- Home

- »

- Healthcare IT

- »

-

Healthcare ERP Market Size, Share & Trends Report, 2030GVR Report cover

![Healthcare ERP Market Size, Share & Trends Report]()

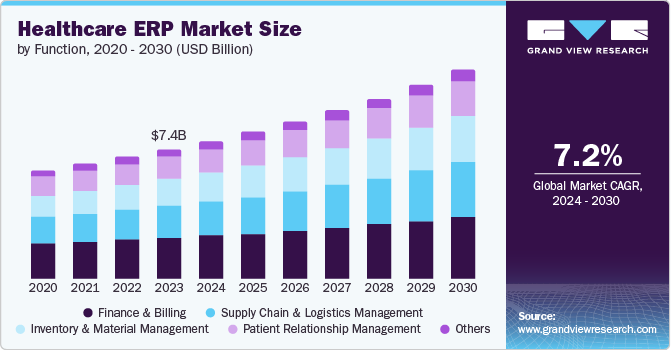

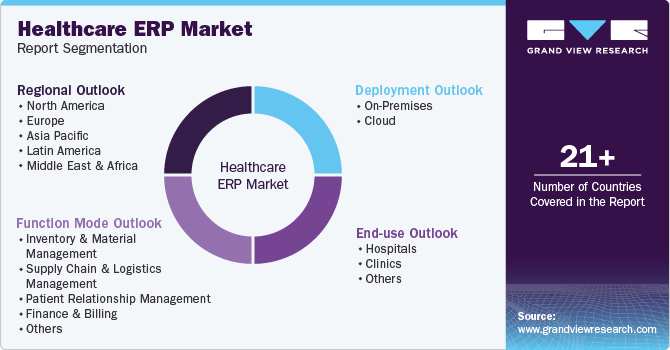

Healthcare ERP Market Size, Share & Trends Analysis Report By Function (Inventory & Material Management, Supply Chain & Logistics Management), By Deployment (On-premises, Cloud), By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-390-4

- Number of Report Pages: 128

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Healthcare ERP Market Size & Trends

The global healthcare ERP market size was estimated at USD 7.42 billion in 2023 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. Growing healthcare expenditure, ineffective hospital service management, rising workforce shortage, and rapidly growing patient population at healthcare facilities are motivating public and private stakeholders to innovate new modes of delivering healthcare. Clinicians are growing aware of the benefits associated with these advanced technological solutions, such as delivering high-quality patient care, reducing operational costs, and eliminating data siloes in back-end operations, which is expected to contribute to the growing demand & adoption rate of ERP solutions.

The growing adoption rates of ERP systems amongst small and medium businesses are contributing to the rising demand for these systems to reduce operational costs and enhance functional outcomes. Centralized patient data allows seamless access from remote locations to improve patient acquisition and patient management techniques. These systems enable businesses to amalgamate data generated from human resources, manufacturing & inventories, supply chain cycles, finances & accounting, and optimize back-end processes such as accounts management, payroll management, and inventory management. Pharmacies and laboratories have begun adopting ERP systems for inventory management, point-of-sale profiles, purchases, accounts, and selling.

Institutes and facilities are rapidly adopting cloud-deployed ERP systems owing to multiple benefits associated with them, such as minimum ownership cost, agile & flexible infrastructure capacity, limited in-house technical expertise, low capital requirement, and consistent upgrades. Since on-premises systems require high cost and capital expenditure, approximately between USD 50 million and USD 150 million, small & medium businesses are rapidly adopting cloud-deployed ERP systems. Cloud-based systems do not require upfront investment and are based on recurring fees.

The COVID-19 pandemic challenged the functioning of global healthcare systems. The pandemic burdened the workforce, exposed shortcomings in existing systems, and disrupted supply & demand cycles. Businesses are adopting cloud services to seamlessly access data, streamline workflow, automate inventory & supply chain management functions, and overall improve financial & clinical outcomes of the industry due to the increasing shift towards remote healthcare and remote working of employees. During the pandemic, many hospitals planned to go live with their ERP. For instance, the CentraCare healthcare system in the U.S. decided to go live with Oracle Cloud. The ERP solution strengthened CentraCare’s supply chain, which boosted the company’s position in managing the pandemic.

Vendors and developers are constantly focusing on integrating artificial intelligence (AI) algorithms into ERP systems for various applications, such as customized patient engagement and data insights. For instance, in March 2023, Microsoft introduced a new wave of AI product updates to its business applications portfolio, including the launch of Microsoft Dynamics 365 Copilot. This AI-driven tool offers interactive assistance across various business functions, leveraging recent advancements in generative AI to automate routine tasks and enhance workforce creativity. Dynamics 365 Copilot aims to optimize CRM and ERP systems, accelerating innovation and improving business outcomes across different operational areas.

Market players are constantly enhancing their technologies to deliver innovative products for the healthcare industry. In addition, the key players are focusing on strengthening their merger & acquisition strategies, technological collaborations, and product expansion strategies to propel the growth and development of the market. For instance, in January 2021, SAP and Microsoft announced their strategic alliance and plans to integrate SAP’s intelligent suite of software solutions with Microsoft Teams. In addition to their existing strategic alliance, the companies formalized an extensive expansion to accelerate the adoption of SAP S/4HANA on Microsoft Azure. Through this partnership, SAP is focusing on improving customer experience and expanding interoperability with Microsoft Azure.

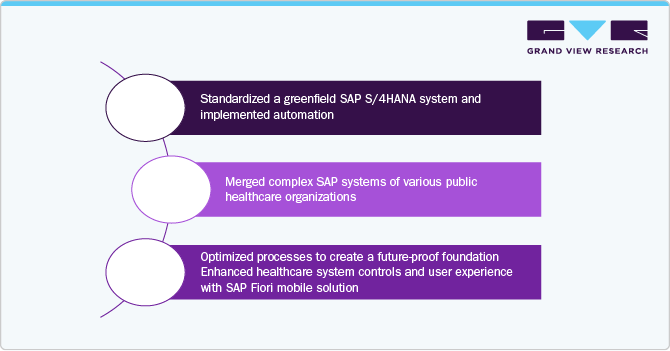

Case Study: The One.ERP Project

The One.ERP project, one of the most extensive European SAP initiatives in the healthcare industry, aims to optimize processes and consolidate numerous systems for the General Hospital of the City of Vienna (AKH) and the Vienna Municipal Clinics (WSK).

-

Over 400 employees of WiGeV and global contractors implemented the One.ERP system as a unified team.

-

The program involved more than 23 departments across various medical specialties and was divided into 13 sub-projects.

-

Standardizing over 100 external application interfaces added complexity to the project.

-

A cost unit accounting system for hospitals was introduced, providing WiGeV with a highly effective control tool, unique in Europe.

-

After the trial operation, the high-performance IT solution enhances efficiency through mobile logistics and promotes collaboration among different company departments and divisions.

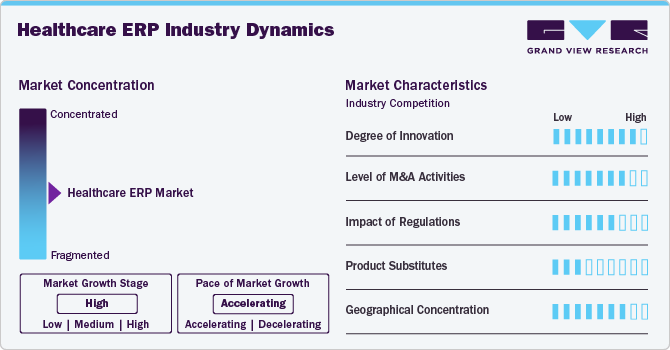

Market Characteristics & Concentration

The degree of innovation in the healthcare ERP industry is high. Technological innovation in the market is driven by artificial intelligence (AI) and machine learning advancements, enhancing performance and efficiency. For instance:

-

In July 2022, Infor announced that Confluence Health successfully implemented AI solutions to accelerate business innovation and enhance community care.

-

This AI-driven solution replaces a manual, error-prone process for calculating reorder points, which previously took hours.

-

With Inventory Intelligence, the system continuously analyzes changes within the ERP system and provides recommendations for review.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in October 2019, Epicor Software Corporation acquired 1 EDI Source, Inc. 1 EDI Source provides cloud and on-premise solutions that facilitate the secure and EDI-compliant exchange of transactional documents between trading partners, directly integrating with ERP systems and supply chain applications.

The regulatory framework for the market includes compliance with the Health Insurance Portability and Accountability Act (HIPAA) for data privacy and security. It also involves adherence to the General Data Protection Regulation (GDPR) for handling patient data within and outside the EU. In addition, FDA regulations may apply to software solutions involved in clinical and patient care settings.

Key players in the market are focusing on geographical expansion, which assists in addressing untapped markets. This expansion allows for the adoption of healthcare ERP solutions in emerging markets, where the demand for efficient healthcare management systems is rising. For instance, Aptean received a strategic investment from TA Associates and Insight Partners aimed at fostering innovation and facilitating its global market expansion.

Function Insights

The finance and billing segment dominated the market with the largest revenue share of 32% in 2023. Healthcare organizations are rapidly adopting ERP systems to optimize processes and lower barriers between front-end revenue cycle management tasks and back-end tasks, such as claims management. Businesses are adopting these systems to track profits, eliminate financial data siloes, manage ledgers, reporting, risk management, manage fixed assets, multi-currency management, and tax management.

Several market players offer a variety of financial features through their ERP software offerings. For instance, Oracle Fusion Cloud ERP provides a user-friendly and adaptable financial reporting system. It streamlines financial close processes and facilitates the implementation of new business models, including value-based care and telehealth.

However, inventory and material management are anticipated to grow the fastest CAGR of during the forecast period. A key driver for the inventory and material management segment in the market is the projected shift to cloud-based supply chain management (SCM). According to the Global Healthcare Exchange, LLC, by 2026, 70% of health systems are expected to adopt this approach.

Over the past three decades, healthcare SCM technology has evolved from materials management information systems (MMIS) for order processing and inventory management to ERP systems that automate both financial operations and materials management. As highlighted by the 2023 GHX Cloud Survey, the upcoming phase involves hospitals transitioning to cloud-based ERP systems, making cloud integration solutions a new standard across the healthcare industry.

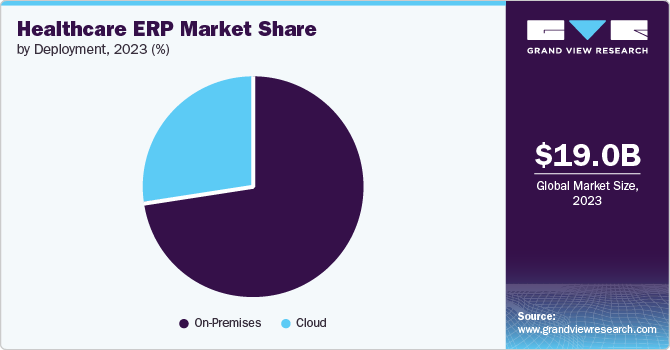

Deployment Insights

The on-premises segment held the highest market share of 73% in 2023. The growth is attributed to several benefits, including minimal maintenance, reduced vendor dependency, remote access, lower costs, complete operational control, easy customization, and enhanced security and privacy. On-premises software deployment, often referred to as "shrink-wrap," involves installing systems and solutions on the company's computers. While these solutions are installed on local servers, they can be accessed remotely, reducing implementation costs and power consumption.

Furthermore, cloud deployment is projected to grow the fastest CAGR over the forecast period. Cloud-deployed software solutions are replacing on-premises installed software solutions. The growth of cloud computing and web-based applications, enhanced ease of access, and improved accessibility of the internet are driving the segment's growth. Cloud-deployed software solutions do not require upfront investment and operating on recurring fees is supporting the transition from on-premise deployed software to cloud-deployed software. In cloud-deployed software, the data is stored remotely and allows data retrieval as per the need of the user.

Healthcare organizations are under significant pressure from consumers, employers, regulatory agencies, and governing boards to increase cost-efficiency while maintaining the quality of care. Oracle Enterprise Resource Planning Cloud is being utilized by over 1,800 healthcare organizations for an efficient, collaborative, and intuitive back-office hub with rich operational and financial capabilities to support reducing costs and modernizing business practices to gain insights and improve productivity.

End-use Insights

By end use, hospital segment dominated the market, with the largest share in 2023. A significant driving factor for the hospital segment in the market is the need for efficient patient and doctor management tools that reduce paperwork, improve efficacy, and enhance patient care while controlling budget expenses. Many healthcare organizations are adopting ERP software to streamline hospital operations.

These systems improve patient care by minimizing paperwork and reducing the time doctors spend locating patient data, allowing them to focus more on patient care. In addition, ERP solutions integrate all departments, including finance, HR, and inventory, thereby enhancing overall operational efficiency, which results in the rapid adoption of ERP by hospitals.

The clinics segment is expected to grow significantly from 2024 to 2030. With constant changes in demand and regulations, clinics are quickly adapting and scaling their operations to remain competitive. This has led many clinics to seek ERP solutions that can grow and evolve with their needs. Clinics require user-friendly software to automate time-consuming tasks, allowing them to scale their activities without compromising patient care. ERP systems offer secure and reliable features that distinguish clinics from other practices, providing the agility necessary to thrive in an increasingly competitive healthcare environment.

Regional Insights

North America healthcare ERP market led the global market in 2023 and accounted for a revenue share of 36.02% in 2023. Growth is driven by the need for improved operational efficiency, advanced healthcare infrastructure, compliance with regulatory requirements, and the presence of several market players undertaking several strategic initiatives. For instance, in September 2022, Tecsys Inc. announced that A.M.G. Medical Inc. (AMG), a Canadian manufacturer and distributor of home healthcare and medical professional products, initiated its digital transformation by implementing Tecsys' cloud-based Elite Distribution ERP and Elite WMS, Tecsys' advanced warehouse management solution. In addition, the increasing adoption of advanced technologies such as cloud computing and data analytics enhances the functionality and scalability of ERP systems, further driving market growth.

U.S. Healthcare ERP Market Trends

The healthcare ERP market of the U.S. accounted for the largest global market share in 2023. The market growth is driven by factors such as technological advancements, growing adoptions of ERP software by healthcare organizations, and the introduction of new ERP solutions for the healthcare industry. For instance, in April 2024, Oracle introduced new capabilities to the Oracle Fusion Cloud Applications Suite aimed at enhancing operational efficiency, employee empowerment, and patient outcomes for healthcare organizations. The updates within Oracle Fusion Cloud Human Capital Management (HCM), Oracle Fusion Cloud Supply Chain and Manufacturing (SCM), and Oracle Fusion Cloud Enterprise Resource Planning (ERP) will boost productivity, streamline processes, support employee development, reduce costs, and improve patient care.

Europe Healthcare ERP Market Trends

Europe healthcare ERP market is expected to grow significantly during the forecast period. The growth is attributed to the increasing strategic initiatives undertaken by the market players, along with several other driving factors. For instance, in October 2023, Oracle launched a new Health Support Hub in Barcelona to enhance its service capabilities for European customers as they update their healthcare systems to improve patient outcomes. This facility complements existing Oracle Health support centers globally, offering a comprehensive, tiered support experience designed to address complex issues with technical expertise and advanced automation.

The healthcare ERP market in the UK had a substantial share in 2023, owing to the increasing adoption of AI-based healthcare solutions. The rapid adoption of digital resources and data in UK healthcare, accelerated by COVID-19, is a significant driver for the healthcare ERP market. Initiatives like the government's NHS data strategy and the widely downloaded NHS COVID-19 app highlight this trend. Leveraging this data and AI integration with various healthcare solutions, including ERP, provides healthcare professionals with critical insights, fueling innovation and leading to improved patient care, reduced clinician burnout, enhanced care experiences, and lower costs.

France healthcare ERP market is positively influenced by the need for improved operational efficiency, integrated data management within healthcare institutions, and strategic initiatives by market players. For instance, in June 2023, Gpi expanded its presence in France by acquiring Evolucare, a company specializing in software solutions for the digital transformation of French healthcare.

Asia Pacific Healthcare ERP Market Trends

The healthcare ERP market in Asia Pacific is anticipated to register the fastest growth during the forecast period due to rising healthcare expenditures and the growing workforce shortage. In addition, ineffective health facilities’ services management, the growing patient community, the rising adoption of advanced technological solutions, and the emergence of start-ups are boosting the development of the Asia Pacific market. Moreover, the industry is attracting public & private infrastructure and contributing to the growth and development of infrastructure & economic development.

Japan healthcare ERP market held a significant market share in the region in 2023. Several factors drive the market in Japan, including growing demand for efficient and integrated healthcare management systems to handle increasing patient volumes and complex medical needs. Moreover, the Japanese government's emphasis on healthcare digitization and initiatives to enhance medical infrastructure is driving the adoption of ERP solutions. The rising demand for data-driven decision-making and the need to streamline administrative processes and improve patient care efficiency further fuel market growth.

The healthcare ERP market in India is driven by the increasing digitization of healthcare services, growing demand for efficient healthcare management systems, and government initiatives like the Digital India campaign. The rising prevalence of chronic diseases necessitates improved patient care and data management, further boosting ERP adoption. In addition, the need for streamlined operations and cost-effective healthcare solutions drives the market's growth.

Key Healthcare ERP Company Insights

Key players operating in the market are McKesson Corporation, Oracle, Microsoft, SAP, Aptean, Infor, Odoo, Epicor Software Corporation, Sage Group PLC, and QAD Inc. These players are devising product innovation strategies to expand their product portfolios. In addition, key players are focusing on technological collaboration and partnerships to support product innovation and launch.

Key Healthcare ERP Companies:

The following are the leading companies in the healthcare ERP market. These companies collectively hold the largest market share and dictate industry trends.

- McKesson Corporation

- Oracle

- SAP SE

- Microsoft

- Aptean

- Odoo

- Infor

- Epicor Software Corporation

- SAGE Group PLC

- QAD Inc

Recent Developments

-

In May 2024, SAP announced the integration of Amazon Web Services Bedrock generative AI into its AI Core. This integration aims to enhance the performance and efficiency of cloud-based enterprise workloads and embed generative AI capabilities into clients' critical business applications.

"Partnerships like this collaboration with AWS are critical as we embed generative AI solutions across our ERP applications so that customers can drive innovation at an accelerated pace"

-Christian Klein, SAP's chief executive officer

-

In September 2023, Infor reported that Wayne HealthCare has successfully transitioned its financial and interoperability systems to the cloud using Infor's technology.

“The decision-making process for an ERP will affect your workflow and productivity long into the future. After much research, reference calls and on-site evaluations, Wayne HealthCare chose Infor and GForce Technology Consulting for our next ERP implementation because we felt their team would provide a more evidence-based approach to real-time data and integration to our EHR software”

-Karen Bales, director of materials & supply chain at Wayne HealthCare.

-

In September 2023, Oracle updated multiple applications within its Fusion Cloud suites to support the needs of healthcare enterprise customers better. These updates span across its ERP, Enterprise Performance Management (EPM), Human Capital Management (HCM), and Supply Chain and Manufacturing (SCM) Clouds. The changes are designed to help healthcare organizations streamline operations and enhance patient care.

-

In January 2020, Infor acquired Intelligent InSites, Inc., healthcare software and services provider based in North Dakota. Intelligent InSites, Inc. provides businesses with dynamic, scalable, and intuitive location platforms to optimize operations, streamline patient journeys, and enhance clinical outcomes. Through this acquisition, Infor expanded its technological offerings portfolio and strengthened its business footprint in clinics, emergency departments, urgent care, procedural care, inpatient care, and behavioral health.

Healthcare ERP Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.90 billion

Revenue forecast in 2030

USD 11.96 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

McKesson Corporation; Oracle; SAP SE; Microsoft; Aptean; Odoo; Infor; Epicor Software Corporation; SAGE Group PLC; QAD Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare ERP Market Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global healthcare ERP market report based on function, deployment, end use, and region:

-

Function Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Inventory and Material Management

-

Supply Chain and Logistics Management

-

Patient Relationship Management

-

Finance and Billing

-

Others

-

-

Deployment (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare ERP market size was estimated at USD 7.42 billion in 2023 and is expected to reach USD 7.9 billion in 2024.

b. The global healthcare ERP market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 11.96 billion by 2030.

b. The finance and billing segment dominated the global healthcare ERP market with a share of 32.02% in 2023. The growth is attributed to the increasing adopting of ERP systems among Healthcare organizations to rapidly optimize processes and lower barriers between front-end revenue cycle management tasks and back-end tasks, such as claims management.

b. Some key players operating in the global healthcare ERP market include McKesson Corporation, Oracle, SAP SE, Microsoft, Aptean, Odoo, Infor, Epicor Software Corporation, SAGE Group PLC, and QAD Inc.

b. Key factors that are driving the global healthcare ERP market growth include growing healthcare expenditure, ineffective hospital service management, rising workforce shortage, and rapidly growing patient population at healthcare facilities

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."