- Home

- »

- Next Generation Technologies

- »

-

Healthcare Chatbot Market Size, Share, Industry Report 2030GVR Report cover

![Healthcare Chatbot Market Size, Share & Trends Report]()

Healthcare Chatbot Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (Cloud, On-Premises), By Application (Personal Assistance, Automated Patient Support), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-152-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Chatbot Market Summary

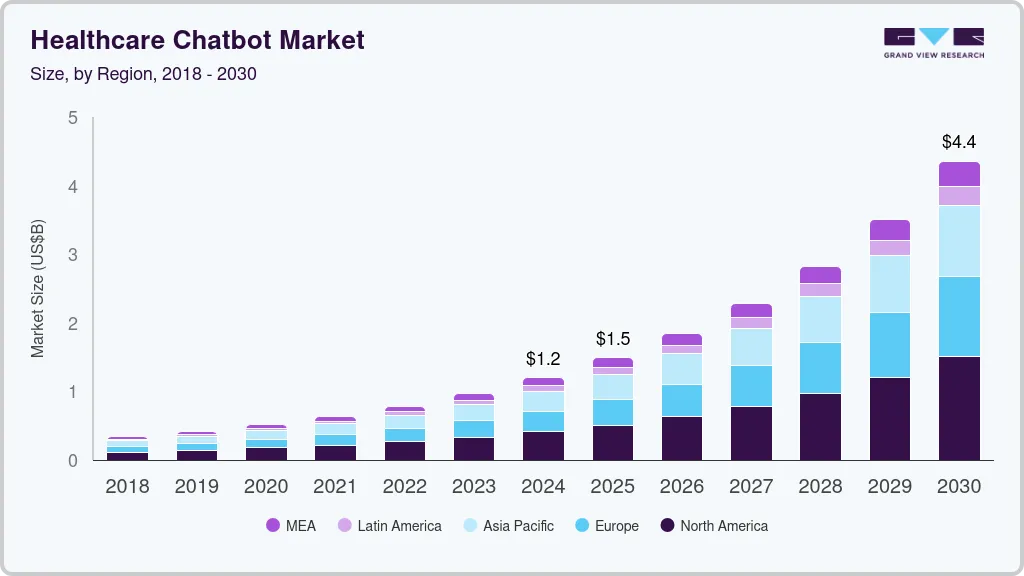

The global healthcare chatbot market size was estimated at USD 1,202.1 million in 2024 and is projected to reach USD 4,355.6 million by 2030, growing at a CAGR of 24% from 2025 to 2030. Healthcare players operate a chatbot to make connections with prospective clients.

Key Market Trends & Insights

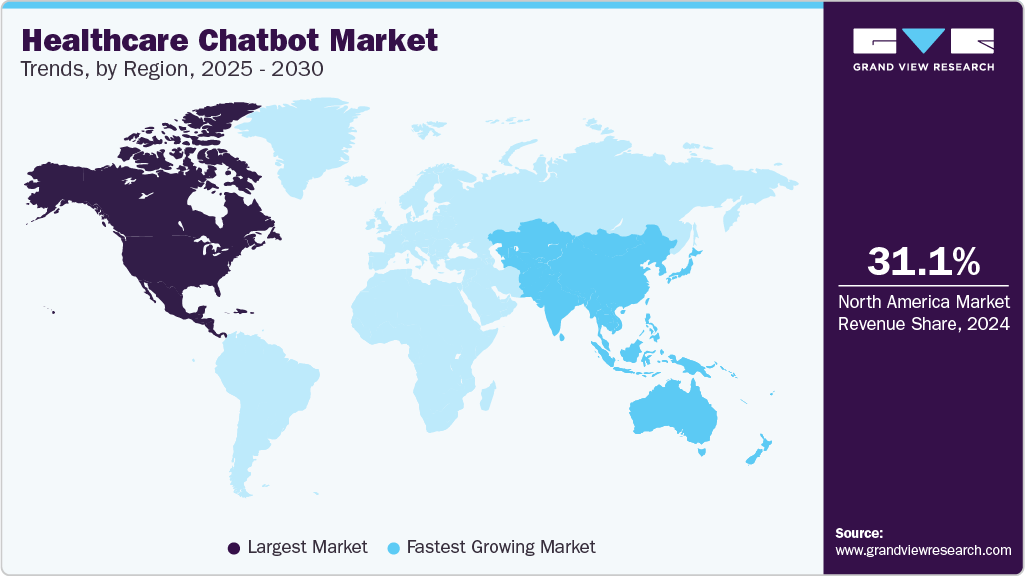

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Korea is expected to register the highest CAGR from 2025 to 2030.

- In terms of component, software accounted for a revenue share of 61.6% in 2024.

- Services is the most lucrative component segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,202.1 Million

- 2030 Projected Market Size: USD 4,355.6 Million

- CAGR (2025-2030): 24%

- North America: Largest market in 2024

Chatbot for healthcare are systems that answer people's questions. With the use of state-of-the-art technology, this program assists doctors in attending to minor patient concerns. The clinical team has saved a lot of time owing to this concept, which has freed up staff members to concentrate more on their work. The healthcare industry is experiencing a significant surge in demand for these digital assistants because of modern technology automating several operations.

The healthcare chatbot market is a rapidly expanding sector within the healthcare industry that involves the use of artificial intelligence-powered chatbot applications to improve patient engagement, streamline administrative tasks, provide health information, and support telemedicine services. These chatbot, often integrated with electronic health records (EHRs) and telehealth platforms, offer 24/7 accessibility, personalized interactions, and efficient appointment scheduling, reducing the burden on healthcare professionals and enhancing the patient experience.

Healthcare chatbot were developed primarily to reduce the workload of primary care physicians and to assist people in learning how to take better care of their own health. For instance, a study shows that AI-driven healthcare chatbot enhances patient engagement which is reflected in increased interaction rates and reduce the workload for clinicians. By effectively handling tasks like patient triage, appointment scheduling, chronic disease management, and high patient volumes, these virtual assistants provide timely and scalable care. They ease the burden on healthcare staff while improving operational efficiency and patient compliance, all without replacing medical professionals.

Component Insights

The software segment accounted for the highest revenue share of 61.6% in 2024. The growth is driven due to enhanced technological features in chatbot software, such as mobile platform compatibility, cloud-based deployment, interference engine, multilingual capabilities, Natural Language Processing (NLP), Application Programming Interface (API), and single point of search. Furthermore, compared to rule-based chatbot, AI software-powered chatbot are the most sophisticated since machine-learning chatbot are typically more conversational, data-driven, and predictive. No matter how the inquiries are expressed, the Al software-based chatbot cannot only comprehend the patient's intent but also provide precise responses. For example, they can schedule consultations and use a symptom checker to diagnose the illness.

The service segment registered a CAGR of 24.5% from 2025 to 2030. Healthcare chatbot services are digital technologies that use conversational interfaces to offer information, assistance, and services to patients, healthcare practitioners, and other industry stakeholders. AI chatbot schedule appointments and handle requests for prescription renewals in addition to offering patients basic informational support (such as details about visiting hours and addresses). Moreover, healthcare chatbot services allow chatbot to evaluate a patient's symptoms to determine whether they need medical attention. Additionally, it can enable medical staff to track patients' conditions and link a patient with a doctor for consultation.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2024. Cloud-based chatbot can be adjusted less, require less initial investment, and are more accessible than on-premises chatbot. Healthcare companies simply scale their chatbot services up or down in response to demand due to cloud-based models in healthcare chatbot. This is essential for effectively managing different user interaction levels, particularly during peak hours. To assist healthcare firms in complying with regulatory standards, such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, reputable cloud providers make significant investments in security measures and issue compliance certifications. They offer services and products for data encryption, access control, and compliance.

The on-premises segment is projected to grow significantly over the forecast period. Healthcare organizations that use on-premises chatbot host the chatbot's data, services, and infrastructure on their own servers or data centers. When a chatbot is deployed on-premises, all of its parts are physically housed and managed by the healthcare institution, as opposed to cloud-based models where resources are maintained in a remote cloud environment. Direct control over data is a major factor in healthcare businesses' decision to use an on-premises strategy. This is particularly crucial for private and sensitive patient health data since it gives the company complete control over data security and privacy.

Application Insights

The medical data repositories segment accounted for the largest market revenue share in 2024. The growth of healthcare chatbot is being driven by the widespread adoption of digital health tools, the need for efficient data handling, and rising demand for around-the-clock healthcare access. Their cost-effectiveness, combined with advances in AI and natural language processing, has made them increasingly capable of delivering accurate and personalized support. Chatbot also assist in managing chronic conditions through reminders and symptom tracking, while growing patient awareness and supportive regulatory frameworks further boost their adoption.

The automated patient support segment is projected to grow significantly over the forecast period. This segment is driven by the rising adoption of digital health technologies, the need for cost-effective care, and the impact of the COVID-19 pandemic on healthcare delivery. Chatbot offer 24/7 accessibility, automate routine tasks such as scheduling and inquiries, and provide personalized patient support. Advances in artificial intelligence (AI) and natural language processing (NLP) have made these tools more accurate and efficient, while increasing patient awareness and demand for virtual care continue to fuel their adoption. Chatbot also improve patient engagement by offering convenient, reshape their interactions.

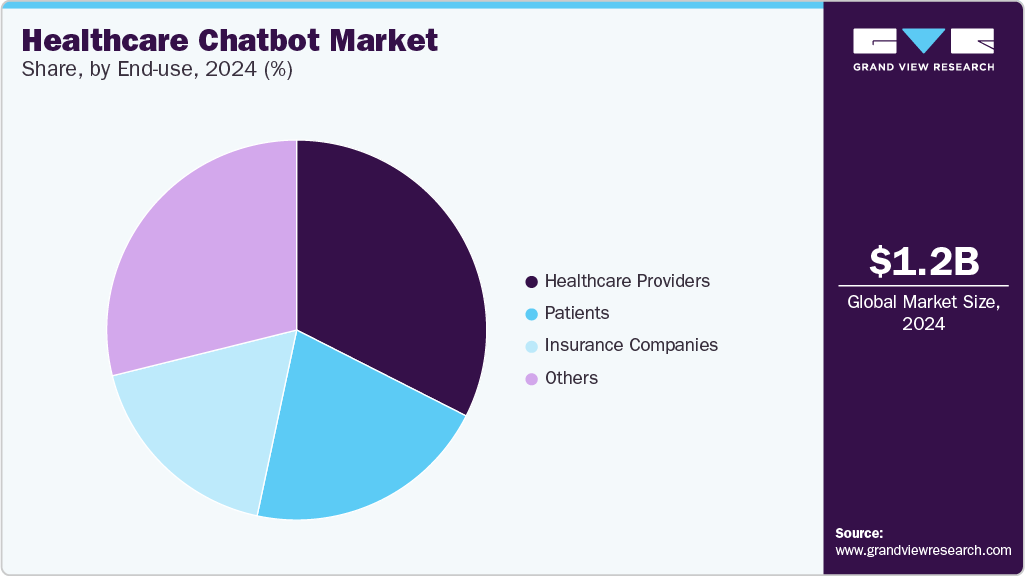

End-use Insights

The healthcare providers segment accounted for the largest market revenue share in 2024.Clinicians, physicians, and healthcare organizations are examples of healthcare providers. To make important judgments, healthcare providers must be able to diagnose disorders and evaluate a vast amount of healthcare data. Healthcare practitioners are increasingly using IT-enabled techniques and software for better treatment possibilities and accurate disease identification to save costs and improve quality of service. For instance, doctors frequently utilize the chatbot SafeDrugBot to identify safe medications that can be given to expectant moms and nursing mothers.

Patients segment is projected to grow significantly over the forecast period. To better understand diseases, patients use apps such as symptom checks and medical triage tools. People connect with virtual healthcare assistants to get the right medical information depending on their symptoms, or they can use healthcare chatbot on social media, mobile, and medical websites. When prospective patients visit a website, healthcare chatbot engage with them, offer a potential diagnosis, assist in locating specialists, set up appointments, and facilitate better access to the appropriate therapies. Chatbot that serve as medical assistants, such as florence and melody, are becoming more and more popular since they remind patients to take their medications on schedule and provide information if a dosage is missed.

Regional Insights

North America dominated the market and accounted for a 31.1% share in 2024. The healthcare chatbot market is expected to rise due to several factors in this region, including the presence of numerous significant competitors, high levels of investment in research & development, and the growing demand for virtual healthcare services. Furthermore, the region's Healthcare Chatbot market is expanding because of the increased number of chronic illnesses and the rising need for patient engagement programs. Due to the extensive use of technology and increased R&D spending, North America is witnessing tremendous market expansion. This market is anticipated to expand because of the high concentration of significant competitors in the area, strategic alliances, quicker FDA approvals, and significant R&D spending. Demand will be driven during the projection period by these improvements.

U.S. Healthcare Chatbot Market Trends

The healthcare chatbot market in the U.S. is driven by the increasing adoption of AI, telehealth, and digital health technologies. The COVID-19 pandemic significantly driven the shift toward virtual care, making chatbot an essential tool for remote patient interaction and support. Ongoing advancements in artificial intelligence and natural language processing are enhancing chatbot capabilities, enabling more accurate, responsive, and personalized healthcare solutions. This evolution aligns with the industry's need for cost-effective, scalable, and patient-centered services. For instance, artificial intelligence is improving mental health care by enabling early diagnosis, tailoring treatments to individual needs, and improving accessibility through AI-driven chatbot and digital tools. These solutions assist mental health professionals by processing data from various sources, enabling prompt responses and offering round-the-clock support, particularly in regions with limited access to care.

Europe Healthcare Chatbot Market Trends

The healthcare chatbot market in Europe is experiencing prominent growth, driven by the growing demand for virtual healthcare services and the desire to lower healthcare expenses in the area, Europe is a sizable market for healthcare chatbot. Due to the presence of important market participants and the rising use of digital healthcare solutions in these nations, the UK, Germany, and France are the main contributors to the growth of the Healthcare Chatbot market in Europe.

Asia Pacific Healthcare Chatbot Market Trends

Asia Pacific is anticipated to register the fastest CAGR over the forecast period. It is expanding rapidly, driven by the widespread adoption of digital health solutions, a high volume of patients especially in countries such as India and China. The continuous advancements in AI and natural language processing enhance the accuracy and personalization of chatbot services. In addition, the rising number of chronic diseases in the region’s population and the demand for cost-effective, round-the-clock healthcare access are further growing the adoption of chatbot across the region.

Key Healthcare Chatbot Market Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Healthily Ltd specializes in developing evidence-based digital health resources and patient education tools aimed at improving health knowledge and self-management skills. Their flagship offer includes the GoShare Healthcare content distribution platform, which enables health professionals to deliver personalized, timely health information and educational content to patients. Healthily focuses on scalable online health programs, leveraging a large library of engaging patient stories, videos, and animations to enhance patient self-efficacy and care outcomes. The company is committed to innovation, collaboration, and inclusivity, providing bespoke health communication solutions that support better patient engagement and wellbeing. Their initiatives emphasize delivering the right health information at the right time to empower individuals in managing their health effectively.

-

Sensely, Inc. provides conversational AI platforms that combines human-like interaction with advanced technology to enhance healthcare member experiences globally. Their offerings include symptom checking, chronic condition management, appointment scheduling, and personalized health education, delivered through an engaging avatar named Molly. The company’s platform integrates trusted clinical content from sources thus, providing accurate, real-time support across multiple channels and languages. Recently acquired by Mediktor, Sensely continues to innovate in AI-powered virtual assistance, aiming to improve patient engagement, lower healthcare costs, and increase access to care worldwide.

Key Healthcare Chatbot Companies:

The following are the leading companies in the healthcare chatbot market. These companies collectively hold the largest market share and dictate industry trends.

- Ada Health GmbH

- Baidu, Inc.

- Buoy Health, Inc.

- eMed

- Fabric Labs, Inc

- Healthily LTD.

- HealthTap, Inc.

- Infermedica

- PACT Care BV

- Teckel Medical

- Woebot Health

Recent Developments

-

In January 2024, Healthily LTD. formed a strategic alliance with Recordati to strengthen digital health services for patients across Europe. The partnership will integrate Healthily’s AI-driven chatbot into Recordati’s patient support offerings, delivering personalized health guidance and symptom-checking tools. This collaboration aims to empower individuals with reliable information for informed decision-making and represents a key advancement in promoting accessible, technology-enabled healthcare throughout the region.

-

In September 2023, HealthTap, Inc. introduced Dr. A.I., an advanced AI-powered pre-appointment interview tool based on ChatGPT-4, designed to streamline virtual doctor visits by efficiently collecting detailed patient information. This technology helps reduce administrative workload for physicians, allowing them to focus more on delivering tailored care and enhancing the patient experience. The company highlights that Dr. A.I. is intended to support, not replace, medical professionals, contributing to more accessible and cost-effective healthcare for everyone.

Healthcare Chatbot Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1487.7 million

Revenue forecast in 2030

USD 4355.6 million

Growth rate

CAGR of 24% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Healthily LTD.;HealthTap, Inc.; Teckel Medical; Buoy Health, Inc.; Infermedica; eMed; Baidu, Inc.; Ada Health GmbH; PACT Care BV; Woebot Health;Fabric Labs, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Chatbot Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare chatbot market report based on component, deployment, application, end-use and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Data Repositories

-

Personal Assistance

-

Automated patient support

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Insurance companies

-

Healthcare providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare chatbots market size was estimated at USD 1,202.1 million in 2024 and is expected to reach USD 1,487.7 million in 2025.

b. The global healthcare chatbots market is expected to grow at a compound annual growth rate of 24.0% from 2025 to 2030 to reach USD 4,355.6 million by 2030.

b. North America dominated the healthcare chatbots market with a share of 31.1% in 2024. This is attributable to the presence of numerous significant competitors, high levels of investment in research & development, and the growing demand for virtual healthcare services.

b. Some key players operating in the healthcare chatbots market include Your.MD, HealthTap Inc., Sensely Inc., Buoy Health Inc., Infermedica, Babylon, Healthcare Service Limited, Baidu Inc., Ada Digital Health Ltd., PACT Care BV, Woebot Labs Inc., GYANT.Com Inc.

b. Key factors that are driving the market growth include the need for improved patient engagement, the growing demand for accessible and cost-effective healthcare services, and advancements in natural language processing (NLP) and AI technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.