- Home

- »

- Medical Devices

- »

-

Healthcare Payer Services Market Size, Share Report, 2030GVR Report cover

![Healthcare Payer Services Market Size, Share & Trends Report]()

Healthcare Payer Services Market Size, Share & Trends Analysis Report By Service (BPO Services, ITO Services, KPO Services), By Application (Claims Management Services, HR Services), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-913-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Healthcare Payer Services Market Trends

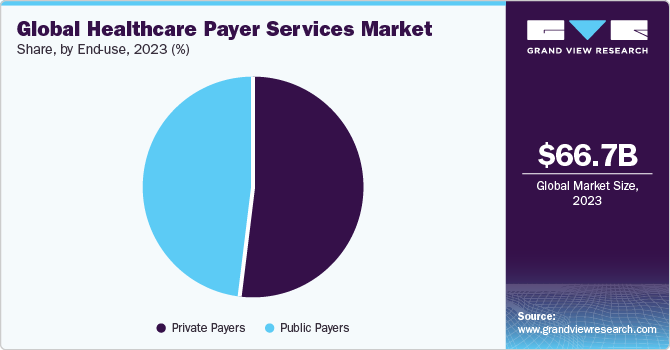

The global healthcare payer services market size was estimated at USD 66.7 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. Outsourcing of healthcare supply chain management services to third-party service providers is known as healthcare supply chain business process outsourcing (BPO). Growth of this market is attributed to rising need for cost-effective operations and growth in demand for advanced supply chain management (SCM) practices. Minimizing overall cost of healthcare supply chain BPO services is likely to boost market growth during the forecast period.

Incorporation of advanced technologies such as AI, analytics, and cloud-based service portfolios by key players produces intense competition in the market. For example, Accenture’s cloud-based solutions diminish logistics costs, improve service revenue, and increase the availability of services for healthcare supply chain. Hence, due to this reason, the market is expected to grow at a considerable rate. Technological advancement and integration of outsourcing processes with SCM are expected to remain key drivers for market revenue growth during the forecast period.

The COVID-19 pandemic created challenges for healthcare payers. The reduction in healthcare funding resulted in improved financial performance for many health insurers during the pandemic. Payers supported healthcare providers vigorously. They created web portals that provide rapid and accurate information about the pandemic, expanded eligibility so that patients can retain health services, provided advance payments, and set up several community programs for health equity. For future initiatives, several key players are involved in strategic partnerships, addressing systematic health inequities.

The rising importance of inventory management has led to a booming healthcare supply chain business process outsourcing market . Other factors responsible towards growth of healthcare supply chain BPO market are a decrease in healthcare delivery costs, implementation of ICD-10 codes, and patent cliffs faced by pharmaceutical companies.

Market Dynamics

Diverse healthcare policies at the national and regional levels significantly impact on the market. These policies create a complex and evolving landscape for healthcare payers, necessitating various services to navigate and comply with the regulations & demands. As prevalence of chronic, infectious, and other diseases increases, healthcare payers face a multitude of challenges in managing costs, providing quality care, & ensuring optimal health outcomes for members. This growing disease burden fuels demand for a wider range of payer services.

Service Insights

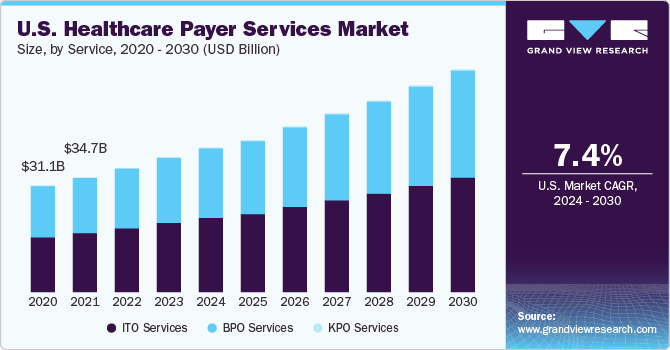

Based on service, the ITO services segment dominated the market in 2023. The major growth factors include high demand for novel and advanced technologies, a surge in investment in AI technology, information that can be easily accessed, and a rise in involvement in healthcare decisions.

The healthcare payer KPO segment is expected to grow at fastest CAGR over the forecast period due to upsurge in the demand for highly skilled professionals, and cost advantage associated with outsourcing such as high-end processes at a low cost to the developing countries. Moreover, growing need in emerging economies for highly skilled professionals at low cost for domain-specific core and non-core activities of the payer vertical is one of the crucial factors anticipated to propel sector growth in the forthcoming years.

Application Insights

Based on application, the claims management services segment held a majority revenue share of over 32.0% in 2023. Strong presence of ACA and increasing overall healthcare expenditure are among some crucial factors that are driving the number of members enrolled in the centers for medicare and medicaid services. Claims processing services are the most data-intensive processes and form bulk of the payer workload. The claims sent by the providers are screened for eligibility criteria, authenticity, and exact amount that needs to be reimbursed. Due to the advent of the digital era, the procedure has been streamlined and turnaround times have improved significantly.

The analytics and fraud management services segment is expected to grow at the highest CAGR over the forecast period. Growing demand for predictive modeling and claim analytics is one of the main factors that is expected to drive segmental demand in the forthcoming years. Increasing demand for low-cost skilled professionals among developed economies to share the workload and to cater to high-end healthcare payer analytical applications, and growing outsourcing of infrastructural management, application management, and data architecture are expected to positively reinforce this segment’s growth during the forecast period.

End-use Insights

Based on end-use, the private payers segment accounted for a majority revenue share of 59.1% in 2023. This is due to increasing private investment in the healthcare payer vertical and growing government support to promote private investment in the healthcare industry.

The public payers segment is predicted to emerge as the fastest CAGR of 7.3% over the estimated timeline. Growing presence of several international health insurance acts including HIPAA, ACA, and ICD-10, growing healthcare expenditure and rapidly decreasing out-of-pocket expenditure are some of the pivotal factors expected to positively reinforce sector growth during the forecast period

Regional Insights

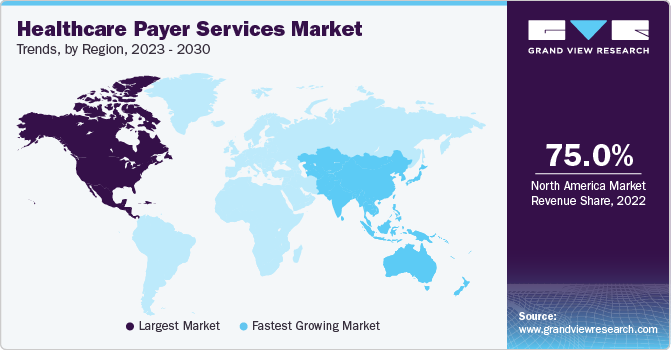

North America dominated and captured a revenue share of over 75.0% in 2023. Growing demand for healthcare IT services is predicted to stimulate healthcare supply chain business process outsourcing market growth during the forecast period. Changes in regulatory scenarios and increasing pressure on healthcare industries to decrease service costs are likely to increase the demand for healthcare supply chain business process outsourcing.

Asia Pacific is expected to grow at a fastest CAGR of 7.6% during the forecast period. This expected growth is owing to rising healthcare expenditure, prevalence of chronic diseases, and demand for resources in developing countries, like China and India. Countries such as Philippines, China, Singapore, India, and Vietnam are at the epicenter of establishing delivery centers by BPO service providers, thus promising higher activity from these regions in the coming few years.

Key Companies & Market Share Insights

Some key players include Cognizant, EXL, HGS Ltd., Accenture, and Genpact. Companies are focusing on research and development to introduce technologically advanced products and gain a competitive edge. Companies are also involved in mergers, partnerships, and acquisitions aiming to strengthen their product portfolio, and manufacturing capacities and provide competitive differentiation.

-

In September 2023, Genpact expanded its collaboration with Amazon Web Services (AWS) to enhance financial crime risk operations using generative AI and large language models. This collaboration is expected to offer a competitive edge over competitors.

-

In April 2023, Cognizant, a provider of IT services, announced extension of long-standing partnership with Microsoft in healthcare. Under this partnership, healthcare payers and providers will have quick access to cutting-edge technological solutions, simplified claims processing, and improved interoperability, all of which are likely to help them improve business processes and provide better patient and member experiences.

-

In December 2022, Ernst & Young LLP (EY US) and EXL, a major provider of data analytics and digital operations and solutions, formed a partnership to jointly create and carry out digital transformation

efforts in insurance, financial services, and healthcare sectors, according to the EY organization.

Key Healthcare Payer Services Companies:

- Cognizant

- EXL

- HGS Ltd. (Hinduja Global Solutions Limited)

- Accenture

- Xerox Corporation

- Concentric Corporation

- Genpact

- WIPRO Ltd.

- HCL Technologies

Healthcare Payer Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.7 billion

Revenue forecast in 2030

USD 108.0 billion

Growth rate

CAGR of 7.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Cognizant; EXL; HGS Ltd.; Accenture; Xerox Corporation; Concentric Corporation; Genpact; WIPRO Ltd.; HCL Technologies

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Payer Services Market Report Segmentation

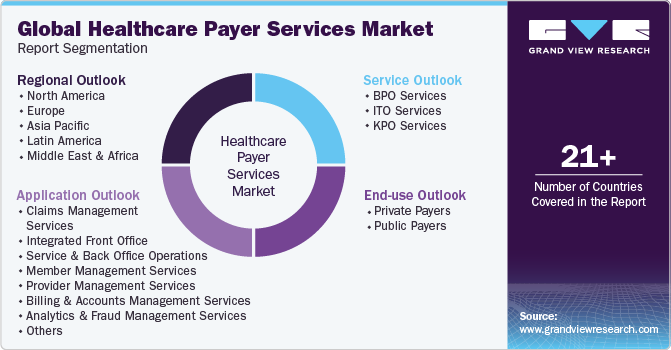

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global healthcare payer services market report based on service, application, end-use, and region:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

BPO Services

-

ITO Services

-

KPO Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Claims Management Services

-

Integrated Front Office Service and Back Office Operations

-

Member Management Services

-

Provider Management Services

-

Billing and Accounts Management Services

-

Analytics and Fraud Management Services

-

HR Services

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Private Payers

-

Public Payers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global healthcare payer services market size was estimated at USD 66.7 billion in 2023 and is expected to reach USD 71.7 billion in 2024.

b. The global healthcare payer services market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach USD 108.0 billion by 2030.

b. North America dominated the healthcare payer services market with a share of 75.7% in 2023. The key factors attributed to the majority shares include increasing investment in the healthcare payer market, the presence of a favorable reimbursement framework, and government policies such as HIPAA and HIMSS

b. Some key players operating in the healthcare payer services market include United HealthCare Services, Inc., Anthem, Inc., Aetna, Inc., Accenture, Cognizant, Xerox Corporation, and Genpact

b. Key factors that are driving the healthcare payer services market growth include increasing demand for streamlined business processes to provide better customer services and reduce the overall operating cost. Increasing use of advanced technology to drive speed and quality of healthcare payer services.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."