- Home

- »

- Healthcare IT

- »

-

Remote Healthcare Market Size, Industry Report, 2030GVR Report cover

![Remote Healthcare Market Size, Share & Trends Report]()

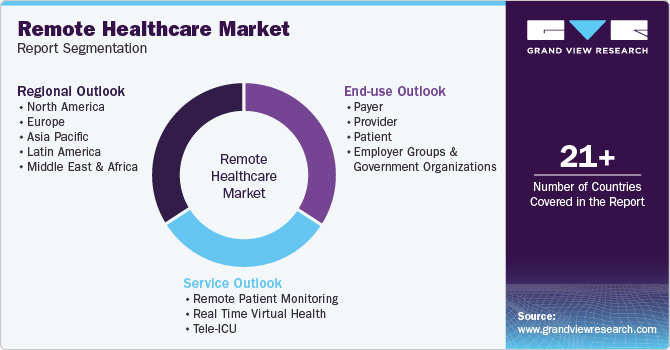

Remote Healthcare Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Remote Patient Monitoring, Real-time Virtual Health, Tele-ICU), By End-use (Payer, Patient, Provider, Employer Groups & Government Organizations), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-374-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Remote Healthcare Market Summary

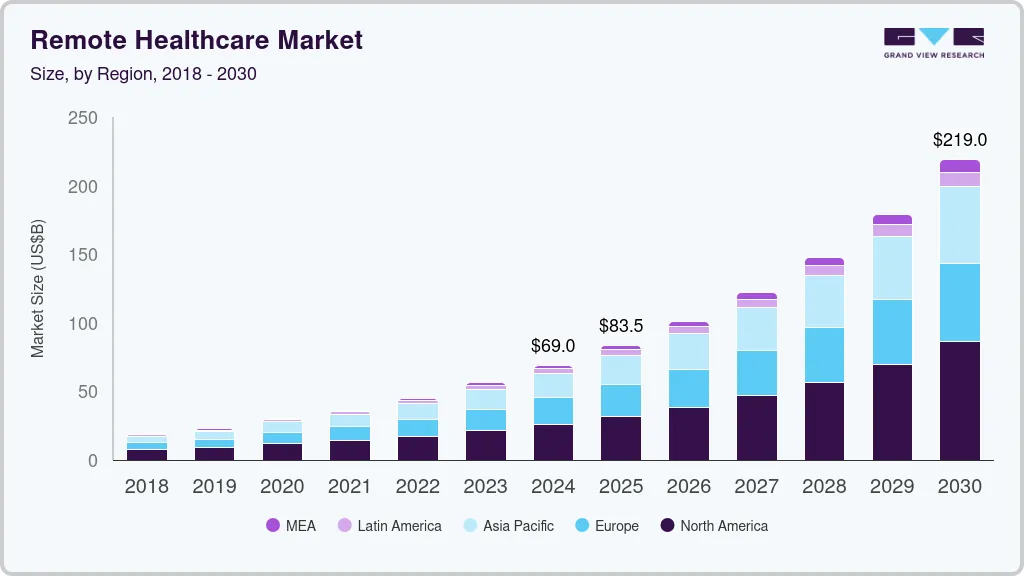

The global remote healthcare market size was estimated at USD 69,024.2 million in 2024 and is projected to reach USD 219,040.3 million by 2030, growing at a CAGR of 21.3% from 2025 to 2030. The growing adoption of telemedicine and digital health technologies drives the demand for remote healthcare market.

Key Market Trends & Insights

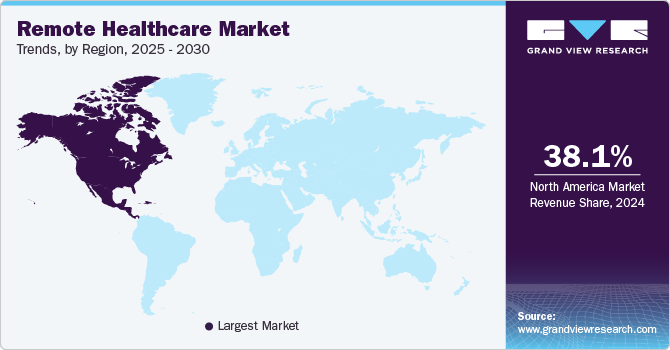

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, UAE is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, real time virtual health accounted for a revenue of USD 53,979.7 million in 2024.

- Remote Patient Monitoring is the most lucrative services segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 69,024.2 Million

- 2030 Projected Market Size: USD 219,040.3 Million

- CAGR (2025-2030): 21.3%

- North America: Largest market in 2024

The rising prevalence of chronic diseases and an aging population are increasing the demand for efficient remote patient monitoring technologies and virtual consultations.

The adoption of digital health platforms is rapidly increasing, transforming how healthcare services are delivered. EHRs and cloud-based platforms help doctors and medical staff share patient information quickly and securely. In addition to EHRs, app-based healthcare services are becoming more popular worldwide. Companies such as Teladoc, Amwell, and Babylon Health provide virtual consultations, making healthcare more accessible. These platforms allow patients to connect with doctors from home, reducing the need for hospital visits. They also offer features such as symptom checkers, prescription management, and mental health support. With the growing demand for convenient and affordable healthcare, digital health platforms continue to expand and improve.

Consumers have been preferring convenient and accessible healthcare services. Many patients now opt for virtual consultations, home healthcare, and remote monitoring instead of waiting long hours in hospitals. These options save time, reduce travel costs, and provide medical care at home. Remote healthcare solutions also help patients with chronic conditions receive continuous monitoring without frequent hospital visits. This shift in preference is driving the rapid growth of telemedicine and digital health services.

The rise in the prevalence of chronic diseases is increasing the need for continuous healthcare monitoring. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders require regular check-ups and timely medical intervention. Remote healthcare solutions help patients track their health and receive medical advice without visiting hospitals frequently. Wearable devices and telemedicine services allow doctors to monitor a patient's vital signs in real time. This approach improves disease management and helps prevent serious health complications.

Along with chronic illnesses, the growing elderly population also drives the demand for convenient healthcare solutions. Older adults often require frequent medical attention but may face difficulties traveling to hospitals. Telehealth and home healthcare services provide them with easy access to doctors and caregivers. These digital solutions ensure they receive proper medical care while staying comfortable at home. As a result, remote healthcare has become essential in managing the health needs of an aging population. In May 2023, the WHO published a fact sheet on aging and health. The report highlighted that the global population aged 60 years and older had doubled since 1980, reaching 1 billion in 2020. This number is projected to continue to rise, reaching 1.4 billion by 2030 and 2.1 billion by 2050.

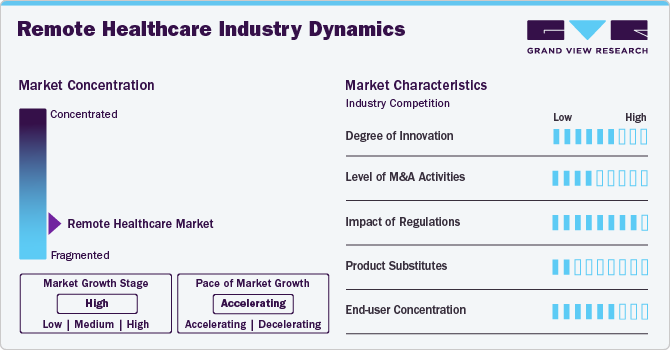

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. Remote healthcare is characterized by a medium degree of innovation due to rapid technological advancements and the inclination among service providers to enhance portfolios. In addition, ongoing research and development activities initiated by key market players in the medical devices industry facilitate novel services provided by healthcare organizations.

The remote healthcare industry has been experiencing a medium level of merger and acquisition (M&A) activity. Large enterprises in this industry often acquire smaller companies with specialized services to strengthen particular business segments. Such activities lead to improved market positioning and enhanced share across regions.

The remote healthcare industry is also subject to increasing regulatory scrutiny. This is due to concerns about the sensitivity of patient data generated in the process, the involvement of digital technologies, potential privacy violations, and the possibility of severe impacts on the health of individuals. Multiple governments have introduced regulations for remote healthcare operations to ensure data privacy, use safe technologies, and eliminate potentially harmful practices in the industry.

There are a limited number of substitute services. Remote healthcare services primarily benefit patients who cannot travel or move from one place to another for treatments or patients seeking solutions for digital consultations. The convenience and efficiency offered by these services are difficult to imitate while attaining the desired level of patient outcome.

Service Insights

Based on services, the real-time virtual health segment accounted for a revenue share of 78.2% in 2024. Growth in this segment is driven by the increasing demand for immediate access to healthcare services and the convenience associated with the service. Real-time virtual health solutions provide on-demand consultations and medical advice, reducing waiting times and improving healthcare accessibility. The convenience of virtual consultations has led to increased patient engagement and satisfaction, particularly among younger demographics and those in rural areas.

The remote patient monitoring segment is expected to experience the fastest CAGR over the forecast period. An increase in the prevalence of chronic diseases, the growing percentage of the aging population in numerous countries, and the need for continuous monitoring of patients outside traditional healthcare settings have fueled the adoption of remote patient monitoring solutions, key growth driving factors for this segment. These technologies enable healthcare providers to remotely track vital signs, symptoms, and medication adherence, improving patient outcomes and reducing hospital readmissions.

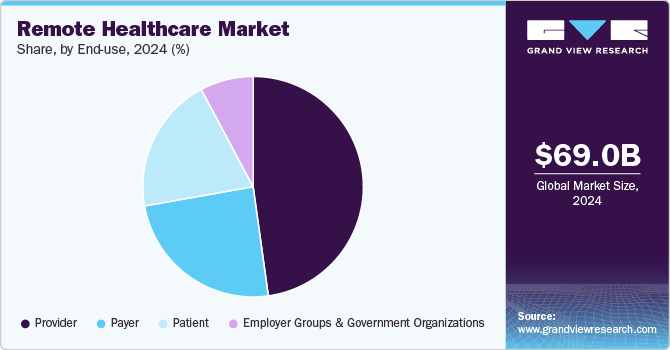

End-use Insights

Based on end use, the provider segment held the largest revenue share of the global remote healthcare market in 2024. This is attributed to the need for improved operational efficiency and advanced patient care delivery. Providers such as hospitals, clinics, and physicians are adopting remote healthcare solutions to expand their reach beyond traditional settings. These technologies facilitate continuous patient monitoring, real-time consultations, and streamlined workflows, improving overall care quality. Adopting telehealth services helps providers address resource constraints while offering personalized care to patients. The increasing use of digital tools for diagnosis and treatment planning has further strengthened the role of providers in the remote healthcare ecosystem.

The patient segment is projected to experience the fastest CAGR during the forecast period. The growth of this segment is attributed to factors such as the rising demand for accessible and convenient healthcare solutions. Patients benefit from remote healthcare services by avoiding travel for consultations and receiving timely medical advice in the comfort of their homes. Wearable devices and mobile health applications empower patients to monitor their health parameters independently, fostering greater engagement in their care plans.

Regional Insights

North America remote healthcare market held the largest revenue share of the global remote healthcare market. It accounted for 38.1% in 2024, driven by advanced technological infrastructure and a high prevalence of chronic diseases, leading to an increasing need for services such as remote healthcare. North America is one of the very first regions to adopt smart healthcare solutions, including various technologies such as mobile apps, tele-intensive care units, smart wearables, and eHealth services, such as Electronic Health Record (EHR) & telemedicine, for remote access to information on severe & chronic healthcare conditions.

U.S. Remote Healthcare Market Trends

The remote healthcare market in the U.S. dominated the North America market in 2024 due to its well-established healthcare infrastructure and widespread adoption of telehealth technologies. The country faces challenges such as physician shortages, which have been leading to increasing dependence on virtual care platforms to meet patient needs. High disposable income levels allow greater access to advanced remote monitoring devices and telemedicine services.

Europe Remote Healthcare Market Trends

Europe was identified as one of the key regions for remote healthcare industry in 2024. This market is primarily driven by the rising prevalence of chronic diseases, an aging population, and advancements in digital health technologies. The rise of remote healthcare solutions has become increasingly crucial as Europe faces a significant demographic shift. With an aging population requiring more medical attention, digital health technologies offer innovative ways to deliver accessible and efficient care.

The remote healthcare market in the UK held the largest revenue share of the regional industry in 2024. This is attributed to its advanced healthcare infrastructure and increasing adoption of telehealth solutions. The rapid adoption of digital health tools highlights the increasing reliance on remote healthcare solutions. The NHS App and login significantly improve patient access to medical services, laying the foundation for expanded telehealth initiatives. The UK government’s investment in adult social care modernization further emphasizes the shift toward digital healthcare. Telehealth advancements demonstrate the effectiveness of virtual consultations and remote patient monitoring in ensuring continuous care.

Middle East & Africa Remote Healthcare Market Trends

Middle East & Africa remote healthcare market driven by increasing internet penetration, the widespread use of smartphones, and a growing focus on patient-centric healthcare solutions. In March 2025, the Financial Times reported that Seha Virtual Hospital in Riyadh had become the world's largest virtual hospital, as recognized by the Guinness Book of Records. Established by the Saudi Ministry of Health in 2022, Seha coordinated with 224 hospitals and offered 44 specialized services, including cardiology, critical care, neurology, and psychiatry. The virtual hospital addressed challenges such as geographical distances, lack of specialized resources, and high healthcare costs, improving patient experiences.

Key Remote Healthcare Company Insights

Some key companies in the remote healthcare industry include Microsoft Corporation, IBM Corporation, Amazon.com, Inc., Clarifai, Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Koninklijke Philips N.V. operates in the remote healthcare market through its connected care segment, offering AI-powered remote patient monitoring solutions. Its portfolio includes various medical devices and software to improve patient care and operational efficiency. The company has a global presence and collaborates with healthcare providers to implement its connected devices and telehealth platforms.

-

Medtronic offers a range of remote patient monitoring solutions, including devices and platforms, for managing conditions such as diabetes and heart failure. Its connected devices communicate with smartphones and tablets, enabling patients to stay connected with healthcare providers.

Key Remote Healthcare Companies:

The following are the leading companies in the remote healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- Hicuity Health

- Koninklijke Philips N.V.

- Teladoc Health, Inc.

- AirStrip Technologies, Inc

- Medtronic

- America Well Corporation (Amwell)

- ClearArch, Inc.

Recent Developments

-

In October 2024, America Well Corporation (Amwell) announced the expansion of its clinical program portfolio to include Hello Heart’s cardiovascular health risk management solution. The integration is intended to enhance remote health monitoring and risk prevention. It provided patients with AI-driven insights to manage blood pressure and heart health.

-

In April 2024, Koninklijke Philips N.V. partnered with smartQare to enhance continuous patient monitoring in and out-of-hospital settings. The collaboration integrated smartQare’s viQtor solution with Philips' clinical monitoring systems to automate and simplify remote patient tracking.

Remote Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.5 billion

Revenue forecast in 2030

USD 219.0 billion

Growth rate

CAGR of 21.3% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hicuity Health; Koninklijke Philips N.V.; Teladoc Health, Inc.; AirStrip Technologies, Inc; Medtronic; America Well Corporation (Amwell); ClearArch, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Remote Healthcare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global remote healthcare market report based on service, end-use, and region.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Remote Patient Monitoring

-

Real Time Virtual Health

-

Video Communication

-

Audio Communication

-

Email/Chat box

-

-

Tele-ICU

-

-

End Use Outlook (Revenue, USD Billion, 2018 – 2030)

-

Payer

-

Provider

-

Patient

-

Employer Groups & Government Organizations

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global remote healthcare market size was estimated at USD 69.0 billion in 2024 and is expected to reach USD 83.54 billion in 2025.

b. The global remote healthcare market is expected to grow at a compound annual growth rate of 21.3% from 2025 to 2030 to reach USD 219.0 billion by 2030.

b. The real-time virtual health segment accounted for a revenue share of 78.2% in 2024. Growth in this segment is driven by the increasing demand for immediate access to healthcare services and the convenience associated with the service.

b. Some key players operating in the remote healthcare market include Hicuity Health; Koninklijke Philips N.V.; Teladoc Health, Inc.; AirStrip Technologies, Inc; Medtronic; America Well Corporation (Amwell); ClearArch, Inc.

b. The growing adoption of telemedicine and digital health technologies drives the demand for remote healthcare market. The rising prevalence of chronic diseases and an aging population are increasing the demand for efficient remote patient monitoring technologies and virtual consultations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.