- Home

- »

- Healthcare IT

- »

-

Healthcare Navigation Platform Market Size Report, 2030GVR Report cover

![Healthcare Navigation Platform Market Size, Share & Trends Report]()

Healthcare Navigation Platform Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud-based, On Premise), By End-use (Large Enterprises, Small & Medium Enterprises), By Region, And Segment Forecast

- Report ID: GVR-4-68040-183-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Navigation Platform Market Summary

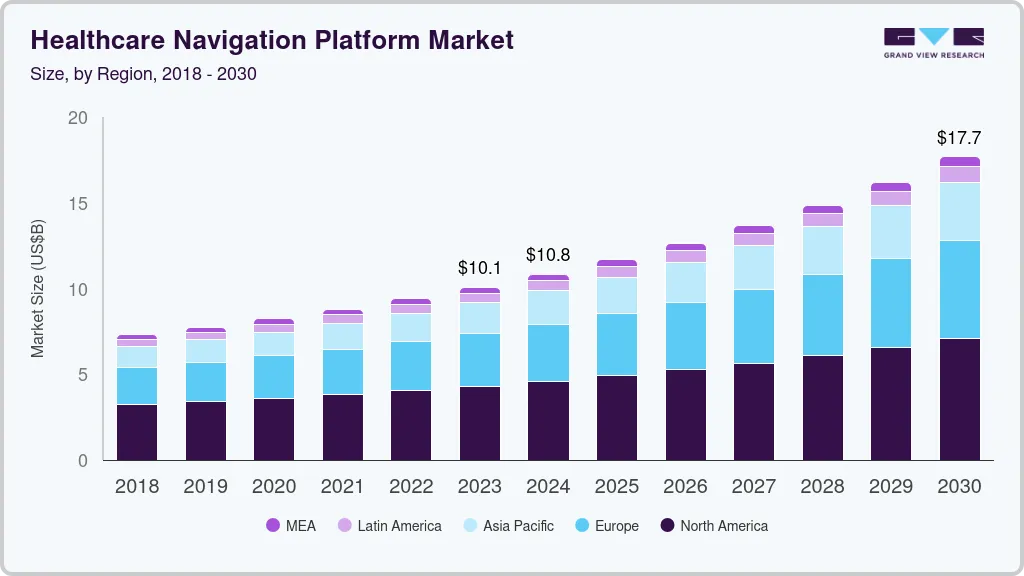

The global healthcare navigation platform market size was estimated at USD 10,077.5 million in 2023 and is projected to reach USD 17,670.1 million by 2030, growing at a CAGR of 8.4% from 2024 to 2030. The market growth is attributed to factors such as an increase in the use of data-driven technologies, an increase in the number of mergers and acquisitions by market players, a rise in government initiatives to encourage healthcare IT usage, and increased adoption of AI technology platforms.

Key Market Trends & Insights

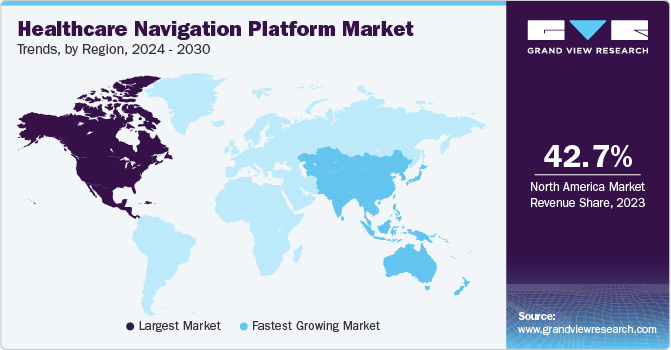

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, cloud based accounted for a revenue of USD 6,378.0 million in 2023.

- Cloud Based is the most lucrative deployment segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 10,077.5 Million

- 2030 Projected Market Size: USD 17,670.1 Million

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

The rapid growth of health tech is anticipated to grow the healthcare navigation market. This platform leverages technology, such as online portals and mobile apps, to provide convenient access to healthcare information, appointment scheduling, telehealth services, and many more. To leverage the growing needs of the organization and employees, the service providers are adopting strategic initiatives such as mergers and acquisitions for developing advanced healthcare navigation platforms. For instance, in March 2023, Transcarent, a care and health service provider, acquired 98point6, an AI-based virtual care platform and care business of an on-demand primary care company. This acquisition aims to provide Transcarent access to AI-powered virtual care technology and deliver high-quality & on-demand care, an affiliated medical group that delivers skilled providers.

Moreover, the increasing cost of healthcare, including medication prices and insurance premiums, has created a need for platforms and tools that support patients in navigating and managing the prices. Healthcare navigation platforms provide information on cost-effective options, discounts, and financial assistance programs. Several market players, such as Accolade; HealthJoy; Quantum Health, Inc.; Virgin Pulse; and Rightway offer varied solutions depending upon the needs of organizations for their employees to make achievable decisions.

Furthermore, healthcare navigation platforms deal with employees’ sensitive information, including personal data and medical records. Concerns about security and data privacy in the business and their employees create a barrier to the adoption of these platforms. Addressing these concerns and implementing robust security measures plays an important role in gaining trust and overcoming these barriers. Moreover, governments across multiple countries are introducing laws and regulations to cater to these problems.

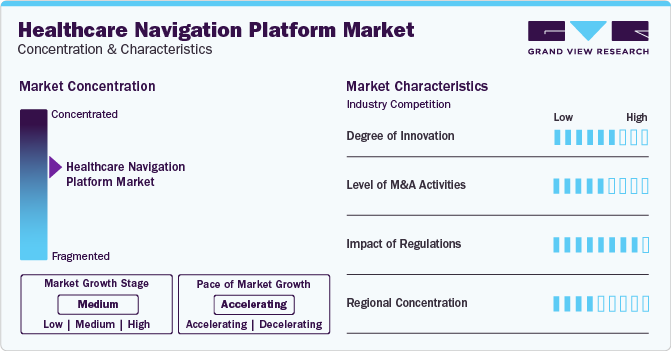

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as the adoption of generative AI and Chatbots, to resolve problems and provide better advice related to health benefits.

The market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new healthcare benefits through platforms, the need to consolidate in a rapidly growing market, and the increasing strategic importance of healthcare navigation.

The market is also subject to increasing regulatory scrutiny. This is due to concerns about the potential negative impacts of healthcare navigation, such as algorithmic bias, privacy violations, and job displacement. As a result, governments around the world are developing regulations to encourage data sharing, interoperability standards, and the adoption of healthcare navigation platforms can create a more cohesive healthcare ecosystem. Regional concentration fuels the expansion of healthcare navigation platforms, with a focused presence and investment in streamlined healthcare solutions. This strategic focus enhances the effectiveness of healthcare solutions tailored to specific geographic areas.

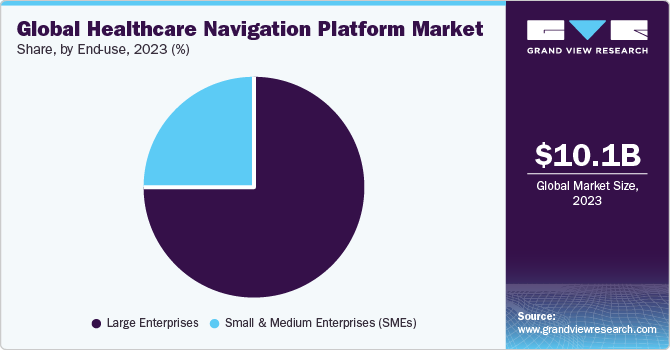

End-use Insights

The large enterprises segment led the market in 2023, owing to the growing adoption and implementation of these platforms on a larger scale, leveraging their organizational size and resources. Moreover, organizations have the resources and initial investment to implement comprehensive healthcare navigation platforms, providing their employees with tools and resources to navigate the complex healthcare system effectively. Large enterprises often prioritize employee well-being and are willing to invest in technology solutions that improve access to care, enhance employee satisfaction, and contain healthcare costs.

The SMEs segment is projected to witness the fastest CAGR over the forecast period. The platform offers SMEs a cost-effective solution to empower their employees in navigating the healthcare system, accessing appropriate care, and managing their health effectively. These platforms provide SMEs with the tools and resources to optimize their healthcare spending, improve employee satisfaction, and enhance overall productivity are driving the segment's growth.

Regional Insights

North America dominated the market with a share of 42.7% in 2023. Major factors contributing to the growth of this region include widespread acceptance of digital health technologies, including telehealth, health apps, and a notable concentration of large enterprises in the region that are investing in solutions for managing employee benefits. Additionally, a significant number of employers who prioritize employee well-being and invest in healthcare benefits are driving the demand for healthcare navigation platforms.

Asia Pacific is anticipated to witness significant growth in the market, owing to the growing population, increasing healthcare expenditure, and rising adoption of digital technologies contribute to the market’s growth. The rising demand for improved healthcare access, cost containment, and enhanced patient experience is driving the adoption of these platforms in the region. In addition, the availability of cloud-based platforms and the focus on digital transformation in healthcare further fuel the growth of the market in Asia Pacific.

Deployment Insights

The cloud-based segment accounted for the largest market revenue share of over 63% in 2023, and this segment is anticipated to grow at the fastest CAGR during the forecast period. The growth of this segment is attributed to numerous advantages, including scalability, flexibility, cost-effectiveness, and ease of implementation. Healthcare navigation platforms hosted on the cloud allow for seamless access to information and services from any location, enabling employees and users to navigate the healthcare system conveniently.

Additionally, cloud-based platforms provide secure storage and backup of sensitive healthcare data, ensuring compliance with data protection regulations. Service providers are developing platforms using data analytics and Gen AI to provide 24/7 user support. For instance, in May 2022, Accolade launched Medication Integrated Care, an innovative offering with innovative analytics powered by Rx Savings solutions for employers to address affordability, prescription medication complications, and care blockades. The growing adoption of cloud computing in various industries, including healthcare, has contributed to the dominance of the cloud-based segment in the markets.

Key Companies & Market Share Insights

Some key players operating in the market include Quantum Health, Inc.; Accolade; Sharecare, Inc.; and Health Advocate

-

Quantum Health, Inc. specializes in healthcare management and navigation services, supporting employees & their families. Quantum Health's integrated healthcare navigation solution consolidates all clinical, member, and provider services into a convenient platform, offering a single point of contact for a streamlined healthcare management experience.

-

Accolade provides healthcare services, including care delivery, navigation, and advocacy. It serves employers as a central point of contact for employees and their families, addressing various health, healthcare, and benefits needs. The company offers expert medical opinion and virtual primary care services to commercial customers.

-

Apree Health; HealthJoy; Transcarent; and Included Health, Inc. are some of the emerging market participants.

-

Included Health, Inc. provides integrated virtual care and navigation, delivering care guidance, advocacy, and access to personalized virtual & in-person care for everyday and urgent healthcare needs, including primary care, behavioral health, and specialty care.

-

Transcarent assists individuals and employers in navigating the healthcare system, providing tools for informed decisions, cost transparency, and care coordination. The developer of a consumer-directed health and care platform uses software, technology, and data science to empower users with information and access.

Key Healthcare Navigation Platform Companies:

- Quantum CorpHealth Pvt Ltd.

- Accolade

- Transcarent

- Included Health, LLC

- Sharecare, Inc.

- Apree Health

- Health Advocate

- Health Joy, LLC

- Wellframe

Recent Developments

-

In May 2023, Apree Health, a combination of Vera Whole Health and Castlight Health, launched a secure, cloud-native platform, Apree Foundation. This platform aggregates, integrates, and normalizes huge amounts of healthcare data to deliver the industry’s data silos with a better-personalized healthcare experience for several people in the U.S.

-

In February 2023, Experian Information Solutions, Inc. announced the launch of its new product, AI Advantage, which mitigates the high volume of healthcare insurance claim denials. The new product, coupled with Experian’s expertise in big data insights & solutions across the entire healthcare value chain, improves service & care for patient consumers.

-

In May 2022, Accolade launched Medication Integrated Care, an innovative offering with innovative analytics powered by Rx Savings solutions for employers to address affordability, prescription medication complications, and care blockades.

Healthcare Navigation Platform Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.83 billion

Revenue forecast in 2030

USD 17.67 billion

Growth rate

CAGR of 8.49% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia and Kuwait

Key companies profiled

Quantum CorpHealth Pvt Ltd.; Accolade; Transcarent; Included Health, LLC; Sharecare, Inc.; Apree Health; Health Advocate; Health Joy, LLC; Wellframe

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Navigation Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare navigation platform market based on deployment, end-use, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud Based

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare navigation platform market size was estimated at USD 10.07 billion in 2023 and is expected to reach USD 10.83 billion in 2024.

b. The global healthcare navigation platform market is expected to grow at a compound annual growth rate of 8.49% from 2024 to 2030 to reach USD 17.67 billion by 2030.

b. The cloud-based segment dominated the global healthcare navigation platform market and accounted for the largest revenue share of over 63% in 2023. The growth of this segment is attributed to numerous advantages, including scalability, flexibility, cost-effectiveness, and ease of implementation.

b. Some key players operating in the healthcare navigation platform market are Quantum Health, Inc.; Accolade; Transcarent; Included Health, Inc.; Sharecare, Inc.; Apree Health; Health Advocate; Health Joy; Wellframe

b. Key factors that are driving the healthcare navigation platform market growth include increase in the use of data-driven technologies, increase in number of mergers & acquisitions by market players, rise in government initiatives to encourage healthcare IT usage, and increased adoption of AI technology platforms.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.