- Home

- »

- Healthcare IT

- »

-

Healthcare Gamification Market Size & Share Report, 2030GVR Report cover

![Healthcare Gamification Market Size, Share & Trends Report]()

Healthcare Gamification Market Size, Share & Trends Analysis Report By Type (Exercise Game, Serious Game, Casual Game), By Application (Education, Therapeutics), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-043-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global healthcare gamification market size was valued at USD 3.15 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 22.6% over the forecast period from 2023 to 2030. The increasing incidence rate of lifestyle related diseases and chronic diseases is expected to drive the demand for better health management by patients and healthcare providers. In addition, the rising adoption of smartphones and increasing internet penetration worldwide are driving the demand for healthcare gamification. According to Groupe Speciale Mobile Association, the total number of mobile subscribers is expected to rise to 5.7 billion by 2025 and internet penetration will increase by 60% around the globe. Healthcare gamification shows wide range of applications in the management of chronic diseases. Gamification can motivate patients to administer medication as prescribed by the physician. According to National Diabetes Statistics Report published by CDC, over 35 million people had diabetes in 2022. According to WHO, patients suffering from chronic diseases are anticipated to increase from 39% in 2008 to 51% by 2030. Furthermore, chronic illnesses are responsible for over 85% of the total deaths in the U.S. Hence, the increasing prevalence of disorders such as diabetes and obesity is likely to drive the need for gamification.

The COVID-19 pandemic positively impacted the global healthcare gamification market pertaining to the increased penetration of digital health solutions. The pandemic led to a surge in demand for healthcare apps for at-home use. The healthcare providers and patients turned to technology to stay connected and engage remotely. COVID-19 affected people's mental health, thereby increasing the need for healthcare mobile applications to manage mental and physical health at home. Healthcare gamification has emerged as an effective way to address this issue. Healthcare apps show wide application in promoting mindfulness, relaxation, and other therapeutic activities that can help reduce stress and anxiety.

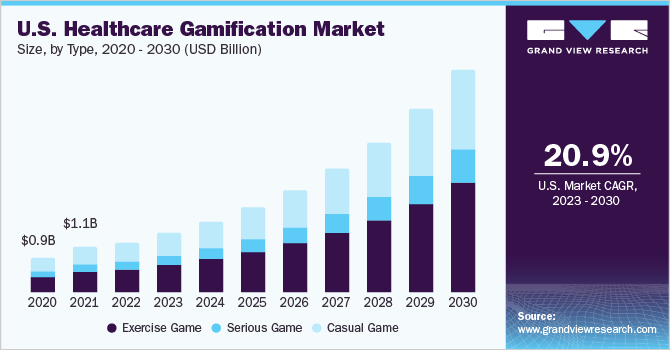

Type Insights

Based on type, the healthcare gamification market is segmented into the exercise game, serious game, and casual game. The exercise game segment held the largest market share of around 45% in 2022 and is also expected to witness the fastest CAGR during the forecast period pertaining to the rising adoption of digital platforms among physicians to enhance clinical results by prescribing personalized health plans to patients.

The casual game segment is anticipated to exhibit a second fastest CAGR of 21.8% during the forecast period owing to user-friendly interface and their effectiveness in despair and trauma therapy in adults. Moreover, these games are also used among children for lowering depression, anxiety, and stress through individually designed gamification modules. According to a study published by MDPI, virtual games exhibited improvements and reduction in preoperative anxiety during the anesthetic induction in pediatric patients.

Application Insights

Based on application, the healthcare gamification market is segmented into education, therapeutics, and prevention. The education segment held the largest market share of over 50% in 2022 owing to its application in educating patients through gaming modules and simulations. For instance, SimX, a healthcare software company, offers various simulation solutions such as emergency medical services, nursing, and military VR training solutions.

The prevention segment is anticipated to grow at a CAGR of 25.1% during the forecast period from 2023 to 2030 owing to the rising adoption of digital technology and games for lifestyle management. The medical sector is steadily shifting toward preventive treatment and making greater use of digital technology and gamification to boost overall well-being of people.

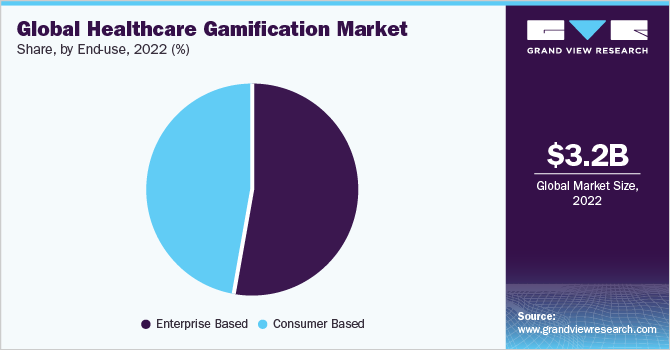

End-use Insights

Based on end-use, the market is segmented into enterprise-based and consumer-based. The enterprise-based segment dominated the market in terms of the revenue share of over 50% in 2022 pertaining to the adoption of serious healthcare digital games adopted by enterprises such as hospitals, clinics, testing labs, and research institutes, among others to educate and train professionals in the field of surgery, diagnostic, and illness-preventive procedures.

The consumer-based segment, on the other hand, is anticipated to show the fastest growth at a CAGR of 24.8% during the forecast period from 2022 to 2030. The segment growth can be attributed to the tremendous adoption of mobile health apps by people due to enhanced monitoring features offered such as heart rate, oxygen level, and exercise module with various incentives. Fitbit, Inc. offers fitness and health solutions such as Fitbit Sence, Fitbit Versa 2, Fitbit Versa 3, Fitbit Luke, Gorjana, Fitbit Charge 4, and Fitbit Inspire 2. These solutions offer continuous monitoring of patients’ vitals making it a preferred option for its consumers.

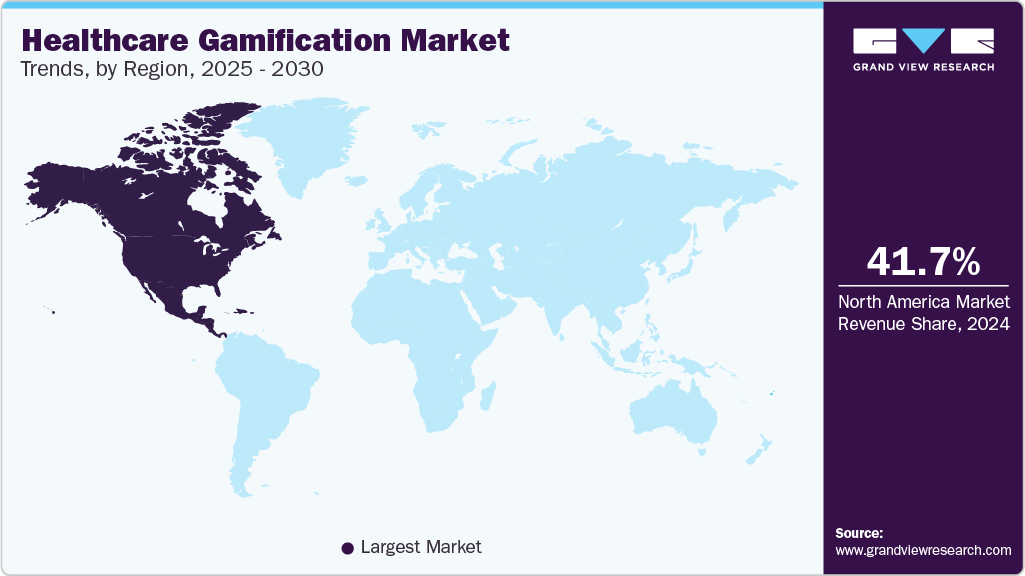

Regional Insights

In 2022, North America dominated the market in terms of revenue share of over 40% in 2022 due to increasing access to smartphones, the rise in internet penetration, and features of gamification applications such as notification about medication adherence, exercise modules, and telehealth appointments. Moreover, major market players are engaging in various strategic initiatives such as new product launches and partnerships, further fueling the market growth in this region. In November 2019, Ayogo Health Inc., a behavior science-based digital health, and Baxter International Inc., launched an app called CKD&Me across the U.S. The new mobile application is capable of providing relevant, personalized, and real-time support to patients suffering from kidney failure.

Asia Pacific is expected to witness the fastest CAGR of 24.8% over the forecast period owing to the technological advancements in the field of digital health. Market players in this region are investing in R&D to offer enhanced healthcare solutions to their customer base. For instance, in August 2019, Astellas, a pharmaceutical company, collaborated with the Tokyo University of the Arts and Yokohama City University to develop and introduce innovative gamified virtual healthcare solutions.

Key Companies & Market Share Insights

The companies are more concentrated on strategic collaborations with technology providers and product development. For instance, In February 2021, Evolv collaborated with Microsoft and ZOTAC to offer RehabKits to hospitals in London and New York to provide telerehabilitation. RehabKit is capable of offering virtual therapy by linking the software to a television. Moreover, exercise games are prescribed by therapists to remotely monitor patient adherence and performance using the system. Some of the prominent players operating in the global healthcare gamification market include:

-

Fitbit, Inc.

-

Ayogo Health, Inc.

-

Evolv Rehabilitation Technology S.L.

-

BI Worldwide (Bunchball, Inc.)

-

Akili Interactive Labs, Inc.

-

Cognifit, Inc.

-

Mango Health

-

Nike, Inc.

Healthcare Gamification Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.82 billion

Revenue forecast in 2030

USD 15.9 billion

Growth rate

CAGR of 22.6% from 2023 to 2030

Base year for estimation

2022

Historic data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million & CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fitbit, Inc.; Ayogo Health, Inc.; Evolv Rehabilitation Technology S.L.; BI Worldwide (Bunchball, Inc.); Akili Interactive Labs, Inc.; Cognifit, Inc.; Mango Health; Nike, Inc.

Customization Scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

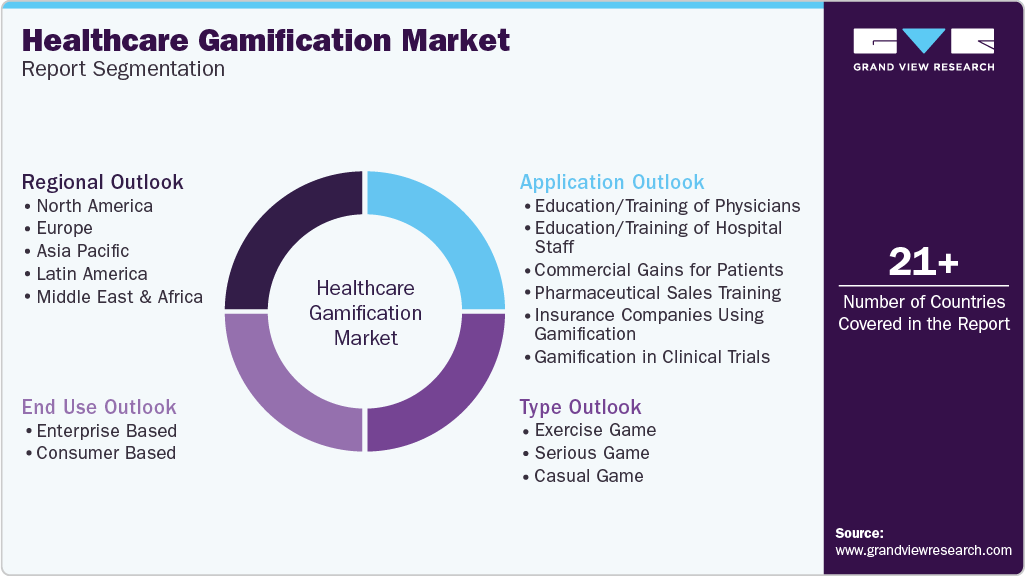

Global Healthcare Gamification Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare gamification market report based on type, application, end-use, and region:

-

Type Outlook (USD Million; 2018 - 2030)

-

Exercise Game

-

Serious Game

-

Casual Game

-

-

Application Outlook (USD Million; 2018 - 2030)

-

Education

-

Therapeutics

-

Prevention

-

-

End-use Outlook (USD Million; 2018 - 2030)

-

Enterprise Based

-

Consumer Based

-

-

Regional Outlook (USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare gamification market size was estimated at USD 3.15 billion in 2022 and is expected to reach USD 3.82 billion in 2023.

b. The global healthcare gamification market is expected to grow at a compound annual growth rate of 22.6% from 2023 to 2030 to reach USD 15.95 billion by 2030.

b. The North America region dominated the market in 2022 with a revenue share of over 40%. The increased adoption of healthcare gamification applications by people for health monitoring benefits after COVID-19 has been on the rise in North America. Increasing awareness about benefits offered by gamification mechanics in management for people suffering from chronic disease.

b. Some key players operating in the Healthcare gamification market are Fitbit, Inc., Ayogo Health, Inc., Evolv Rehabilitation Technology S.L., BI Worldwide (Bunchball, Inc.), Akili Interactive Labs, Inc., and Cognifit, Inc., among others.

b. The increasing prevalence of healthcare gamification applications, health benefits provided through apps such as disease prevention, therapy and education. Healthcare gamification application helps in the early detection of diseases through educating people through gaming mechanics and offering them the exact therapy which is needed depending upon their condition and preventing the disease to increase with proper monitoring requirement.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."