and training sessions. These conferencing tools provide secure and effective means for healthcare professionals to connect and collaborate in real time, transcending geographical limitations. With their ability to support video, voice, and chat communications, along with features such as screen sharing and document sharing, these tools have become crucial for healthcare organizations to ensure operational continuity and deliver high-quality care in remote or hybrid care environments, thus fueling the segment's growth.

Deployment Insights

By deployment, the on-premises segment dominated the market with the largest revenue share in 2024. Many healthcare organizations, especially larger institutions, prioritize the improved data control and compliance provided by on-premises solutions. With the growing business, these organizations seek highly customized and specified software according to their installation preferences. On-premises software solutions offer enhanced integration and customization capabilities, offering greater control over sensitive information and ensuring compliance with industry regulations. For instance, Roundesk.io offers an on-premises telehealth video conferencing solution for healthcare settings.

The cloud segment is anticipated to witness the fastest growth rate with a CAGR of 27.9% over the forecast period. Healthcare organizations are progressively shifting towards hybrid and remote work models, which demand collaboration tools designed for a distributed workforce. Cloud solutions play an essential role by providing access from anywhere with an internet connection, thus enhancing accessibility and efficiency. As these organizations work to improve their IT infrastructure, minimize capital costs, and adopt digital transformation, cloud-based collaboration tools have emerged as the fastest-growing segment in the healthcare business collaboration industry, effectively responding to the industry's changing requirements. For instance, Microsoft offers Microsoft Cloud for Healthcare, an integrated communications and data management platform that works with Microsoft 365 and Azure, which help organize healthcare personnel and other collaborative tools.

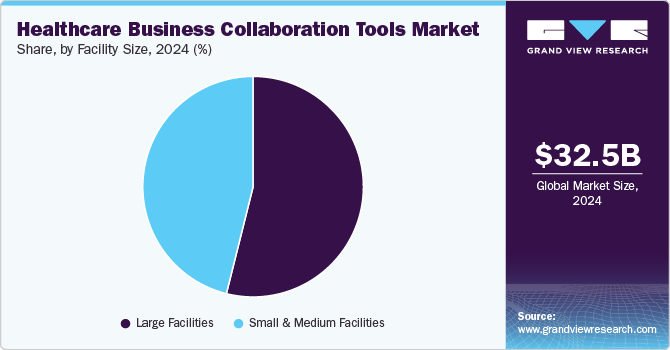

Facility Size Insights

By facility size, the large facilities segment dominated the market with the largest revenue share in 2024. A healthcare organization with at least 500 employees is classified as a large enterprise. These large healthcare entities, including healthcare systems and hospital networks, gain significant advantages from the efficiency and scalability of healthcare business collaboration tools. These organizations cater to a high patient volume and have larger care teams, making ongoing communication and collaboration essential for efficient operations and high-quality patient care. Moreover, large organizations typically possess the financial means to invest in thorough collaboration solutions, enabling them to adopt advanced tools that meet their specific requirements.

The small & medium facilities segment is anticipated to witness the fastest growth with a CAGR of 23.6% over the forecast period. This growth is anticipated to be due to their adaptability, cost-effective cloud-based options, pressing need for telehealth and remote care solutions, scalability, recognition of competitive advantages, focus on delivering quality patient care, and the imperative of regulatory compliance. Moreover, these facilities, often more agile and willing to embrace innovation, find collaboration tools essential in enhancing operational efficiency, maintaining patient care continuity, and ensuring their competitiveness in local healthcare markets, thus driving their rapid adoption of these transformative solutions. These solutions easily integrate with common healthcare systems, improving overall efficiency, and their robust data security features ensure compliance with industry regulations.

Regional Insights

North America healthcare business collaboration tools market is anticipated to register a significant growth rate during the forecast period. Factors such as advanced healthcare infrastructure and the well-established regulatory environment, exemplified by HIPAA, underscore the importance of patient privacy and data security, aligning perfectly with the secure and compliant nature of healthcare business collaboration tools to fuel the market growth.

U.S. Healthcare Business Collaboration Tools Market Trends

The healthcare business collaboration tools market in the U.S. held the largest market share in 2024. The shift towards value-based care and the demand for enhanced patient management coordination has led healthcare organizations to strengthen communication and collaboration among multidisciplinary teams. For instance, in April 2023, Microsoft announced an extended partnership with Cognizant to incorporate Cognizant's TriZetto healthcare products with the Microsoft Cloud for Healthcare. This strategic integration benefits mutual clients by enhancing patient and member engagement, improving data interoperability, facilitating insights, and driving operational efficiencies in a significantly reduced time frame.

Europe Healthcare Business Collaboration Tools Market Trends

Europe healthcare business collaboration tools market dominated globally with a revenue share of 32.4% in 2024. The region's emphasis on cross-border healthcare initiatives and research collaborations encouraged the demand for effective communication and collaboration tools to facilitate information exchange and coordination among healthcare professionals and organizations across borders. Thus, such factors are driving the market growth in this region.

Germany healthcare business collaboration tools market is anticipated to register a considerable growth rate during the forecast period. The country has a well-established and advanced healthcare infrastructure comprising numerous large healthcare organizations and research institutions. These entities are early adopters of collaboration tools to streamline workflows, enhance patient care, and promote medical research and innovation. Such factors drive the country's market growth.

Asia Pacific Healthcare Business Collaboration Tools Market Trends

The Asia Pacific healthcare business collaboration tools market is anticipated to register the fastest CAGR over the forecast period. Asian countries are witnessing population growth and rapid urbanization, prompting healthcare facilities and rising healthcare demands to seek innovative solutions to manage patient care efficiently. The region's diverse healthcare landscape comprises advanced healthcare hubs and emerging markets, making it most suitable for adopting various collaboration tools that cater to a wide range of healthcare needs.

China healthcare business collaboration tools market is anticipated to register a considerable CAGR during the forecast period.In China, governments and healthcare providers sought to ensure access to care while minimizing physical contact. As the country continues to invest in healthcare infrastructure and digital transformation, healthcare business collaboration tools are poised for substantial growth.

Latin America Healthcare Business Collaboration Tools Market Trends

Latin America healthcare business collaboration tools market is anticipated to witness steady growth over the forecast period. With rapid economic growth, the region is witnessing increased healthcare spending, which leads to the adoption of healthcare business collaboration tools. Moreover, governments and healthcare providers are actively working to broaden healthcare access, even in remote and underserved areas, which increases the demand for healthcare business collaboration tools.

Brazil healthcare business collaboration tools market is anticipated to register considerable growth during the forecast period. The Brazil government strongly focuses on digital health integration by implementing telemedicine services and electronic health records (EHR), creating a favorable collaboration environment. Moreover, the country's growing number of healthcare institutions is increasing the demand for healthcare business collaboration tools.

Middle East & Africa Healthcare Business Collaboration Tools Market Trends

The Middle East and Africa healthcare business collaboration tools market is anticipated to experience lucrative growth over the forecast period. Factors such as growing awareness of healthcare solutions, efforts to enhance healthcare infrastructure, and the increasing adoption of digital technologies drive this region's market growth. Digital healthcare business solutions are revolutionizing the MEA, facilitated by improving internet connectivity and substantial investments in developing these tools.

UAE healthcare business collaboration tools market is anticipated to register a considerable CAGR during the forecast period. The healthcare sector in Saudi Arabia is rapidly evolving, and business collaboration tools are being adopted to modernize its healthcare system. With a focus on improving healthcare access, quality, and efficiency, the demand for advanced collaboration platforms in Saudi Arabia’s healthcare sector is expected to continue to rise.

Key Healthcare Business Collaboration Tools Company Insights

Key participants in the healthcare business collaboration tools industry are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Healthcare Business Collaboration Tools Companies:

The following are the leading companies in the healthcare business collaboration tools market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- IBM

- FreshBooks

- CONTUS TECH

- Tvisha Technologies Pvt Ltd.

- Zoho Corporation Pvt. Ltd.

- Wrike, Inc.

- 500apps.com

- BrainCert

View a comprehensive list of companies in the Healthcare Business Collaboration Tools Market.

Recent Developments

-

In June 2024, Keragon Inc., a provider of healthcare automation software, introduced out of stealth the first no-code workflow automation platform developed especially for the U.S. healthcare industry.

Healthcare Business Collaboration Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.40 billion

Revenue forecast in 2030

USD 115.83 billion

Growth Rate

CAGR of 23.4% from 2025 to 2030

Actual data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, facility size, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Microsoft, Google, IBM, FreshBooks, CONTUS TECH, Tvisha Technologies Pvt Ltd., Zoho Corporation Pvt. Ltd., Wrike, Inc., 500apps.com, BrainCert

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Business Collaboration Tools Market Report Segmentation

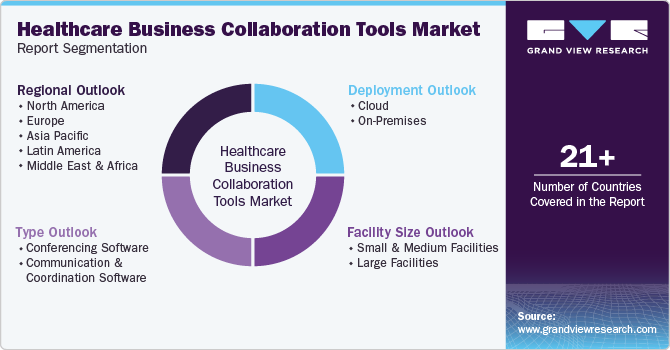

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global healthcare business collaboration tools market report based on type, deployment, facility size, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conferencing Software

-

Communication & Coordination Software

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Facility Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Facilities

-

Large Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare business collaboration tools market size was estimated at USD 32.53 billion in 2024 and is expected to reach USD 40.40 billion in 2025.

b. The global healthcare business collaboration tools market is expected to grow at a compound annual growth rate of 23.4% from 2025 to 2030 to reach USD 115.83 billion by 2030.

b. Europe dominated the healthcare business collaboration tools market with a share of 32.4% in 2024. Europe has a well-established and advanced healthcare infrastructure and the healthcare entities are early adopters of collaboration tools to streamline workflows, enhance patient care, and promote medical research and innovation.

b. Some key players operating in the healthcare business collaboration tools market include Microsoft; Google; IBM; FreshBooks; CONTUS TECH; Tvisha Technologies Pvt Ltd.; and Zoho Corporation Pvt. Ltd.

b. Key factors that are driving the market growth include increasing demand for remote & real-team collaboration tools and the ongoing trend towards digitization & automation in healthcare workflows highlighted the growth of healthcare business collaboration tools.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."